please help asap.

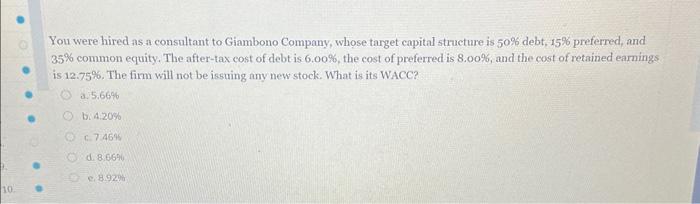

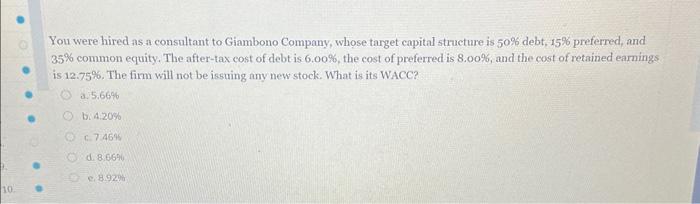

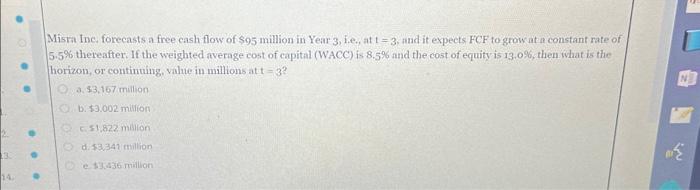

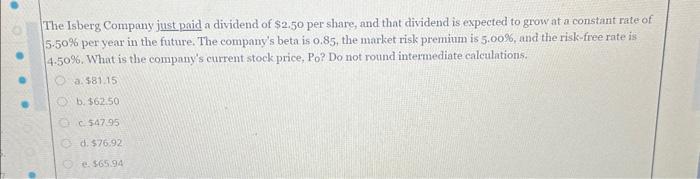

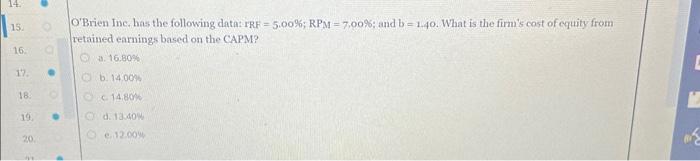

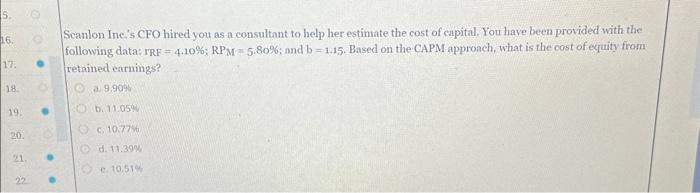

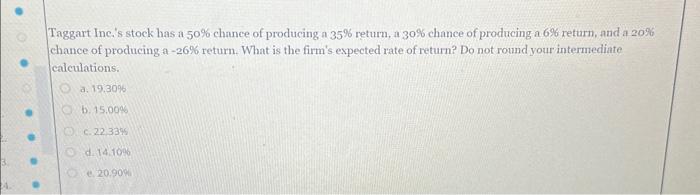

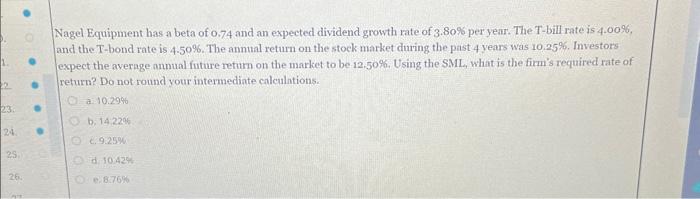

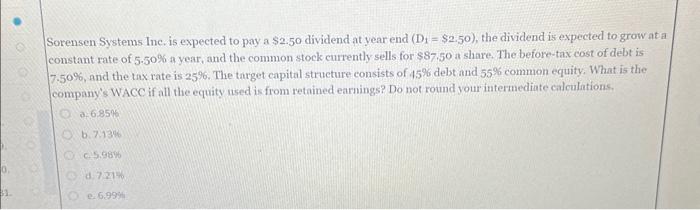

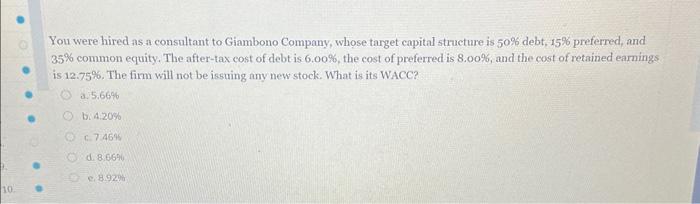

You were hired as a consultant to Giambono Company, whose target capital structure is 50% debt, 15% preferred, and 35% common equity. The after-tax cost of debt is 6.00%, the cost of preferred is 8.00%, and the cost of retained earnings is 12.75%. The firm will not be issuing any new stock. What is its WACC? a. 5.66% b. 4:20% c. 7.45% d. 86640 2.8929 Misra Inc, forecasts a free cash flow of $95 million in Year 3 , i.e, at t=3, and it expects FCF to grow at a constant rate of 5.5% thereafter. If the weighted average cost of capital (WACC) is 8.5% and the cost of equity is 13.0%, then what is the horizon, or continuing, value in millions at t=3 ? a. $3,167 milion b. 53.002 mistion c. 51,822 minion d. $3.341 million e. \$13.436 mialion The Isberg Company just paid a dividend of $2.50 per share, and that dividend is expected to grow at a constant rate of 5.50% per year in the future. The company's beta is 0.85 , the market risk premium is 5.00%, and the risk-free rate is 4.50\%. What is the company's current stock price, Po? Do not round intermediate calculations. a. 581.15 b. 362.50 c. 54795 d. $76.92 (e. $65.94 O'Brien Inc, has the following datat rRF =5,00%;RPM=7,00%; and b=1.40. What is the firm's cost of equity from retained earnings based on the CAPM? (3.) 16.80% b. 1400% c. 14.800 d. 1340% e.12.00\% Scanlon Inc', CFO hired you as a consultant to help her estimate the cost of capital. You have been provided with the following data: rRF=4,10%;RPM=5.80%; and b=1.15. Based on the CAPM approach, what is the cost of equity from retained earnings? a. 9.90% b. 11.054 c. 10770 d. 11.39% e. 10.51+ Taggart Inc's stock has a 50% chance of producing a 35% return, a 30% chance of producing a 6% return, and a 20%6 chance of producing a -26\% return. What is the firm's expected rate of return? Do not round your intermediate calculations. a. 19.3096 b. 15.000 c. 22.3340 d. 14.108 e. 20.90% Nagel Equipment has a beta of 0.74 and an expected dividend growth rate of 3.80% per year. The T-bill rate is 4.00%6, and the T-bond rate is 4.50%. The annual return on the stock market during the past 4 years was 10.25%. Investors expect the average annual future refurn on the market to be.12.50\%. Using the SML, what is the firm's required rate of return? Do not round your intermediate calculntions. a. 10.29% b. 14.2296 c. 9.25% d 10.424 e. 8.76% Sorensen Systems Ine. is expected to pay a $2.50 dividend at year end (D1=$2.50), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for $87.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 25%. The target capital structure consists of 45% debt and 55% common equity. What is the company's WACC if all the equity used is from retained earnings? Do not round your intermediate calculations. a. 6.8504 b. 7.134 c.s.98\% d. 7214 e. 6.994