Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help and show workings (All amounts in $ millions.) An airline is considering selling an old aircraft and replacing it with a new aircraft.

Please help and show workings

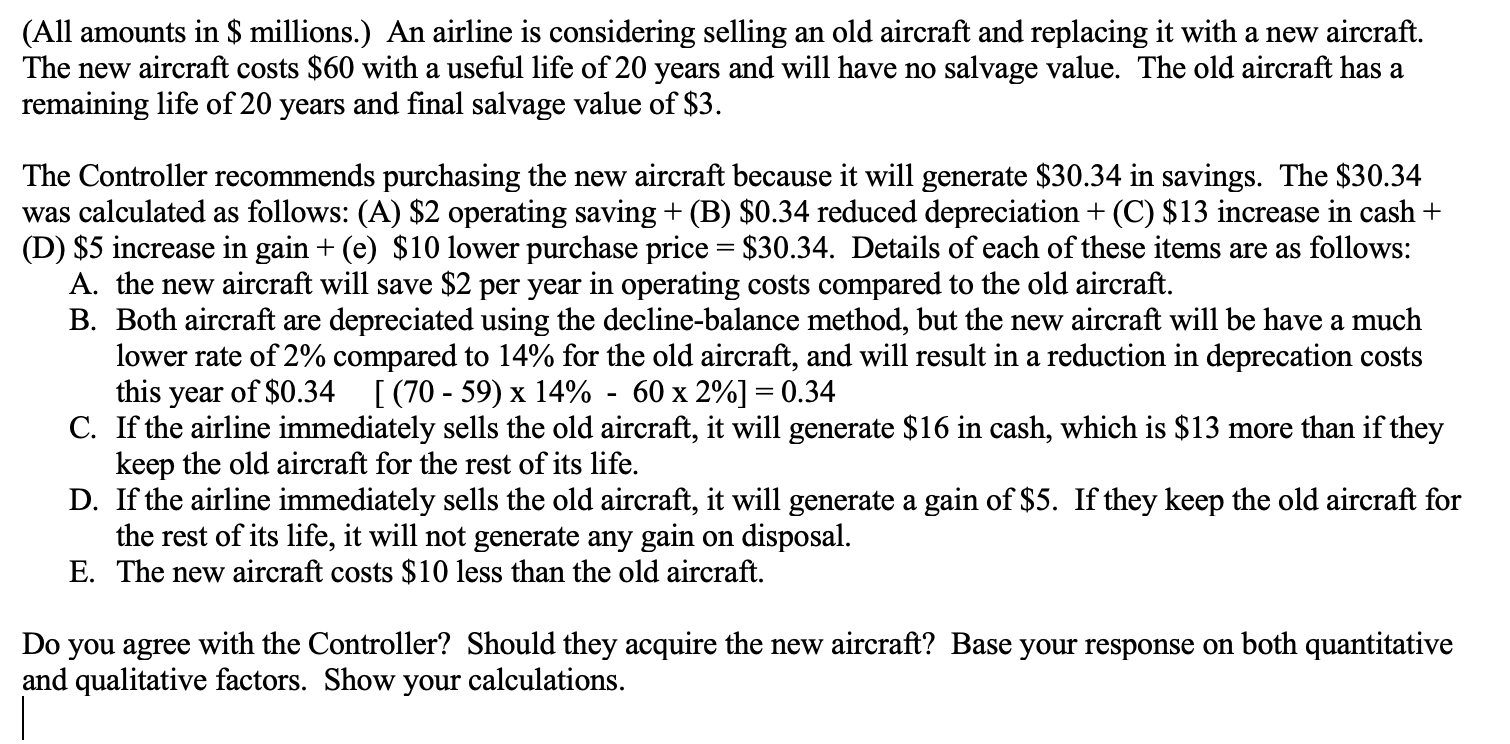

(All amounts in \$ millions.) An airline is considering selling an old aircraft and replacing it with a new aircraft. The new aircraft costs $60 with a useful life of 20 years and will have no salvage value. The old aircraft has a remaining life of 20 years and final salvage value of $3. The Controller recommends purchasing the new aircraft because it will generate $30.34 in savings. The $30.34 was calculated as follows: (A) $2 operating saving + (B) $0.34 reduced depreciation + (C) $13 increase in cash + (D) $5 increase in gain + (e) $10 lower purchase price =$30.34. Details of each of these items are as follows: A. the new aircraft will save $2 per year in operating costs compared to the old aircraft. B. Both aircraft are depreciated using the decline-balance method, but the new aircraft will be have a much lower rate of 2% compared to 14% for the old aircraft, and will result in a reduction in deprecation costs this year of $0.34[(7059)14%602%]=0.34 C. If the airline immediately sells the old aircraft, it will generate $16 in cash, which is $13 more than if they keep the old aircraft for the rest of its life. D. If the airline immediately sells the old aircraft, it will generate a gain of $5. If they keep the old aircraft for the rest of its life, it will not generate any gain on disposal. E. The new aircraft costs $10 less than the old aircraft. Do you agree with the Controller? Should they acquire the new aircraft? Base your response on both quantitative and qualitative factors. Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started