Answered step by step

Verified Expert Solution

Question

1 Approved Answer

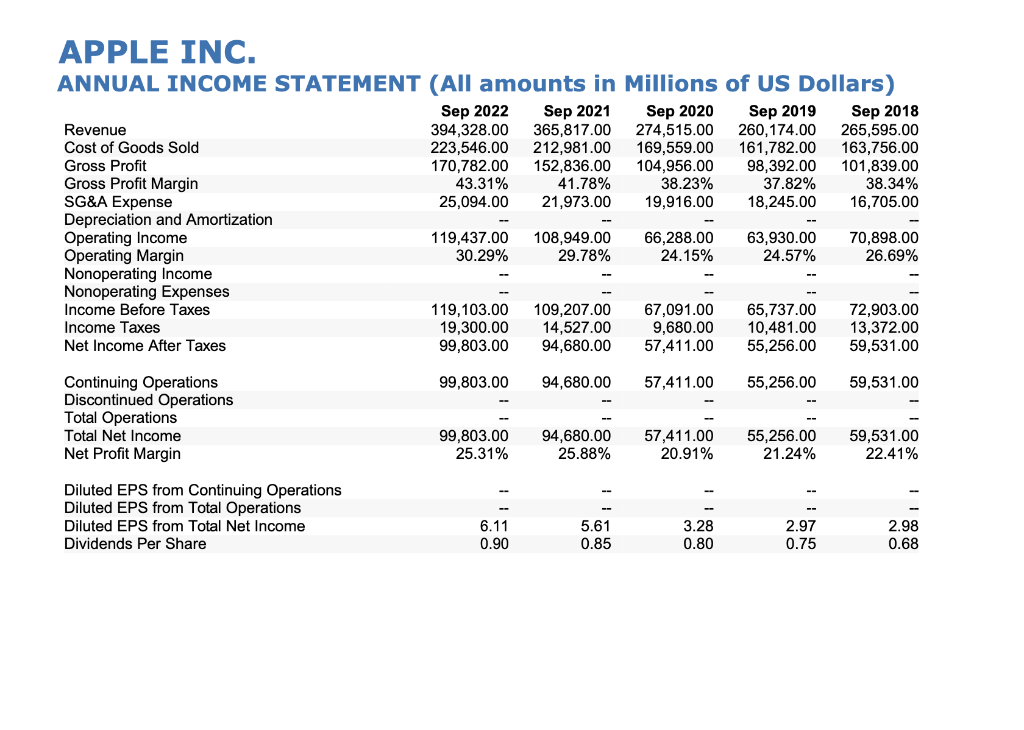

please help calculate these ratios, Thank youu 1)Net profit margin% Net profit margin%= net profit / total revenue x100 2)ROE ROE= net income/shareholder equality 3)Earning

please help calculate these ratios, Thank youu

1)Net profit margin%

Net profit margin%= net profit / total revenue x100

2)ROE

ROE= net income/shareholder equality

3)Earning per share

Earning per share=net income-preferred dividends/profit divided by the outstanding shares of common stock

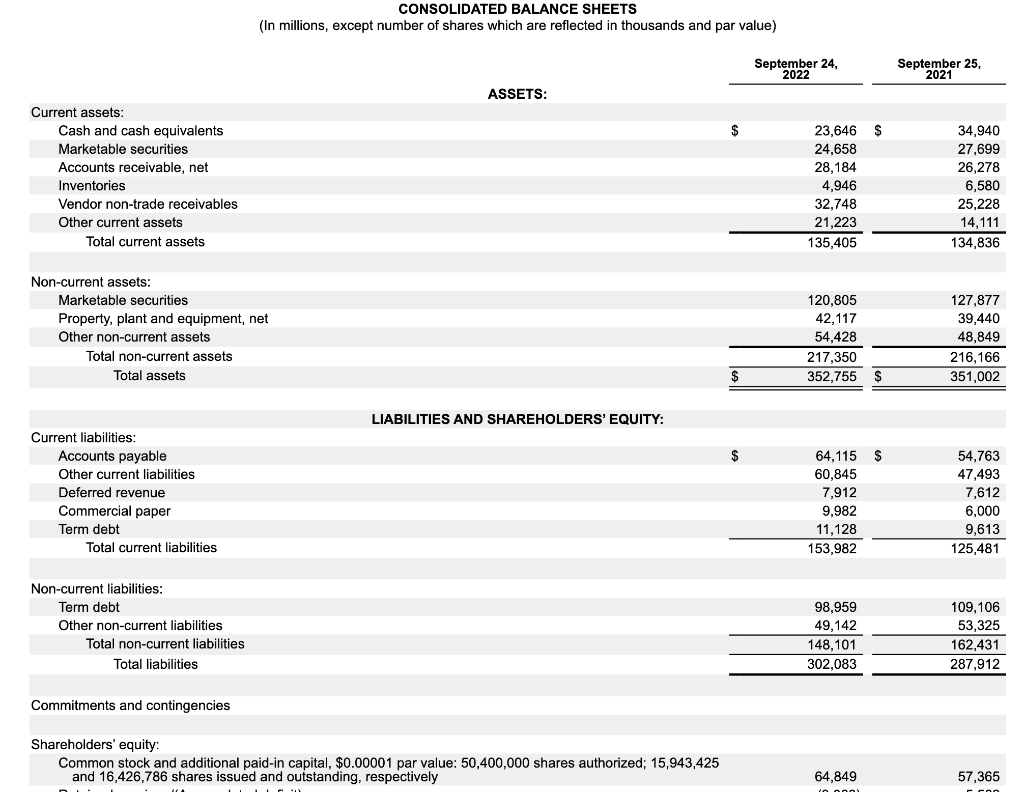

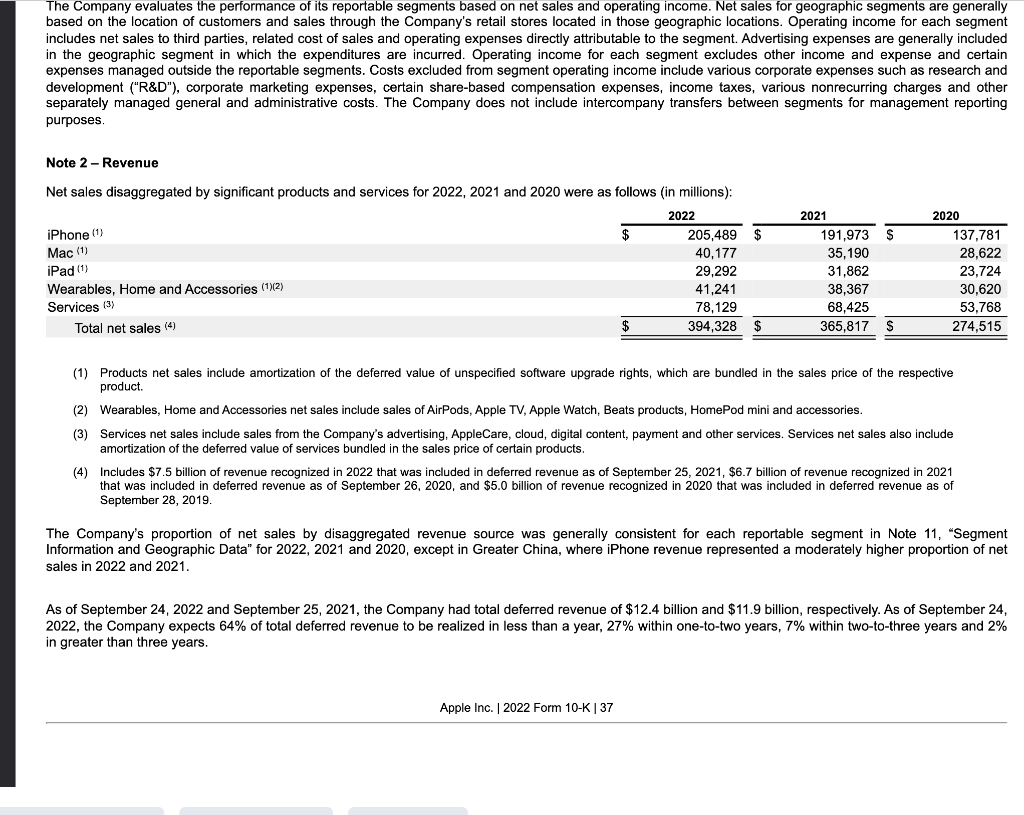

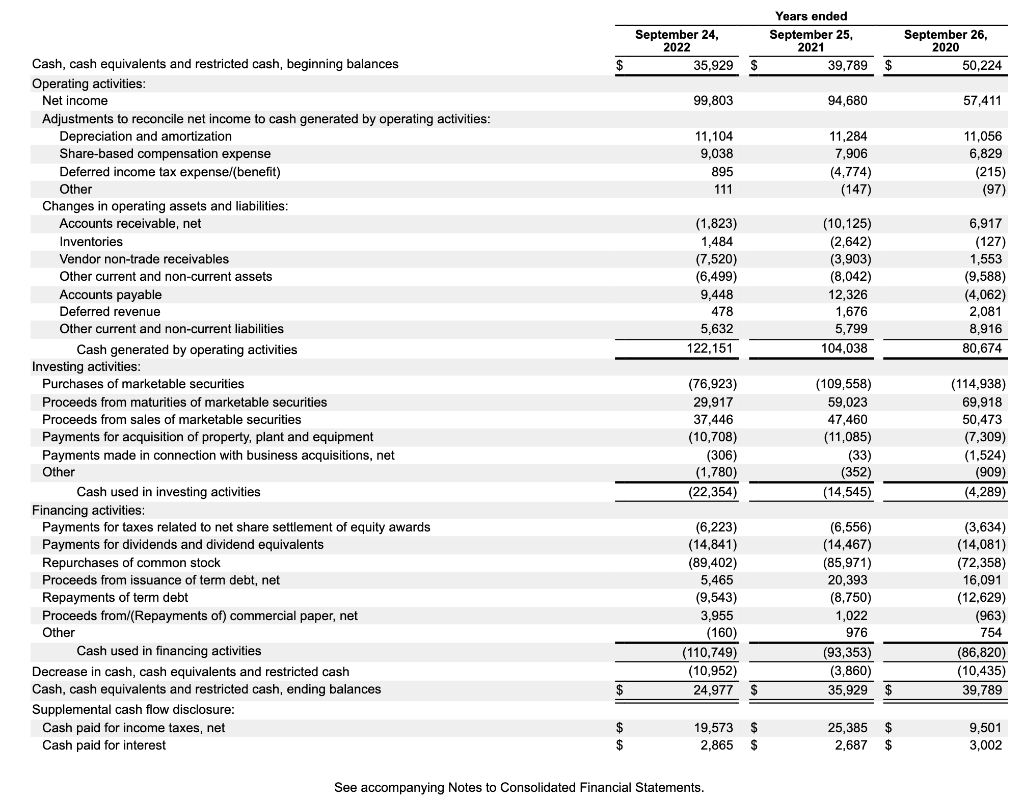

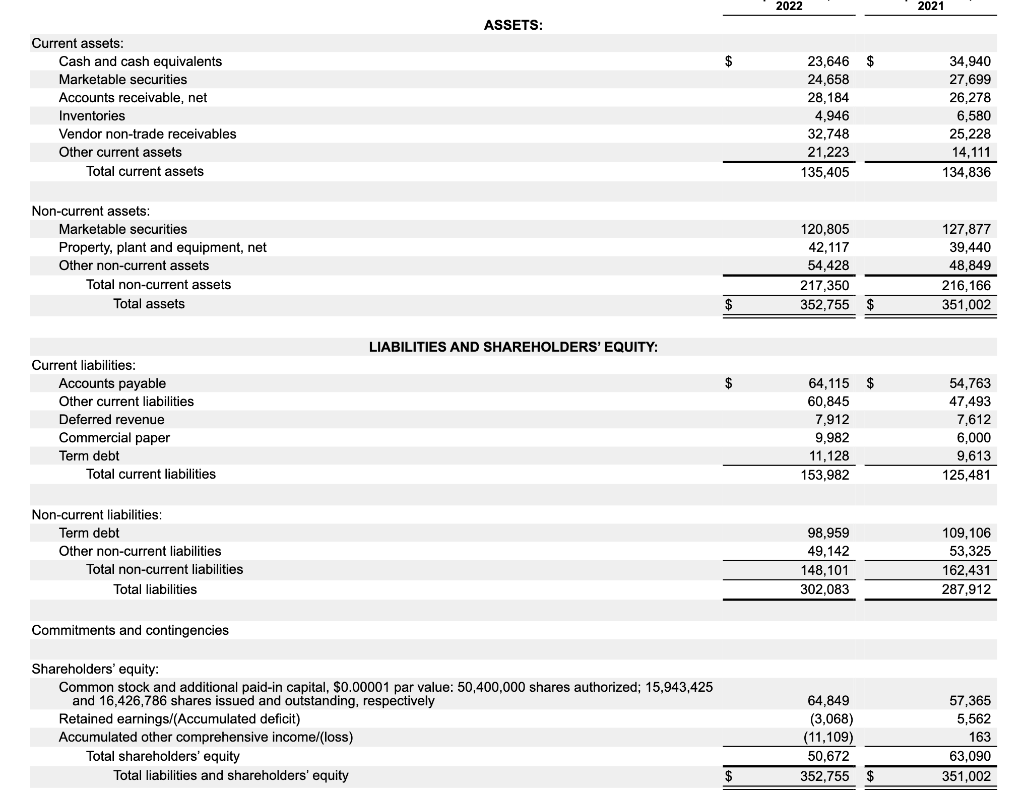

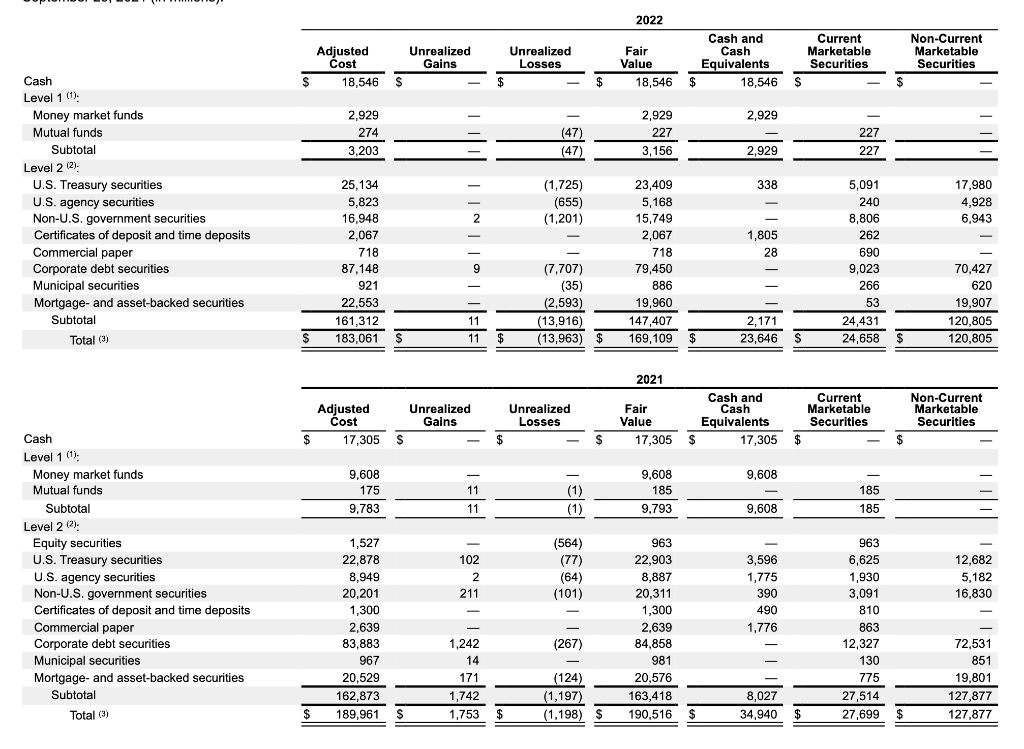

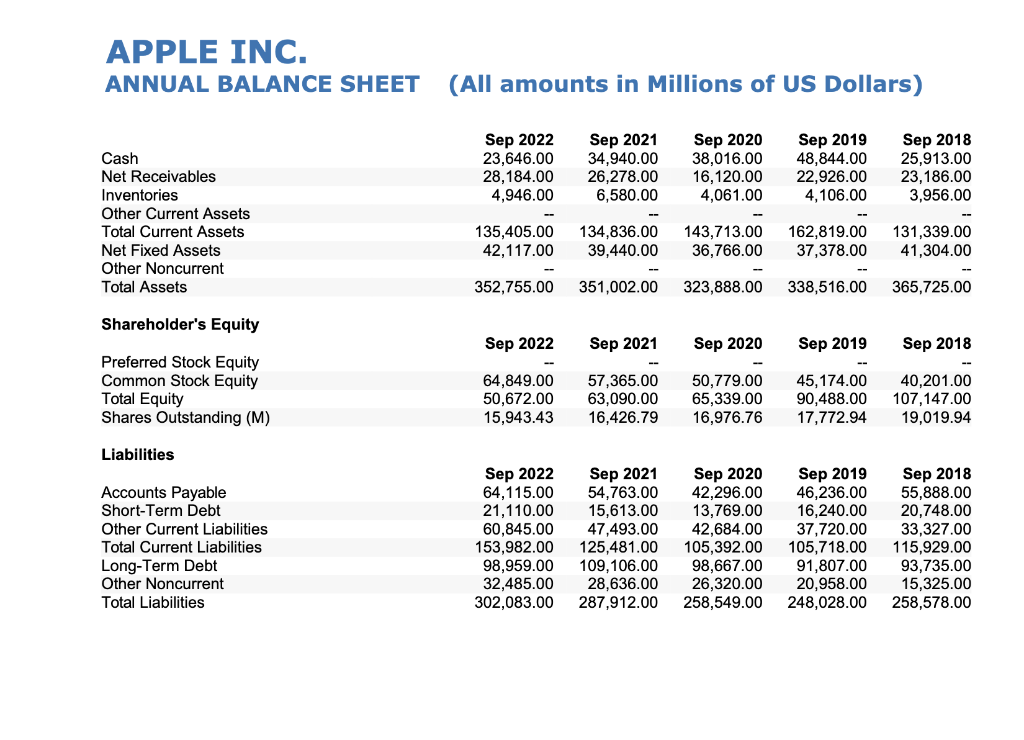

CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) The Company evaluates the performance of its reportable segments based on net sales and operating income. Net sales for geographic segments are generally based on the location of customers and sales through the Company's retail stores located in those geographic locations. Operating income for each segment includes net sales to third parties, related cost of sales and operating expenses directly attributable to the segment. Advertising expenses are generally included in the geographic segment in which the expenditures are incurred. Operating income for each segment excludes other income and expense and certain expenses managed outside the reportable segments. Costs excluded from segment operating income include various corporate expenses such as research and development ("R\&D"), corporate marketing expenses, certain share-based compensation expenses, income taxes, various nonrecurring charges and other separately managed general and administrative costs. The Company does not include intercompany transfers between segments for management reporting purposes. Note 2 - Revenue Net sales disaggregated by significant products and services for 2022, 2021 and 2020 were as follows (in millions): iPhone (1) Mac (1) iPad (1) Wearables, Home and Accessories (1)(2) Services [3) Total net sales (4) (1) Products net sales include amortization of the deferred value of unspecified software upgrade rights, which are bundled in the sales price of the respective product. (2) Wearables, Home and Accessories net sales include sales of AirPods, Apple TV, Apple Watch, Beats products, HomePod mini and accessories. (3) Services net sales include sales from the Company's advertising, AppleCare, cloud, digital content, payment and other services. Services net sales also include amortization of the deferred value of services bundled in the sales price of certain products. (4) Includes $7.5 billion of revenue recognized in 2022 that was included in deferred revenue as of September 25 , 2021, $6.7 billion of revenue recognized in 2021 that was included in deferred revenue as of September 26, 2020, and $5.0 billion of revenue recognized in 2020 that was included in deferred revenue as of September 28,2019. The Company's proportion of net sales by disaggregated revenue source was generally consistent for each reportable segment in Note 11, "Segment Information and Geographic Data" for 2022, 2021 and 2020, except in Greater China, where iPhone revenue represented a moderately higher proportion of net sales in 2022 and 2021. As of September 24, 2022 and September 25, 2021, the Company had total deferred revenue of $12.4 billion and $11.9 billion, respectively. As of September 24 , 2022 , the Company expects 64% of total deferred revenue to be realized in less than a year, 27% within one-to-two years, 7% within two-to-three years and 2% in greater than three years. See accompanying Notes to Consolidated Financial Statements. ASSETS: Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities LIABILITIES AND SHAREHOLDERS' EQUITY: 2021 \begin{tabular}{rrr} 23,646 & $ & 34,940 \\ 24,658 & 27,699 \\ 28,184 & 26,278 \\ 4,946 & 6,580 \\ 32,748 & 25,228 \\ 21,223 & 14,111 \\ \cline { 1 - 2 } & 134,836 \end{tabular} LIABILITIES AND SHAREHOLDERS' EQUITY: APPLE INC. ANNUAL BALANCE SHEET (All amounts in Millions of US Dollars) APPLE INC. ANNUAL INCOME STATEMENT (All amounts in Millions of US Dollars)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started