Answered step by step

Verified Expert Solution

Question

1 Approved Answer

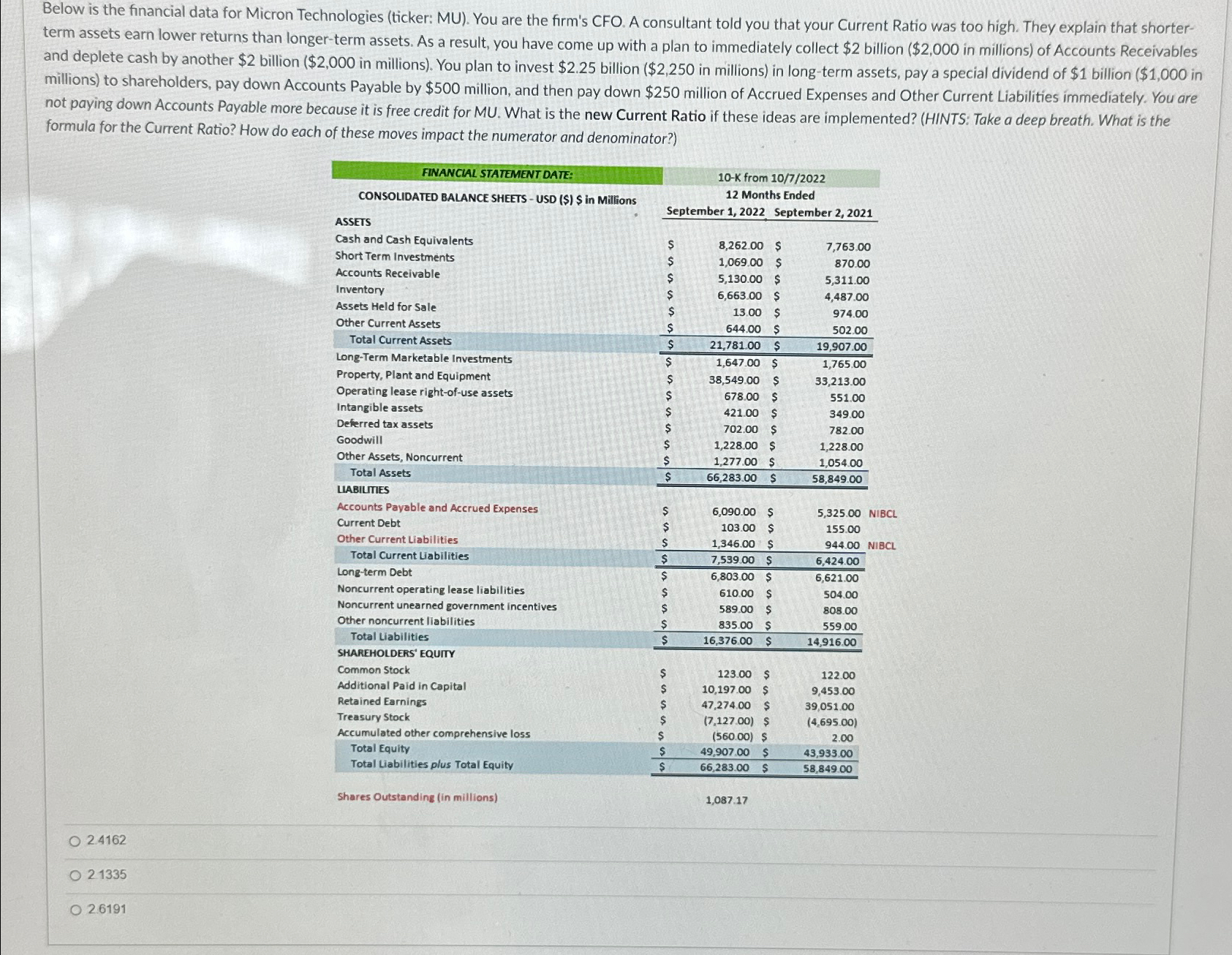

Below is the financial data for Micron Technologies ( ticker: MU ) . You are the firm's CFO. A consultant told you that your Current

Below is the financial data for Micron Technologies ticker: MU You are the firm's CFO. A consultant told you that your Current Ratio was too high. They explain that shorterterm assets earn lower returns than longerterm assets. As a result, you have come up with a plan to immediately collect $ billion $ in millions of Accounts Receivables and deplete cash by another $ billion $ in millions You plan to invest $ billion $ in millions in longterm assets, pay a special dividend of $ billion $ in millions to shareholders, pay down Accounts Payable by $ million, and then pay down $ million of Accrued Expenses and Other Current Liabilities immediately. You are not paying down Accounts Payable more because it is free credit for MU What is the new Current Ratio if these ideas are implemented? HINTS: Take a deep breath. What is the formula for the Current Ratio? How do each of these moves impact the numerator and denominator?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started