PLEASE HELP ASAP. WILL RATE.

I need help with this part "You will need to create T accounts for each account in your chart of accounts, insert beginning balances to be used in your financial statements."

I made the financial statements but I have to incorporate in T accounts. Any data that you may need, for example beginning balances, you can make up.

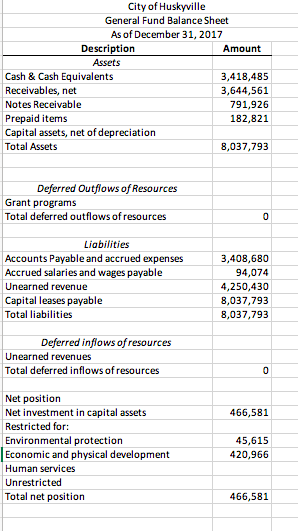

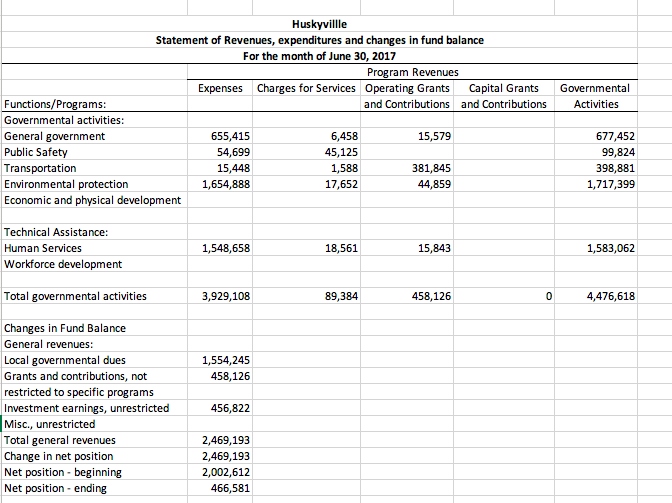

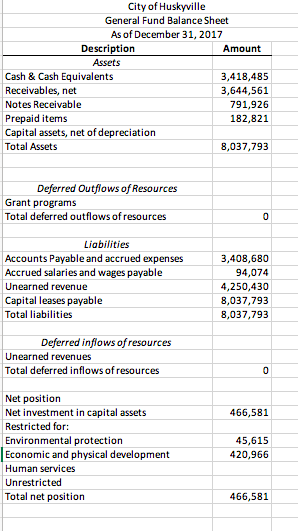

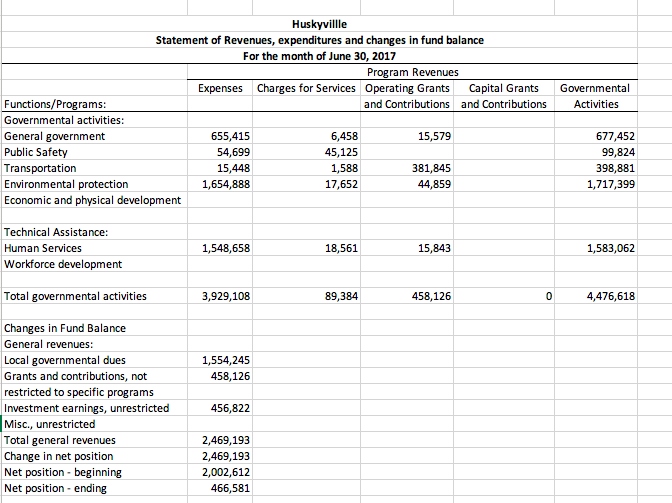

. Create financial statements for one month for your organization. If you are a city government, you only need to create financial statements for the general fund, which are: 1. a balance sheet, and 2. a statement of revenues, expenditures, and changes in fund balances. If you are a not-for-profit organization, you need to create: 1. a statement of financial position, and 2. a statement of activities. You will need to create T-accounts for each account in your chart of accounts, insert beginning balances, and post the transactions from item 3 to the accounts to arrive at ending balances to be used in your financial statements. If you are a not-for-profit organization, you will need to designate net assets as net assets with donor restrictions or net assets without donor restrictions (formerly unrestricted, temporarily restricted, and permanently restricted) General Fund Balance Sheet As of December 31, 2017 Description Assets Amount Cash & Cash Equivalents Receivables, net Notes Receivable Prepaid items Capital assets, net of depreciation Total Assets 3,418,485 3,644,561 791,926 182,821 8,037,793 Deferred Outfiows of Resources Grant programs Total deferred outflows of resources Liabilities Accounts Payable and accrued expenses Accrued salaries and wages payable Unearned revenue Capital leases payable Total liabilities 3,408,680 94,074 4,250,430 8,037,793 8,037,793 Deferred infiows of resources Unearned revenues Total deferred inflows of resources Net position Net investment in capital assets Restricted for Environmental protection Economic and physical development Human services Unrestricted Total net position 45,615 Huskyvillle Statement of Revenues, expenditures and changes in fund balance For the month of June 30, 2017 Program Revenues Expenses Charges for Services Operating Grants Capital Grants Governmental Functions/Programs: Governmental activities: General government Public Safety Transportation Environmental protection Economic and physical development and Contributions and Contributions Activities 655,415 54,699 15,448 1,654,888 6,458 45,125 1,588 17,652 15,579 677,452 99,824 398,881 1,717,399 381,845 44,859 Technical Assistance: Human Services Workforce development 1,548,658 18,561 15,843 1,583,062 Total governmental activities 3,929,108 89,384 458,126 4,476,618 Changes in Fund Balance General revenues: Local governmental dues Grants and contributions, not restricted to specific programs Investment earnings, unrestricted Misc., unrestricted Total general revenues Change in net position Net position- beginning Net position - ending 1,554,245 458,126 456,822 2,469,193 2,469,193 2,002,612 466,581 . Create financial statements for one month for your organization. If you are a city government, you only need to create financial statements for the general fund, which are: 1. a balance sheet, and 2. a statement of revenues, expenditures, and changes in fund balances. If you are a not-for-profit organization, you need to create: 1. a statement of financial position, and 2. a statement of activities. You will need to create T-accounts for each account in your chart of accounts, insert beginning balances, and post the transactions from item 3 to the accounts to arrive at ending balances to be used in your financial statements. If you are a not-for-profit organization, you will need to designate net assets as net assets with donor restrictions or net assets without donor restrictions (formerly unrestricted, temporarily restricted, and permanently restricted) General Fund Balance Sheet As of December 31, 2017 Description Assets Amount Cash & Cash Equivalents Receivables, net Notes Receivable Prepaid items Capital assets, net of depreciation Total Assets 3,418,485 3,644,561 791,926 182,821 8,037,793 Deferred Outfiows of Resources Grant programs Total deferred outflows of resources Liabilities Accounts Payable and accrued expenses Accrued salaries and wages payable Unearned revenue Capital leases payable Total liabilities 3,408,680 94,074 4,250,430 8,037,793 8,037,793 Deferred infiows of resources Unearned revenues Total deferred inflows of resources Net position Net investment in capital assets Restricted for Environmental protection Economic and physical development Human services Unrestricted Total net position 45,615 Huskyvillle Statement of Revenues, expenditures and changes in fund balance For the month of June 30, 2017 Program Revenues Expenses Charges for Services Operating Grants Capital Grants Governmental Functions/Programs: Governmental activities: General government Public Safety Transportation Environmental protection Economic and physical development and Contributions and Contributions Activities 655,415 54,699 15,448 1,654,888 6,458 45,125 1,588 17,652 15,579 677,452 99,824 398,881 1,717,399 381,845 44,859 Technical Assistance: Human Services Workforce development 1,548,658 18,561 15,843 1,583,062 Total governmental activities 3,929,108 89,384 458,126 4,476,618 Changes in Fund Balance General revenues: Local governmental dues Grants and contributions, not restricted to specific programs Investment earnings, unrestricted Misc., unrestricted Total general revenues Change in net position Net position- beginning Net position - ending 1,554,245 458,126 456,822 2,469,193 2,469,193 2,002,612 466,581