Please help:

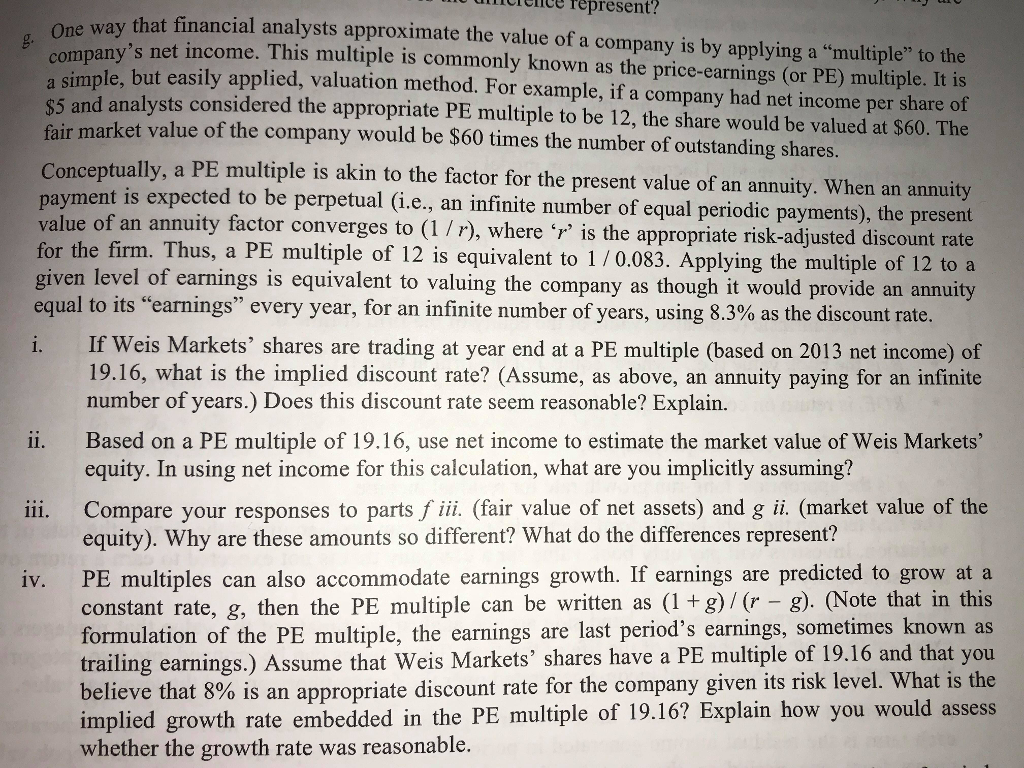

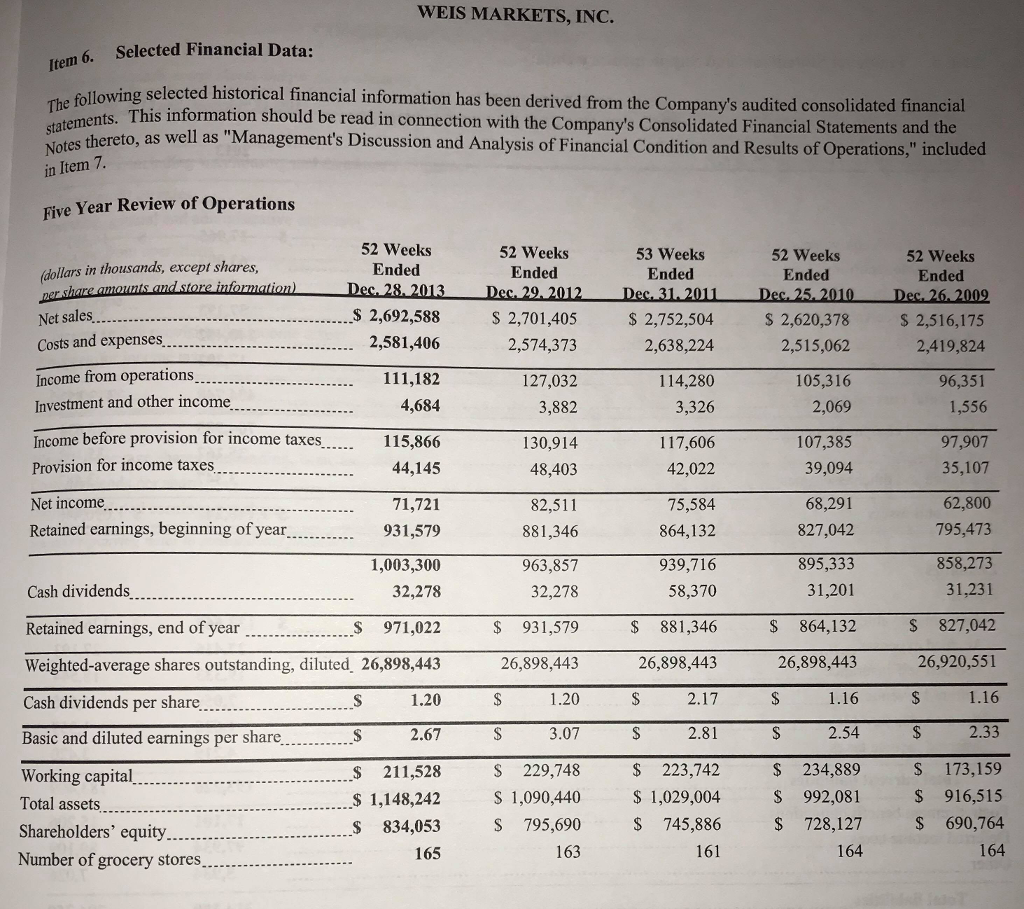

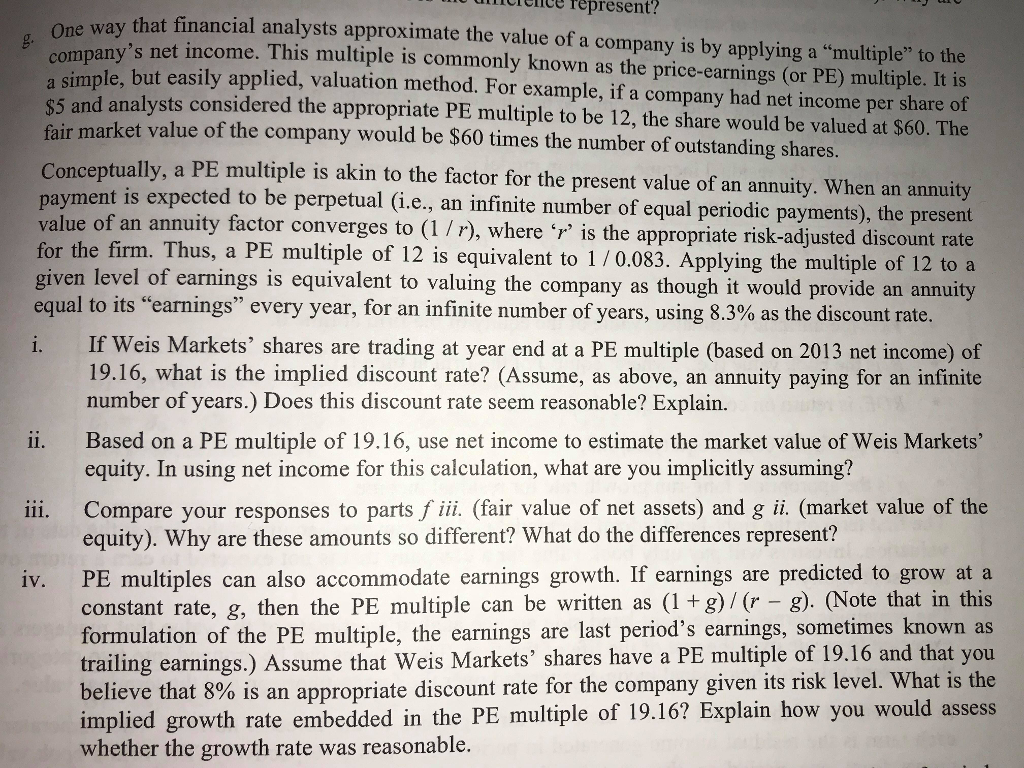

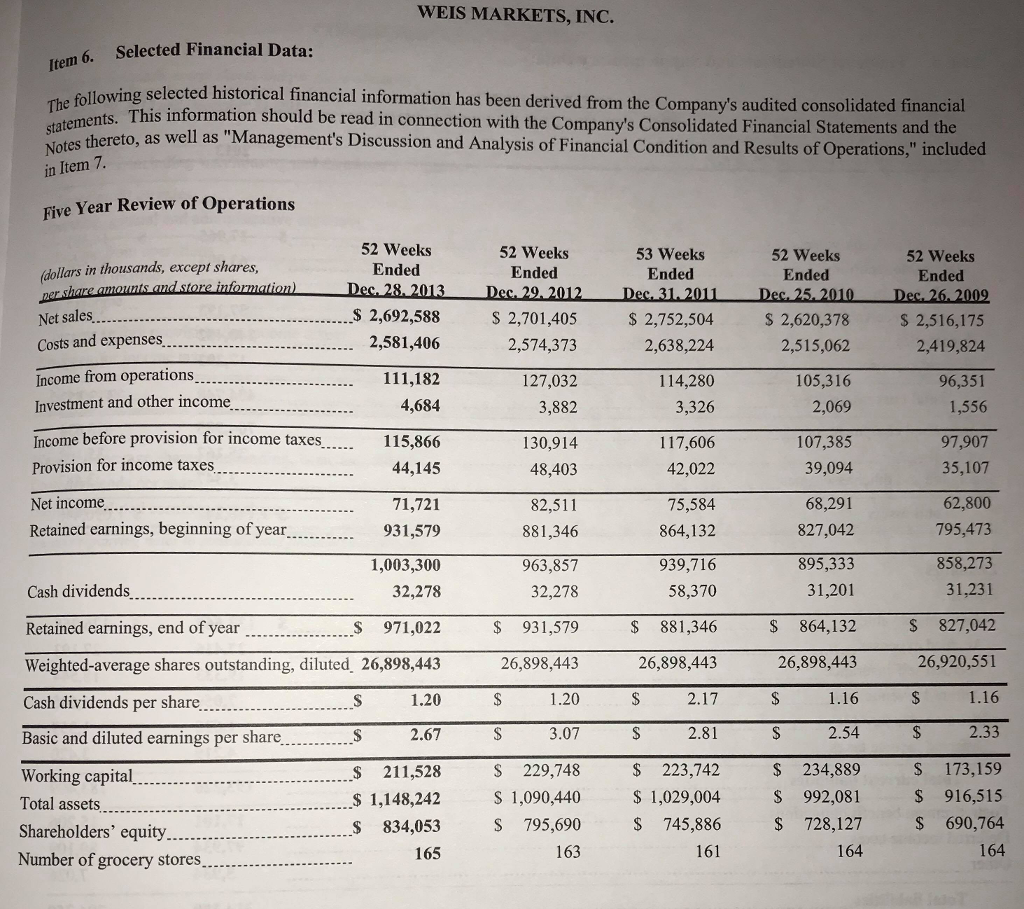

g. One way that financial muumene represent? oy that financial analysts approximate the value of a company is by applying a "multiple to the any's net income. This multiple is commonly known as the price-earnings (or PE) multiple. It is simple. but easily applied, valuation method. For example, if a company had net income per share of s5 and analysts considered the appropriate PE multiple to be 12, the share would be valued at $60. The fair market value of the company would be $60 times the number of outstanding shares. Conceptually, a PE multiple is akin to the factor for the present value of an annuity. When an annuity payment is expected to be perpetual (i.e., an infinite number of equal periodic payments), the present value of an annuity factor converges to (1 / r), where 'r' is the appropriate risk-adjusted discount rate for the firm. Thus, a PE multiple of 12 is equivalent to 1 /0.083. Applying the multiple of 12 to a given level of earnings is equivalent to valuing the company as though it would provide an annuity equal to its "earnings" every year, for an infinite number of years, using 8.3% as the discount rate. If Weis Markets' shares are trading at year end at a PE multiple (based on 2013 net income) of 19.16, what is the implied discount rate? (Assume, as above, an annuity paying for an infinite number of years.) Does this discount rate seem reasonable? Explain. Based on a PE multiple of 19.16, use net income to estimate the market value of Weis Markets' equity. In using net income for this calculation, what are you implicitly assuming? Compare your responses to parts f iii. (fair value of net assets) and g ii. (market value of the equity). Why are these amounts so different? What do the differences represent? PE multiples can also accommodate earnings growth. If earnings are predicted to grow at a constant rate, g, then the PE multiple can be written as (1 + g)/(r - g). (Note that in this formulation of the PE multiple, the earnings are last period's earnings, sometimes known as trailing earnings.) Assume that Weis Markets' shares have a PE multiple of 19.16 and that you believe that 8% is an appropriate discount rate for the company given its risk level. What is the implied growth rate embedded in the PE multiple of 19.16? Explain how you would assess whether the growth rate was reasonable. g. One way that financial muumene represent? oy that financial analysts approximate the value of a company is by applying a "multiple to the any's net income. This multiple is commonly known as the price-earnings (or PE) multiple. It is simple. but easily applied, valuation method. For example, if a company had net income per share of s5 and analysts considered the appropriate PE multiple to be 12, the share would be valued at $60. The fair market value of the company would be $60 times the number of outstanding shares. Conceptually, a PE multiple is akin to the factor for the present value of an annuity. When an annuity payment is expected to be perpetual (i.e., an infinite number of equal periodic payments), the present value of an annuity factor converges to (1 / r), where 'r' is the appropriate risk-adjusted discount rate for the firm. Thus, a PE multiple of 12 is equivalent to 1 /0.083. Applying the multiple of 12 to a given level of earnings is equivalent to valuing the company as though it would provide an annuity equal to its "earnings" every year, for an infinite number of years, using 8.3% as the discount rate. If Weis Markets' shares are trading at year end at a PE multiple (based on 2013 net income) of 19.16, what is the implied discount rate? (Assume, as above, an annuity paying for an infinite number of years.) Does this discount rate seem reasonable? Explain. Based on a PE multiple of 19.16, use net income to estimate the market value of Weis Markets' equity. In using net income for this calculation, what are you implicitly assuming? Compare your responses to parts f iii. (fair value of net assets) and g ii. (market value of the equity). Why are these amounts so different? What do the differences represent? PE multiples can also accommodate earnings growth. If earnings are predicted to grow at a constant rate, g, then the PE multiple can be written as (1 + g)/(r - g). (Note that in this formulation of the PE multiple, the earnings are last period's earnings, sometimes known as trailing earnings.) Assume that Weis Markets' shares have a PE multiple of 19.16 and that you believe that 8% is an appropriate discount rate for the company given its risk level. What is the implied growth rate embedded in the PE multiple of 19.16? Explain how you would assess whether the growth rate was reasonable