Answered step by step

Verified Expert Solution

Question

1 Approved Answer

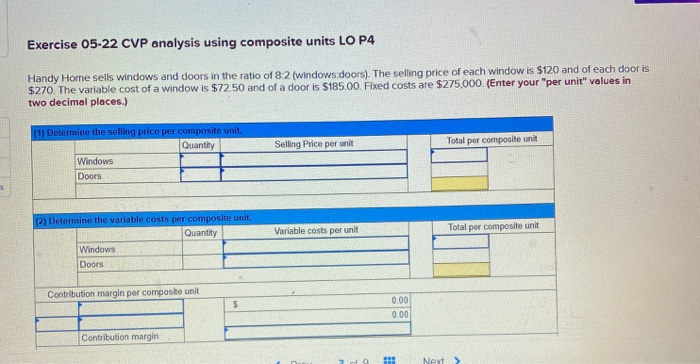

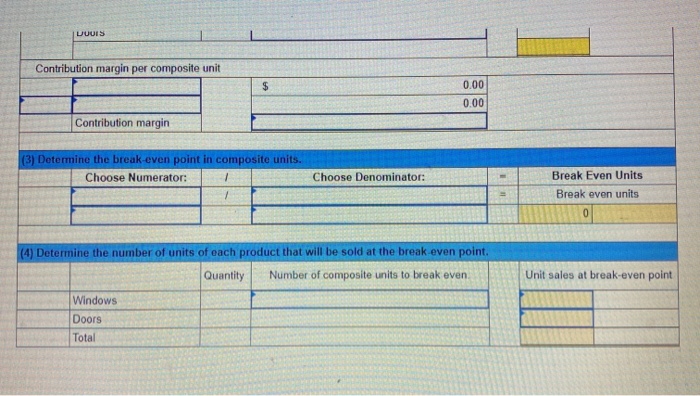

please help asap!! Exercise 05-22 CVP analysis using composite units LO P4 Handy Home sells windows and doors in the ratio of 8:2 (windows.doors). The

please help asap!!

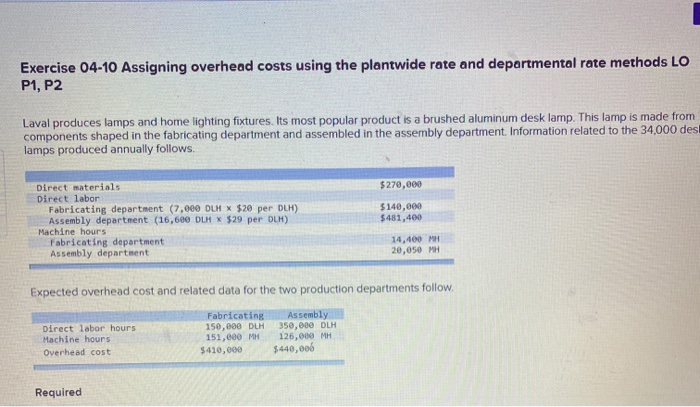

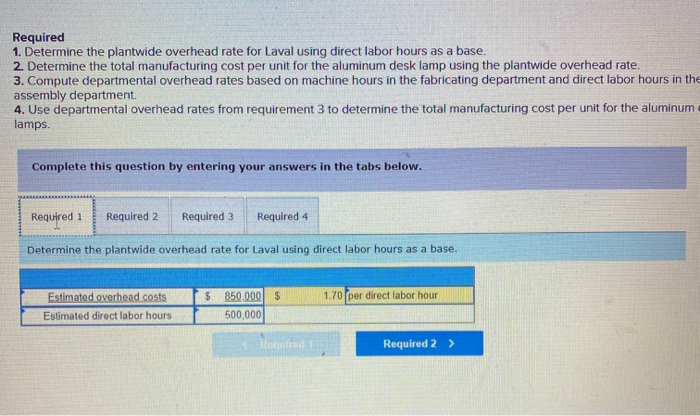

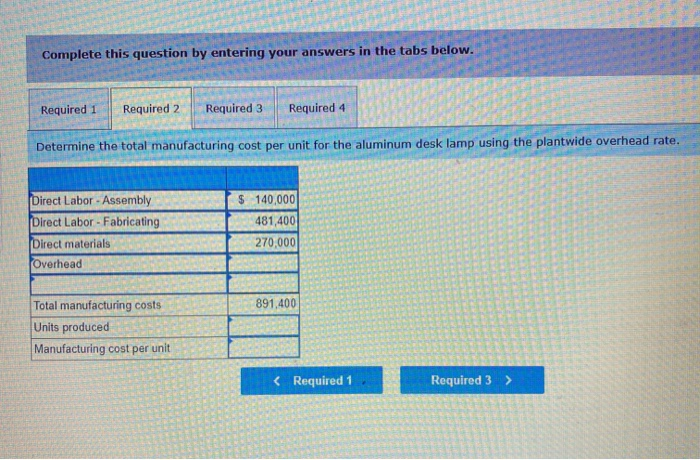

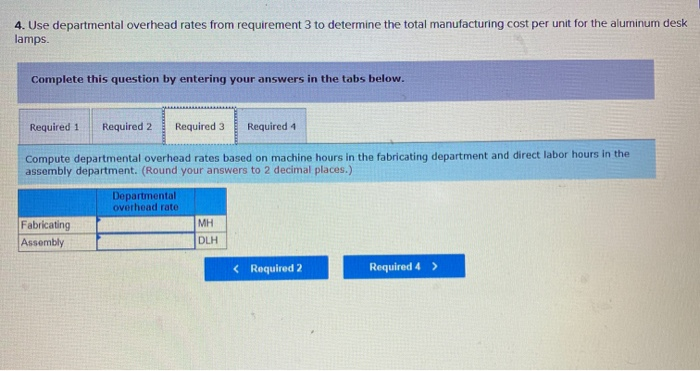

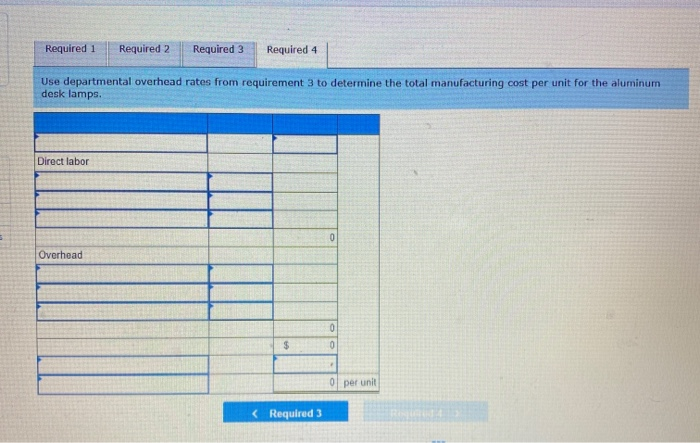

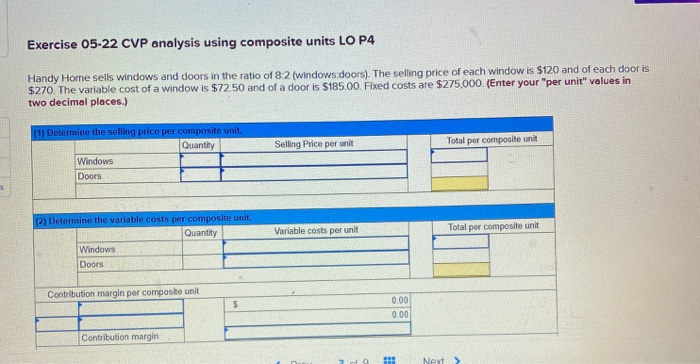

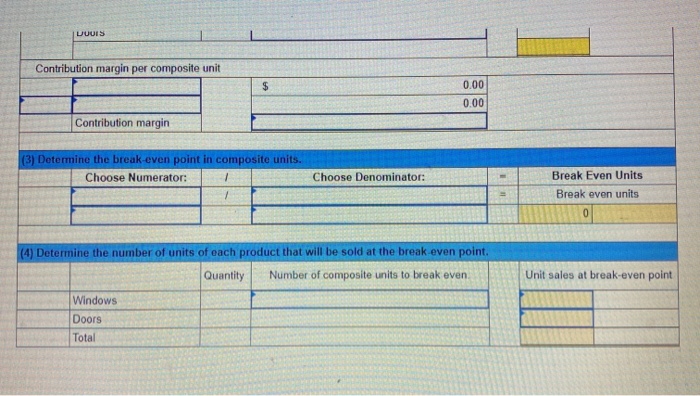

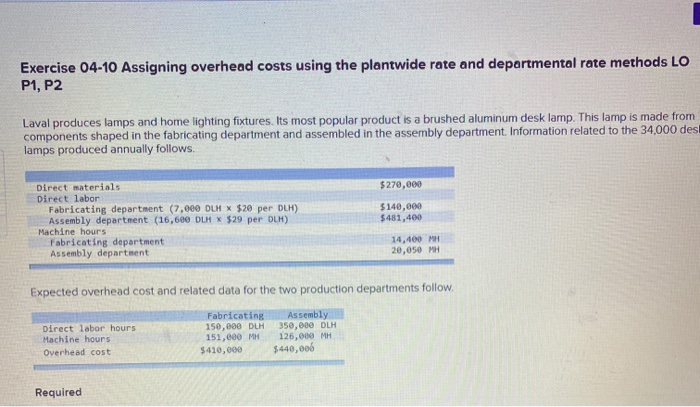

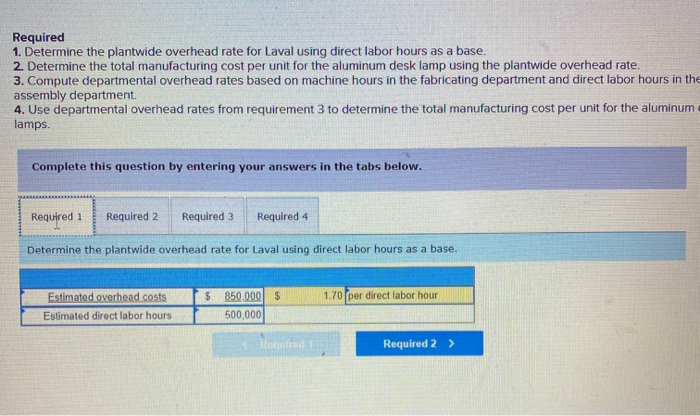

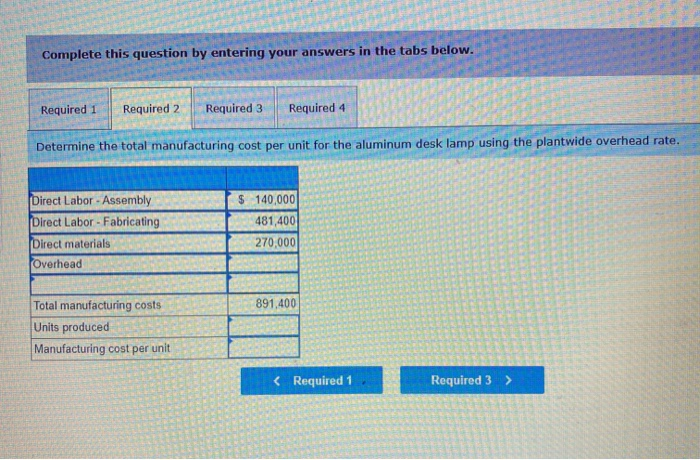

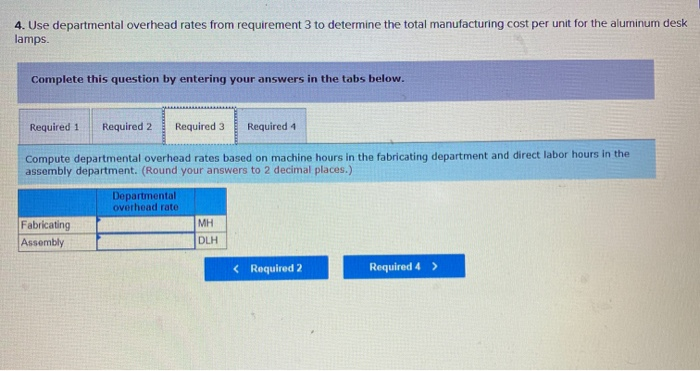

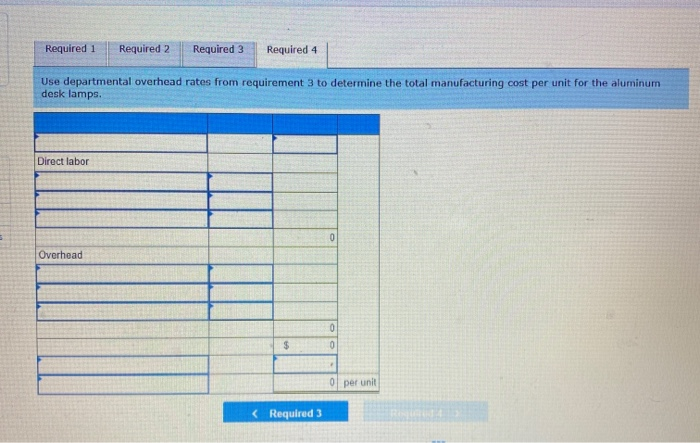

Exercise 05-22 CVP analysis using composite units LO P4 Handy Home sells windows and doors in the ratio of 8:2 (windows.doors). The selling price of each window is $120 and of each door is $270 The variable cost of a window is $72.50 and of a door is $185.00. Fixed costs are $275,000. (Enter your "per unit" values in two decimal places.) Selling Price per unit Total per composite unit (1) Determine the selling price per composite unit. Quantity Windows Doors Variable costs per unit Total per composite unit (2) Determine the variable costs per composite unit. Quantity Windows Doors Contribution margin per composite unit $ 0.00 0.00 Contribution margin Next > UUS Contribution margin per composite unit $ 0.00 0.00 Contribution margin (3) Determine the break-even point in composite units. Choose Numerator: Choose Denominator: Break Even Units Break even units 0 Unit sales at break-even point (4) Determine the number of units of each product that will be sold at the break-even point. Quantity Number of composite units to break even Windows Doors Total Exercise 04-10 Assigning overhead costs using the plantwide rate and departmental rate methods LO P1, P2 Laval produces lamps and home lighting fixtures. Its most popular product is a brushed aluminum desk lamp. This lamp is made from components shaped in the fabricating department and assembled in the assembly department. Information related to the 34,000 des lamps produced annually follows. $ 270,000 Direct materials Direct labor Fabricating department (7,000 DLH X $20 per DLH) Assembly department (16,600 DLH * $29 per DLH) Machine hours Fabricating department Assembly department $140,000 $481,400 14,400 MH 20,050 MH Expected overhead cost and related data for the two production departments follow. Direct labor hours Machine hours Overhead cost Fabricating 150,000 DLH 151,000 MH $410,000 Assembly 350,000 DLH 126,000 MH $440,00 Required Required 1. Determine the plantwide overhead rate for Laval using direct labor hours as a base. 2. Determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate. 3. Compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department. 4. Use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum lamps. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine the plantwide overhead rate for Laval using direct labor hours as a base. $ 1.70 per direct labor hour Estimated overhead costs Estimated direct labor hours $ 850.000 500,000 Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Determine the total manufacturing cost per unit for the aluminum desk lamp using the plantwide overhead rate. Direct Labor - Assembly Direct Labor - Fabricating (Direct materials Overhead $ 140,000 481,400 270,000 891,400 Total manufacturing costs Units produced Manufacturing cost per unit 4. Use departmental overhead rates from requirement 3 to determine the total manufacturing cost per unit for the aluminum desk lamps. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute departmental overhead rates based on machine hours in the fabricating department and direct labor hours in the assembly department. (Round your answers to 2 decimal places.) Departmental overhead rate Fabricating Assembly MH DLH

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started