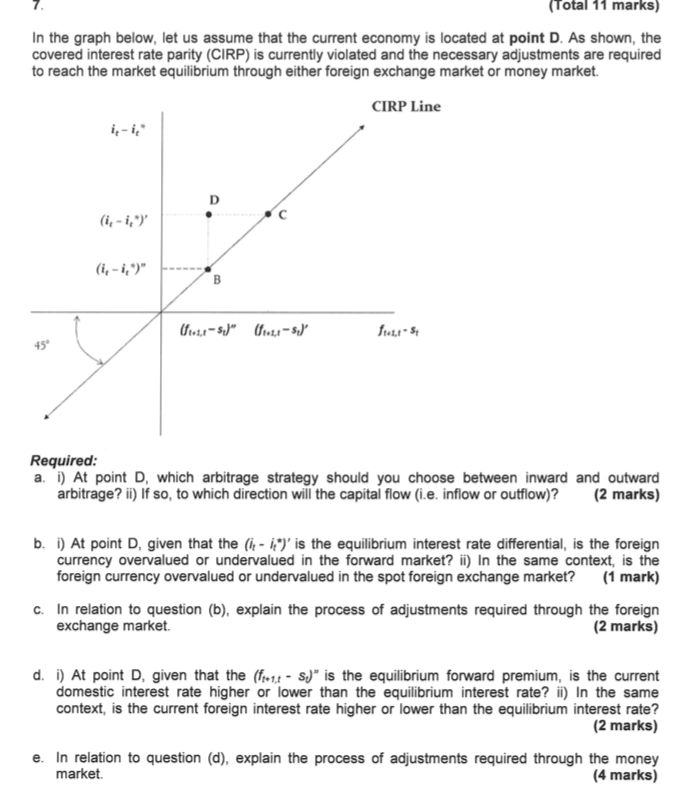

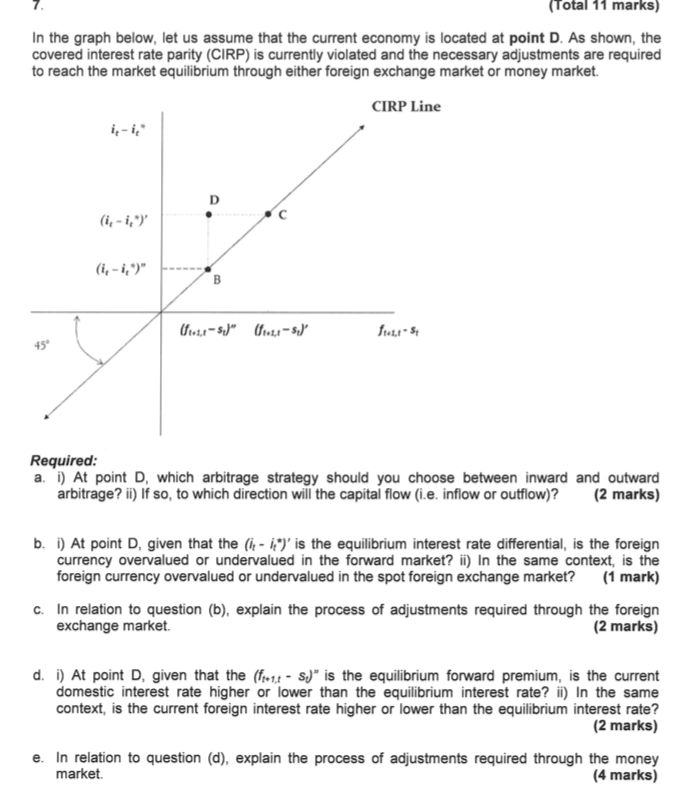

(Total 11 marks) In the graph below, let us assume that the current economy is located at point D. As shown, the covered interest rate parity (CIRP) is currently violated and the necessary adjustments are required to reach the market equilibrium through either foreign exchange market or money market. CIRP Line D B (2,7-8.)" (-1.2-so) fueras 45 Required: a. i) At point D, which arbitrage strategy should you choose between inward and outward arbitrage? ii) If so, to which direction will the capital flow (i.e. inflow or outflow)? (2 marks) b. i) At point D, given that the (in - 1,*)' is the equilibrium interest rate differential, is the foreign currency overvalued or undervalued in the forward market? ii) In the same context, is the foreign currency overvalued or undervalued in the spot foreign exchange market? (1 mark) C. In relation to question (b), explain the process of adjustments required through the foreign exchange market (2 marks) d. i) At point D, given that the (f=14 - s.)" is the equilibrium forward premium, is the current domestic interest rate higher or lower than the equilibrium interest rate? ii) In the same context, is the current foreign interest rate higher or lower than the equilibrium interest rate? (2 marks) e. In relation to question (d), explain the process of adjustments required through the money market (4 marks) (Total 11 marks) In the graph below, let us assume that the current economy is located at point D. As shown, the covered interest rate parity (CIRP) is currently violated and the necessary adjustments are required to reach the market equilibrium through either foreign exchange market or money market. CIRP Line D B (2,7-8.)" (-1.2-so) fueras 45 Required: a. i) At point D, which arbitrage strategy should you choose between inward and outward arbitrage? ii) If so, to which direction will the capital flow (i.e. inflow or outflow)? (2 marks) b. i) At point D, given that the (in - 1,*)' is the equilibrium interest rate differential, is the foreign currency overvalued or undervalued in the forward market? ii) In the same context, is the foreign currency overvalued or undervalued in the spot foreign exchange market? (1 mark) C. In relation to question (b), explain the process of adjustments required through the foreign exchange market (2 marks) d. i) At point D, given that the (f=14 - s.)" is the equilibrium forward premium, is the current domestic interest rate higher or lower than the equilibrium interest rate? ii) In the same context, is the current foreign interest rate higher or lower than the equilibrium interest rate? (2 marks) e. In relation to question (d), explain the process of adjustments required through the money market (4 marks)