Answered step by step

Verified Expert Solution

Question

1 Approved Answer

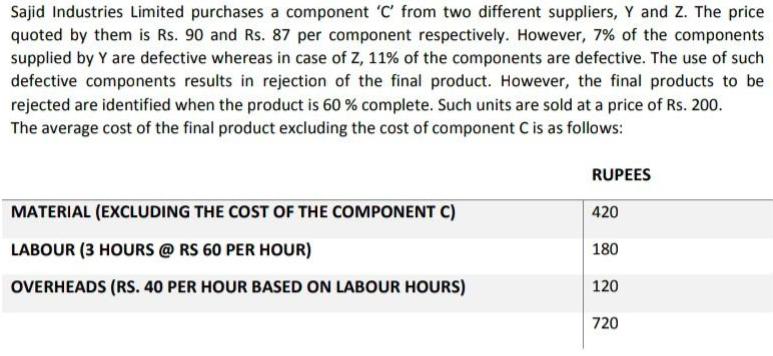

Sajid Industries Limited purchases a component 'C' from two different suppliers, Y and Z. The price quoted by them is Rs. 90 and Rs.

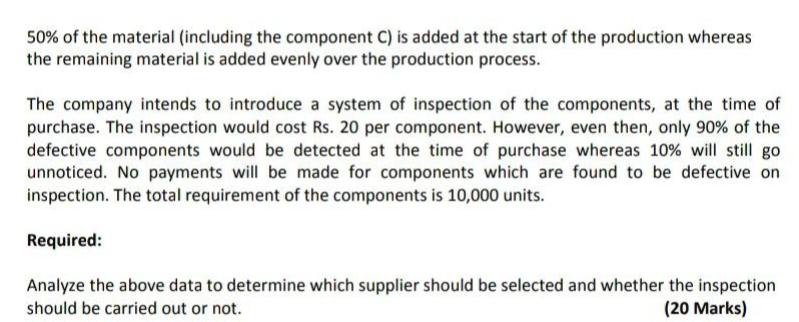

Sajid Industries Limited purchases a component 'C' from two different suppliers, Y and Z. The price quoted by them is Rs. 90 and Rs. 87 per component respectively. However, 7% of the components supplied by Y are defective whereas in case of Z, 11% of the components are defective. The use of such defective components results in rejection of the final product. However, the final products to be rejected are identified when the product is 60 % complete. Such units are sold at a price of Rs. 200. The average cost of the final product excluding the cost of component C is as follows: MATERIAL (EXCLUDING THE COST OF THE COMPONENT C) LABOUR (3 HOURS @ RS 60 PER HOUR) OVERHEADS (RS. 40 PER HOUR BASED ON LABOUR HOURS) RUPEES 420 180 120 720 50% of the material (including the component C) is added at the start of the production whereas the remaining material is added evenly over the production process. The company intends to introduce a system of inspection of the components, at the time of purchase. The inspection would cost Rs. 20 per component. However, even then, only 90% of the defective components would be detected at the time of purchase whereas 10% will still go unnoticed. No payments will be made for components which are found to be defective on inspection. The total requirement of the components is 10,000 units. Required: Analyze the above data to determine which supplier should be selected and whether the inspection should be carried out or not. (20 Marks)

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Endur Iculation of loss due to rejection of final product excluding cost of component Particulars Sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started