please help!!!

i dont think i did the sales journal right

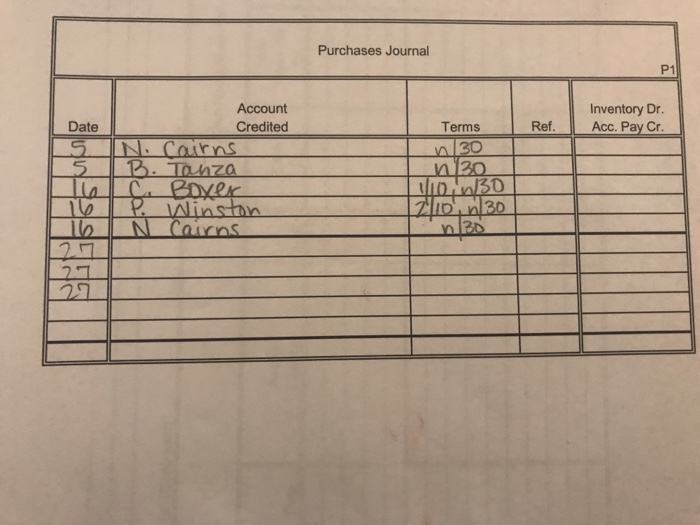

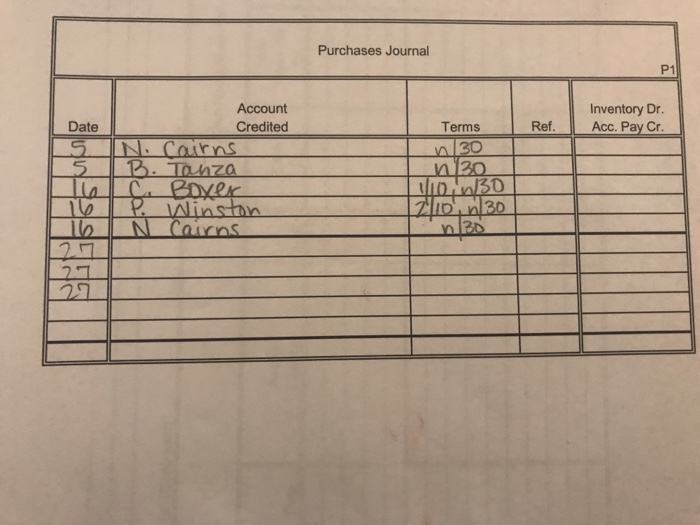

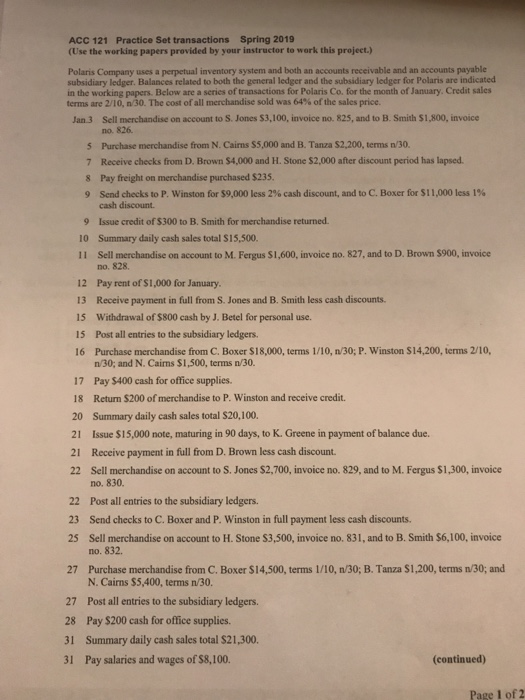

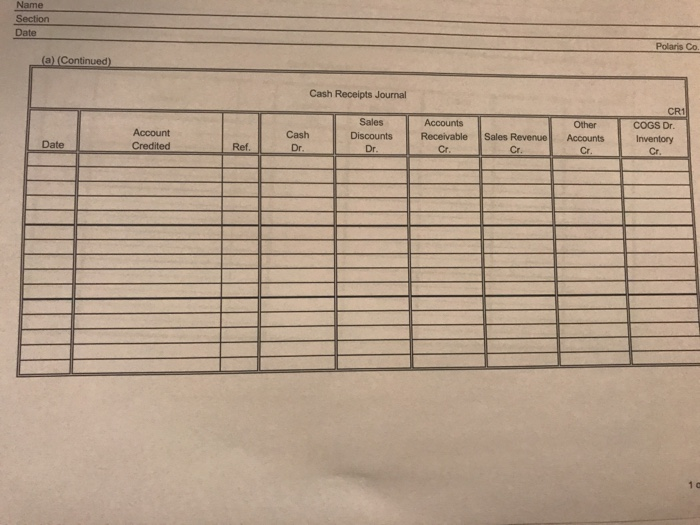

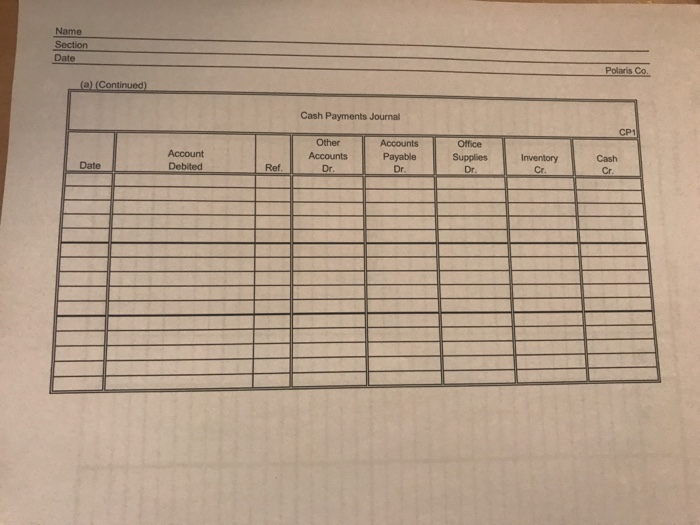

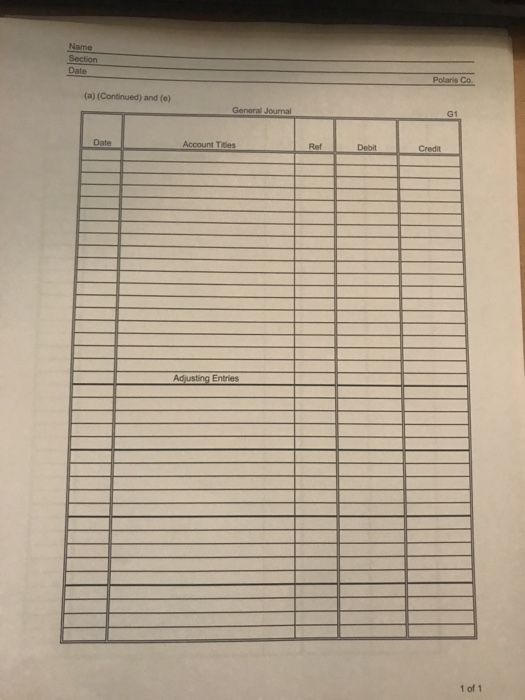

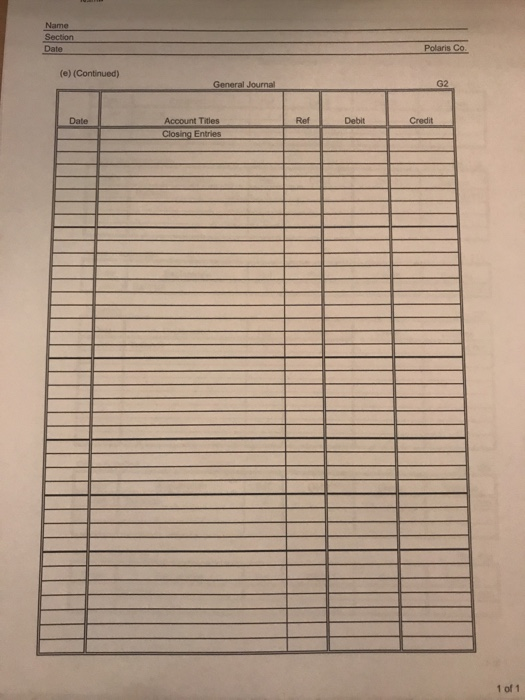

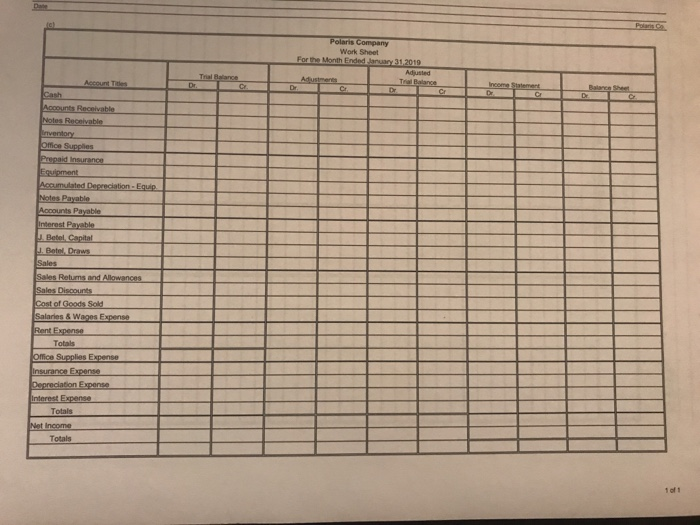

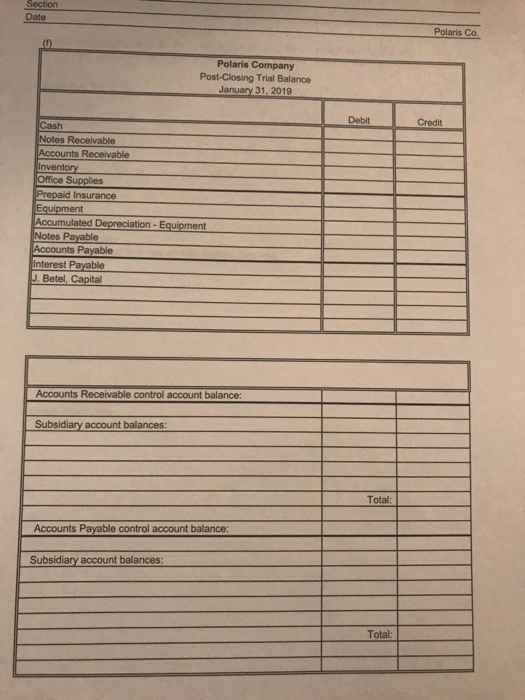

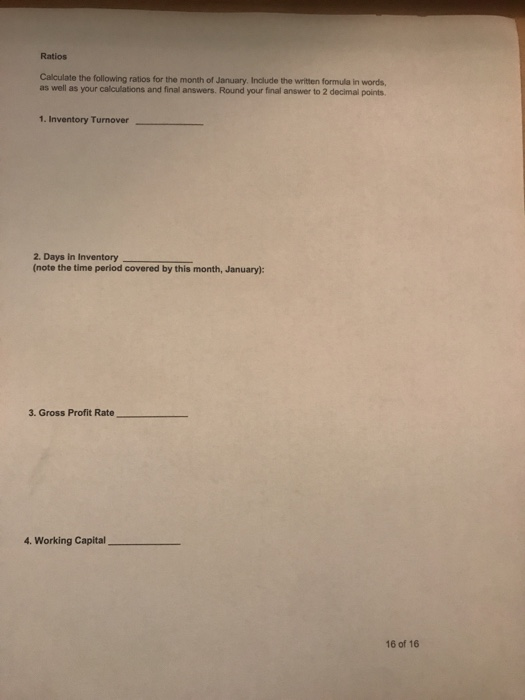

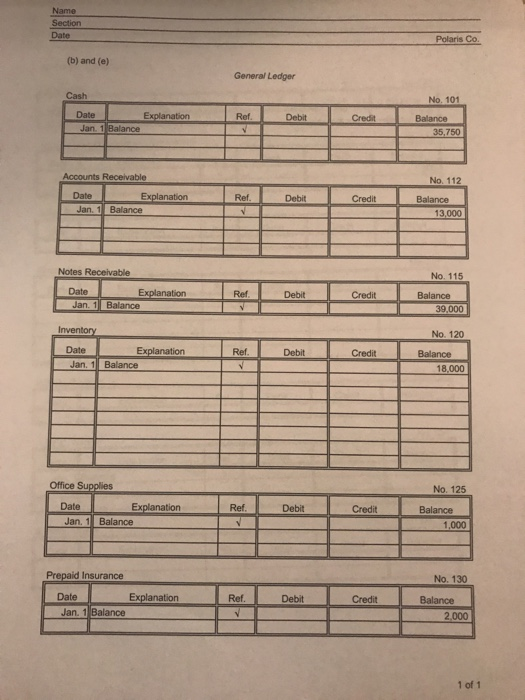

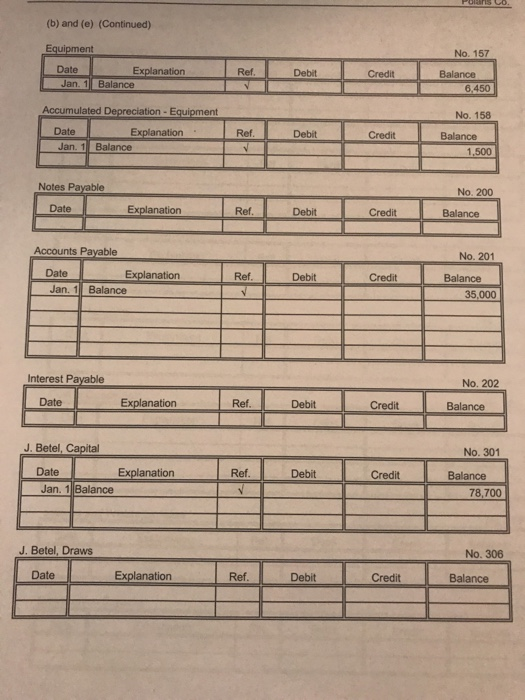

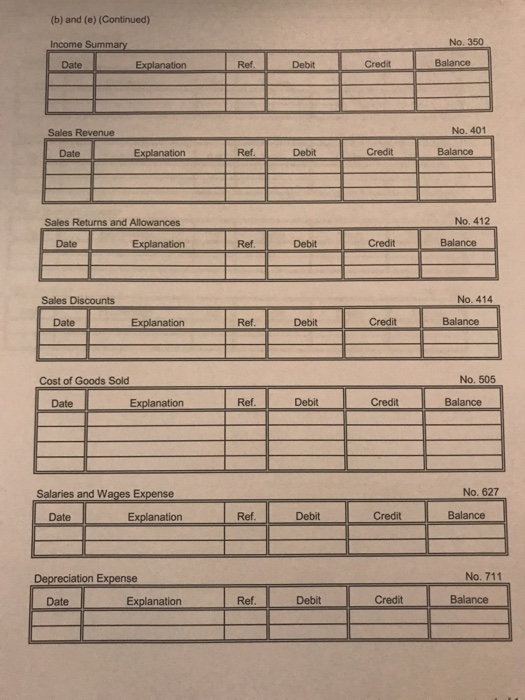

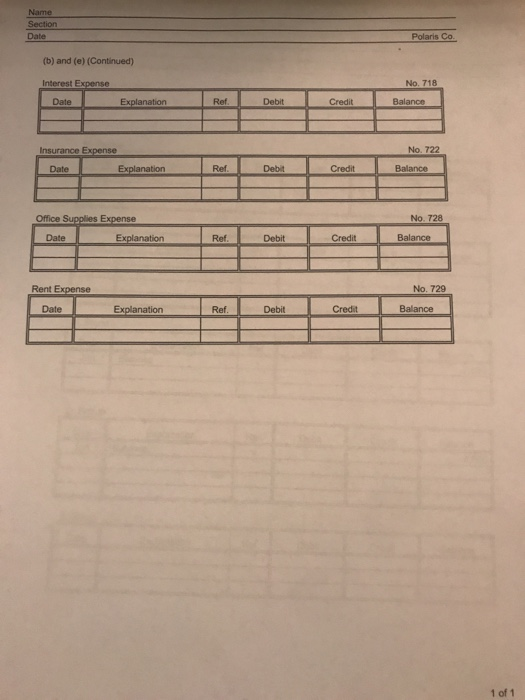

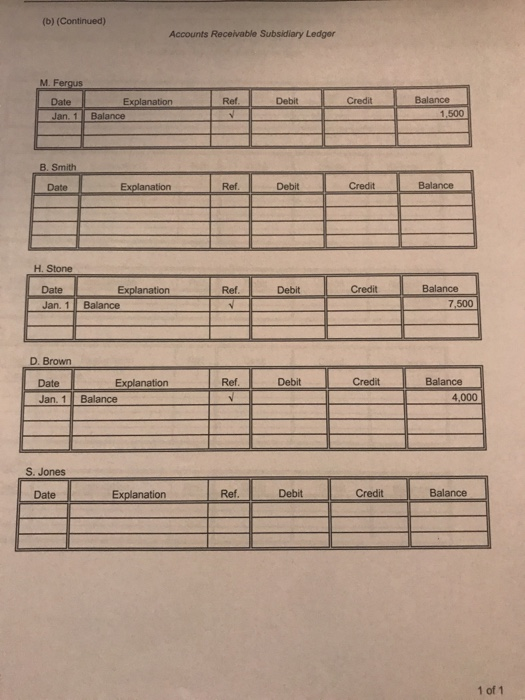

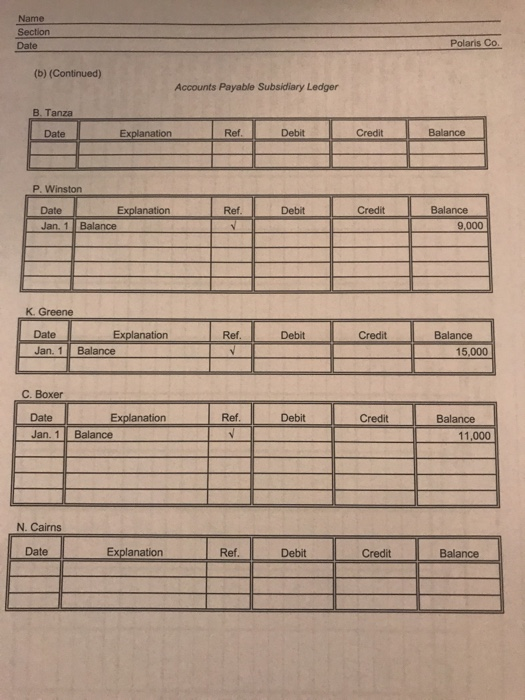

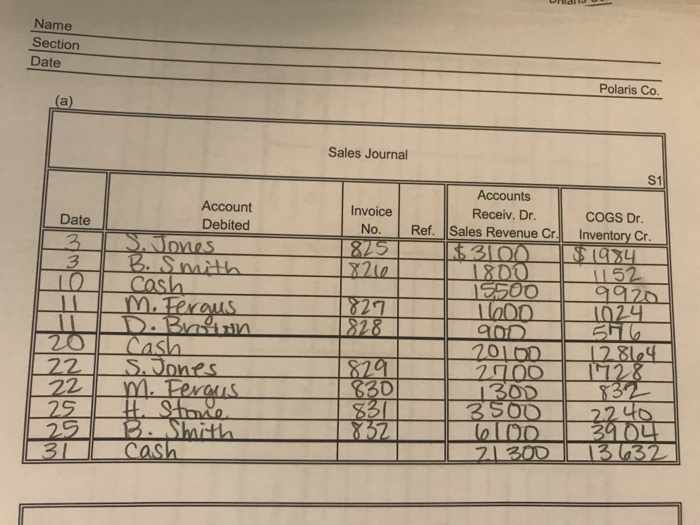

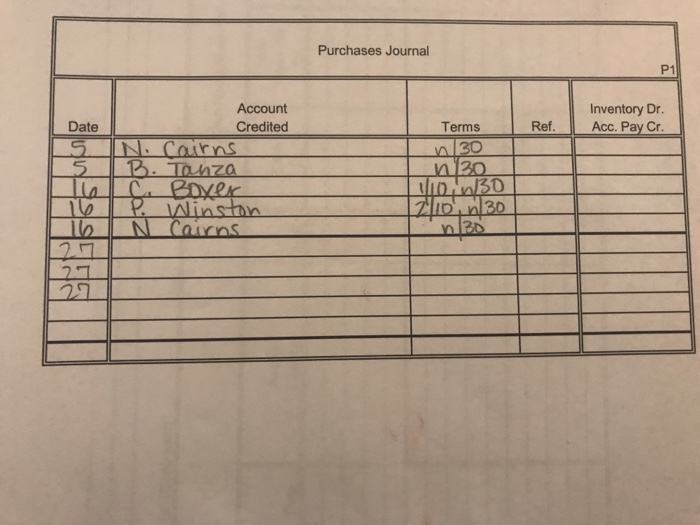

Purchases Journal P1 Account Credited Inventory Dr Date Ref. Acc. Pay Cr. Terms 30 120 0 30 Ho Cairns 2 ACC 121 Practice Set transactions Spring 2019 (Use the working papers provided by your instructor to work this project.) Polaris Company uses a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary ledger. Balances related to both the general ledger and the subsidiary ledger for Polaris are indicated in the working papers. Below are a series of transactions for Polaris Co. for the month of January, Credit sales terms are 210, n.30. The cost of all merchandise sold was 64% of the sales price. Jan 3 Sell merchandise on account to S. Jones $3,100, invoice no. 825, and to B. Smith $1,800, invoice no. 826. 5 Purchase merchandise from N. Cairns $5,000 and B. Tanza $2,200, terms n/30. 7 Receive checks from D. Brown $4,000 and H. Stone $2,000 after discount period has lapsed 8 Pay freight on merchandise purchased $235. Send checks to P. Winston for S9,000 less 2% cash discount, and to C. Boxer for SI 1 ,000 less 1% cash discount 9 9 Issue credit of $300 to B. Smith for merchandise returned 10 Summary daily cash sales total $15,500. 11 Sell merchandise on account to M. Fergus $1,600, invoice no. 827, and to D. Brown $900, invoicoe 12 Pay rent of $1,000 for January 13 Receive payment in full from S. Jones and B. Smith less cash discounts 15 Withdrawal of $800 cash by J. Betel for personal use. 15 Post all entries to the subsidiary ledgers 16 Purchase merchandise from C. Boxer $18,000, terms 1/10, n/30; P. Winston $14,200, terms 2/10, no. 828. n/30; and N. Caims $1,500, terms n/30. 17 Pay $400 cash for office supplies 18 Return $200 of merchandise to P. Winston and receive credit. 20 Summary daily cash sales total $20,100. 21 Issue $15,000 note, maturing in 90 days, to K. Greene in payment of balance due. 21 Receive payment in full from D. Brown less cash discount 22 Sell merchandise on account to S. Jones $2,700, invoice no. 829, and to M. Fergus $1,300, invoice 22 23 25 no. 830. Post all entries to the subsidiary ledgers. Send checks to C. Boxer and P. Winston in full payment less cash discounts. Sell merchandise on account to H. Stone $3,500, invoice no. 831, and to B. Smith $6,100, invoice no. 832 27 Purchase merchandise from C. Boxer $14,500, terms 1/10, n/30; B. Tanza $1,200, terms n/30, and N. Cairns $5,400, terms n/30 27 Post all entries to the subsidiary ledgers. 28 Pay $200 cash for office supplies. 31 Summary daily cash sales total S21,300. 31 Pay salaries and wages of $8,100 (continued) Page 1 of 2 Name Section Date Polaris Co Cash Receipts Journal CR1 Sales Discounts Accounts Other COGS Dr Account Credited Cash Dr Receivable Sales Revenue Accounts Date Ref Cr Name Sectiorn Date Polaris Co Cash Payments Journal CP1 Account Debited Other Accounts Dr Accounts Payable Office SuppliesInventory Cash Cr Date Ref Dr. Cr Name Date Polaris Co. (a) (Continued) and (e) General Journal G1 Date Account Titles Ref Debit Credit Adjusting Entries 1 of 1 Name Date (e) (Continued) General Journal G2 Date Account Tities Ref Debit Credit 1 of 1 Work Sheet Adjusted Tral Balance Accumulated Degreciation-Equip ales Returns and Allowances Rent Expense Totals Interest Expense Totals Totals 1 of 1 Date Polaris Co Polaris Company Income Statement For the Month Ended January 31. 2019 Polaris Co Polaris Company Owner's Equity Statement For the Month Ended January 31, 2019 Polaris Company Balance Sheet January 31, 2019 Assets Liabilities and Owner's Equity 1 of 1 Section Date Polaris Co Polaris Company Post-Closing Trial Balance Debit Credit Cash Notes Receivable Accounts Receivable Office Supplies Accumulated Depreciation-Equipment nterest Betel Accounts Receivable control account balance: Subsidiary account balances Total: Accounts Payable control account balance: Subsidiary account balances: Total: Ratios Calculate the following ratios for the month of January Indlude the written formula in words, as well as your calculations and final answers. Round your final answer to 2 decimal points 1. Inventory Turnover 2. Days in Inventory note the time period covered by this month, January): 3. Gross Profit Rate 4. Working Capital 16 of 16 Section Date Polaris Co (b) and (e) General Ledger No. 101 Date Balance 35,750 Accounts Receivable No. 112 Date Ex Jan. 1 Balance 13,000 Notes Receivable No. 115 Explanation Balance 39,000 No. 120 Date Ref Credit Balance Jan. 1 Balance 18,000 Office S No. 125 Date Explanation Ref Debit Credit Balance Jan. 1 Balance 1,000 Prepaid Insurance No. 130 Date Ex Ref Debit Jan. 1 Balance 2000 1 of 1 (b) and (e) (Continued) No. 157 Date Ref Balance Jan. 1 Balance 6.450 Accumulated No. 158 Explanation Ref Jan. 1 Balance 1,500 Notes Pa No. 200 Date Ex Ref Debit Credit Balance Accounts Payable No. 201 Date Jan. 1 Balance Explanation Ref Debit Credit 35,000 Interest Payable No. 202 Date Explanation Ref Debit Credit Balance J. Betel, Capital No. 301 Date Explanation Ref Debit Credit Balance 78,700 J. Betel, Draws No. 306 Date Explanation Ref Debit Credit Balance (b) and (e) (Continued) Income Summary No. 350 Explanation Ref.Debit Credit Sales Revenue No. 401 Date Ex Ref Debit Credit Sales Returns and Allowances No. 412 Ref Balance Sales Discounts No. 414 Date Ex Ref Credit Balance Cost of Goods Sold No. 505 Explanation Ref Debit Credit Balance No. 627 Salaries and Wages Expense Ex nation Ref. Debit Credit Depreciation Expense tion Ref. Debit Credit Balance Section Date Polaris Co (b) and (e) (Continued) Interest Expense No. 718 Date Ref Debit Credit Balance No. 722 Date Explanation Debit Credit Balance No. 728 Date Ref Debit Credit Rent Expense No. 729 Date Explanation Ref 1 of 1 (b) (Continued) Accounts Receivable Subsidiary Ledger M. F Ex Ref Jan. 1 Balance 1,500 B. Smith Date Ref Debit H. Stone Explanation Ref Credit Balance Jan. 1 Balance D. Brown Date Ex Ref Credit Balance 4,000 S. Jones Date Ex Ref Debit Balance 1 of 1 Name Section Date Polaris Co (b) (Continued) Accounts Payable Subsidiary Ledger B. Tanza Date Ex Ref Credit P. Winston Date Explanation Ref Debit Credit Balance Jan. 1 Balance 9,000 Date Jan. 1 Balance Explanation Ref. Debit Credit Balance 15,000 C. Boxer Ex Ref Debit Credit Balance Jan. 1 Balance 11,000 N. Cairns Date Explanation Ref Debit Credit Balance Name Section Date Polaris Co Sales Journal S1 Accounts Receiv. Dr No. Ref. Sales Revenue Cr. Inventory Cr Invoice COGS Dr Account Debited Date 1801 $27 828 20100128 22S.Dnnes 870 2. Purchases Journal P1 Account Credited Inventory Dr Date Ref. Acc. Pay Cr. Terms 30 120 0 30 Ho Cairns 2 ACC 121 Practice Set transactions Spring 2019 (Use the working papers provided by your instructor to work this project.) Polaris Company uses a perpetual inventory system and both an accounts receivable and an accounts payable subsidiary ledger. Balances related to both the general ledger and the subsidiary ledger for Polaris are indicated in the working papers. Below are a series of transactions for Polaris Co. for the month of January, Credit sales terms are 210, n.30. The cost of all merchandise sold was 64% of the sales price. Jan 3 Sell merchandise on account to S. Jones $3,100, invoice no. 825, and to B. Smith $1,800, invoice no. 826. 5 Purchase merchandise from N. Cairns $5,000 and B. Tanza $2,200, terms n/30. 7 Receive checks from D. Brown $4,000 and H. Stone $2,000 after discount period has lapsed 8 Pay freight on merchandise purchased $235. Send checks to P. Winston for S9,000 less 2% cash discount, and to C. Boxer for SI 1 ,000 less 1% cash discount 9 9 Issue credit of $300 to B. Smith for merchandise returned 10 Summary daily cash sales total $15,500. 11 Sell merchandise on account to M. Fergus $1,600, invoice no. 827, and to D. Brown $900, invoicoe 12 Pay rent of $1,000 for January 13 Receive payment in full from S. Jones and B. Smith less cash discounts 15 Withdrawal of $800 cash by J. Betel for personal use. 15 Post all entries to the subsidiary ledgers 16 Purchase merchandise from C. Boxer $18,000, terms 1/10, n/30; P. Winston $14,200, terms 2/10, no. 828. n/30; and N. Caims $1,500, terms n/30. 17 Pay $400 cash for office supplies 18 Return $200 of merchandise to P. Winston and receive credit. 20 Summary daily cash sales total $20,100. 21 Issue $15,000 note, maturing in 90 days, to K. Greene in payment of balance due. 21 Receive payment in full from D. Brown less cash discount 22 Sell merchandise on account to S. Jones $2,700, invoice no. 829, and to M. Fergus $1,300, invoice 22 23 25 no. 830. Post all entries to the subsidiary ledgers. Send checks to C. Boxer and P. Winston in full payment less cash discounts. Sell merchandise on account to H. Stone $3,500, invoice no. 831, and to B. Smith $6,100, invoice no. 832 27 Purchase merchandise from C. Boxer $14,500, terms 1/10, n/30; B. Tanza $1,200, terms n/30, and N. Cairns $5,400, terms n/30 27 Post all entries to the subsidiary ledgers. 28 Pay $200 cash for office supplies. 31 Summary daily cash sales total S21,300. 31 Pay salaries and wages of $8,100 (continued) Page 1 of 2 Name Section Date Polaris Co Cash Receipts Journal CR1 Sales Discounts Accounts Other COGS Dr Account Credited Cash Dr Receivable Sales Revenue Accounts Date Ref Cr Name Sectiorn Date Polaris Co Cash Payments Journal CP1 Account Debited Other Accounts Dr Accounts Payable Office SuppliesInventory Cash Cr Date Ref Dr. Cr Name Date Polaris Co. (a) (Continued) and (e) General Journal G1 Date Account Titles Ref Debit Credit Adjusting Entries 1 of 1 Name Date (e) (Continued) General Journal G2 Date Account Tities Ref Debit Credit 1 of 1 Work Sheet Adjusted Tral Balance Accumulated Degreciation-Equip ales Returns and Allowances Rent Expense Totals Interest Expense Totals Totals 1 of 1 Date Polaris Co Polaris Company Income Statement For the Month Ended January 31. 2019 Polaris Co Polaris Company Owner's Equity Statement For the Month Ended January 31, 2019 Polaris Company Balance Sheet January 31, 2019 Assets Liabilities and Owner's Equity 1 of 1 Section Date Polaris Co Polaris Company Post-Closing Trial Balance Debit Credit Cash Notes Receivable Accounts Receivable Office Supplies Accumulated Depreciation-Equipment nterest Betel Accounts Receivable control account balance: Subsidiary account balances Total: Accounts Payable control account balance: Subsidiary account balances: Total: Ratios Calculate the following ratios for the month of January Indlude the written formula in words, as well as your calculations and final answers. Round your final answer to 2 decimal points 1. Inventory Turnover 2. Days in Inventory note the time period covered by this month, January): 3. Gross Profit Rate 4. Working Capital 16 of 16 Section Date Polaris Co (b) and (e) General Ledger No. 101 Date Balance 35,750 Accounts Receivable No. 112 Date Ex Jan. 1 Balance 13,000 Notes Receivable No. 115 Explanation Balance 39,000 No. 120 Date Ref Credit Balance Jan. 1 Balance 18,000 Office S No. 125 Date Explanation Ref Debit Credit Balance Jan. 1 Balance 1,000 Prepaid Insurance No. 130 Date Ex Ref Debit Jan. 1 Balance 2000 1 of 1 (b) and (e) (Continued) No. 157 Date Ref Balance Jan. 1 Balance 6.450 Accumulated No. 158 Explanation Ref Jan. 1 Balance 1,500 Notes Pa No. 200 Date Ex Ref Debit Credit Balance Accounts Payable No. 201 Date Jan. 1 Balance Explanation Ref Debit Credit 35,000 Interest Payable No. 202 Date Explanation Ref Debit Credit Balance J. Betel, Capital No. 301 Date Explanation Ref Debit Credit Balance 78,700 J. Betel, Draws No. 306 Date Explanation Ref Debit Credit Balance (b) and (e) (Continued) Income Summary No. 350 Explanation Ref.Debit Credit Sales Revenue No. 401 Date Ex Ref Debit Credit Sales Returns and Allowances No. 412 Ref Balance Sales Discounts No. 414 Date Ex Ref Credit Balance Cost of Goods Sold No. 505 Explanation Ref Debit Credit Balance No. 627 Salaries and Wages Expense Ex nation Ref. Debit Credit Depreciation Expense tion Ref. Debit Credit Balance Section Date Polaris Co (b) and (e) (Continued) Interest Expense No. 718 Date Ref Debit Credit Balance No. 722 Date Explanation Debit Credit Balance No. 728 Date Ref Debit Credit Rent Expense No. 729 Date Explanation Ref 1 of 1 (b) (Continued) Accounts Receivable Subsidiary Ledger M. F Ex Ref Jan. 1 Balance 1,500 B. Smith Date Ref Debit H. Stone Explanation Ref Credit Balance Jan. 1 Balance D. Brown Date Ex Ref Credit Balance 4,000 S. Jones Date Ex Ref Debit Balance 1 of 1 Name Section Date Polaris Co (b) (Continued) Accounts Payable Subsidiary Ledger B. Tanza Date Ex Ref Credit P. Winston Date Explanation Ref Debit Credit Balance Jan. 1 Balance 9,000 Date Jan. 1 Balance Explanation Ref. Debit Credit Balance 15,000 C. Boxer Ex Ref Debit Credit Balance Jan. 1 Balance 11,000 N. Cairns Date Explanation Ref Debit Credit Balance Name Section Date Polaris Co Sales Journal S1 Accounts Receiv. Dr No. Ref. Sales Revenue Cr. Inventory Cr Invoice COGS Dr Account Debited Date 1801 $27 828 20100128 22S.Dnnes 870 2