Answered step by step

Verified Expert Solution

Question

1 Approved Answer

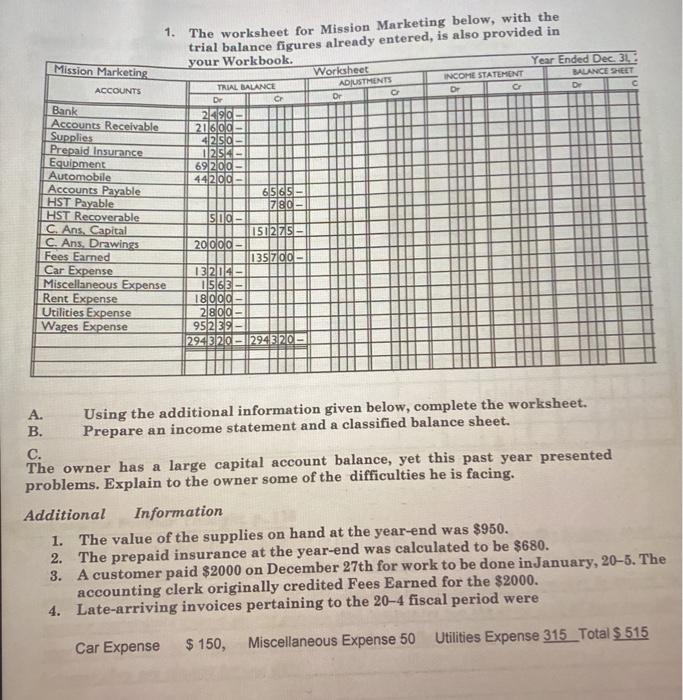

please help C Dr 1. The worksheet for Mission Marketing below, with the trial balance figures already entered, is also provided in your Workbook. Year

please help

C Dr 1. The worksheet for Mission Marketing below, with the trial balance figures already entered, is also provided in your Workbook. Year Ended Dec 3L Mission Marketing Worksheet INCOME STATEMENT BALANCE SHEET ACCOUNTS TRIAL BALANCE ADJUSTMENTS G De Dr OP Bank 29a Accounts Receivable 21600 Supplies 4250 Prepaid Insurance 1254 Equipment 692 od Automobile 4420la Accounts Payable 65&s! HST Payable 1780 HST Recoverable 150CE C. Ans. Capital 151275! C. Ans. Drawings 20 colo- Fees Earned 13570cl Car Expense 13204 Miscellaneous Expense 15631 Rent Expense 18000! Utilities Expense 2800 Wages Expense 952EEE 294320-1294520 A. Using the additional information given below, complete the worksheet. B. Prepare an income statement and a classified balance sheet. C. The owner has a large capital account balance, yet this past year presented problems. Explain to the owner some of the difficulties he is facing. Additional Information 1. The value of the supplies on hand at the year-end was $950. 2. The prepaid insurance at the year-end was calculated to be $680. 3. A customer paid $2000 on December 27th for work to be done in January, 20-5. The accounting clerk originally credited Fees Earned for the $2000. 4. Late-arriving invoices pertaining to the 20-4 fiscal period were Car Expense $ 150, Miscellaneous Expense 50 Utilities Expense 315_Total $ 515 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started