Question: please help, i do not know what i am misisng while completing these problems, i am not getting a 100% 6. Future value of annuities

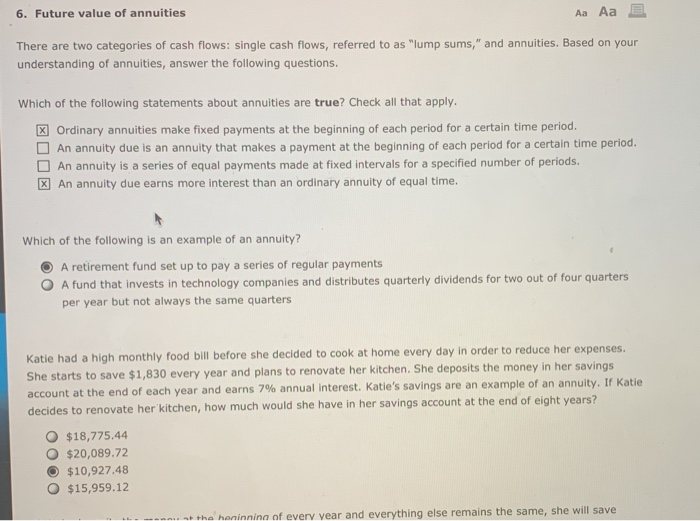

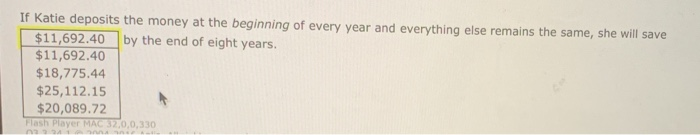

6. Future value of annuities Aa Aa E There are two categories of cash flows: single cash flows, referred to as "lump sums," and annuities. Based on your understanding of annuities, answer the following questions. Which of the following statements about annuities are true? Check all that apply. x Ordinary annuities make fixed payments at the beginning of each period for a certain time period. An annuity due is an annuity that makes a payment at the beginning of each period for a certain time period. An annuity is a series of equal payments made at fixed intervals for a specified number of periods. x An annuity due earns more interest than an ordinary annuity of equal time. Which of the following is an example of an annuity? O O A retirement fund set up to pay a series of regular payments A fund that invests in technology companies and distributes quarterly dividends for two out of four quarters per year but not always the same quarters Katie had a high monthly food bill before she decided to cook at home every day in order to reduce her expenses. She starts to save $1,830 every year and plans to renovate her kitchen. She deposits the money in her savings account at the end of each year and earns 7% annual interest. Katie's savings are an example of an annuity. If Katie decides to renovate her kitchen, how much would she have in her savings account at the end of eight years? O $18,775.44 $20,089.72 $10,927.48 $15,959.12 O en t ha honinning of every year and everything else remains the same, she will save If Katie deposits the money at the beginning of every year and everything else remains the same, she will save $11,692.40 by the end of eight years. $11,692.40 $18,775.44 $25,112.15 $20,089.72 Flash Player MAC 32,0,0,330

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts