Please help

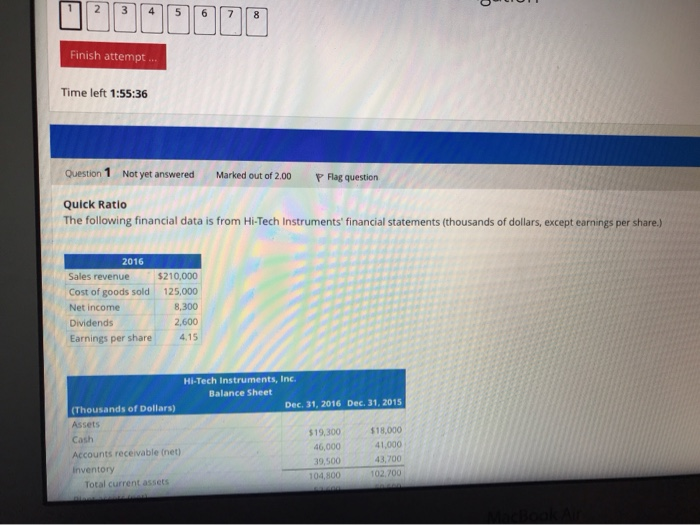

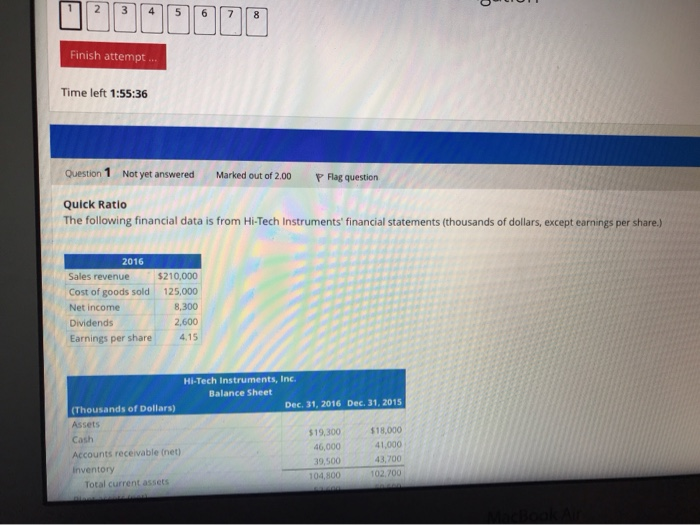

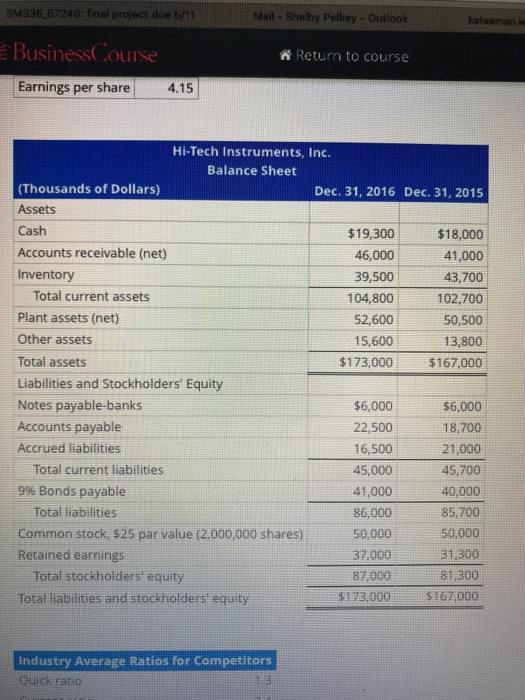

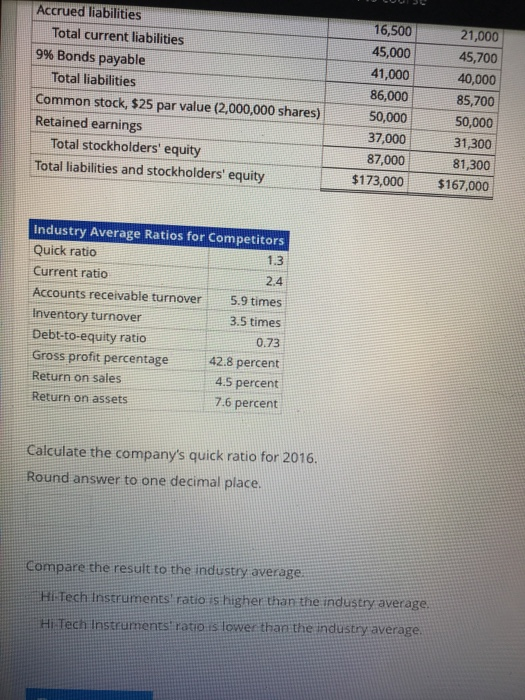

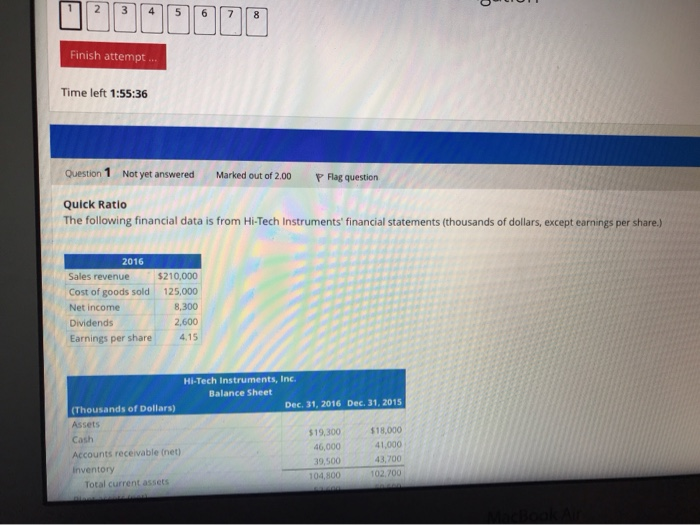

3 4 5 6 10 Finish attempt... Time left 1:55:36 Question 1 Not yet answered Marked out of 2.00 P Flag question Quick Ratio The following financial data is from Hi-Tech Instruments' financial statements (thousands of dollars, except earnings per share.) 2016 Sales revenue Cost of goods sold Net income Dividends Earnings per share $210,000 125,000 8,300 2,600 4.15 Hi-Tech Instruments, Inc. Balance Sheet (Thousands of Dollars) Dec 31, 2016 Dec 31, 2015 Assets Cash $19,300 $18,000 Accounts receivable net) 46,000 41,000 Inventory 39,500 43,700 Total current assets 104,800 102,700 SM336_67240: final project due 5/11 Mail-Shelby Pelkey - Outlook kataman Business Course Return to course Earnings per share 4.15 Hi-Tech Instruments, Inc. Balance Sheet (Thousands of Dollars) Dec. 31, 2016 Dec. 31, 2015 Assets Cash $19,300 $18,000 Accounts receivable (net) 46,000 41,000 Inventory 39,500 43,700 Total current assets 104,800 102,700 Plant assets (net) 52,600 50,500 Other assets 15,600 13,800 Total assets $173,000 $167,000 Liabilities and Stockholders' Equity Notes payable-banks $6,000 $6,000 Accounts payable 22,500 18,700 Accrued liabilities 16,500 21,000 Total current liabilities 45,000 45,700 9% Bonds payable 41,000 40,000 Total liabilities 86,000 85,700 Common stock, $25 par value (2,000,000 shares) 50,000 50,000 Retained earnings 37,000 31,300 Total stockholders' equity 87,000 81,300 Total liabilities and stockholders' equity $178,000 $167,000 Industry Average Ratios for Competitors Quick ratio 13 Accrued liabilities Total current liabilities 9% Bonds payable Total liabilities Common stock, $25 par value (2,000,000 shares) Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 16,500 45,000 41,000 86,000 50,000 37,000 87,000 $173,000 21,000 45,700 40,000 85,700 50,000 31,300 81,300 $167,000 Industry Average Ratios for Competitors Quick ratio 1.3 Current ratio 2.4 Accounts receivable turnover 5.9 times Inventory turnover 3.5 times Debt-to-equity ratio 0.73 Gross profit percentage 42.8 percent Return on sales 4.5 percent Return on assets 7.6 percent Calculate the company's quick ratio for 2016. Round answer to one decimal place. Compare the result to the industry average. Hi Tech Instruments' ratio is higher than the industry average. Hi Tech Instruments ratio is lower than the industry average