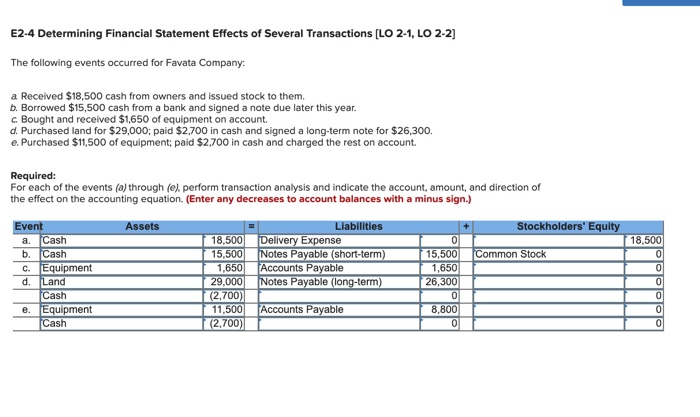

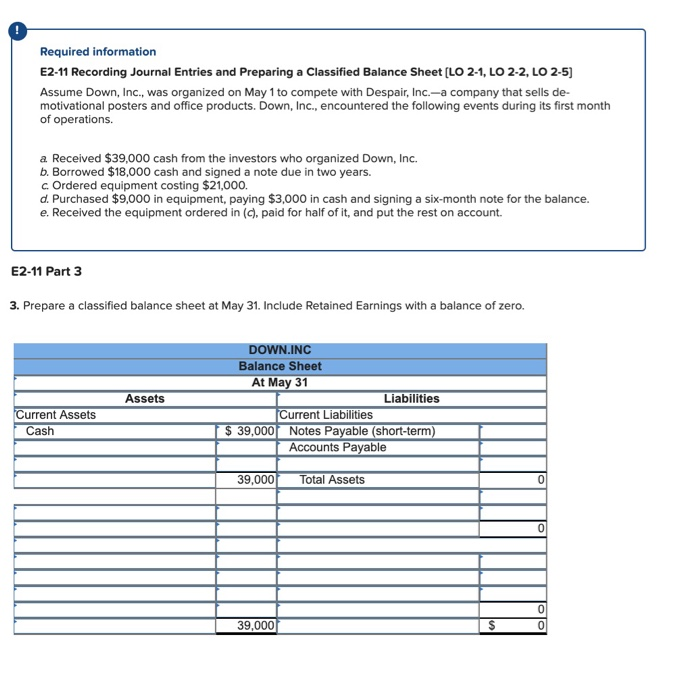

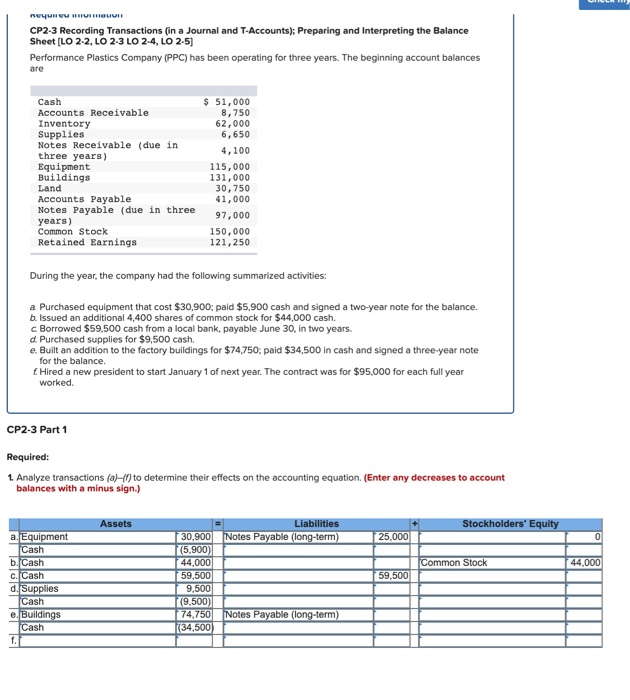

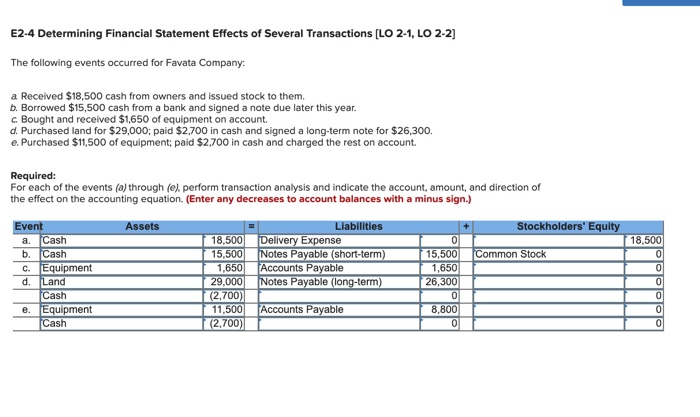

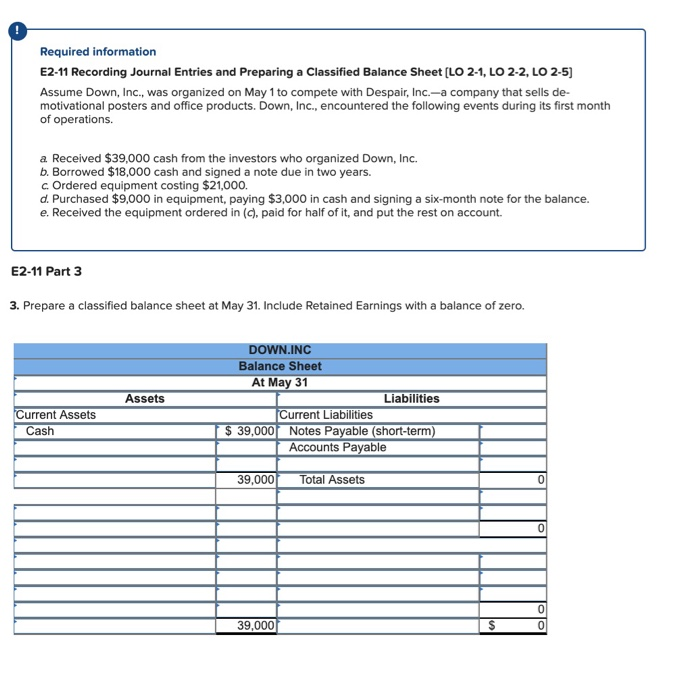

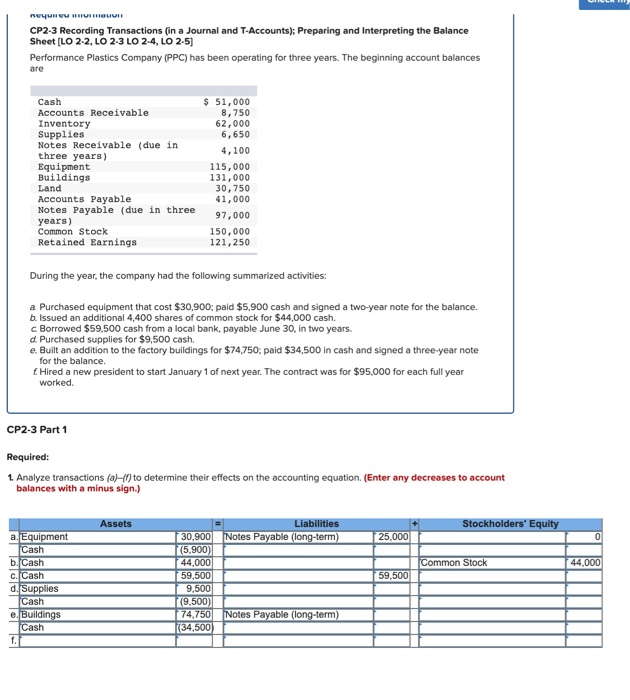

E2.4 Determining Financial Statement Effects of several Transactions (LO 2-1, LO 2-2] The following events occurred for Favata Company a Received $18,500 cash from owners and issued stock to them. b. Borrowed $15,500 cash from a bank and signed a note due later this year. c Bought and received $1,650 of equipment on account. d. Purchased land for $29,000; paid $2,700 in cash and signed a long-term note for $26,300. e. Purchased $11,500 of equipment; paid $2,700 in cash and charged the rest on account. Required: For each of the events (a) through (e) perform transaction analysis and indicate the account, amount, and direction of the effect on the accounting equation. (Enter any decreases to account balances with a minus sign.) Assets Stockholders' Equity [ 18.500 Common Stock Event a Cash b. Cash C. Equipment Land Cash TEquipment Cash Liabilities Delivery Expense Notes Payable (short-term) Accounts Payable Notes Payable (long-term) | 18,500 15,500 1,650 29,000 (2,700) 11,500 (2,700) d. 0 15,500 1,650 26,300 0 8,800 TO Accounts Payable Required information E2-11 Recording Journal Entries and Preparing a Classified Balance Sheet (LO 2-1, LO 2-2, LO 2-5) Assume Down, Inc., was organized on May 1 to compete with Despair, Inc.-a company that sells de- motivational posters and office products. Down, Inc., encountered the following events during its first month of operations. a Received $39,000 cash from the investors who organized Down, Inc. b. Borrowed $18,000 cash and signed a note due in two years. c. Ordered equipment costing $21,000. d. Purchased $9,000 in equipment, paying $3,000 in cash and signing a six-month note for the balance. e. Received the equipment ordered in (C), paid for half of it, and put the rest on account. E2-11 Part 3 3. Prepare a classified balance sheet at May 31. Include Retained Earnings with a balance of zero. Assets DOWN.INC Balance Sheet At May 31 Liabilities Current Liabilities $ 39,000f Notes Payable (short-term) Accounts Payable Current Assets Cash 39,000 Total Assets 39,000 $ 0 YUUSTOL CP2-3 Recording Transactions (in a Journal and T-Accounts): Preparing and Interpreting the Balance Sheet (LO 2-2, LO 2-3 LO 2-4, LO 2-5) Performance Plastics Company (PPC) has been operating for three years. The beginning account balances are Cash Accounts Receivable Inventory Supplies Notes Receivable (due in three years) Equipment Buildings Land Accounts Payable Notes Payable (due in three years) Common Stock Retained Earnings $ 51,000 8,750 62,000 6,650 4,100 115,000 131,000 30,750 41,000 97,000 150,000 121,250 During the year, the company had the following summarized activities: a Purchased equipment that cost $30,900: paid $5.900 cash and signed a two-year note for the balance. b. Issued an additional 4,400 shares of common stock for $44,000 cash. c Borrowed $59,500 cash from a local bank, payable June 30, in two years. d. Purchased supplies for $9,500 cash. e. Built an addition to the factory buildings for $74,750: paid $34,500 in cash and signed a three-year note for the balance. Hired a new president to start January 1 of next year. The contract was for $95,000 for each full year worked. CP2-3 Part 1 Required: 1. Analyze transactions (a)-in) to determine their effects on the accounting equation. (Enter any decreases to account balances with a minus sign.) Assets + Stockholders' Equity Liabilities Notes Payable (long-term) 25,000 Common Stock 59,500 a. Equipment Cash b. Cash c. Cash d.Supplies Cash e. Buildings Cash f. 30.900 1775.900) 144.000 59,500 9,500 (9,500) 74,750 |(34,500) Notes Payable (long-term)