Answered step by step

Verified Expert Solution

Question

1 Approved Answer

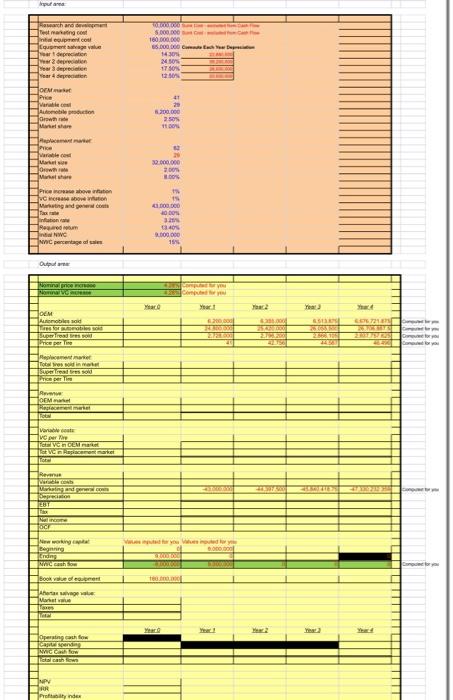

Please help GOODWEEK TIRES, INC. After extensive research and development, Goodwork Tires, Inc., has recently developed a new tire the Super Tread, and must decide

Please help

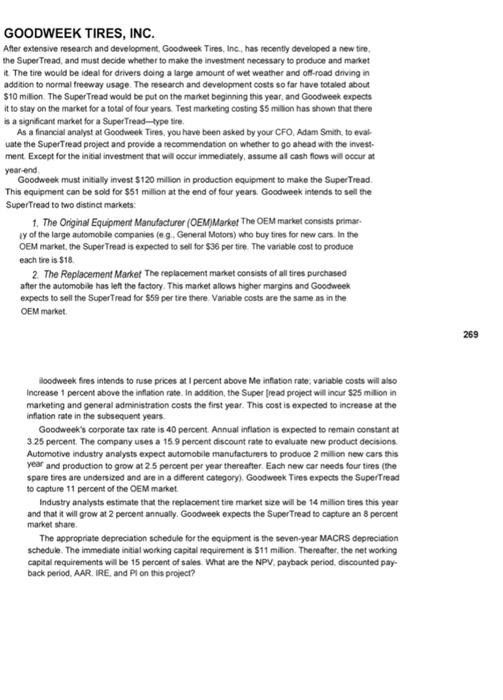

GOODWEEK TIRES, INC. After extensive research and development, Goodwork Tires, Inc., has recently developed a new tire the Super Tread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and development costs so far have totaled about $10 million The Super Tread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5 million has shown that there is a significant market for a Super Tread-type tire As a financial analyst at Goodiveek Times, you have been asked by your CFO, Adam Smith, to eval uate the Super Tread project and provide a recommendation on whether to go ahead with the invest ment Except for the initial investment that will occur immediately, assume al cash flows will occur at year-end Goodweek must initially invest $120 million in production equipment to make the Super Tread. This equipment can be sold for $51 million at the end of four years. Goodweek intends to sell the SuperTread to two distinct markets: 1. The Original Equipment Manufacturer (OEM)Market The OEM market consists primar y of the large automobile companies (eg. General Motors) who buy tires for new cars. In the OEM market, the Super Tread is expected to sell for $36 per tire. The variable cost to produce each tire is $18 2 The Replacement Market The replacement market consists of all tires purchased after the automobile has left the factory. This market allows higher margins and Goodweek expects to sell the Super Tread for $59 per tre there Variable costs are the same as in the OEM market 269 iloodweek fires intends to fuse prices at I percent above Me inflation rate variable costs will also Increase 1 percent above the inflation rate. In addition, the Super [read project will incur 525 million in marketing and general administration costs the first year. This cost is expected to increase at the inflation rate in the subsequent years. Goodweek's corporate tax rate is 40 percent. Annual inflation is expected to remain constant at 325 percent. The company uses a 15.9 percent discount rate to evaluate new product decisions Automotive industry analysts expect automobile manufacturers to produce 2 million new cars this year and production to grow at 25 percent per year thereafter. Each new car needs four tires (the spare tires are undersized and are in a different category) Goodwok Tires expects the SuperTread to capture 11 percent of the OEM market Industry analysts estimate that the replacement tire market size will be 14 million tires this year and that it will grow at 2 percent annually. Goodweek expects the Super Tread to capture an 8 percent market share The appropriate depreciation schedule for the equipment is the seven-year MACRS depreciation schedule. The immediate initial working capital requirement is $11 million. Thereafter the networking capital requirements will be 15 percent of sales What are the NPV payback period, discounted pay- back period, AAR. IRE. and Pl on this project? pulan thane mango icon quentage value ar trece ww2 depreciation TO 5.000.000 160.000.000 85.000.000 143 17 50% OEM Price artic Autotection whe Msha 200.000 2509 11 32.000.000 200 100 cos w low Mehr Price above to vrboven ng and inflation Perum percentage de DO DOO 2000 340 9.000.000 14 Dutput IN COLOR ace Your 2 Year 200 SOL TOEM And Latest superiores TE 2000 RE 2 2 Red Totes on Ice TOEM cement Po Vaste V OLM License EBY Toch wing VW Nahm Book Mar Operating the TER WWE La nown NPV RR Proinde GOODWEEK TIRES, INC. After extensive research and development, Goodwork Tires, Inc., has recently developed a new tire the Super Tread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and development costs so far have totaled about $10 million The Super Tread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5 million has shown that there is a significant market for a Super Tread-type tire As a financial analyst at Goodiveek Times, you have been asked by your CFO, Adam Smith, to eval uate the Super Tread project and provide a recommendation on whether to go ahead with the invest ment Except for the initial investment that will occur immediately, assume al cash flows will occur at year-end Goodweek must initially invest $120 million in production equipment to make the Super Tread. This equipment can be sold for $51 million at the end of four years. Goodweek intends to sell the SuperTread to two distinct markets: 1. The Original Equipment Manufacturer (OEM)Market The OEM market consists primar y of the large automobile companies (eg. General Motors) who buy tires for new cars. In the OEM market, the Super Tread is expected to sell for $36 per tire. The variable cost to produce each tire is $18 2 The Replacement Market The replacement market consists of all tires purchased after the automobile has left the factory. This market allows higher margins and Goodweek expects to sell the Super Tread for $59 per tre there Variable costs are the same as in the OEM market 269 iloodweek fires intends to fuse prices at I percent above Me inflation rate variable costs will also Increase 1 percent above the inflation rate. In addition, the Super [read project will incur 525 million in marketing and general administration costs the first year. This cost is expected to increase at the inflation rate in the subsequent years. Goodweek's corporate tax rate is 40 percent. Annual inflation is expected to remain constant at 325 percent. The company uses a 15.9 percent discount rate to evaluate new product decisions Automotive industry analysts expect automobile manufacturers to produce 2 million new cars this year and production to grow at 25 percent per year thereafter. Each new car needs four tires (the spare tires are undersized and are in a different category) Goodwok Tires expects the SuperTread to capture 11 percent of the OEM market Industry analysts estimate that the replacement tire market size will be 14 million tires this year and that it will grow at 2 percent annually. Goodweek expects the Super Tread to capture an 8 percent market share The appropriate depreciation schedule for the equipment is the seven-year MACRS depreciation schedule. The immediate initial working capital requirement is $11 million. Thereafter the networking capital requirements will be 15 percent of sales What are the NPV payback period, discounted pay- back period, AAR. IRE. and Pl on this project? pulan thane mango icon quentage value ar trece ww2 depreciation TO 5.000.000 160.000.000 85.000.000 143 17 50% OEM Price artic Autotection whe Msha 200.000 2509 11 32.000.000 200 100 cos w low Mehr Price above to vrboven ng and inflation Perum percentage de DO DOO 2000 340 9.000.000 14 Dutput IN COLOR ace Your 2 Year 200 SOL TOEM And Latest superiores TE 2000 RE 2 2 Red Totes on Ice TOEM cement Po Vaste V OLM License EBY Toch wing VW Nahm Book Mar Operating the TER WWE La nown NPV RR Proinde

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started