please help calculate, will give thumbs up

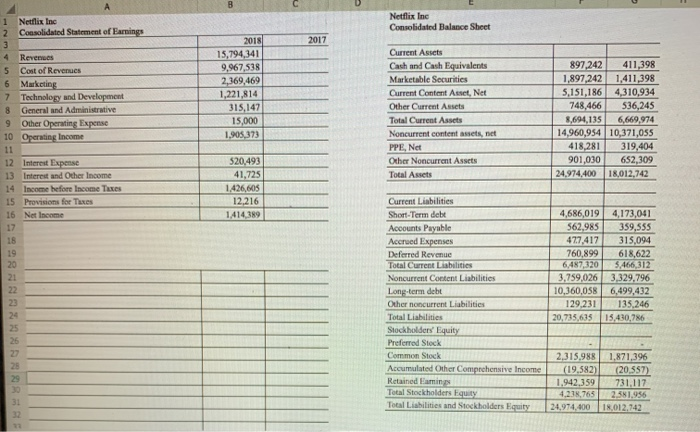

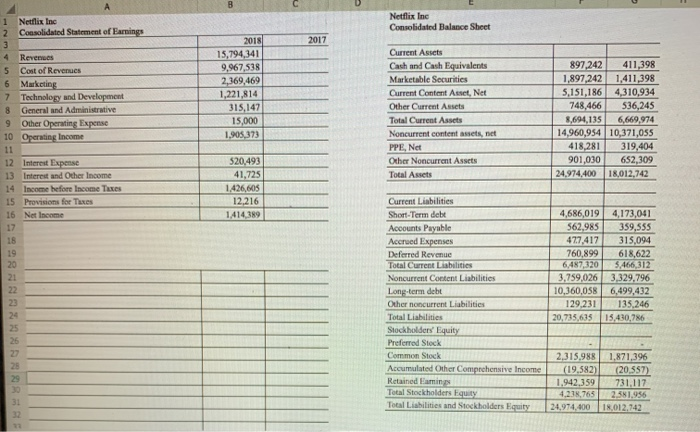

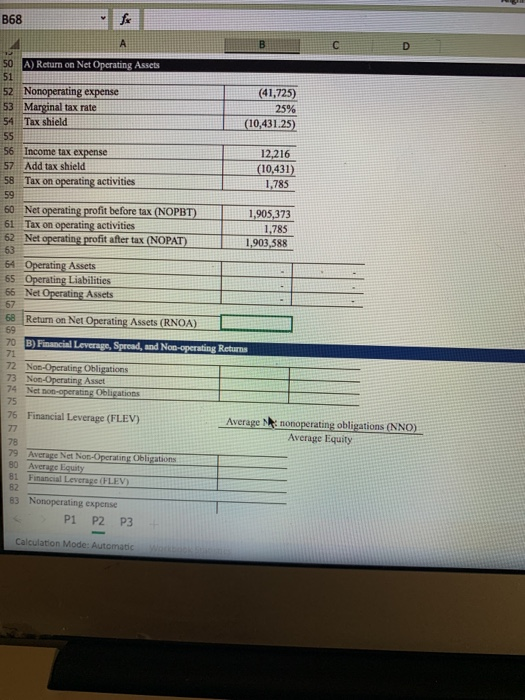

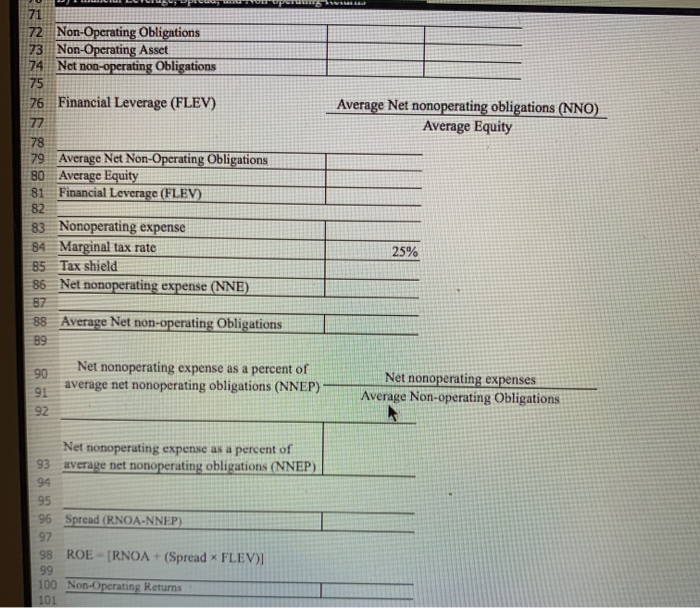

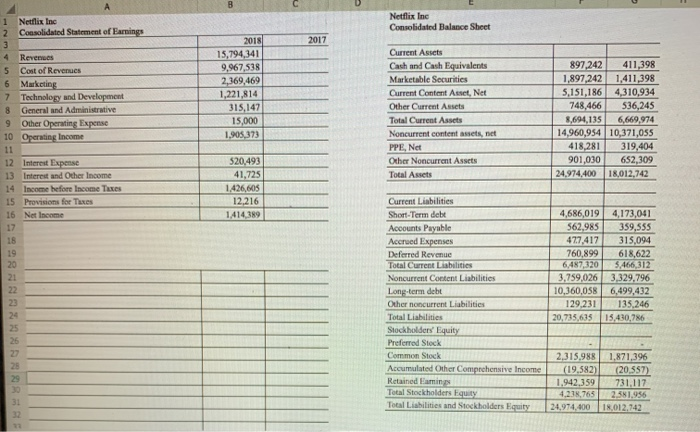

B Netflix Inc Consolidated Balance Sheet 2017 2018 15,794,341 9,967,538 2,369,469 1,221,814 315,147 15,000 1,905,373 Current Assets Cash and Cash Equivalents Marketable Securities Current Content Asset, Net Other Current Assets Total Current Assets Noncurrent content assets, net PPE, Net Other Noncurrent Assets Total Assets 897,242 411,398 1,897,242 1,411,398 5,151,186 4,310,934 748,466 536,245 8,694,135 6,669,974 14,960,95410,371,055 418,281 319,404 901,030 652,309 24,974.400 18,012.742 Netflix Inc 2 Consolidated Statement of Earnings 3 4 Revenues S Cost of Revenues 6 Marketing 7 Technology and Development 8 General and Administrative 9 Other Operating Expense 10 Operating Income 11 12 Interest Expense 13 Interest and Other Income 14 Income before Income Taxes 15 Provision for Taxes 16 Net Income 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 520,493 41,725 1.426,605 12,216 1,414,389 Current Liabilities Short-Term debt Accounts Payable Accrued Expenses Deferred Revenue Total Current Liabilities Noncurrent Content Liabilities Long-term debt Other no current Liabilities Total Liabilities Stockholders' Equity Preferred Stock Common Stock Accumulated Other Comprehensive Income Retained Emines Total Stockholders Equity Total Liabilities and Stockholders Equity 4,686,019 4,173,041 562,985 359,555 477.417 315,094 760,899 618,622 6,487,320 5,466,312 3,759,026 3,329,796 10,360,058 6,499,432 129,231 135.246 20,735,635 15.430,786 2,315,988 1,871,396 (19.582) (20.557) 1.942,359 731,117 4,218,765 2.381.956 24,974,400 18,012.742 B68 50 A) Return on Net Operating Assets 51 52 Nonoperating expense (41,725) 53 Marginal tax rate 25% 54 Tax shield (10,431.25) 55 56 Income tax expense 12,216 57 Add tax shield (10,431) 58 Tax on operating activities 1,785 59 60 Net operating profit before tax (NOPBT) 1,905,373 61 Tax on operating activities 1,785 62 Net operating profit after tax (NOPAT) 1,903,588 63 64 Operating Assets 65 Operating Liabilities 66 Net Operating Assets 67 68 Return on Net Operating Assets (RNOA) 69 70 B) Financial Leverage, Spread, and Non-operating Returns 71 72 Non-Operating Obligations 73 Non-Operating Asset 74 Net non-operating Obligations 75 76 Financial Leverage (FLEV) Average nonoperating obligations (NNO) 77 Average Equity 78 79 Average Net Non-Operating Obligations 80 Average Equity 81 Financial Leverage (FLEV) 82 83 Nonoperating expense P1 P2 P3 Calculation Mode: Automatic Average Net nonoperating obligations (NNO) Average Equity 71 72 Non-Operating Obligations 73 Non-Operating Asset 74 Net non-operating Obligations 75 76 Financial Leverage (FLEV) 77 78 79 Average Net Non-Operating Obligations 80 Average Equity 81 Financial Leverage (FLEX) 82 83 Nonoperating expense 84 Marginal tax rate 85 Tax shield 86 Net nonoperating expense (NNE) 87 88 Average Net non-operating Obligations B9 25% 90 91 92 Net nonoperating expense as a percent of average net nonoperating obligations (NNEP) Net nonoperating expenses Average Non-operating Obligations Net nonoperating expense as a percent of 93 average net nonoperating obligations (NNEP) 94 95 96 Spread (RNOA-NNEP) 97 98 ROE - (RNOA + (Spread * FLEV) 99 100 Non-Operating Returns 101