Please help explain where did 6,000 from. Show its calculation and your work for the final answer.

It has been solved but I dont understand the conversion costs equivalent unit calculation. Where the 6,000 comes from? How we get that?

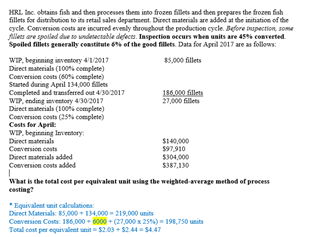

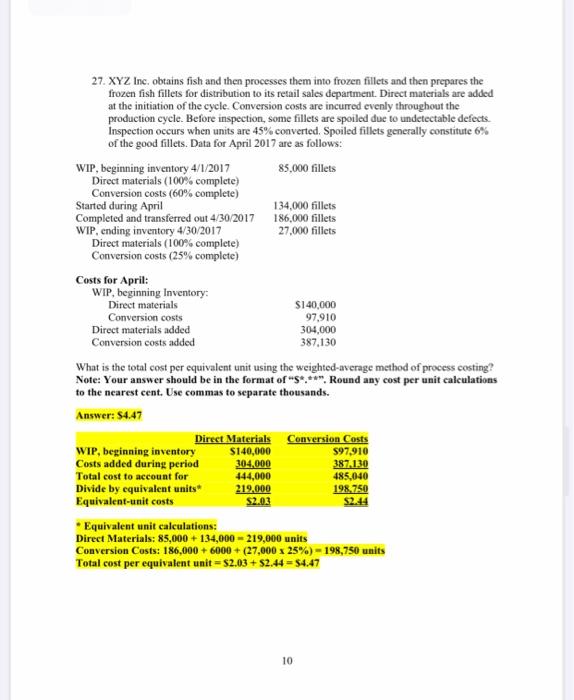

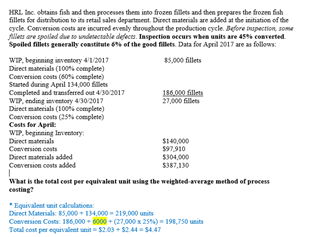

HRL. We obtains fish and then processes them into frozen fillets and then prepares the frozen fish fillets for distribution to its retail sales department. Direct materials are added at the instiation of the cycle Conversion costs are incurred evenly throughout the production cycle. Before dupection, som files are spoiled due to understable defects. Inspection occurs when units are 45% converted Spoiled fillets generally constitute 6% of the good fillets Data for April 2017 are as follows: WIP beginning investory 4/1/2017 $5,000 fillets Direct materials (100% complete) Conversion costs (60% complete) Started during April 134,000 Alles Completed and transferred out 4/30/2017 186.000 Gillets Wending investory 4/30/2017 27,000 fillets Direct materials (10046 complete) Conversicos (25% complete) Costs for April WE, beginning Intory Direct materials $140,000 Conversions $97.910 Direct materials added $304,000 Conversion costs added 5387,130 1 What is the total cost per equivalent unit using the weighted average method of process casting? Equivalent unit calculations Direct Material: 85,000+ 134,000 - 219.000 units Conversion Cost: 186.000 6000 (27,000x296) 198,750 units Toul cost per equivalent $2.032.445447 27. XYZ Inc. obtains fish and then processes them into frozen fillets and then prepares the frozen fish fillets for distribution to its retail sales department. Direct materials are added at the initiation of the cycle. Conversion costs are incurred evenly throughout the production cycle. Before inspection, some fillets are spoiled due to undetectable defects. Inspection occurs when units are 45% converted, Spoiled fillets generally constitute 6% of the good fillets. Data for April 2017 are as follows: WIP, beginning inventory 4/1/2017 85,000 fillets Direct materials (100% complete) Conversion costs (60% complete) Started during April 134,000 fillets Completed and transferred out 4/30/2017 186,000 fillets WIP, ending inventory 4/30/2017 27,000 fillets Direct materials (100% complete) Conversion costs (25% complete) Costs for April: WIP, beginning Inventory: Direct materials $140,000 Conversion costs 97,910 Direct materials added 304,000 Conversion costs added 387,130 What is the total cost per equivalent unit using the weighted-average method of process costing? Note: Your answer should be in the format of "S**". Round any cost per unit calculations to the nearest cent. Use commas to separate thousands. Answer: 94.47 Direct Materials Conversion Costs WIP, beginning inventory $140,000 597,910 Costs added during period 304,000 387.130 Total cost to account for 444,000 485,040 Divide by equivalent units 219.000 198.750 Equivalent-unit costs S2.03 S2.44 * Equivalent unit calculations: Direct Materials: 85,000 + 134,000 - 219,000 units Conversion Costs: 186,000 + 6000 + (27,000 x 25%) - 198,750 units Total cost per equivalent unit = $2.03 +52.44 = $4.47 10 HRL. We obtains fish and then processes them into frozen fillets and then prepares the frozen fish fillets for distribution to its retail sales department. Direct materials are added at the instiation of the cycle Conversion costs are incurred evenly throughout the production cycle. Before dupection, som files are spoiled due to understable defects. Inspection occurs when units are 45% converted Spoiled fillets generally constitute 6% of the good fillets Data for April 2017 are as follows: WIP beginning investory 4/1/2017 $5,000 fillets Direct materials (100% complete) Conversion costs (60% complete) Started during April 134,000 Alles Completed and transferred out 4/30/2017 186.000 Gillets Wending investory 4/30/2017 27,000 fillets Direct materials (10046 complete) Conversicos (25% complete) Costs for April WE, beginning Intory Direct materials $140,000 Conversions $97.910 Direct materials added $304,000 Conversion costs added 5387,130 1 What is the total cost per equivalent unit using the weighted average method of process casting? Equivalent unit calculations Direct Material: 85,000+ 134,000 - 219.000 units Conversion Cost: 186.000 6000 (27,000x296) 198,750 units Toul cost per equivalent $2.032.445447 27. XYZ Inc. obtains fish and then processes them into frozen fillets and then prepares the frozen fish fillets for distribution to its retail sales department. Direct materials are added at the initiation of the cycle. Conversion costs are incurred evenly throughout the production cycle. Before inspection, some fillets are spoiled due to undetectable defects. Inspection occurs when units are 45% converted, Spoiled fillets generally constitute 6% of the good fillets. Data for April 2017 are as follows: WIP, beginning inventory 4/1/2017 85,000 fillets Direct materials (100% complete) Conversion costs (60% complete) Started during April 134,000 fillets Completed and transferred out 4/30/2017 186,000 fillets WIP, ending inventory 4/30/2017 27,000 fillets Direct materials (100% complete) Conversion costs (25% complete) Costs for April: WIP, beginning Inventory: Direct materials $140,000 Conversion costs 97,910 Direct materials added 304,000 Conversion costs added 387,130 What is the total cost per equivalent unit using the weighted-average method of process costing? Note: Your answer should be in the format of "S**". Round any cost per unit calculations to the nearest cent. Use commas to separate thousands. Answer: 94.47 Direct Materials Conversion Costs WIP, beginning inventory $140,000 597,910 Costs added during period 304,000 387.130 Total cost to account for 444,000 485,040 Divide by equivalent units 219.000 198.750 Equivalent-unit costs S2.03 S2.44 * Equivalent unit calculations: Direct Materials: 85,000 + 134,000 - 219,000 units Conversion Costs: 186,000 + 6000 + (27,000 x 25%) - 198,750 units Total cost per equivalent unit = $2.03 +52.44 = $4.47 10