Answered step by step

Verified Expert Solution

Question

1 Approved Answer

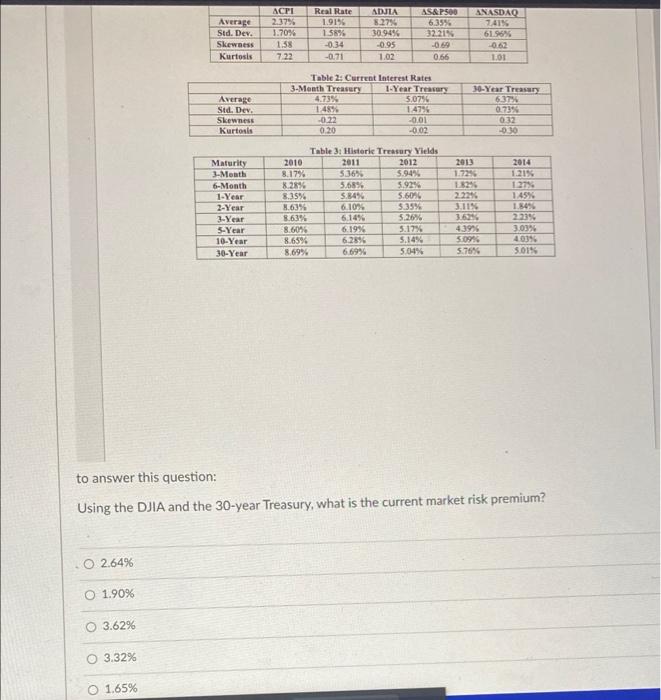

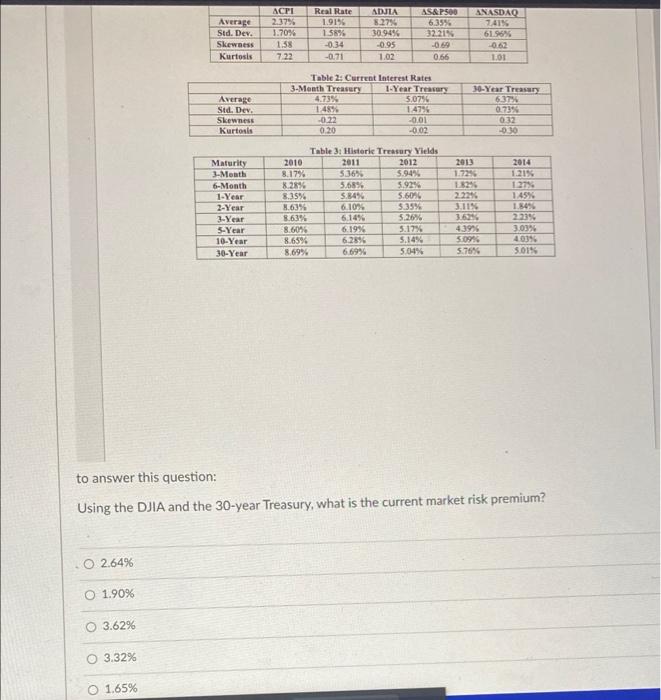

please help answering Average Std. Dev. Skewness Kurtosis ACPI 2.3756 1.70% 1.58 Real Rate 1.9156 1.58% -0.34 -0.71 ADULA 8.27% 30.9496 -0.95 1.02 AS&P500 6.35%

please help answering

Average Std. Dev. Skewness Kurtosis ACPI 2.3756 1.70% 1.58 Real Rate 1.9156 1.58% -0.34 -0.71 ADULA 8.27% 30.9496 -0.95 1.02 AS&P500 6.35% 32.215 -0.69 0.66 ANASDAQ 7415 61.56% 0.62 1.01 7.22 Average Std. Der Skewness Kurtos Table 2: Current Interest Rates 3-Month Treasury 1-Year Treasury 4.73% 5.0796 1.48% 1.4795 -0.22 -0.01 020 -0.02 30-Year Treasury 6.37 0.73% 032 -0.30 Maturity 3-Month 6-Month 1-Year 2-Year 3-Year 5-Year 10-Year 30-Year Table 3: Historie Treasury Yields 2010 2011 2012 8.1794 5.36% 5.94% 8.2896 5.68% 5.92% 8.35% 5.84% 5.6096 3.63% 6.10 5.35% 8.63% 6.14% 5.26% 8.609 6.1996 5.17% 8.6594 6.2896 5.14% 8.699 504% 2013 1.72 1829 2.22% 3.11% 3.63% 43935 5099 5.76% 2014 1.215 27% 1,45% 1.8495 2.23% 3.03% 40146 3.015 to answer this question: Using the DJIA and the 30-year Treasury, what is the current market risk premium? 0 2.64% O 1.90% O 3.62% 3.32% 1.65%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started