Answered step by step

Verified Expert Solution

Question

1 Approved Answer

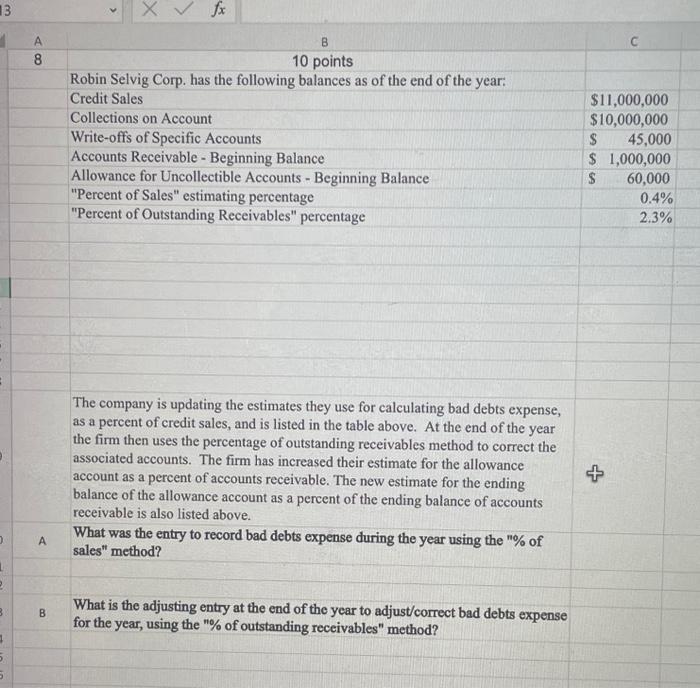

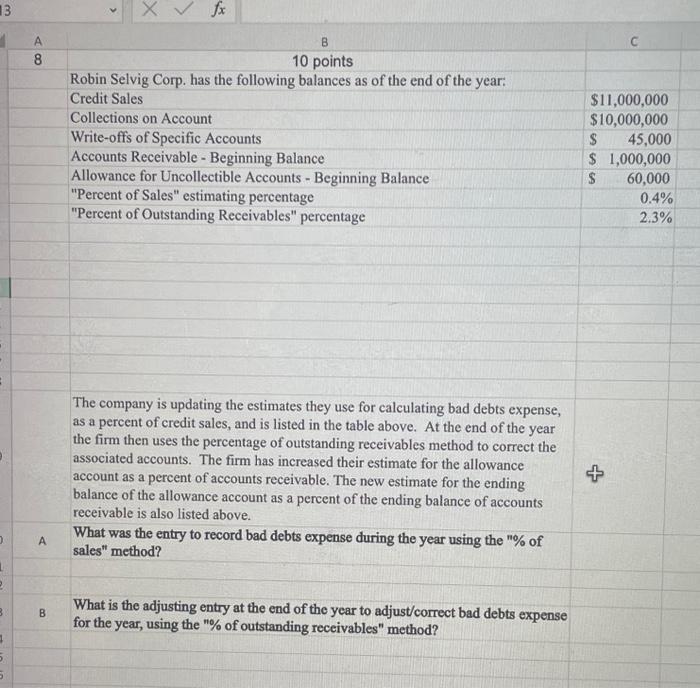

please help 13 begin{tabular}{|c|c|c|} hline A & B & c hline 8 & 10 points & hline & Robin Selvig Corp. has the

please help

13 \begin{tabular}{|c|c|c|} \hline A & B & c \\ \hline 8 & 10 points & \\ \hline & Robin Selvig Corp. has the following balances as of the end of the year: & \\ \hline & Credit Sales & $11,000,000 \\ \hline & Collections on Account & $10,000,000 \\ \hline & Write-offs of Specific Accounts & $45,000 \\ \hline & Accounts Receivable - Beginning Balance & $1,000,000 \\ \hline & Allowance for Uncollectible Accounts - Beginning Balance & $60,000 \\ \hline & "Percent of Sales" estimating percentage & 0.4% \\ \hline & "Percent of Outstanding Receivables" percentage & 2.3% \\ \hline \end{tabular} The company is updating the estimates they use for calculating bad debts expense, as a percent of credit sales, and is listed in the table above. At the end of the year the firm then uses the percentage of outstanding receivables method to correct the associated accounts. The firm has increased their estimate for the allowance account as a percent of accounts receivable. The new estimate for the ending balance of the allowance account as a percent of the ending balance of accounts receivable is also listed above. A What was the entry to record bad debts expense during the year using the "% of sales" method? B What is the adjusting entry at the end of the year to adjust/correct bad debts expense for the year, using the "\% of outstanding receivables" method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started