Answered step by step

Verified Expert Solution

Question

1 Approved Answer

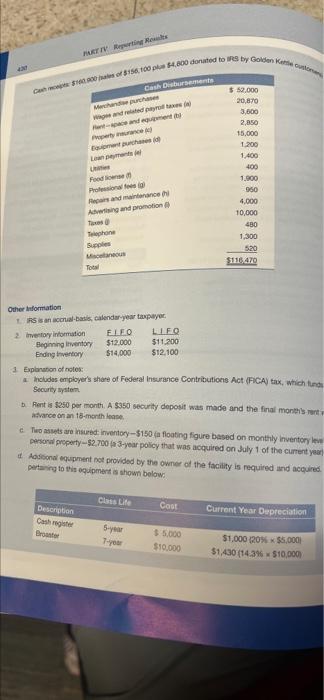

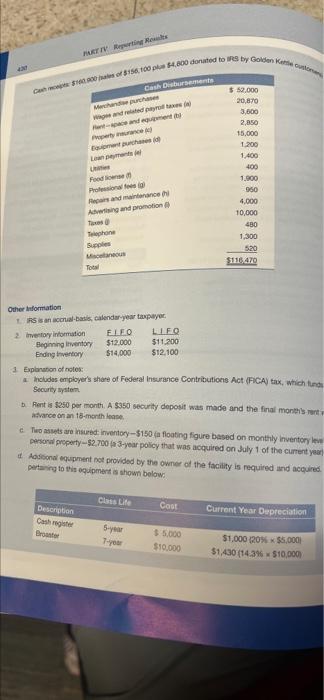

please help answer PART Reporting CES of $150.000 donated to by Golden Karton $ 52,000 20,870 Cash Disbursements Minden and payroll wand 2,850 15.000 1.200

please help answer

PART Reporting CES of $150.000 donated to by Golden Karton $ 52,000 20,870 Cash Disbursements Minden and payroll wand 2,850 15.000 1.200 1.400 he Laman Food Profesional and maintenance Awgand promotion 1.900 950 4,000 10,000 480 1.300 520 $111.470 Telephone B Other Information is an il-basis, calendar year taxpayer Inventory Information ELIO LLEO Beginning inventory $12,000 $11.200 Ending wory $14,000 $12.100 Exploration of notes houdes employer's share of Federal Insurance Contributions Act (FICA) tax, which und Security system Rent is $250 per month. A $350 security deposit was made and the final month's rent Advance on an 18-month lase e Tweets are sure inventory-S150 a floating figure based on monthly invertory personal property-$2.700 a 3-year policy that was acquired on July 1 of the current Adicional equipment provided by the owner of the facility is required and acquired Dung to this equipment is shown below Clans Life Cost Current Year Depreciation Description Cashier Brown 5-year Ty $ 5.000 $10.000 $1,000 (20% $5,000 $1,430 (14.34 $10,000 431 $200 a mortis and to Bretlana on 5.000 cu o puchementni expenses $450 $200 pied on January 1 and My two caserole, who motor.com Breakdown of this per 1200-ration of your um 5000 --Payment to wheet for her pure which will be used to build the wine now future 11.100 Alometer in detinga um brought by customer who camed that she was was under cooked food, which led to Therious customer com trought out in action by the Human ordered and change ting 3000 ton and cred 1000. The $300 is includin $950 repairs and maintenance figure out the street blonde come totum Includes $1.000 advertising 2.400 paid for a low marw next year's telephone dructor, which will be in October Estimated federal income tax payment on the Review chapter content and explore online resources at http://ebon, appel.com/indete PART Reporting CES of $150.000 donated to by Golden Karton $ 52,000 20,870 Cash Disbursements Minden and payroll wand 2,850 15.000 1.200 1.400 he Laman Food Profesional and maintenance Awgand promotion 1.900 950 4,000 10,000 480 1.300 520 $111.470 Telephone B Other Information is an il-basis, calendar year taxpayer Inventory Information ELIO LLEO Beginning inventory $12,000 $11.200 Ending wory $14,000 $12.100 Exploration of notes houdes employer's share of Federal Insurance Contributions Act (FICA) tax, which und Security system Rent is $250 per month. A $350 security deposit was made and the final month's rent Advance on an 18-month lase e Tweets are sure inventory-S150 a floating figure based on monthly invertory personal property-$2.700 a 3-year policy that was acquired on July 1 of the current Adicional equipment provided by the owner of the facility is required and acquired Dung to this equipment is shown below Clans Life Cost Current Year Depreciation Description Cashier Brown 5-year Ty $ 5.000 $10.000 $1,000 (20% $5,000 $1,430 (14.34 $10,000 431 $200 a mortis and to Bretlana on 5.000 cu o puchementni expenses $450 $200 pied on January 1 and My two caserole, who motor.com Breakdown of this per 1200-ration of your um 5000 --Payment to wheet for her pure which will be used to build the wine now future 11.100 Alometer in detinga um brought by customer who camed that she was was under cooked food, which led to Therious customer com trought out in action by the Human ordered and change ting 3000 ton and cred 1000. The $300 is includin $950 repairs and maintenance figure out the street blonde come totum Includes $1.000 advertising 2.400 paid for a low marw next year's telephone dructor, which will be in October Estimated federal income tax payment on the Review chapter content and explore online resources at http://ebon, appel.com/indete

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started