Answered step by step

Verified Expert Solution

Question

1 Approved Answer

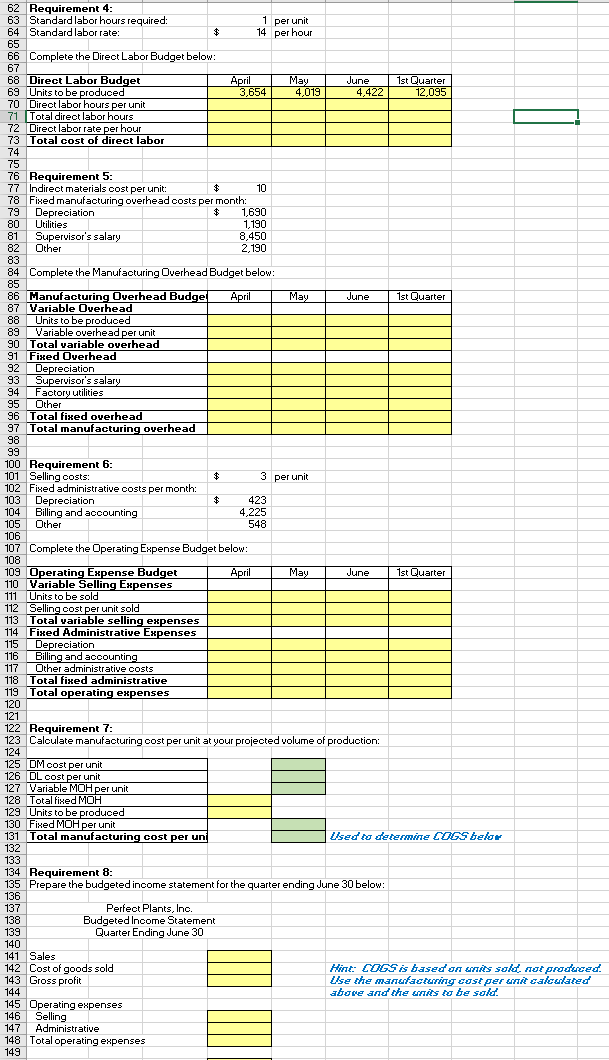

Please help and try to solve the whole thing, thanks in advance. 62 Requirement 4: 63 Standard labor hours required: 1 per unit 64 Standard

Please help and try to solve the whole thing, thanks in advance.

62 Requirement 4: 63 Standard labor hours required: 1 per unit 64 Standard labor rate: $ 14 per hour 65 66 Complete the Direct Labor Budget below: 67 68 Direct Labor Budget April May June 1st Quarter 69 Units to be produced 3,654 4,019 4,422 12,095 70 Direct labor hours per unit 71 Total direct labor hours 72 Direct labor rate per hour 73 Total cost of direct labor 74 75 76 Requirement 5: 77 Indirect materials cost per unit: 10 78 Fixed manufacturing overhead costs per month: 79 Depreciation 1,690 80 Utilities 1,190 81 Supervisor's salary 8,450 82 Other 2,190 83 84 Complete the Manufacturing Overhead Budget below: 85 86 Manufacturing Overhead Budge April May June 1st Quarter 87 Variable Overhead 88 Units to be produced 89 Variable overhead per unit 90 Total variable overhead 91 Fixed Overhead 92 Depreciation 93 Supervisor's salary 94 Factory utilities 95 Other 96 Total fixed overhead 97 Total manufacturing overhead 98 99 100 Requirement 6: 101 Selling costs: $ 3 per unit 102 Fixed administrative costs per month: 103 Depreciation $ 423 104 Billing and accounting 4,225 105 Other 548 106 107 Complete the Operating Expense Budget below: 108 109 Operating Expense Budget April May June 1st Quarter 110 Variable Selling Expenses 111 Units to be sold 112 Selling cost per unit sold 113 Total variable selling expenses 114 Fixed Administrative Expenses 115 Depreciation 116 Billing and accounting 117 Other administrative costs 118 Total fixed administrative 119 Total operating expenses 120 121 122 Requirement 7: 123 Calculate manufacturing cost per unit at your projected volume of production: 124 125 DM cost per unit 126 DL cost per unit 127 Variable MOH per unit 128 Total fixed MOH 129 Units to be produced 130 Fixed MOH per unit 131 Total manufacturing cost per un Used'ou determine COGS belor 132 133 134 Requirement 8: 135 Prepare the budgeted income statement for the quarter ending June 30 below: 136 137 Perfect Plants, Ino. 138 Budgeted Income Statement 139 Quarter Ending June 30 140 141 Sales 142 Cost of goods sold Hint: COGS is based on untis sold. not produced 143 Gross profit Use the manufacturing cost per un calculated 144 above and the unds to be sold! 145 Operating expenses 146 Selling 147 Administrative 148 Total operating expenses 149 62 Requirement 4: 63 Standard labor hours required: 1 per unit 64 Standard labor rate: $ 14 per hour 65 66 Complete the Direct Labor Budget below: 67 68 Direct Labor Budget April May June 1st Quarter 69 Units to be produced 3,654 4,019 4,422 12,095 70 Direct labor hours per unit 71 Total direct labor hours 72 Direct labor rate per hour 73 Total cost of direct labor 74 75 76 Requirement 5: 77 Indirect materials cost per unit: 10 78 Fixed manufacturing overhead costs per month: 79 Depreciation 1,690 80 Utilities 1,190 81 Supervisor's salary 8,450 82 Other 2,190 83 84 Complete the Manufacturing Overhead Budget below: 85 86 Manufacturing Overhead Budge April May June 1st Quarter 87 Variable Overhead 88 Units to be produced 89 Variable overhead per unit 90 Total variable overhead 91 Fixed Overhead 92 Depreciation 93 Supervisor's salary 94 Factory utilities 95 Other 96 Total fixed overhead 97 Total manufacturing overhead 98 99 100 Requirement 6: 101 Selling costs: $ 3 per unit 102 Fixed administrative costs per month: 103 Depreciation $ 423 104 Billing and accounting 4,225 105 Other 548 106 107 Complete the Operating Expense Budget below: 108 109 Operating Expense Budget April May June 1st Quarter 110 Variable Selling Expenses 111 Units to be sold 112 Selling cost per unit sold 113 Total variable selling expenses 114 Fixed Administrative Expenses 115 Depreciation 116 Billing and accounting 117 Other administrative costs 118 Total fixed administrative 119 Total operating expenses 120 121 122 Requirement 7: 123 Calculate manufacturing cost per unit at your projected volume of production: 124 125 DM cost per unit 126 DL cost per unit 127 Variable MOH per unit 128 Total fixed MOH 129 Units to be produced 130 Fixed MOH per unit 131 Total manufacturing cost per un Used'ou determine COGS belor 132 133 134 Requirement 8: 135 Prepare the budgeted income statement for the quarter ending June 30 below: 136 137 Perfect Plants, Ino. 138 Budgeted Income Statement 139 Quarter Ending June 30 140 141 Sales 142 Cost of goods sold Hint: COGS is based on untis sold. not produced 143 Gross profit Use the manufacturing cost per un calculated 144 above and the unds to be sold! 145 Operating expenses 146 Selling 147 Administrative 148 Total operating expenses 149Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started