Answered step by step

Verified Expert Solution

Question

1 Approved Answer

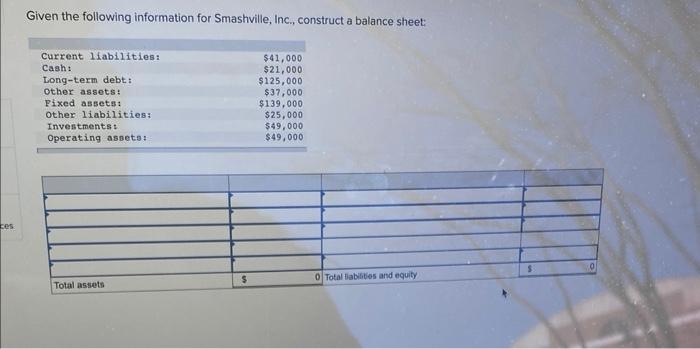

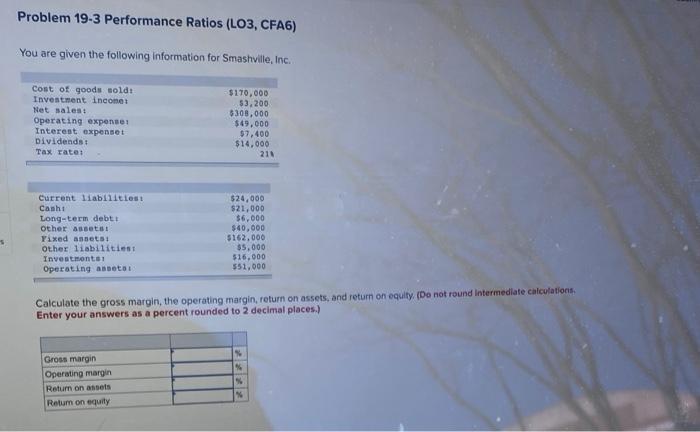

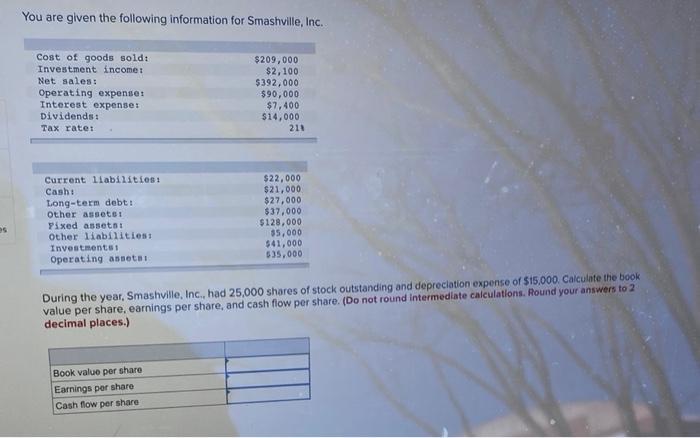

please help answer all of the following questions there are 9 Given the following information for Smashville, Inc., construct a balance sheet: Problem 19-3 Performance

please help answer all of the following questions there are 9

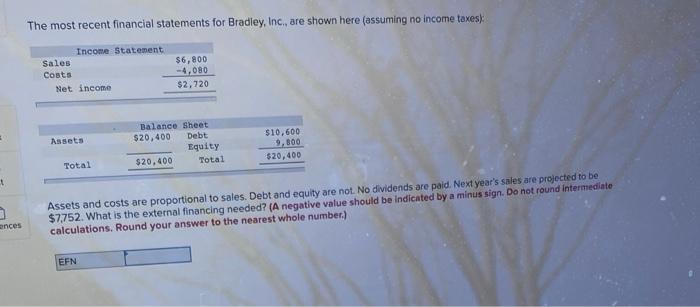

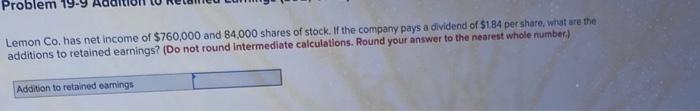

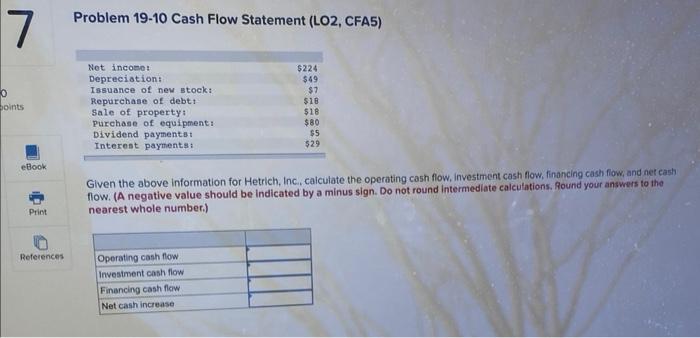

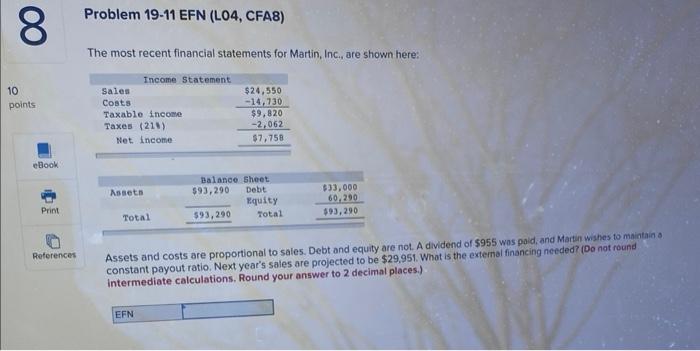

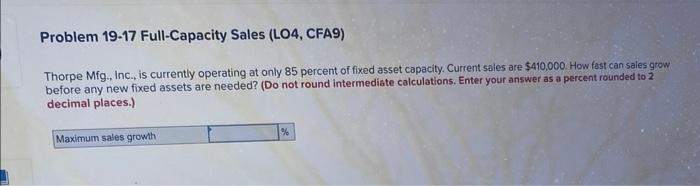

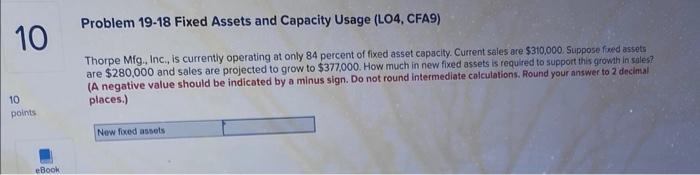

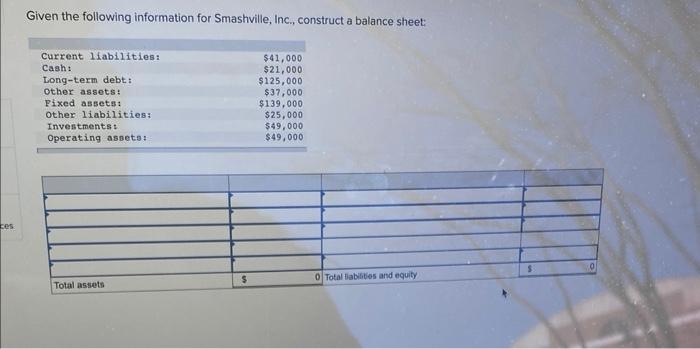

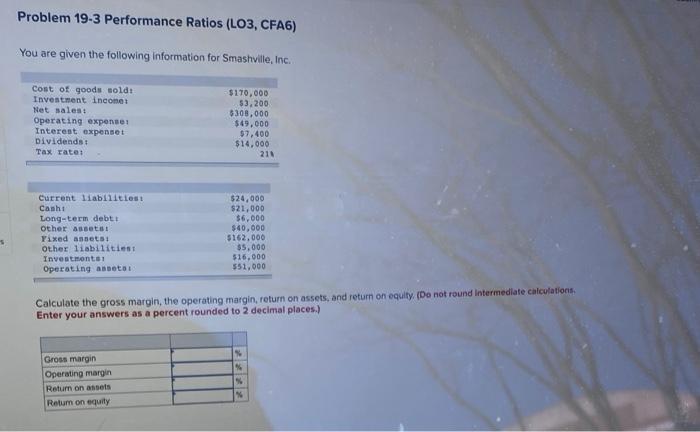

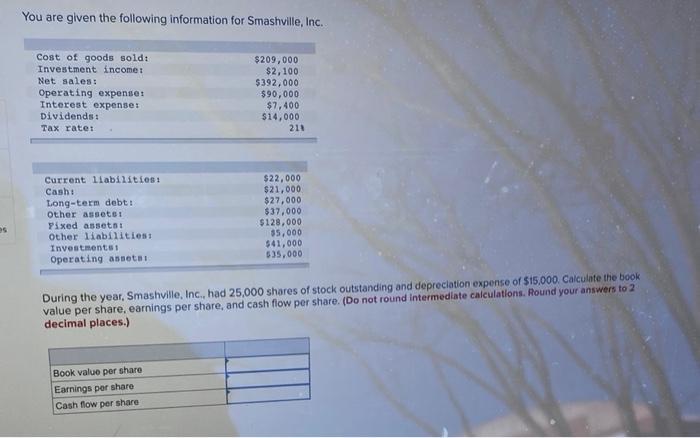

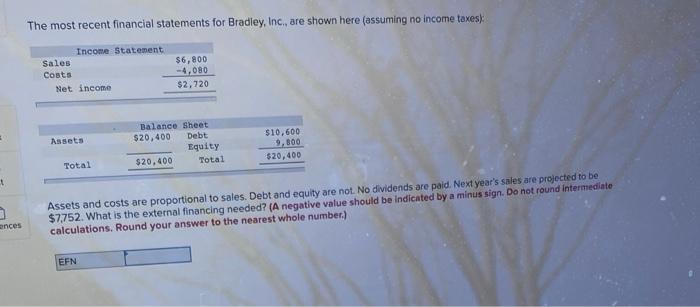

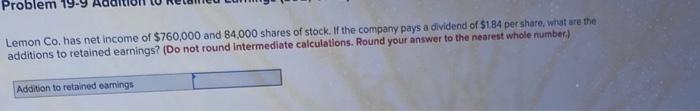

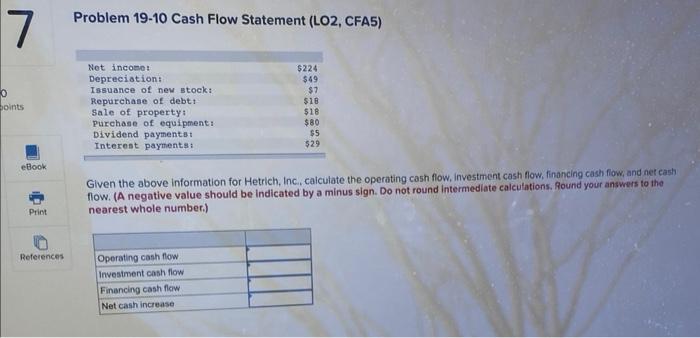

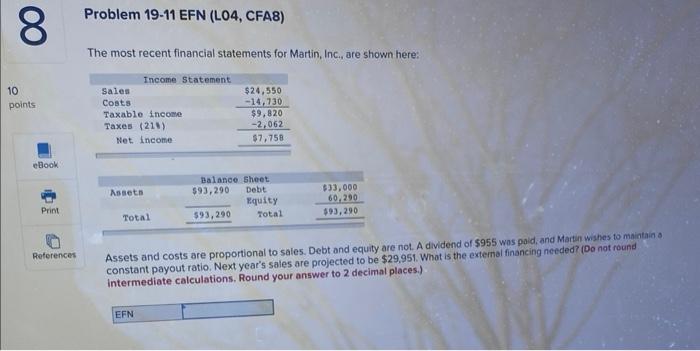

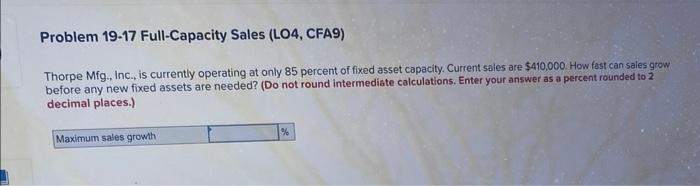

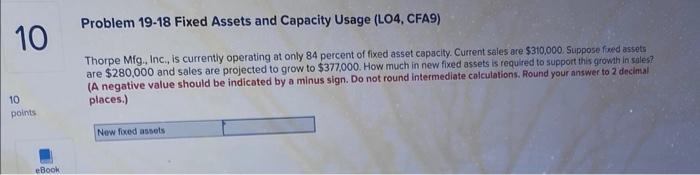

Given the following information for Smashville, Inc., construct a balance sheet: Problem 19-3 Performance Ratios (LO3, CFA6) You are given the following information for Smashville, Inc. Calculate the gross margin, the operating margin, return on assets, and return on equity, (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) You are given the following information for Smashville, Inc. During the year, Smashville, Inc, had 25,000 shares of stock outstanding and depreciation expense of $15,000. Calculate the book value per share, earnings per share, and cash flow per share. (Do not round intermediate calculations. Alound your answers to 2 decimal places.) The most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $7.752. What is the external financing needed? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.) Lemon Co. has net income of $760,000 and 84,000 shares of stock. If the company pays a dividend of $184 per share, wivt are the additions to retained earnings? (Do not round intermediate calculations. Round your answer to the nearest whole number) Problem 19-10 Cash Flow Statement (LO2, CFA5) Given the above information for Hetrich, Inc, calculate the operating cash flow, investment cash flow, financing cash flow, and net cash flow. (A negative value should be indicated by a minus sign. Do not round intermediate calcutations. Pound your answers to the nearest whole number.) Problem 19-11 EFN (LO4, CFA8) The most recent financial statements for Martin, Inc., are shown here: Assets and costs are proportional to sales. Debt and equity are not. A dividend of $955 was paid, and Martin wishes to maintain s. constant payout ratio. Next year's sales are projected to be $29,951. Whot is the extemal financing needed? (Da not round intermediate calculations. Round your answer to 2 decimal places.) Thorpe Mfg. Inc., is currently operating at only 85 percent of fixed asset capacity. Current sales are $410,000. How fost can sales grow before any new fixed assets are needed? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Problem 19-18 Fixed Assets and Capacity Usage (LO4, CFA9) Thorpe Mig. Inc, is currently operating at only 84 percent of fixed asset capacity. Current sales are $310.000. Suppose fred assets are $280,000 and sales are projected to grow to $377,000. How much in new fixed assets is requ red to support this growth in sales? (A negative value should be indicated by a minus sign. Do not round intermedlate calculations. Found your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started