Answered step by step

Verified Expert Solution

Question

1 Approved Answer

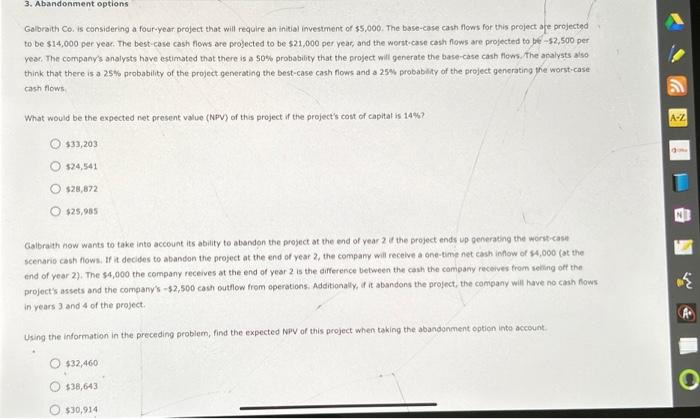

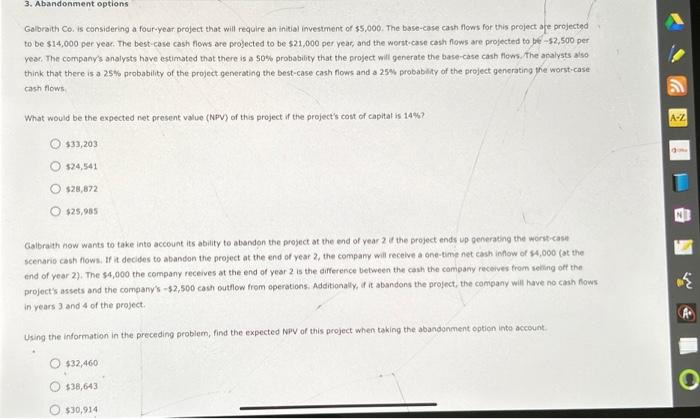

Please help! Golbraith Co, is considering a four-year, project that will require an initial investment of 55,000 . The base-case cash flows for this project

Please help!

Golbraith Co, is considering a four-year, project that will require an initial investment of 55,000 . The base-case cash flows for this project are projected to be $14,000 per yeac. The best-case cash flows are projected to be $21,000 per year, and the worst-case cash flows are projected to jef - 52,500 per year. The company's analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probabilty of the project generating the worst-case cash flews What would be the expected net present value (Npr) of this project if the project's cost of capitak is 14 h? $33,203$74,541$28,872$25,965 Galbraith how wants to take into account its ability to absndon the project at the end of year 2 if the project ends up generating the workticase scenano cash flows. If it decides to abandon the project at the end of year 2 , the company will receive a one-time net cash inhow of s4, ooo (at the end of year 2). The 54,000 the company receives at the end of year 2 is the difference between the cash the company recives trom seting oft the project's assets and the company's $2,500 cash outflow from operations. Additionally, if it abandons the project, the company will have no caah flows. in years 3 and 4 of the project. Using the information in the preceding problem, find the expected Npy of this project when taking the abandonment option into account. $32,460436,643530,914

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started