Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ASAP! Below are two sets of regression results on the stock of Costco Wholesale Corp (ticker: COST). One set of the output is

PLEASE HELP ASAP!

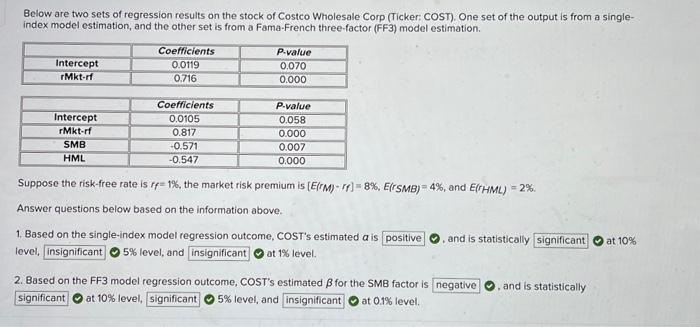

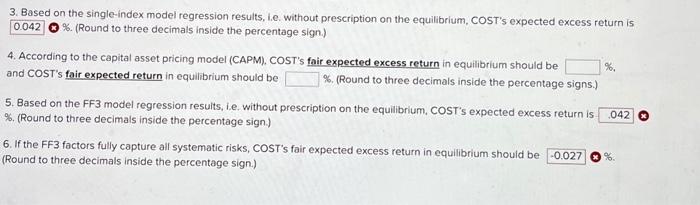

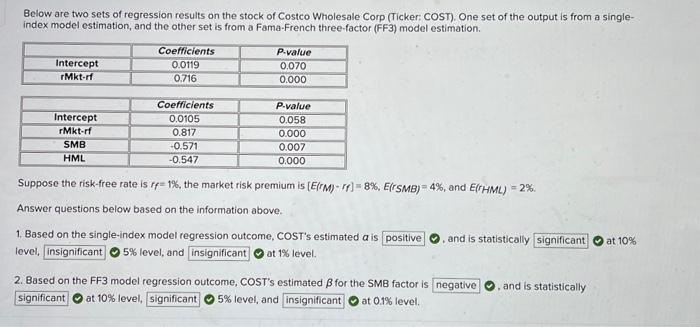

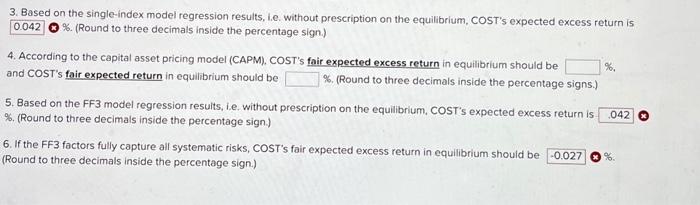

Below are two sets of regression results on the stock of Costco Wholesale Corp (ticker: COST). One set of the output is from a singleindex model estimation, and the other set is from a Fama-French three-factor (FF3) model estimation. Suppose the risk-free rate is if=1%, the market risk premium is [E(rM)rf]=8%,E(rSMB)=4%, and E(rHML)=2%. Answer questions below based on the information above. 1. Based on the single-index model regression outcome, COST's estimated a is at 10% level, 5% level, and at 1% level. 2. Based on the FF3 model regression outcome, COST's estimated for the SMB factor is , and is statistically at 10% level, 5% level, and at 0.1% level. 3. Based on the single-index model regression results, i.e. without prescription on the equilibrium, COST's expected excess return is * . (Round to three decimals inside the percentage sign.) 4. According to the capital asset pricing model (CAPM), COST's fair expected excess return in equilibrium should be and COST's fair expected return in equilibrium should be \%. (Round to three decimals inside the percentage signs.) 5. Based on the FF3 model regression results, i.e. without prescription on the equilibrium, COST's expected excess return is \%. (Round to three decimals inside the percentage sign.) 6. If the FF3 factors fully capture all systematic risks, COST's fair expected excess return in equilibrium should be (Round to three decimals inside the percentage sign.) Below are two sets of regression results on the stock of Costco Wholesale Corp (ticker: COST). One set of the output is from a singleindex model estimation, and the other set is from a Fama-French three-factor (FF3) model estimation. Suppose the risk-free rate is if=1%, the market risk premium is [E(rM)rf]=8%,E(rSMB)=4%, and E(rHML)=2%. Answer questions below based on the information above. 1. Based on the single-index model regression outcome, COST's estimated a is at 10% level, 5% level, and at 1% level. 2. Based on the FF3 model regression outcome, COST's estimated for the SMB factor is , and is statistically at 10% level, 5% level, and at 0.1% level. 3. Based on the single-index model regression results, i.e. without prescription on the equilibrium, COST's expected excess return is * . (Round to three decimals inside the percentage sign.) 4. According to the capital asset pricing model (CAPM), COST's fair expected excess return in equilibrium should be and COST's fair expected return in equilibrium should be \%. (Round to three decimals inside the percentage signs.) 5. Based on the FF3 model regression results, i.e. without prescription on the equilibrium, COST's expected excess return is \%. (Round to three decimals inside the percentage sign.) 6. If the FF3 factors fully capture all systematic risks, COST's fair expected excess return in equilibrium should be (Round to three decimals inside the percentage sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started