Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Ayayai Ltd. purchased a used truck from Trans Auto Sales Inc. Ayayai paid a $3,000 down payment and signed a note that calls

please help

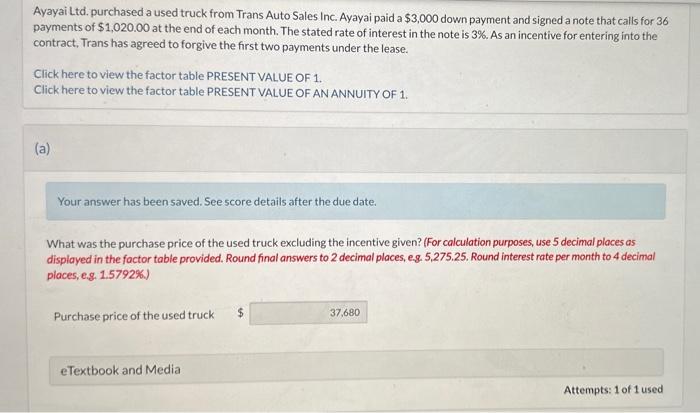

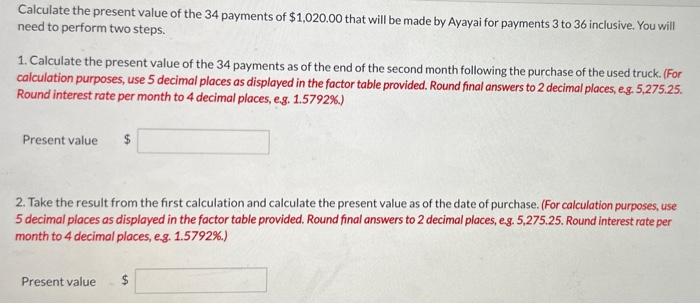

Ayayai Ltd. purchased a used truck from Trans Auto Sales Inc. Ayayai paid a $3,000 down payment and signed a note that calls for 36 payments of $1,020.00 at the end of each month. The stated rate of interest in the note is 3%. As an incentive for entering into the contract, Trans has agreed to forgive the first two payments under the lease. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (a) Your answer has been saved. See score details after the due date. What was the purchase price of the used truck excluding the incentive given? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answers to 2 decimal places, eg. 5,275.25. Round interest rate per month to 4 decimal places, e.g. 1.5792\%.) Purchase price of the used truck \$ Calculate the present value of the 34 payments of $1,020.00 that will be made by Ayayai for payments 3 to 36 inclusive. You will need to perform two steps. 1. Calculate the present value of the 34 payments as of the end of the second month following the purchase of the used truck. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answers to 2 decimal places, eg. 5,275.25. Round interest rate per month to 4 decimal places, e.g. 1.5792\%.) Present value 2. Take the result from the first calculation and calculate the present value as of the date of purchase. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round final answers to 2 decimal places, eg. 5,275.25. Round interest rate per month to 4 decimal places, eg. 1.5792\%.) Present value $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started