Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help answer both pictures please 10) 20 points. On January 1, Year 1, Jefferson Manufacturing Company purchased equipment for $212,000. Jefferson paid $4,000 to

please help

answer both pictures please

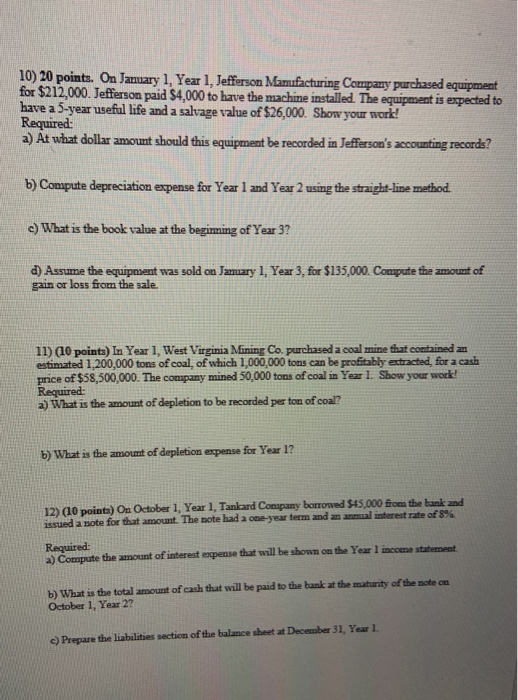

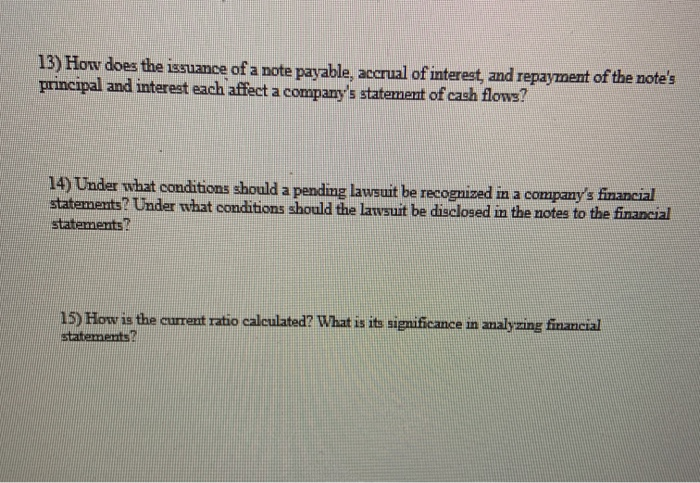

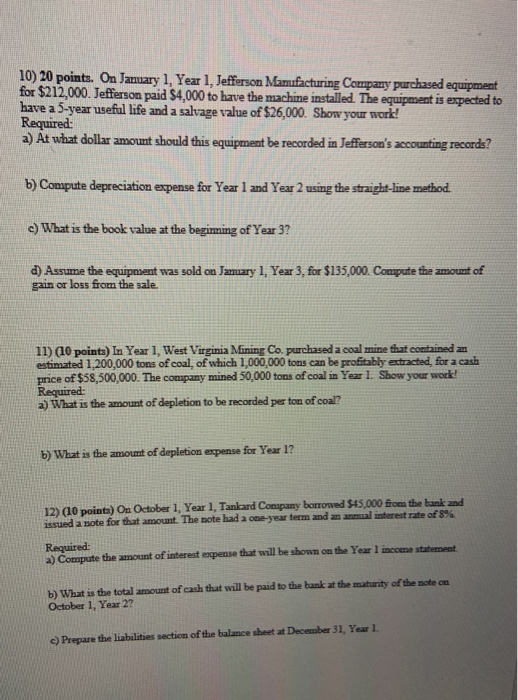

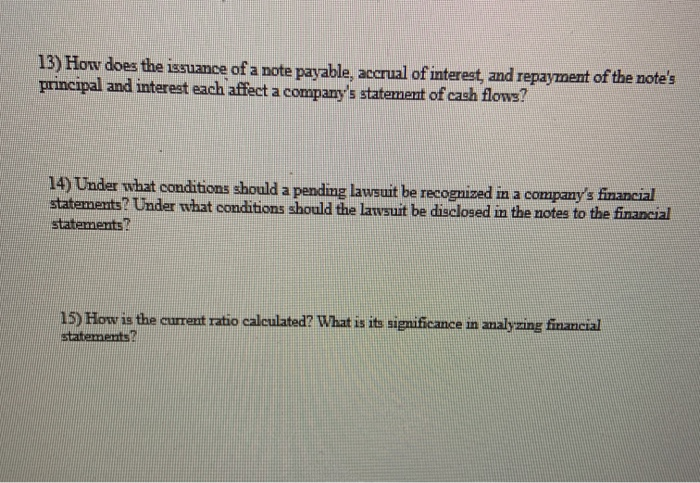

10) 20 points. On January 1, Year 1, Jefferson Manufacturing Company purchased equipment for $212,000. Jefferson paid $4,000 to have the machine installed. The equipment is expected to have a 5-year useful life and a salvage value of $26,000. Show your work! Required: a) At what dollar amount should this equipment be recorded in Jefferson's accounting records? b) Compute depreciation expense for Year 1 and Year 2 using the straight-line method. c) What is the book value at the beginning of Year 3? d) Assume the equipment was sold on January 1, Year 3, for $135,000. Compute the amount of gain or loss from the sale. 11) (10 points) In Year 1, West Virginia Mining Co. purchased a coal mine that contained an estimated 1,200,000 tons of coal, of which 1,000,000 tons can be profitably extracted, for a cash price of $58,500,000. The company mined 50,000 tons of coal in Year 1. Show your work! Required: a) What is the amount of depletion to be recorded per ton of coal? b) What is the amount of depletion expense for Year 1? 12) (10 points) On October 1, Year 1. Tankard Company borrowed $45,000 from the bank and issued a note for that amount. The note had a one-year term and an annual interest rate of 8% Required: a) Compute the amount of interest expense that will be shown on the Year I income statement b) What is the total amount of cash that will be paid to the bank at the maturity of the potem October 1, Year 2? c) Prepare the liabilities section of the balance sheet at December 31, Year 1 13) How does the issuance of a note payable, accrual of interest, and repayment of the note's principal and interest each affect a company's statement of cash flowy? 14) Under what conditions should a pending lawsuit be recognized in a company's financial statements? Under what conditions should the lawsuit be disclosed in the notes to the financial statements? 15) How is the current ratio calculated? What is its significance in analyzing financial statements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started