Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help 3.34 pts D Question 24 CSCOO Inc. reported for the current year sales of $1,425,000, costs $1,285,000 and had a tax rate of

please help

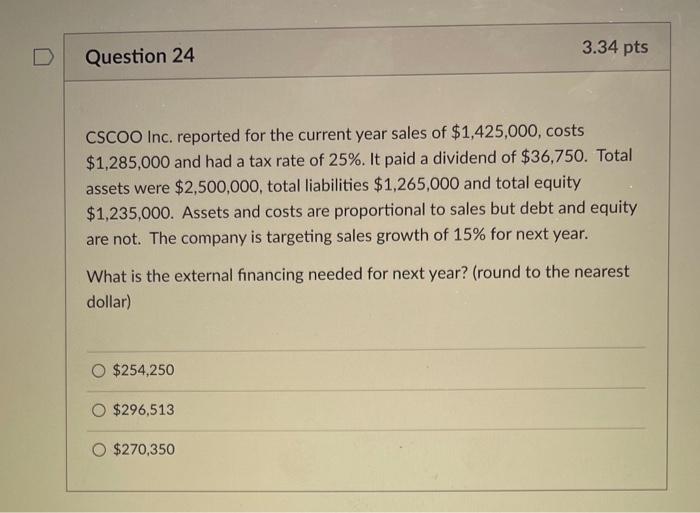

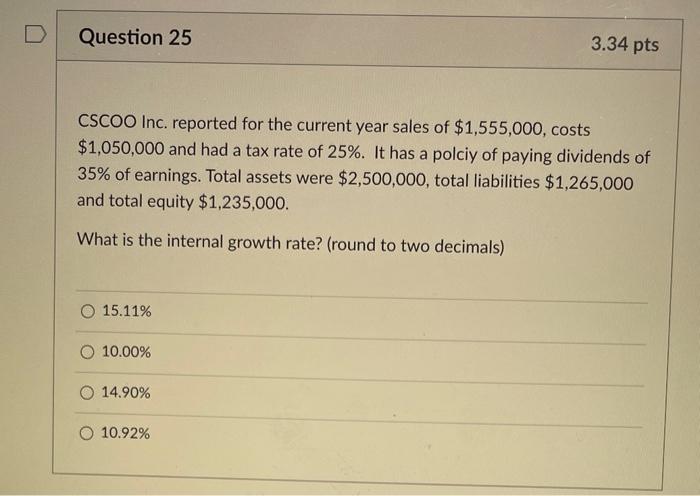

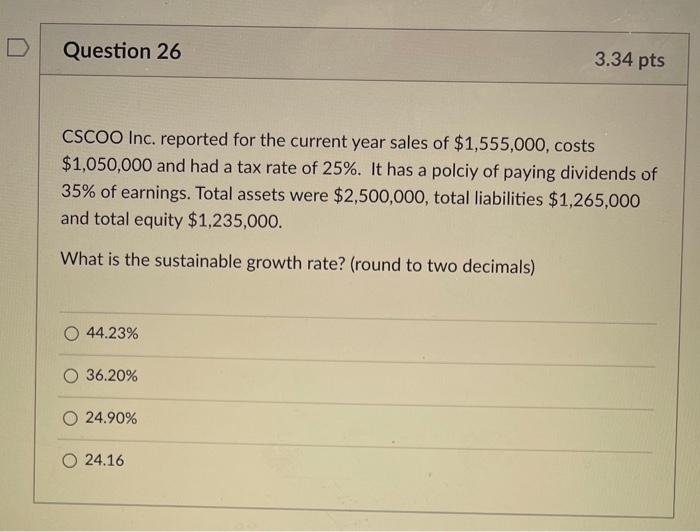

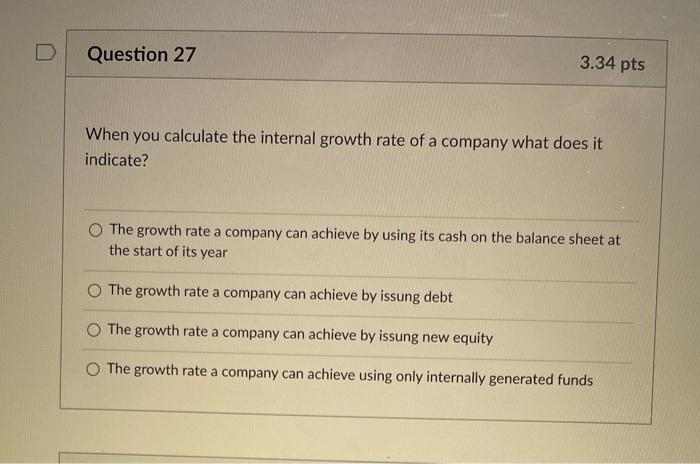

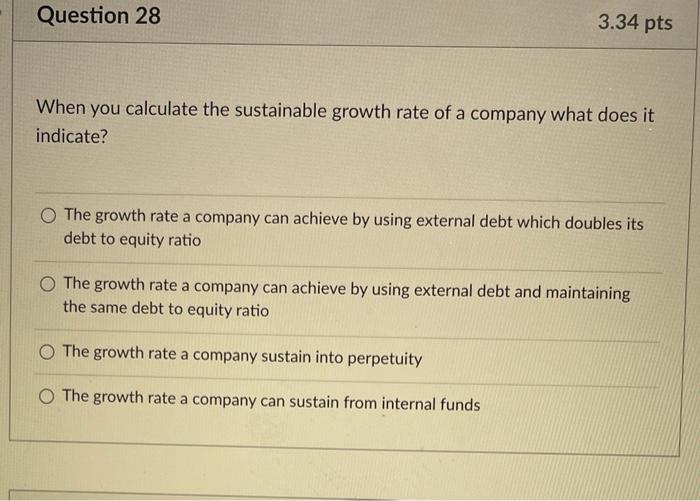

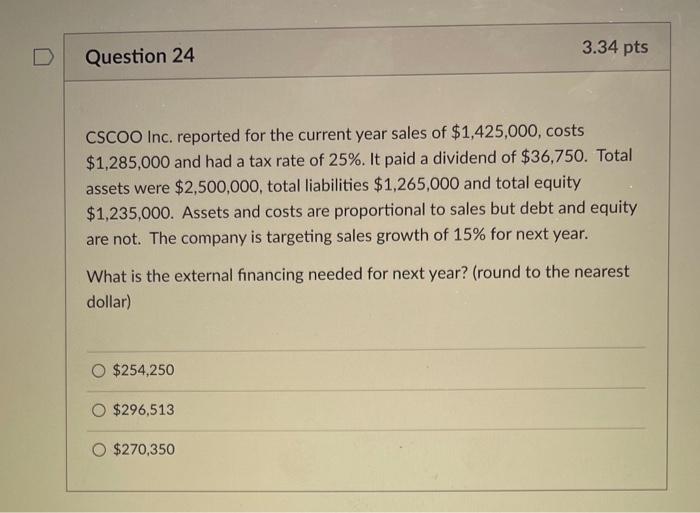

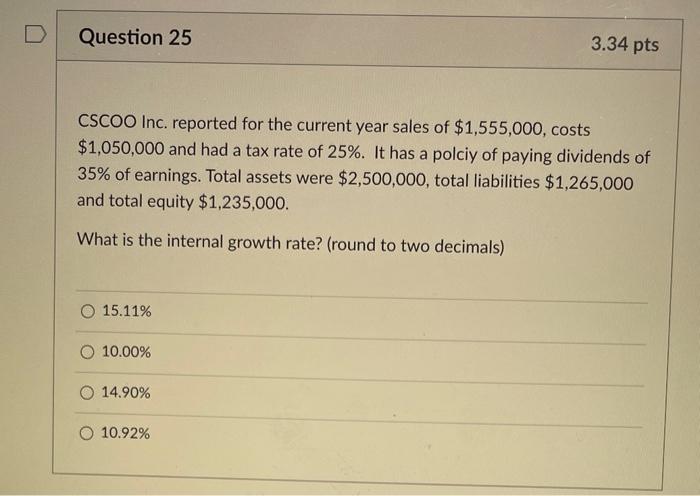

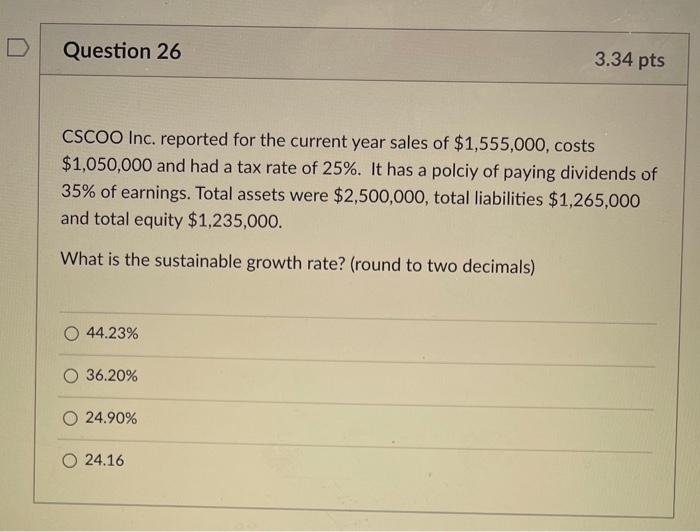

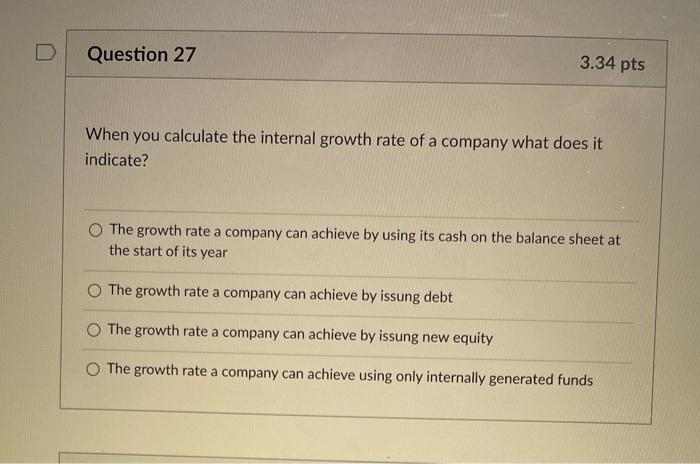

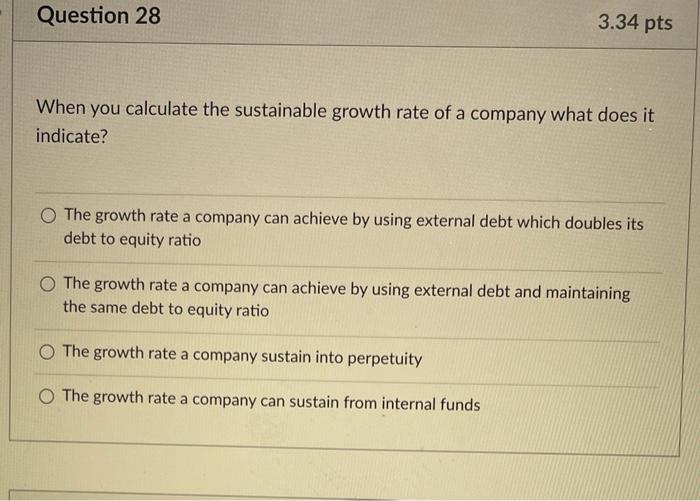

3.34 pts D Question 24 CSCOO Inc. reported for the current year sales of $1,425,000, costs $1,285,000 and had a tax rate of 25%. It paid a dividend of $36,750. Total assets were $2,500,000, total liabilities $1,265,000 and total equity $1,235,000. Assets and costs are proportional to sales but debt and equity are not. The company is targeting sales growth of 15% for next year. What is the external financing needed for next year?(round to the nearest dollar) $254,250 $296,513 $270,350 D Question 25 3.34 pts CSCOO Inc. reported for the current year sales of $1,555,000, costs $1,050,000 and had a tax rate of 25%. It has a polciy of paying dividends of 35% of earnings. Total assets were $2,500,000, total liabilities $1,265,000 and total equity $1,235,000. What is the internal growth rate? (round to two decimals) 15.11% O 10.00% O 14.90% 10.92% Question 26 3.34 pts CSCOO Inc. reported for the current year sales of $1,555,000, costs $1,050,000 and had a tax rate of 25%. It has a polciy of paying dividends of 35% of earnings. Total assets were $2,500,000, total liabilities $1,265,000 and total equity $1,235,000. What is the sustainable growth rate? (round to two decimals) 44.23% O 36.20% O 24.90% 0 24.16 Question 27 3.34 pts When you calculate the internal growth rate of a company what does it indicate? The growth rate a company can achieve by using its cash on the balance sheet at the start of its year The growth rate a company can achieve by issung debt The growth rate a company can achieve by issung new equity The growth rate a company can achieve using only internally generated funds Question 28 3.34 pts When you calculate the sustainable growth rate of a company what does it indicate? The growth rate a company can achieve by using external debt which doubles its debt to equity ratio The growth rate a company can achieve by using external debt and maintaining the same debt to equity ratio The growth rate a company sustain into perpetuity The growth rate a company can sustain from internal funds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started