Answered step by step

Verified Expert Solution

Question

1 Approved Answer

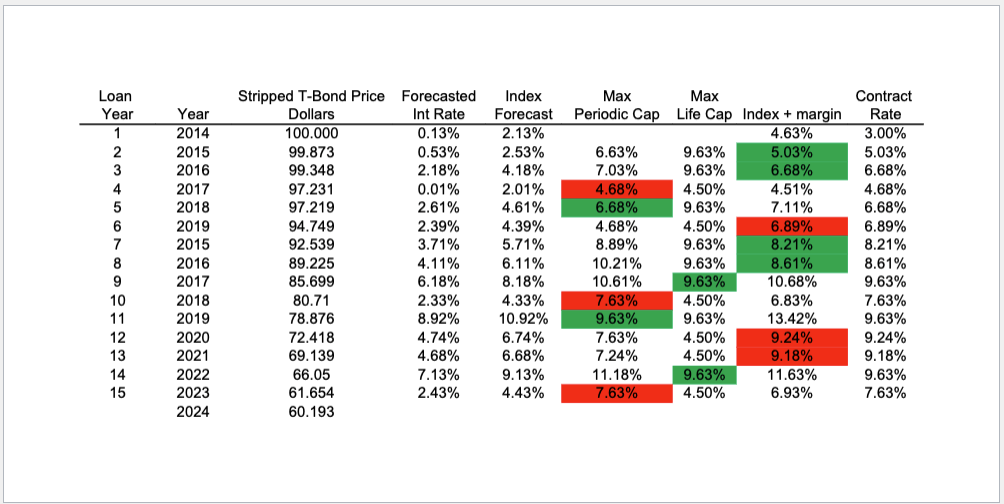

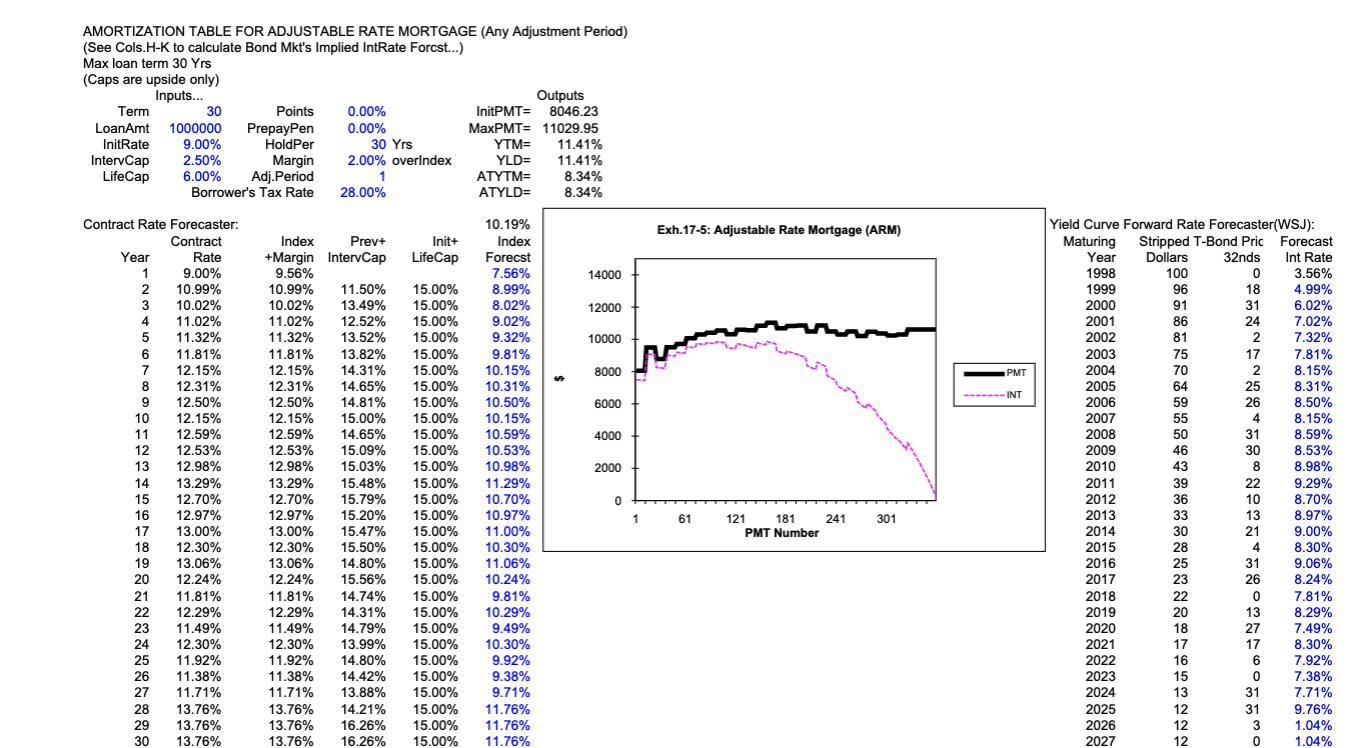

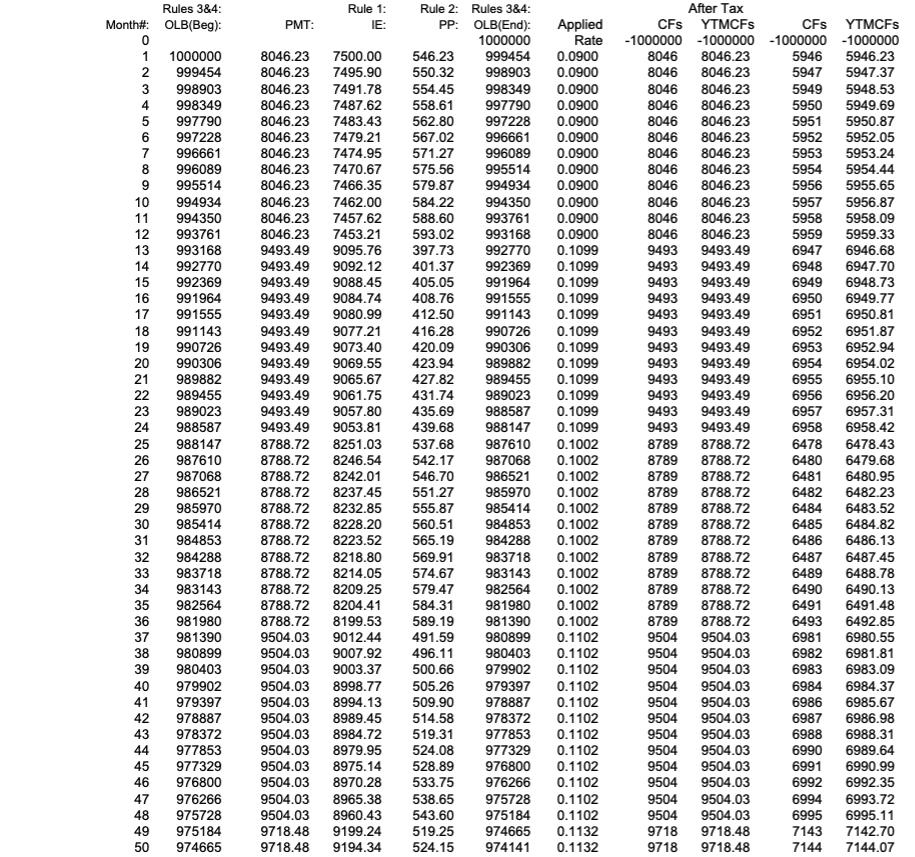

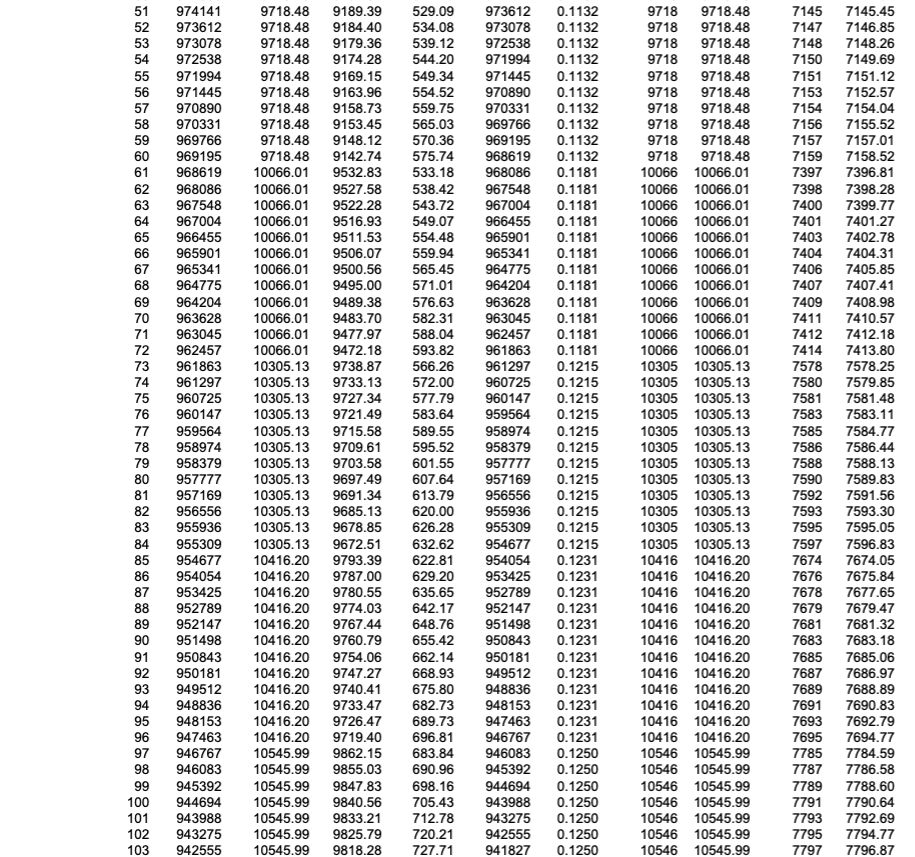

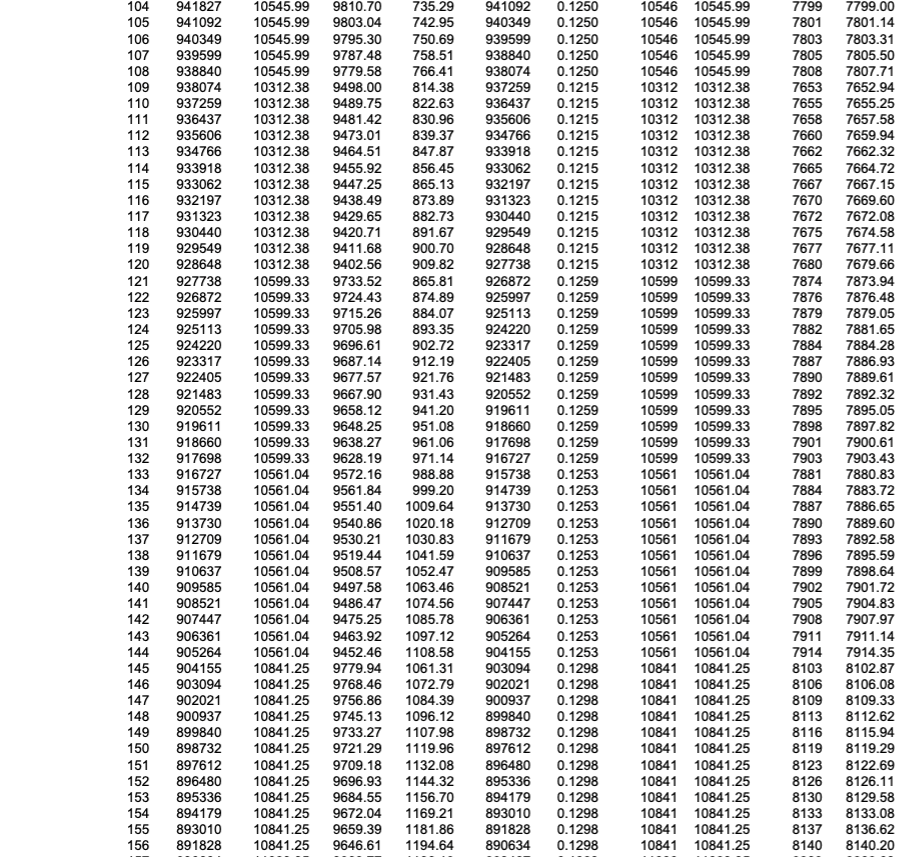

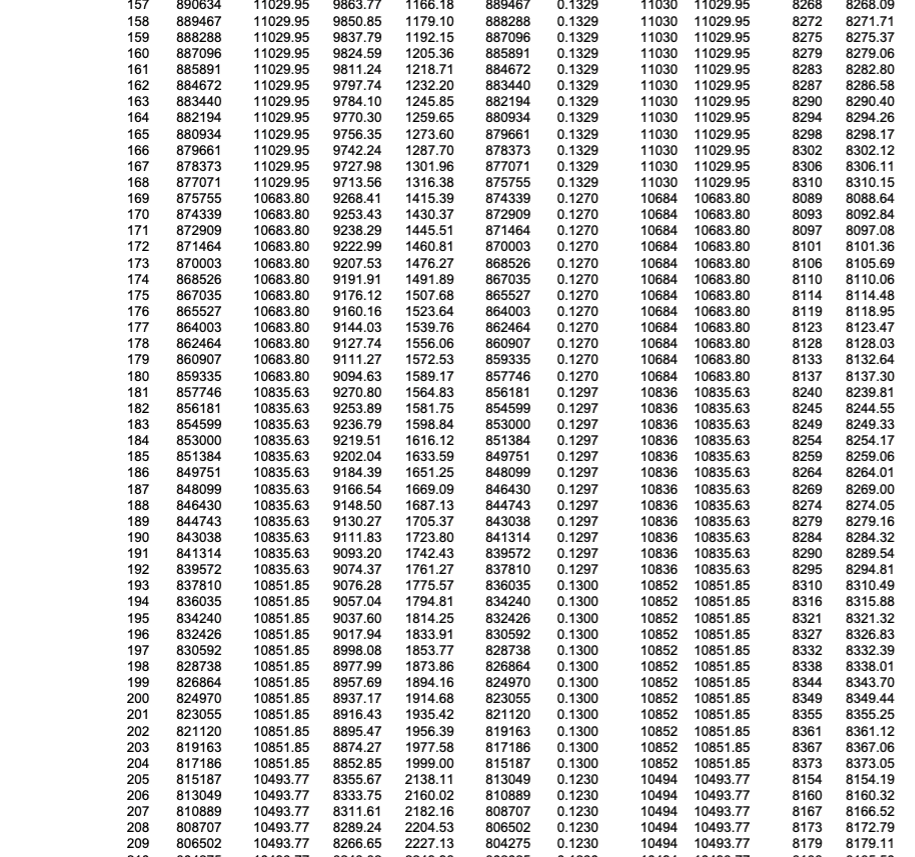

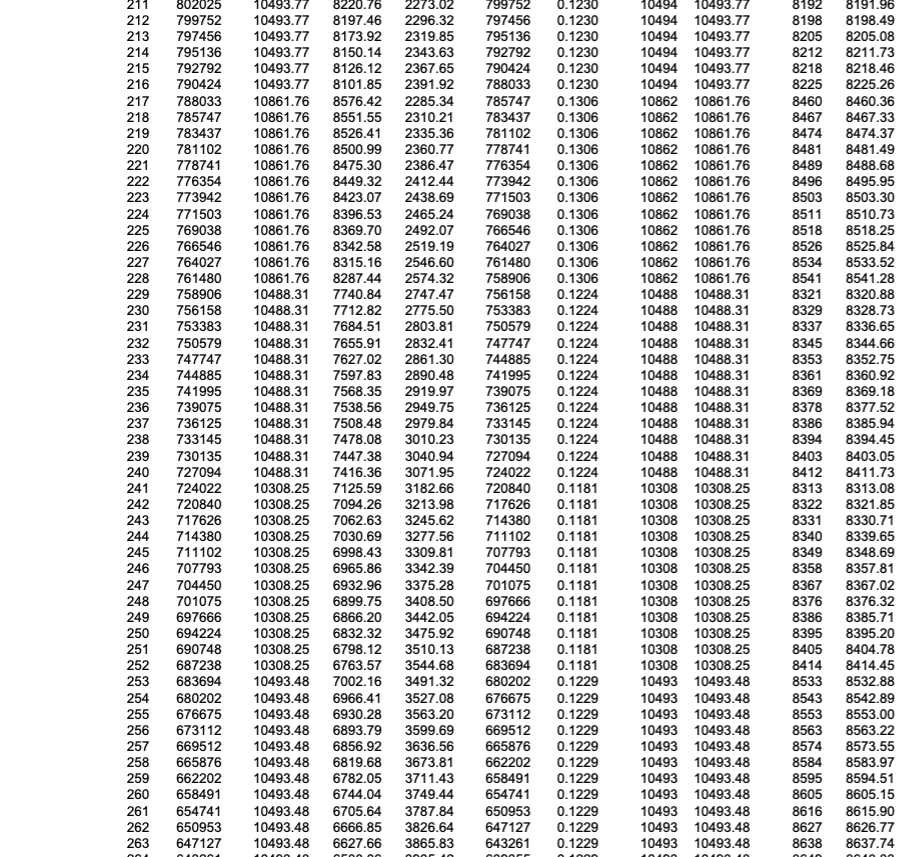

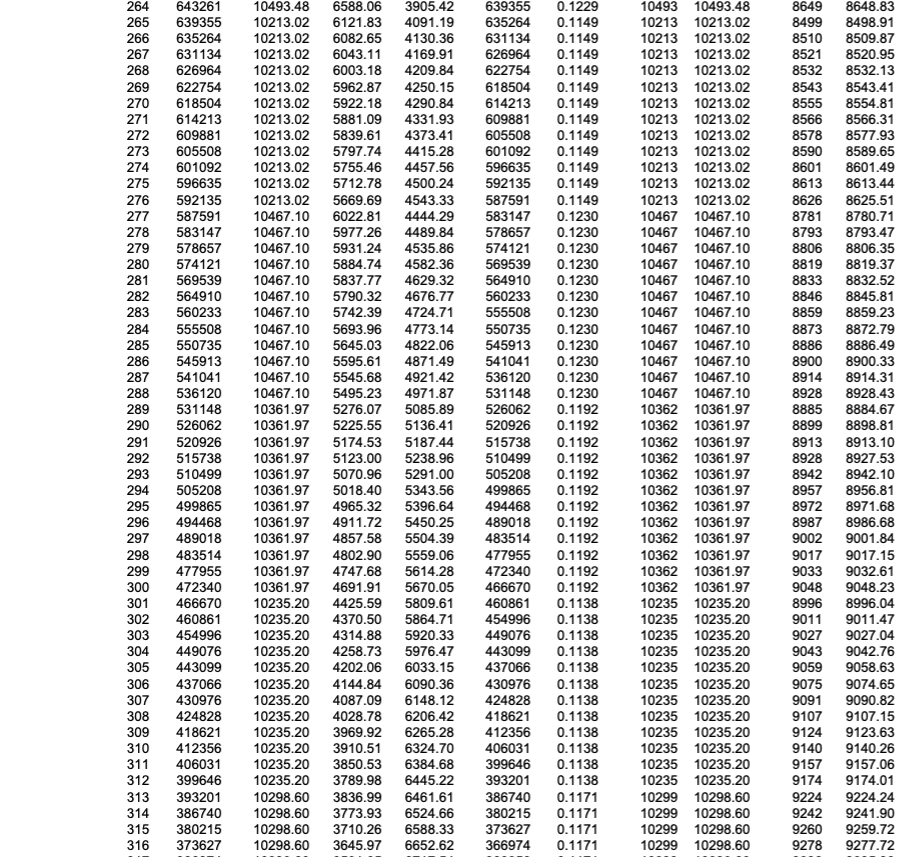

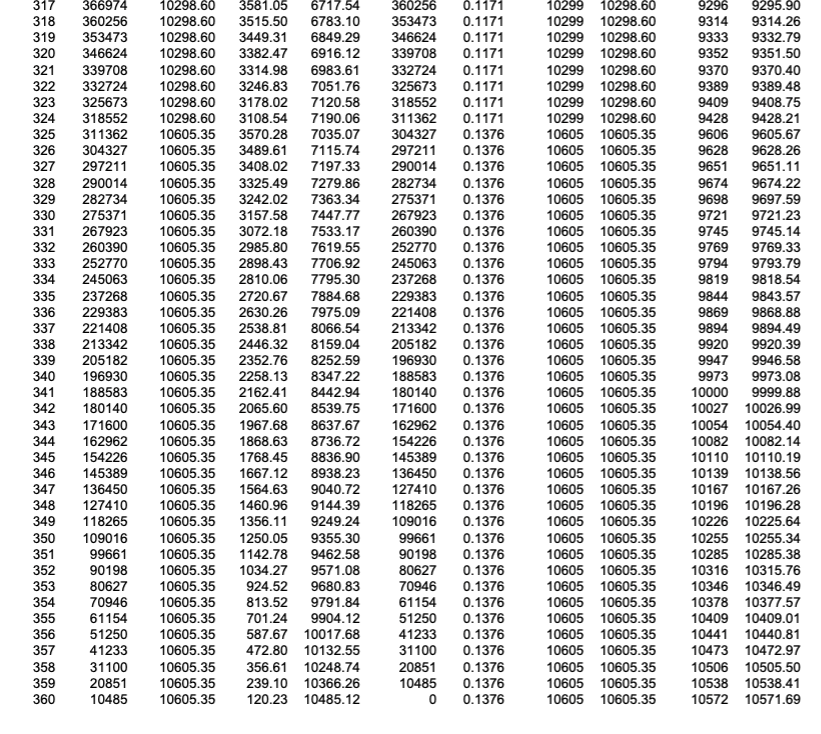

PLEASE HELP AMORTIZATION TABLE FOR ADJUSTABLE RATE MORTGAGE (Any Adjustment Period) (See Cols.H-K to calculate Bond Mkt's Implied IntRate Forcst...) Max loan term 30 Yrs

PLEASE HELP

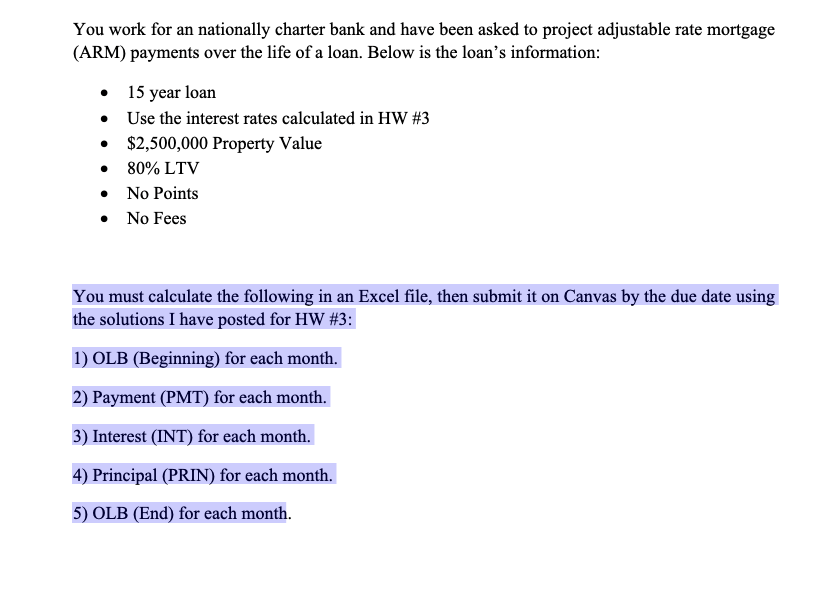

AMORTIZATION TABLE FOR ADJUSTABLE RATE MORTGAGE (Any Adjustment Period) (See Cols.H-K to calculate Bond Mkt's Implied IntRate Forcst...) Max loan term 30 Yrs (Caps are upside only) C You work for an nationally charter bank and have been asked to project adjustable rate mortgage (ARM) payments over the life of a loan. Below is the loan's information: - 15 year loan - Use the interest rates calculated in HW#3 - $2,500,000 Property Value - 80% LTV - No Points - No Fees You must calculate the following in an Excel file, then submit it on Canvas by the due date using the solutions I have posted for HW#3 : 1) OLB (Beginning) for each month. 2) Payment (PMT) for each month. 3) Interest (INT) for each month. 4) Principal (PRIN) for each month. 5) OLB (End) for each month. AMORTIZATION TABLE FOR ADJUSTABLE RATE MORTGAGE (Any Adjustment Period) (See Cols.H-K to calculate Bond Mkt's Implied IntRate Forcst...) Max loan term 30 Yrs (Caps are upside only) C You work for an nationally charter bank and have been asked to project adjustable rate mortgage (ARM) payments over the life of a loan. Below is the loan's information: - 15 year loan - Use the interest rates calculated in HW#3 - $2,500,000 Property Value - 80% LTV - No Points - No Fees You must calculate the following in an Excel file, then submit it on Canvas by the due date using the solutions I have posted for HW#3 : 1) OLB (Beginning) for each month. 2) Payment (PMT) for each month. 3) Interest (INT) for each month. 4) Principal (PRIN) for each month. 5) OLB (End) for each monthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started