Answered step by step

Verified Expert Solution

Question

1 Approved Answer

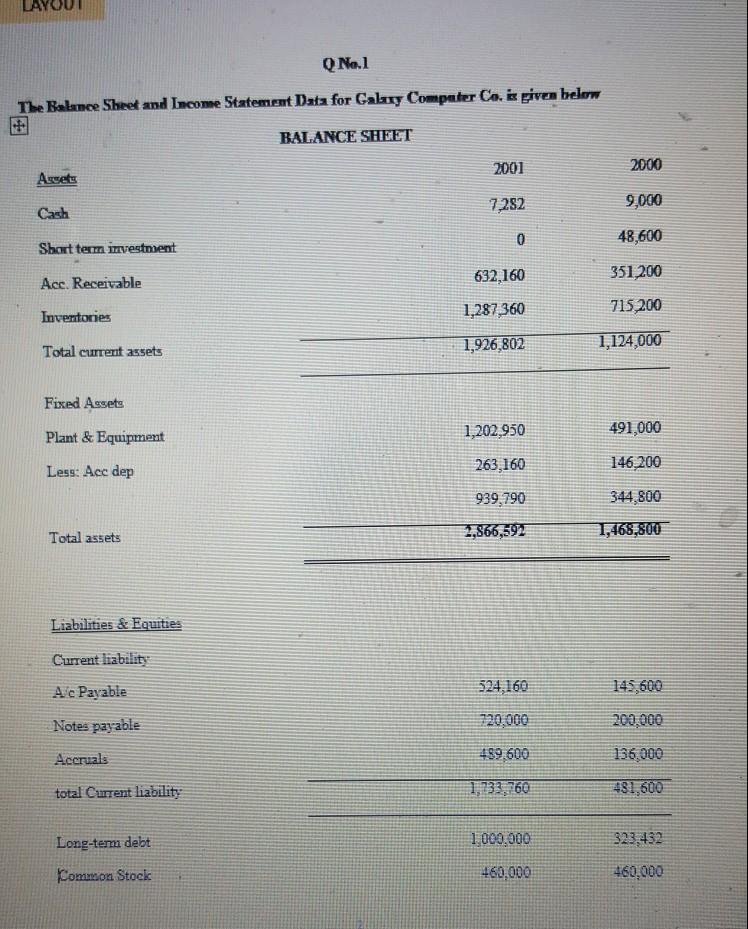

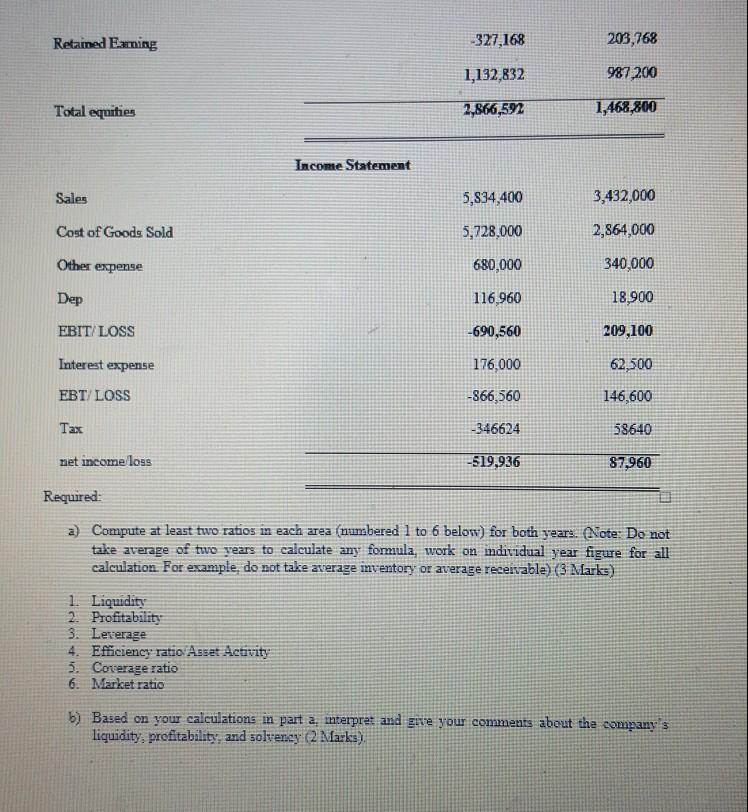

Please give the solution of question a) and b) as soon as possible. Please check both the pictures to solve the questions. Balance sheet and

Please give the solution of question a) and b) as soon as possible. Please check both the pictures to solve the questions. Balance sheet and Income statement given to solve the questions. Will be grateful...

Q No.1 The Balance Sheet and Income Statement Data for Galaxy Computer Co. is given belon BALANCE SHEET 2001 2000 Awets 7,282 9,000 Cash 0 48,600 Short term investment 632,160 351,200 Acc. Receivable Inventories 1,287,360 715,200 1,926,802 Total current assets 1,124,000 Fixed Assets 1,202,950 Plant & Equip 491,000 263,160 146 200 Less: Acc dep 939.790 344,800 Total assets 2,866,592 1,468,800 Liabilities & Equities Current liability A c Payable 524,160 Notes payable 320,000 Accruals 489,600 136,000 total Current liability 481,600 Long-term debt 1,000,000 323,432 460,000 Common Stock 460,000 Retained Earning -327,168 203,768 1,132,832 987 200 Total equities 2,866,592 1,468,800 Income Statement Sales 5,834,400 3,432,000 Cost of Goods Sold 5,728,000 2,864,000 Other expense 680,000 340,000 Dep 116,960 18,900 209,100 EBIT/LOSS -690,560 Interest expense 176,000 62,500 EBT/LOSS -866,560 146,600 Tax -346624 58640 net income loss -519,936 87.960 Required: a) Compute at least two ratios in each area (numbered 1 to 6 below) for both years. (Note: Do not take average of two years to calculate any formula, work on individual year figure for all calculation. For example, do not take average inventory or average receivable) (3 Marks) 1. Liquidity 2. Profitability 3. Leverage 4. Efficiency ratio Asset Activity 5. Coverage ratio 6. Market ratio b) Based on your calculations in part a, interpret and give your comments about the company's liquidity, profitability, and solvency (2 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started