Answered step by step

Verified Expert Solution

Question

1 Approved Answer

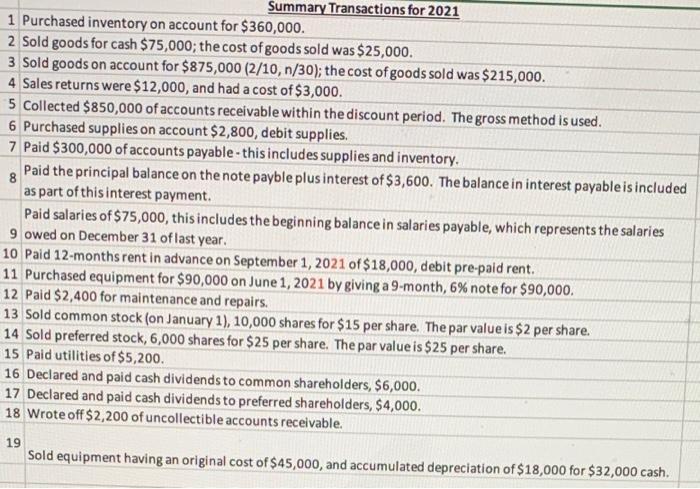

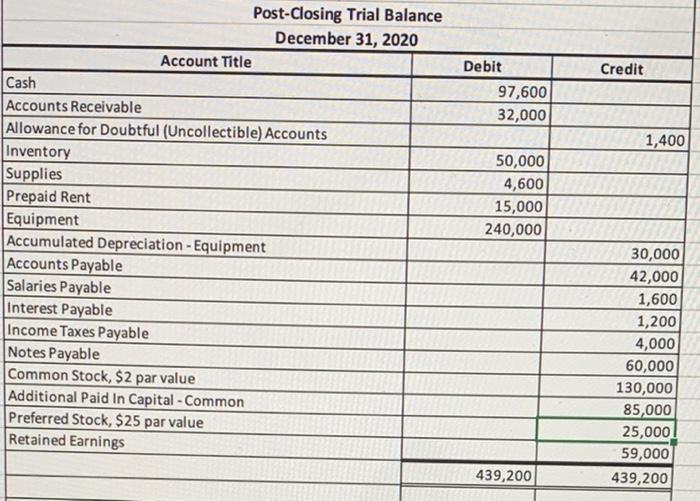

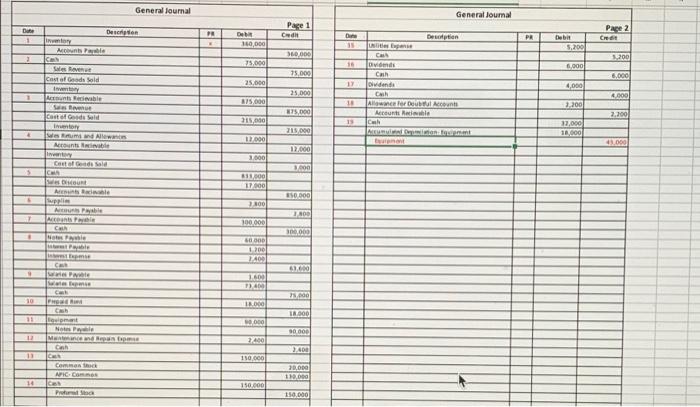

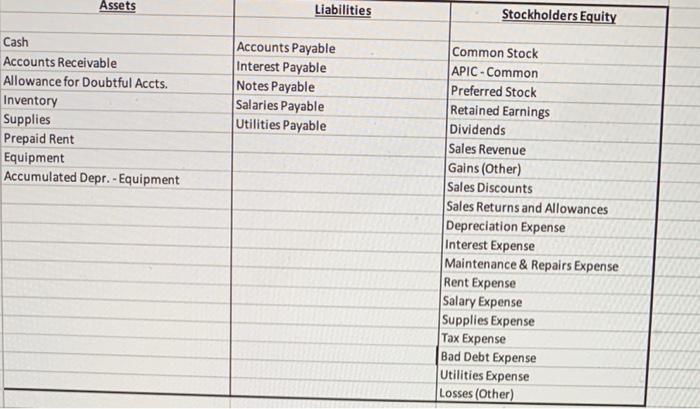

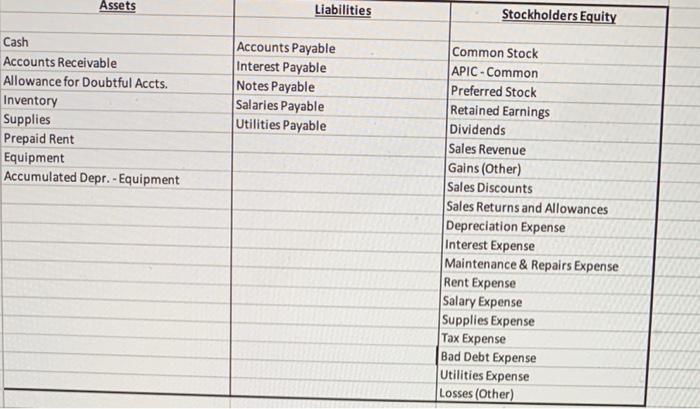

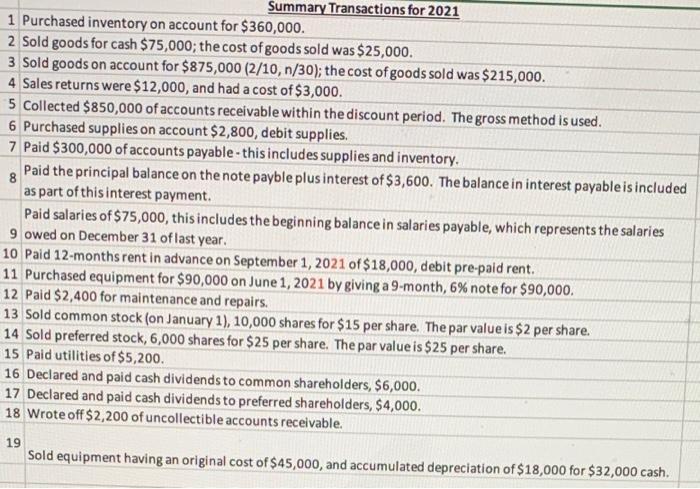

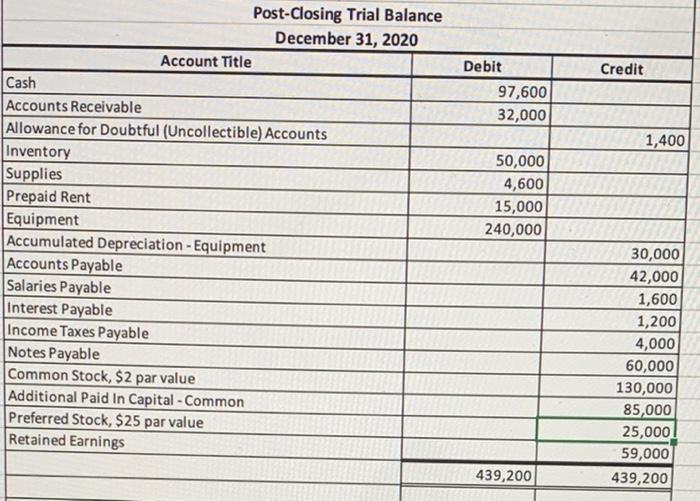

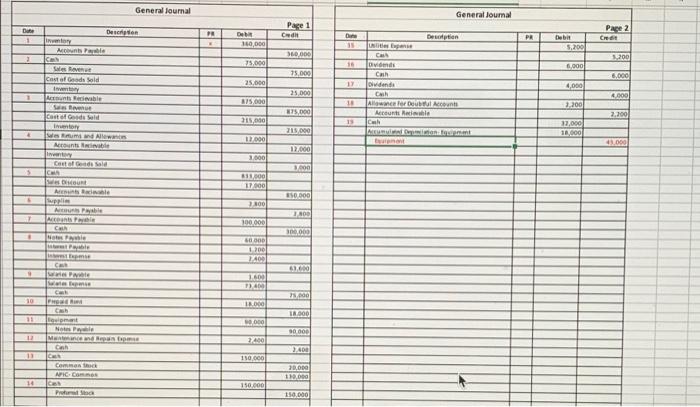

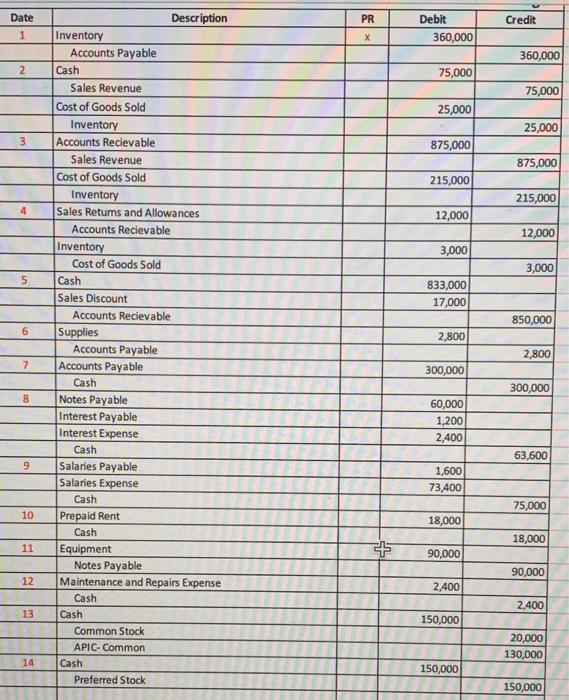

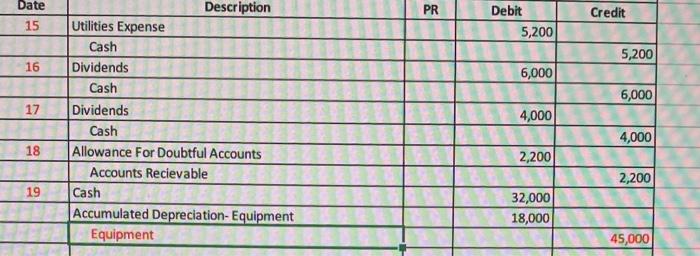

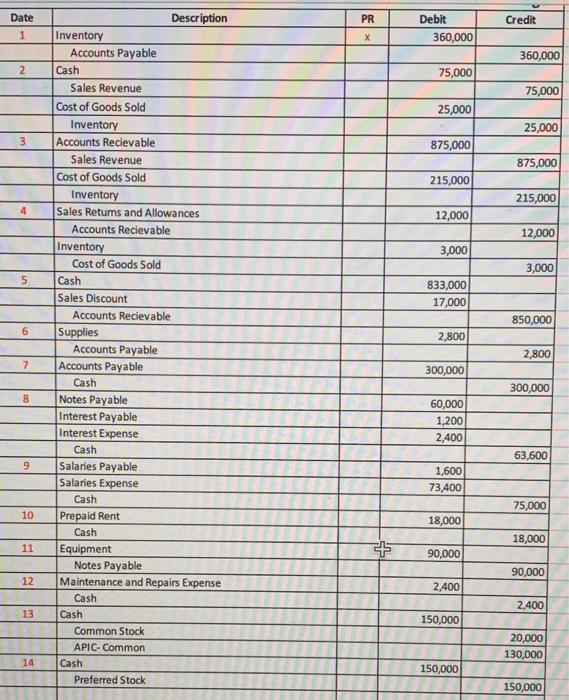

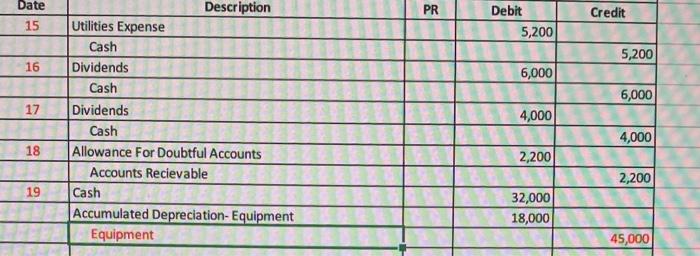

Please help complete general ledger for accounts. (provided images in the order of chart of accounts, summary transactions, trial balance, and journal entries) better quality

Please help complete general ledger for accounts.

(provided images in the order of chart of accounts, summary transactions, trial balance, and journal entries)

better quality image of general journal entries

Assets Liabilities Stockholders Equity Cash Accounts Receivable Allowance for Doubtful Accts. Inventory Supplies Prepaid Rent Equipment Accumulated Depr.- Equipment Accounts Payable Interest Payable Notes Payable Salaries Payable Utilities Payable Common Stock APIC - Common Preferred Stock Retained Earnings Dividends Sales Revenue Gains (Other) Sales Discounts Sales Returns and Allowances Depreciation Expense Interest Expense Maintenance & Repairs Expense Rent Expense Salary Expense Supplies Expense Tax Expense Bad Debt Expense Utilities Expense Losses (Other) 8 Summary Transactions for 2021 1 Purchased inventory on account for $360,000. 2 Sold goods for cash $75,000; the cost of goods sold was $25,000. 3 Sold goods on account for $875,000 (2/10, n/30); the cost of goods sold was $215,000. 4 Sales returns were $12,000, and had a cost of $3,000. 5 Collected $850,000 of accounts receivable within the discount period. The gross method is used. 6 Purchased supplies on account $2,800, debit supplies. 7 Paid $300,000 of accounts payable-this includes supplies and inventory. Paid the principal balance on the note payble plus interest of $3,600. The balance in interest payable is included as part of this interest payment. Paid salaries of $75,000, this includes the beginning balance in salaries payable, which represents the salaries 9 owed on December 31 of last year. 10 Paid 12-months rent in advance on September 1, 2021 of $18,000, debit pre-paid rent. 11 Purchased equipment for $90,000 on June 1, 2021 by giving a 9-month, 6% note for $90,000. 12 Paid $2,400 for maintenance and repairs. 13 Sold common stock (on January 1), 10,000 shares for $15 per share. The par value is $2 per share. 14 Sold preferred stock, 6,000 shares for $25 per share. The par value is $25 per share. 15 Paid utilities of $5,200. 16 Declared and paid cash dividends to common shareholders, $6,000. 17 Declared and paid cash dividends to preferred shareholders, $4,000. 18 Wrote off$2,200 of uncollectible accounts receivable. 19 Sold equipment having an original cost of $45,000, and accumulated depreciation of $18,000 for $32,000 cash. Credit Debit 97,600 32,000 1,400 Post-Closing Trial Balance December 31, 2020 Account Title Cash Accounts Receivable Allowance for Doubtful (Uncollectible) Accounts Inventory Supplies Prepaid Rent Equipment Accumulated Depreciation - Equipment Accounts Payable Salaries Payable Interest Payable Income Taxes Payable Notes Payable Common Stock, $2 par value Additional Paid In Capital - Common Preferred Stock, $25 par value Retained Earnings 50,000 4,600 15,000 240,000 30,000 42,000 1,600 1,200 4,000 60,000 130,000 85,000 25,000 59,000 439,200 439,200 General Journal General Journal Dube 1 PR Page 1 Ced PE Dame Description tor Ace Deption Page 2 Credit 140,000 5,200 3000 2 1.200 75,000 16 6,000 We Raven Castofado Sold 75,000 5,000 25.000 17 4,000 1919 25 000 C DOM Cash Dividende Ch All Account Antiale Cash 4.000 sevible 315.000 18 2200 EIS.000 2.300 315.000 19 Castelo de Sold Ion We de 215.000 32,000 10.000 11.00 41.000 12.000 3.000 Gastfeed Said 3.000 811.000 17 000 80.000 DOU AB 5 Ab A CH 100 100 100 000 300.000 GOD 1200 40 C 63.000 1600 1300 10 PH 18.000 18.000 150 11 000 ant Na Mandante Cash 10 000 2460 3400 11 110.000 20,000 Common ACCORD 10 150.000 Preto 150.000 PR Credit Date 1 Debit 360,000 360,000 2 75,000 75,000 25,000 25,000 3 875,000 875,000 215,000 215,000 4 12,000 12,000 3,000 3,000 5 833,000 17,000 850,000 6 2,800 Description Inventory Accounts Payable Cash Sales Revenue Cost of Goods Sold Inventory Accounts Recievable Sales Revenue Cost of Goods Sold Inventory Sales Retums and Allowances Accounts Recievable Inventory Cost of Goods Sold Cash Sales Discount Accounts Recievable Supplies Accounts Payable Accounts Payable Cash Notes Payable Interest Payable Interest Expense Cash Salaries Payable Salaries Expense Cash Prepaid Rent Cash Equipment Notes Payable Maintenance and Repairs Expense Cash Cash Common Stock APIC- Common Cash Preferred Stock 2,800 7 300,000 300,000 8 60,000 1,200 2,400 63,600 9 1,600 73.400 75,000 10 18,000 18,000 11 + 90,000 90,000 12 2,400 2,400 13 150,000 20,000 130,000 14 150,000 150,000 PR Date 15 Credit Debit 5,200 5,200 16 6,000 6,000 17 Description Utilities Expense Cash Dividends Cash Dividends Cash Allowance For Doubtful Accounts Accounts Recievable Cash Accumulated Depreciation Equipment Equipment 4,000 4,000 18 2,200 2,200 19 32,000 18,000 45,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started