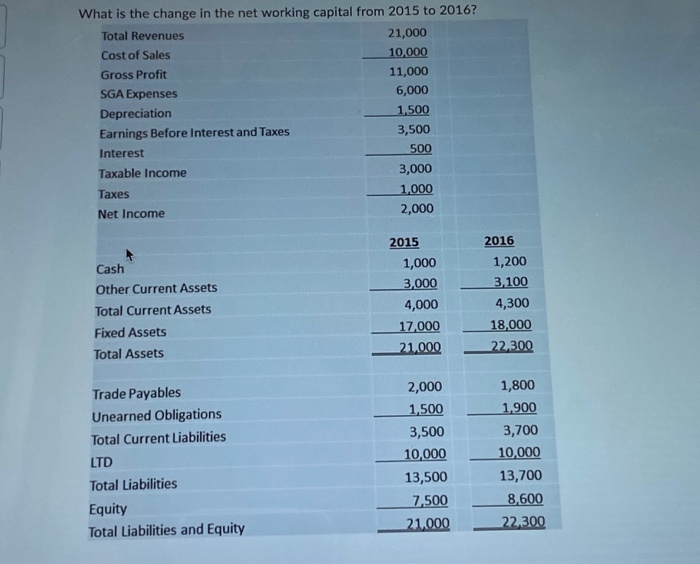

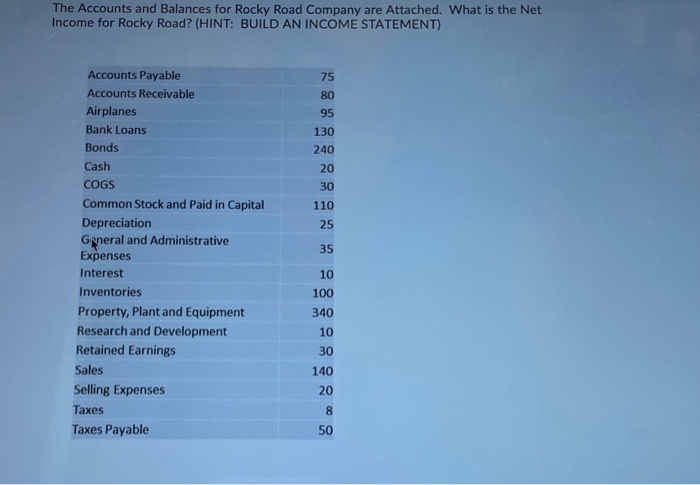

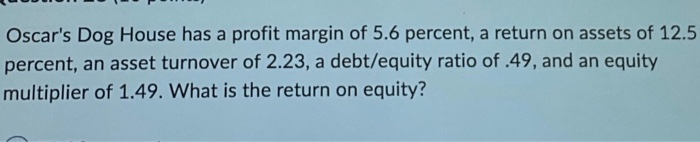

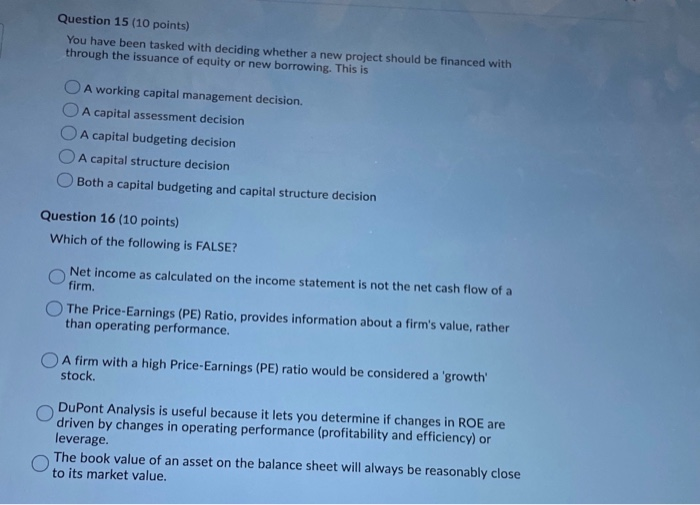

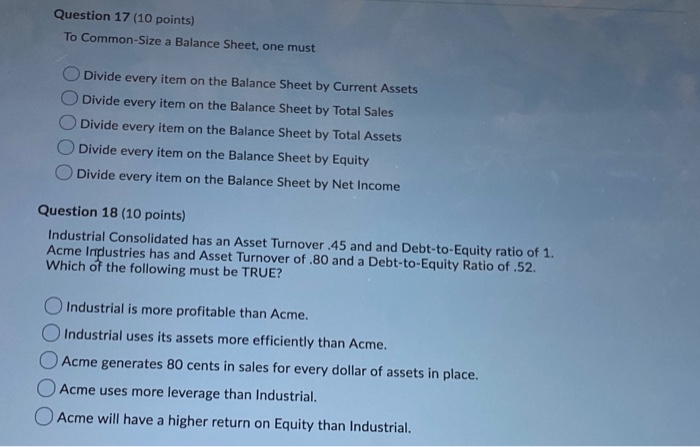

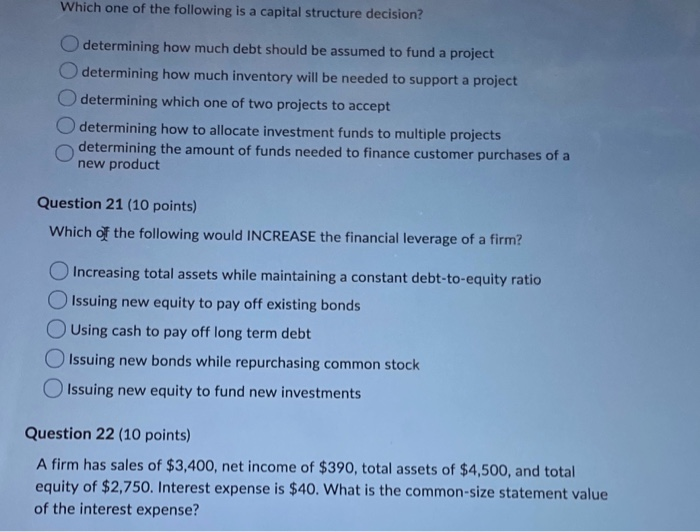

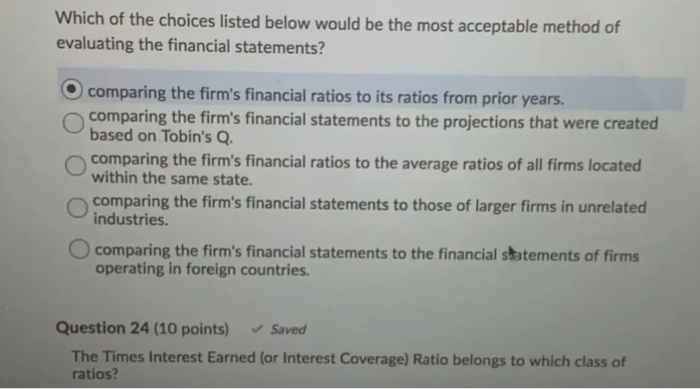

6,000 What is the change in the net working capital from 2015 to 2016? Total Revenues 21,000 Cost of Sales 10,000 Gross Profit 11,000 SGA Expenses Depreciation 1,500 Earnings Before Interest and Taxes 3,500 Interest 500 Taxable income 3,000 Taxes 1,000 Net Income 2,000 2016 1,200 Cash Other Current Assets Total Current Assets Fixed Assets Total Assets 2015 1,000 3,000 4,000 17,000 21.000 3.100 4,300 18,000 22.300 Trade Payables Unearned Obligations Total Current Liabilities LTD Total Liabilities Equity Total Liabilities and Equity 2,000 1,500 3,500 10,000 13,500 7.500 21.000 1,800 1.900 3,700 10,000 13,700 8,600 22.300 The Accounts and Balances for Rocky Road Company are Attached. What is the Net Income for Rocky Road? (HINT: BUILD AN INCOME STATEMENT) 80 130 240 Accounts Payable Accounts Receivable Airplanes Bank Loans Bonds Cash COGS Common Stock and Paid in Capital Depreciation Gineral and Administrative Expenses Interest Inventories Property, Plant and Equipment Research and Development Retained Earnings Sales Selling Expenses Taxes Taxes Payable Oscar's Dog House has a profit margin of 5.6 percent, a return on assets of 12.5 percent, an asset turnover of 2.23, a debt/equity ratio of 49, and an equity multiplier of 1.49. What is the return on equity?! Question 15 (10 points) You have been tasked with deciding whether a new project should be financed with through the issuance of equity or new borrowing. This is O A working capital management decision. O A capital assessment decision O A capital budgeting decision O A capital structure decision Both a capital budgeting and capital structure decision Question 16 (10 points) Which of the following is FALSE? Net income as calculated on the income statement is not the net cash flow of a firm The Price-Earnings (PE) Ratio, provides information about a firm's value, rather than operating performance. O A firm with a high Price-Earnings (PE) ratio would be considered a 'growth stock DuPont Analysis is useful because it lets you determine if changes in ROE are driven by changes in operating performance (profitability and efficiency) or leverage. The book value of an asset on the balance sheet will always be reasonably close to its market value. Question 17 (10 points) To Common-Size a Balance Sheet, one must Divide every item on the Balance Sheet by Current Assets Divide every item on the Balance Sheet by Total Sales Divide every item on the Balance Sheet by Total Assets Divide every item on the Balance Sheet by Equity Divide every item on the Balance Sheet by Net Income Question 18 (10 points) Industrial Consolidated has an Asset Turnover .45 and and Debt-to-Equity ratio of 1. Acme Implustries has and Asset Turnover of .80 and a Debt-to-Equity Ratio of .52 Which of the following must be TRUE? Industrial is more profitable than Acme. Industrial uses its assets more efficiently than Acme. Acme generates 80 cents in sales for every dollar of assets in place. Acme uses more leverage than Industrial. Acme will have a higher return on Equity than Industrial. Which one of the following is a capital structure decision? determining how much debt should be assumed to fund a project determining how much inventory will be needed to support a project Odetermining which one of two projects to accept determining how to allocate investment funds to multiple projects determining the amount of funds needed to finance customer purchases of a new product Question 21 (10 points) Which of the following would INCREASE the financial leverage of a firm? O Increasing total assets while maintaining a constant debt-to-equity ratio Issuing new equity to pay off existing bonds Using cash to pay off long term debt Issuing new bonds while repurchasing common stock Issuing new equity to fund new investments Question 22 (10 points) A firm has sales of $3,400, net income of $390, total assets of $4,500, and total equity of $2,750. Interest expense is $40. What is the common-size statement value of the interest expense? Which of the choices listed below would be the most acceptable method of evaluating the financial statements?! O comparing the firm's financial ratios to its ratios from prior years. comparing the firm's financial statements to the projections that were created based on Tobin's Q. comparing the firm's financial ratios to the average ratios of all firms located within the same state. comparing the firm's financial statements to those of larger firms in unrelated industries. comparing the firm's financial statements to the financial statements of firms operating in foreign countries. Question 24 (10 points) Saved The Times Interest Earned (or Interest Coverage) Ratio belongs to which class of ratios