Answered step by step

Verified Expert Solution

Question

1 Approved Answer

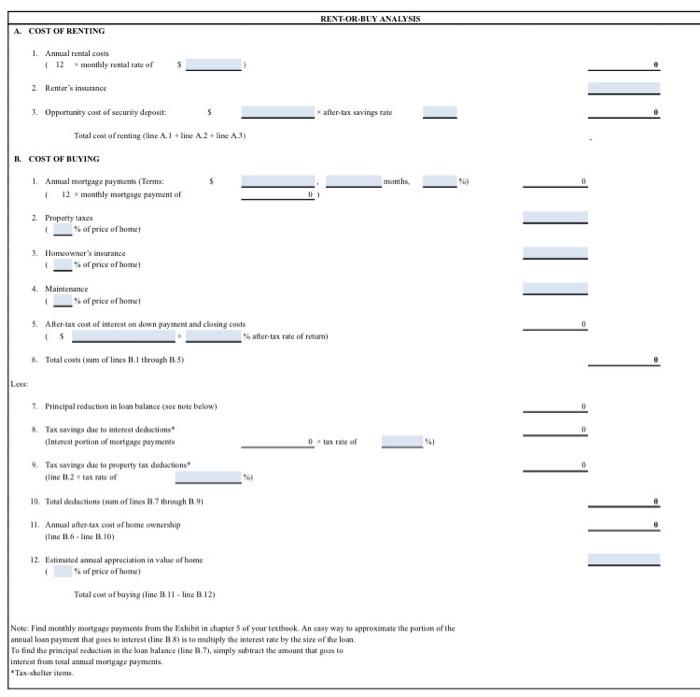

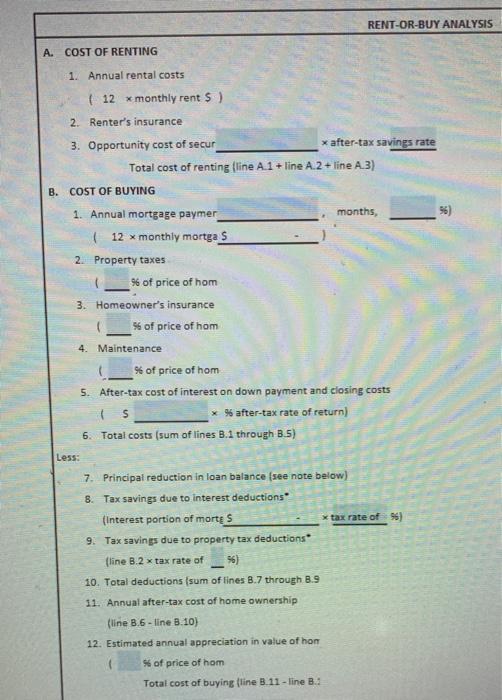

please help fill the spots Assignment Using the Excel sheet below please conduct a rent vs buy analysis for a home. Please use the internet

please help fill the spots

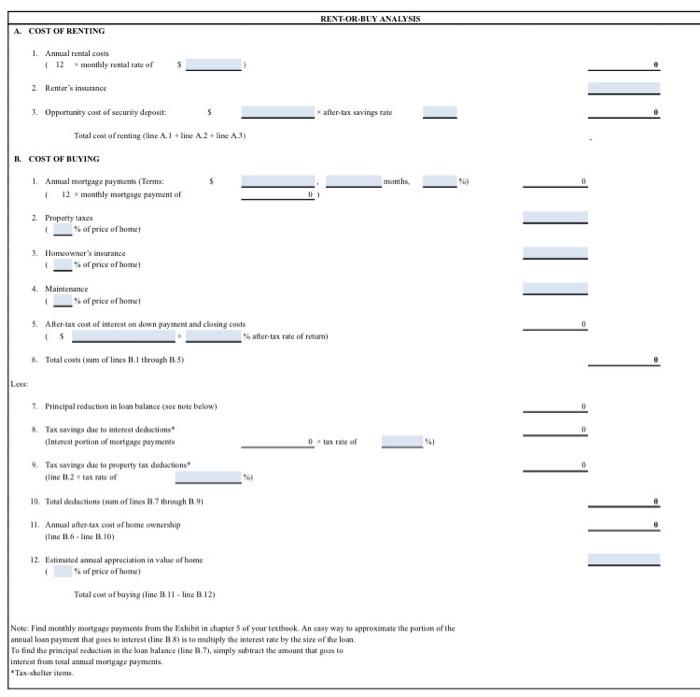

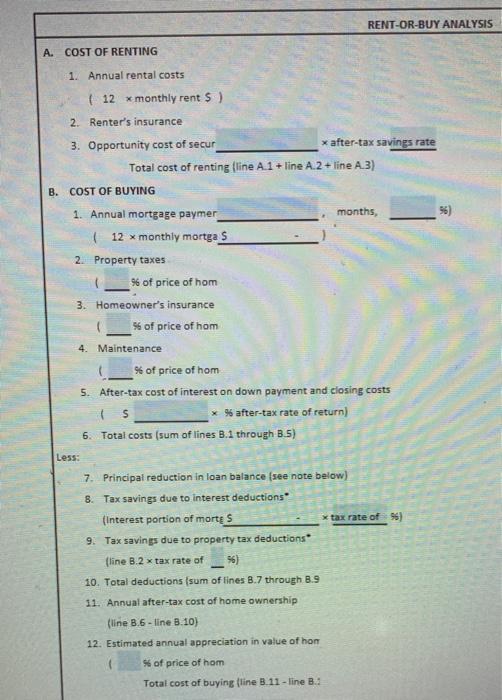

Assignment Using the Excel sheet below please conduct a rent vs buy analysis for a home. Please use the internet to locate a home you would be interested in buying and a property that you would be interested in renting to conduct your analysis. Please submit the assignment in the Excel file listed below. Please remember to place your name ,assignment number and date within the Excel file. Rent vs Buy Worksheet.xlsx RENTOR-BUY ANALYSIS A COST OF RENTING I. Annual restal costs 12 monthly rata rate of 2 Renter's insurance 1 Opportunity cost of security deposit Total cost of reading line A.1 +tie A2 + lite 4.3) *ather-tax savings rate R. COST OF BUYING months. 1. Annual mortgage payments Terms 12 monthly motoage payment of 2. Property taxes of price of home 1. Homeowner's insurance of price of home 4. Maintenance of price of home $. Attet tax cost of interest on down payment and closing costs water tax rate of return Total coste (ram of lines 11.1 through 3.5) 7. Principal reduction inom balmce (se note below Tax Saviny do to interne deduction Intel portion of payments O as of 167 111 Tax savings due to property tax deduction (line 11.2 tax nute of 16. Totul dedactions (sum of lines through 0.01 11. Annual for tax cost of homeownership line 1.6 line 11.10) 12. Estimated antul appreciation in value of home of price of home Total cost of buying (line 1.11. line 8:12) Note : Find monthly mortgage payments from the Exhibit in chapter 5 of your textbook. An easy way to approximate the portion of the annual loan payment that goes to interest (line B1 is to multiply the interest rate by the size of the loan To find the principal reduction in the loan balance (line 2.7), simply subtract the amount that goes to interest from focal annual mortgage payments Tax.chelter item RENT-OR-BUY ANALYSIS A. COST OF RENTING 1. Annual rental costs ( 12 x monthly rent 5 ) 2. Renter's insurance 3. Opportunity cost of secur * after-tax savings rate Total cost of renting (line A.1 + line A.2 + line A.3) B. COST OF BUYING 9) 1. Annual mortgage paymer months, 12 monthly mortgas 2. Property taxes 9 of price of hom 3. Homeowner's insurance % of price of hom 4. Maintenance % of price of hom 5. After-tax cost of interest on down payment and closing costs * % after-tax rate of return) 6. Total costs (sum of lines B.1 through 3.5) S Less: 7. Principal reduction in loan balance (see note below) 8. Tax savings due to interest deductions (Interest portion of mortes tax rate of 96) 9. Tax savings due to property tax deductions (line B.2 x tax rate of %) 10. Total deductions (sum of lines 8.7 through B.9 11. Annual after-tax cost of home ownership (line 3.6-line B.10) 12. Estimated annual appreciation in value of hom of price of hom Total cost of buying (line B. 11-line B.: Assignment Using the Excel sheet below please conduct a rent vs buy analysis for a home. Please use the internet to locate a home you would be interested in buying and a property that you would be interested in renting to conduct your analysis. Please submit the assignment in the Excel file listed below. Please remember to place your name ,assignment number and date within the Excel file. Rent vs Buy Worksheet.xlsx RENTOR-BUY ANALYSIS A COST OF RENTING I. Annual restal costs 12 monthly rata rate of 2 Renter's insurance 1 Opportunity cost of security deposit Total cost of reading line A.1 +tie A2 + lite 4.3) *ather-tax savings rate R. COST OF BUYING months. 1. Annual mortgage payments Terms 12 monthly motoage payment of 2. Property taxes of price of home 1. Homeowner's insurance of price of home 4. Maintenance of price of home $. Attet tax cost of interest on down payment and closing costs water tax rate of return Total coste (ram of lines 11.1 through 3.5) 7. Principal reduction inom balmce (se note below Tax Saviny do to interne deduction Intel portion of payments O as of 167 111 Tax savings due to property tax deduction (line 11.2 tax nute of 16. Totul dedactions (sum of lines through 0.01 11. Annual for tax cost of homeownership line 1.6 line 11.10) 12. Estimated antul appreciation in value of home of price of home Total cost of buying (line 1.11. line 8:12) Note : Find monthly mortgage payments from the Exhibit in chapter 5 of your textbook. An easy way to approximate the portion of the annual loan payment that goes to interest (line B1 is to multiply the interest rate by the size of the loan To find the principal reduction in the loan balance (line 2.7), simply subtract the amount that goes to interest from focal annual mortgage payments Tax.chelter item RENT-OR-BUY ANALYSIS A. COST OF RENTING 1. Annual rental costs ( 12 x monthly rent 5 ) 2. Renter's insurance 3. Opportunity cost of secur * after-tax savings rate Total cost of renting (line A.1 + line A.2 + line A.3) B. COST OF BUYING 9) 1. Annual mortgage paymer months, 12 monthly mortgas 2. Property taxes 9 of price of hom 3. Homeowner's insurance % of price of hom 4. Maintenance % of price of hom 5. After-tax cost of interest on down payment and closing costs * % after-tax rate of return) 6. Total costs (sum of lines B.1 through 3.5) S Less: 7. Principal reduction in loan balance (see note below) 8. Tax savings due to interest deductions (Interest portion of mortes tax rate of 96) 9. Tax savings due to property tax deductions (line B.2 x tax rate of %) 10. Total deductions (sum of lines 8.7 through B.9 11. Annual after-tax cost of home ownership (line 3.6-line B.10) 12. Estimated annual appreciation in value of hom of price of hom Total cost of buying (line B. 11-line B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started