Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! 3. Asset management ratios Asset management ratios are used to measure how effectively a firm manages its assets, by relating the amount a

Please help!

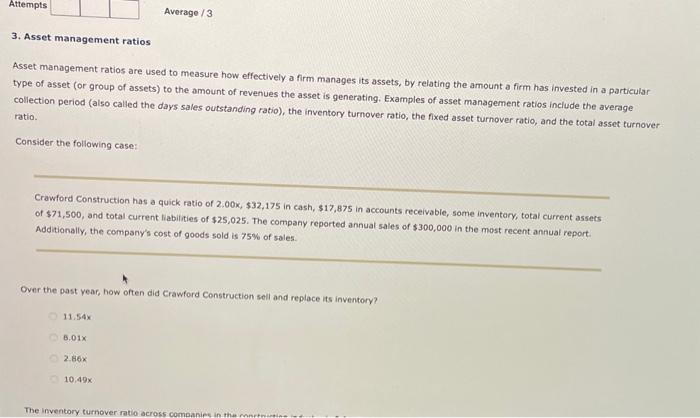

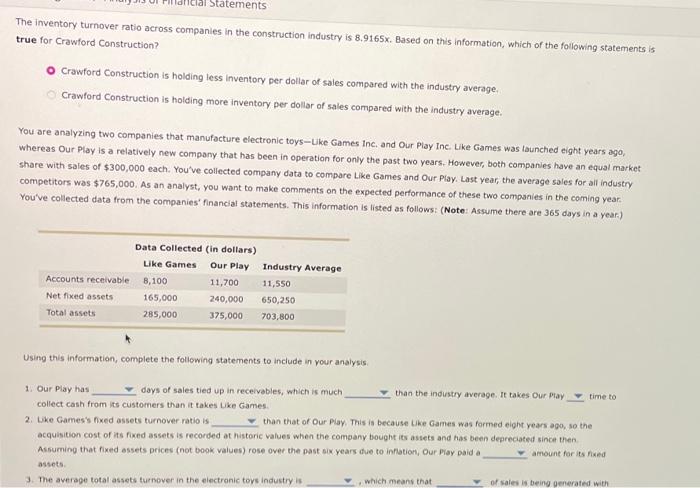

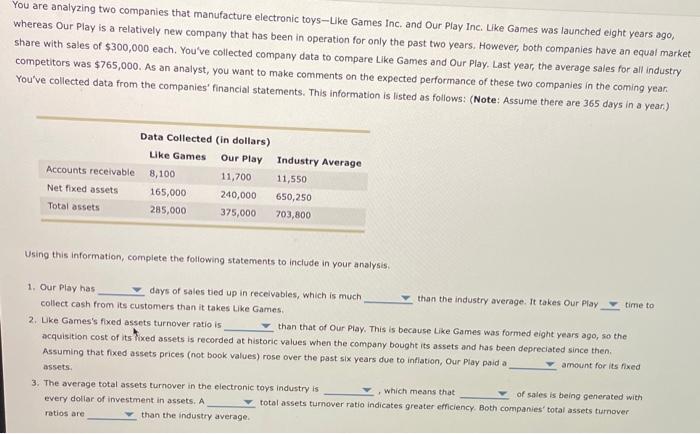

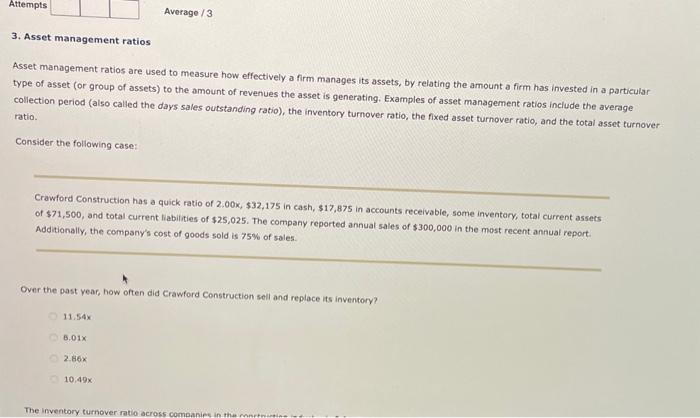

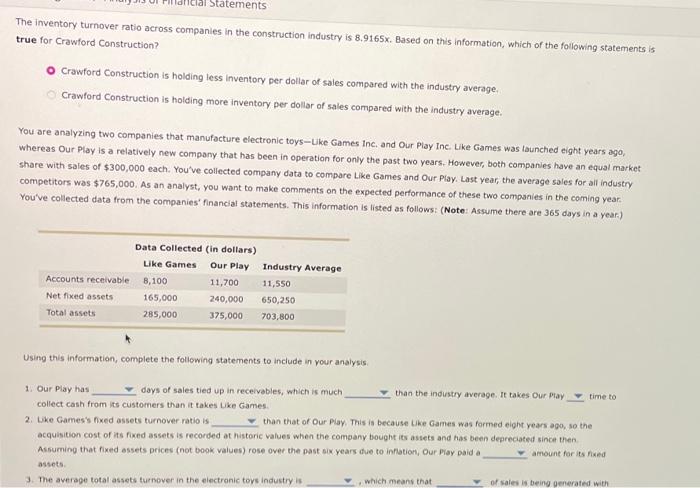

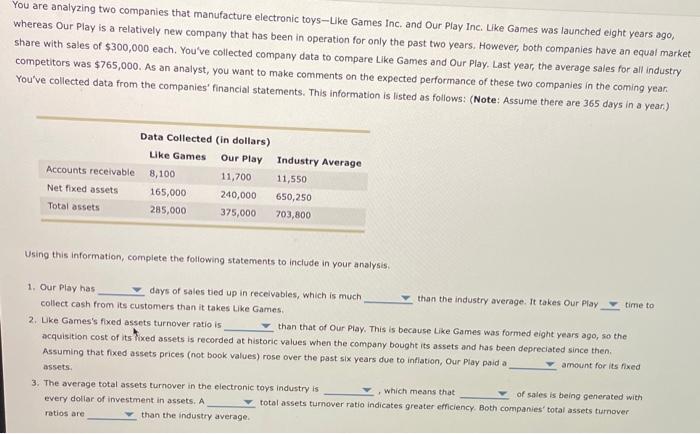

3. Asset management ratios Asset management ratios are used to measure how effectively a firm manages its assets, by relating the amount a firm has invested in a particular type of asset (or group of assets) to the amount of revenues the asset is generating. Examples of asset management ratios include the average collection period (also called the days sales outstanding ratio), the inventory turnover ratio, the fixed asset turnover ratio, and the total asset turnover ratio. Consider the following case: Crawford Construction has a quick ratio of 2.00x,$32,175 in cash, $17,875 in accounts receivable, some inventary, total current assets of $71,500, and total current liabilities of $25,025. The company reported annual sales of $300,000 in the most recent annual report. Additionally, the company's cost of goods sold is 75% of sales. Over the past year, how often did Crawford Construction sell and replace its inventory? 11,54x B, 01x 2+66x 10.49x The inventory turnover ratio across companies in the construction industry is 8.9165. Based on this information, which of the following statements is true for Crawford Construction? Crawford Construction is holding less inventory per dollar of sales compared with the industry average. Crawford Construction is holding more inventory per dollar of sales compared with the industry average. You are analyzing two companies that manufacture electronic toys-Like Games Inc. and Our Play Inc. Like Games was launched eight years ago, Whereas Our Play is a relatively new company that has been in operation for only the past two years. However, both companies have an equal market. share with sales of $300,000 each. You've collected company data to compare Like Games and Our Play. Last year, the average sales for all industry competitors was $765,000. As an analyst, you want to make comments on the expected performance of these two companies in the coming year. You've collected data from the companies' financial statements. This information is listed as follows: (Note: Assume there are 365 days in a year.) Using this information, complete the following statements to include in your analysis 1. Our Play has days of sales tied up in receivables, which is much collect cash from its customers than it takes Like Games. than the industry average. It takes Our Pay time to 2. Wke Games's fixed assets turnover ratio is than that of Our Play. This is because Uke Games was formed eight years ago, so the acquisition cost of its fixed assets is recorded at historic values when the company bought its assets and has been deareciated since then. Assuming that fixed assets prices (not book values) rose over the past six years dve to infotion, Our Piay paid a assets. amount far its fixed 3. The average total assets turmover in the electronic tovs industry is 1. which means that of sales is being generated with You are analyzing two companies that manufacture electronic toys-Like Games Inc. and Our Play Inc. Like Games was launched eight years ago, whereas Our Play is a relatively new company that has been in operation for only the past two years, However, both companies have an equal market share with sales of $300,000 each. You've collected company data to compare Like Games and Our Play. Last year, the average sales for all industry competitors was $765,000. As an analyst, you want to make comments on the expected performance of these two companies in the coming year. You've collected data from the companies' financial statements. This information is listed as follows: (Note: Assume there are 365 days in a year)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started