Answered step by step

Verified Expert Solution

Question

1 Approved Answer

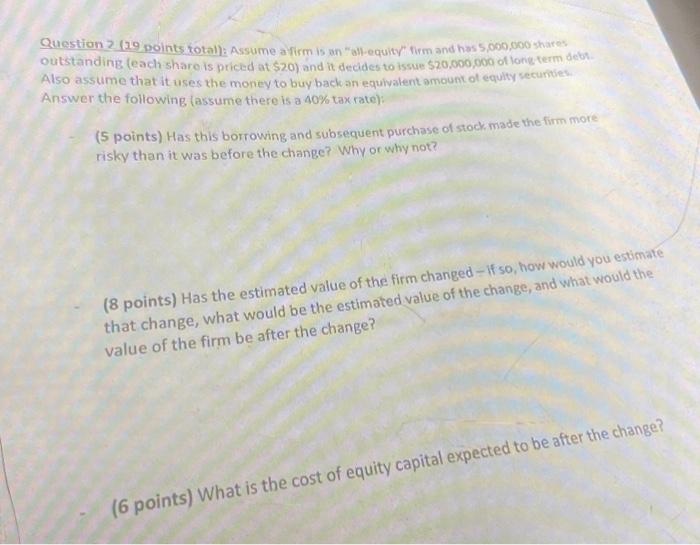

please help answer all three parts! Question 2 (19 points tota): Assume a firm is un all-equity firm and has 5,000,000 shares outstanding (each share

please help answer all three parts!

Question 2 (19 points tota): Assume a firm is un "all-equity" firm and has 5,000,000 shares outstanding (each share is priced at $20) and it decides to issue $20,000, pogot torin termdett Also assume that it uses the money to buy back an equivalent amount of equity securities Answer the following (assume there is a 40% tax rate) (5 points) Has this borrowing and subsequent purchase of stock made the firm more risky than it was before the change? Why or why not? (8 points) Has the estimated value of the firm changed -- if so, how would you estimate that change, what would be the estimated value of the change, and what would the value of the firm be after the change? (6 points) What is the cost of equity capital expected to be after the change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started