please help

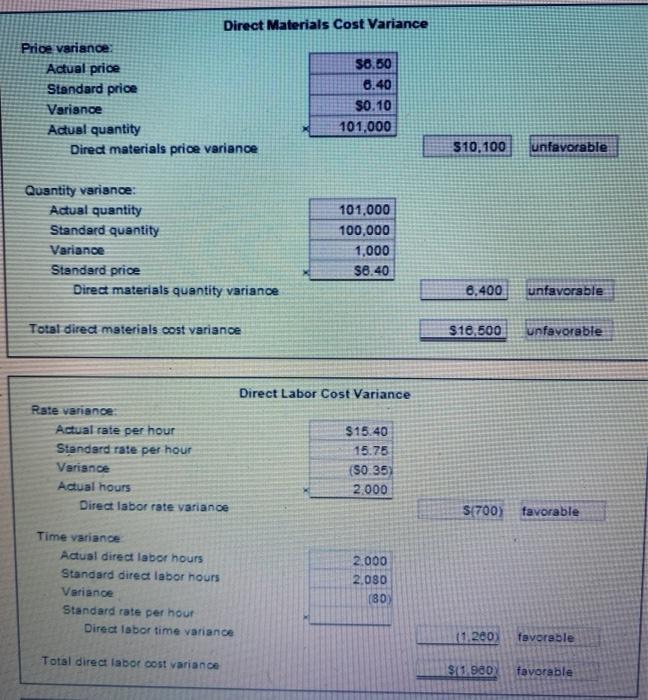

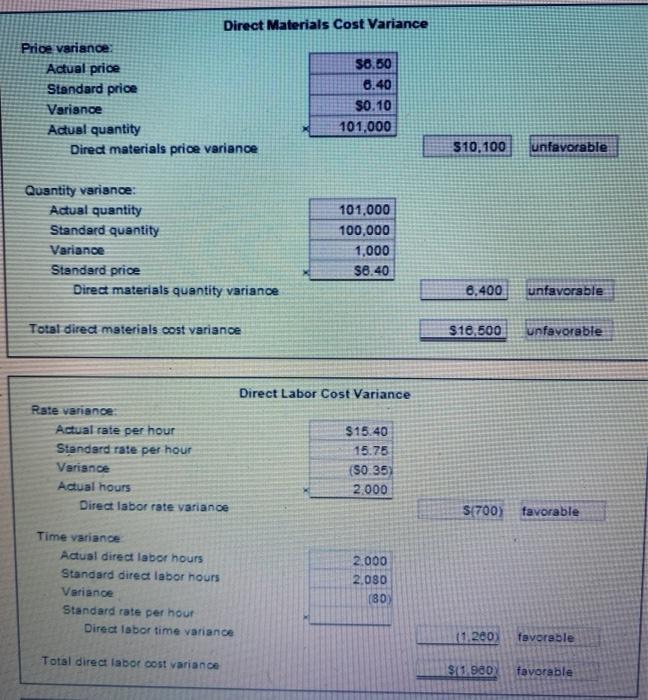

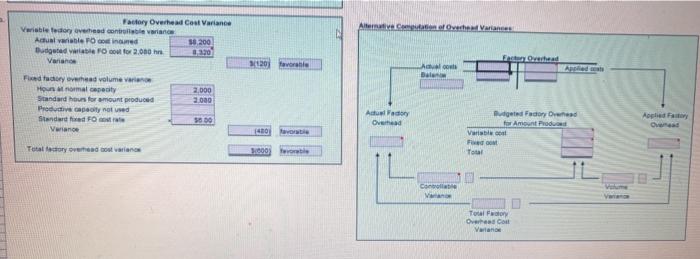

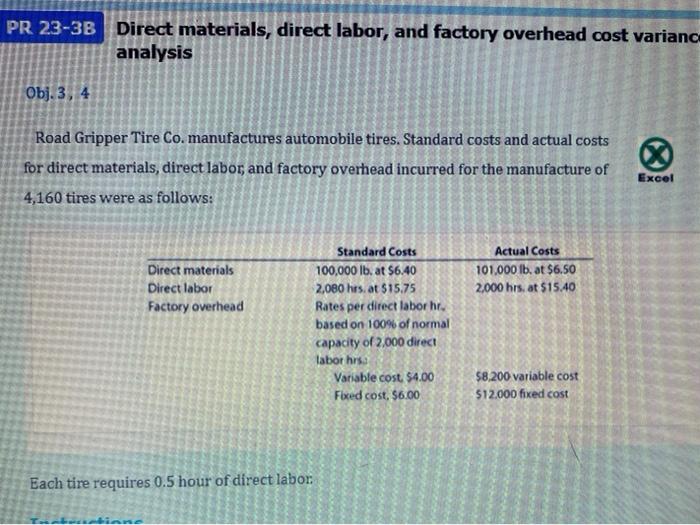

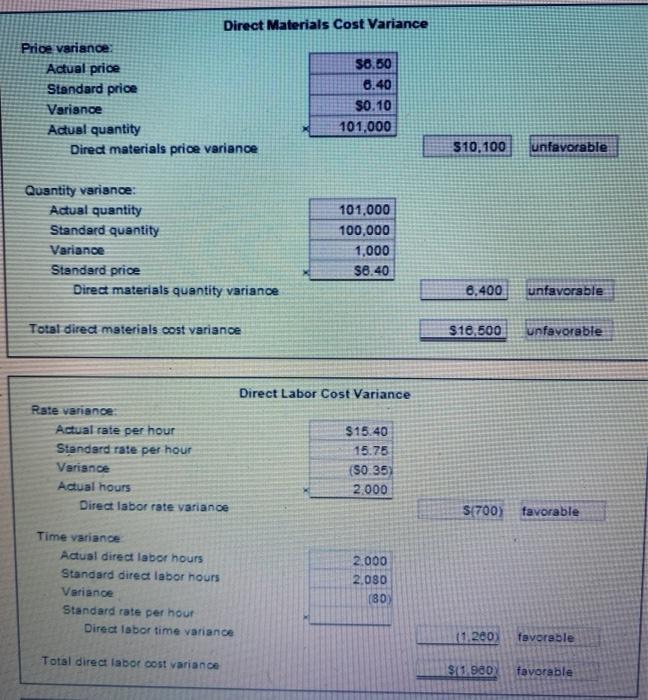

Direct Materials Cost Variance Price variance Actual price Standard price Variance Actual quantity Direct materials price variance $6,50 6.40 $0.10 101,000 $10.100 unfavorable Quantity variance: Actual quantity Standard quantity Variance Standard price Direct materials quantity variance 101,000 100,000 1,000 $8.40 8.400 unfavorable Total direct materials cost variance $18,500 unfavorable Direct Labor Cost Variance Rate variance Actual rate per hour Standard rate per hour Variance Actual hours Direct labor rate variance $15.40 15.75 (S0.35 2.000 ${700) favorable Time variance Actual direct labor hours Standard direct labor hours Variance Standard rate per hour Direct labor time variance 2.000 2.080 80 (1.260 favorable Total direct labor cost variance $11.900 favorable Alternative of Oveche Variantes Factory Overhead Cool Variance Variable dorehead controllable variance Adual viable Price 50.200 Dugtad Fotox 2.00 h Vanane Everhead 120 favorable All Firdary ad volume van Hormal capacity Standard hours for amount produced Product capacity not used Standard FOM Vwiance 2,000 2.000 Adulatory Ovad Aplied 580 geted Factory Dead for Ametoda Vio 400 tavot Total factory Ovendos varianos 1800 fot To Com Total Overhead Coil Varian PR 23-3B Direct materials, direct labor, and factory overhead cost varianc analysis Obj. 3, 4 Road Gripper Tire Co. manufactures automobile tires. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 tires were as follows: Excel Direct materials Direct labor Factory overhead Actual Costs 101.000 lb. at $6.50 2000 hrs. at $15.40 Standard Costs 100,000 lb. at $6.40 2,080 hrs. at $15.75 Rates per direct labor hr. based on 100% of normal capacity of 2.000 direct labor hrs Variable cost. 54.00 Fored cost, $6.00 $8,200 variable cost 512.000 fixed cost Each tire requires 0.5 hour of direct labor Instructions Determine (a) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; (b) the direct labor rate variance, direct labor time variance, and total direct labor cost variance; and (c) the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance. Check Figure: Direct materials price variance, $10,100 U