Answered step by step

Verified Expert Solution

Question

1 Approved Answer

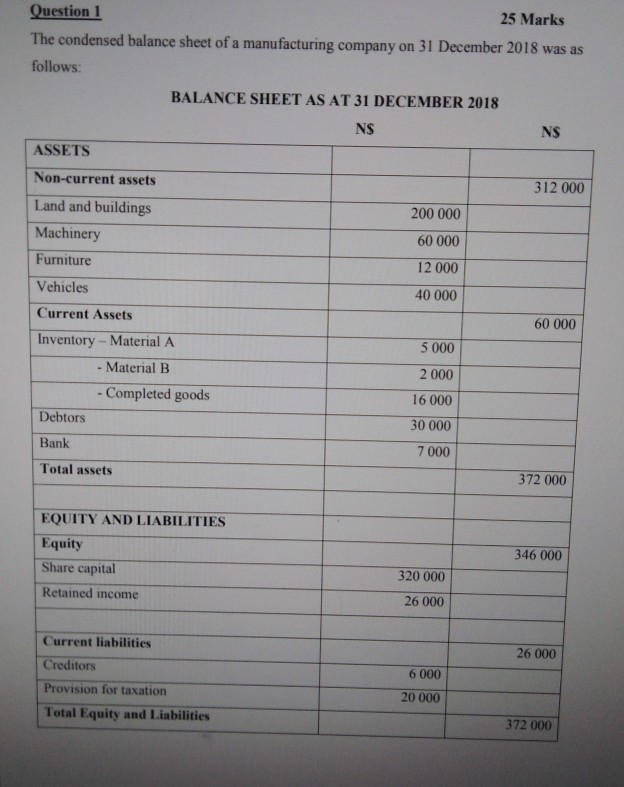

Question 1 25 Marks The condensed balance sheet of a manufacturing company on 31 December 2018 was as follows: BALANCE SHEET AS AT 31 DECEMBER

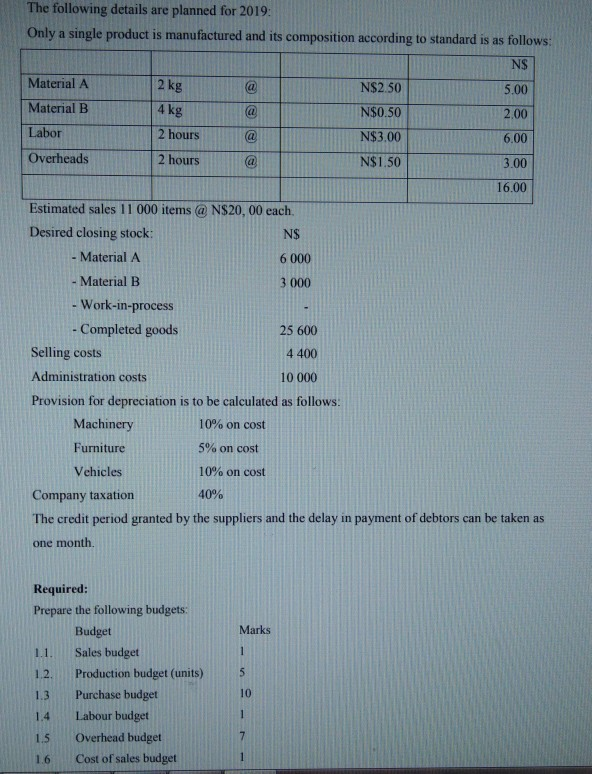

Question 1 25 Marks The condensed balance sheet of a manufacturing company on 31 December 2018 was as follows: BALANCE SHEET AS AT 31 DECEMBER 2018 NS ASSETS Non-current assets 312 000 Land and buildings 200 000 Machinery 60 000 Furniture 12 000 Vehicles 40 000 Current Assets 60 000 Inventory - Material A 5 000 - Material B 2 000 - Completed goods 16 000 Debtors 30 000 Bank 7 000 Total assets 372 000 346 000 EQUITY AND LIABILITIES Equity Share capital Retained income 320 000 26 000 26 000 Current liabilities Creditors Provision for taxation Total Equity and Liabilities 6 000 20 000 372 000 The following details are planned for 2019: Only a single product is manufactured and its composition according to standard is as follows: NS Material A 2 kg @ N$2.50 5.00 Material B 4 kg @ N$0.50 2.00 Labor 2 hours N$3.00 6.00 Overheads 2 hours N$1.50 3.00 16.00 NS Estimated sales 11 000 items @ N$20,00 each. Desired closing stock: - Material A 6 000 - Material B 3 000 - Work-in-process - Completed goods 25 600 Selling costs 4 400 Administration costs 10 000 Provision for depreciation is to be calculated as follows: Machinery 10% on cost Furniture 5% on cost Vehicles 10% on cost Company taxation 40% The credit period granted by the suppliers and the delay in payment of debtors can be taken as one month Marks Required: Prepare the following budgets: Budget 1.1. Sales budget 12. Production budget (units) 1.3 Purchase budget Labour budget Overhead budget 1.6 Cost of sales budget 1.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started