Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help, I just need the loss for part IV please explain the answer. thank you. Complete Form 8582 below. Note: - If an amount

please help, I just need the loss for part IV please explain the answer. thank you.

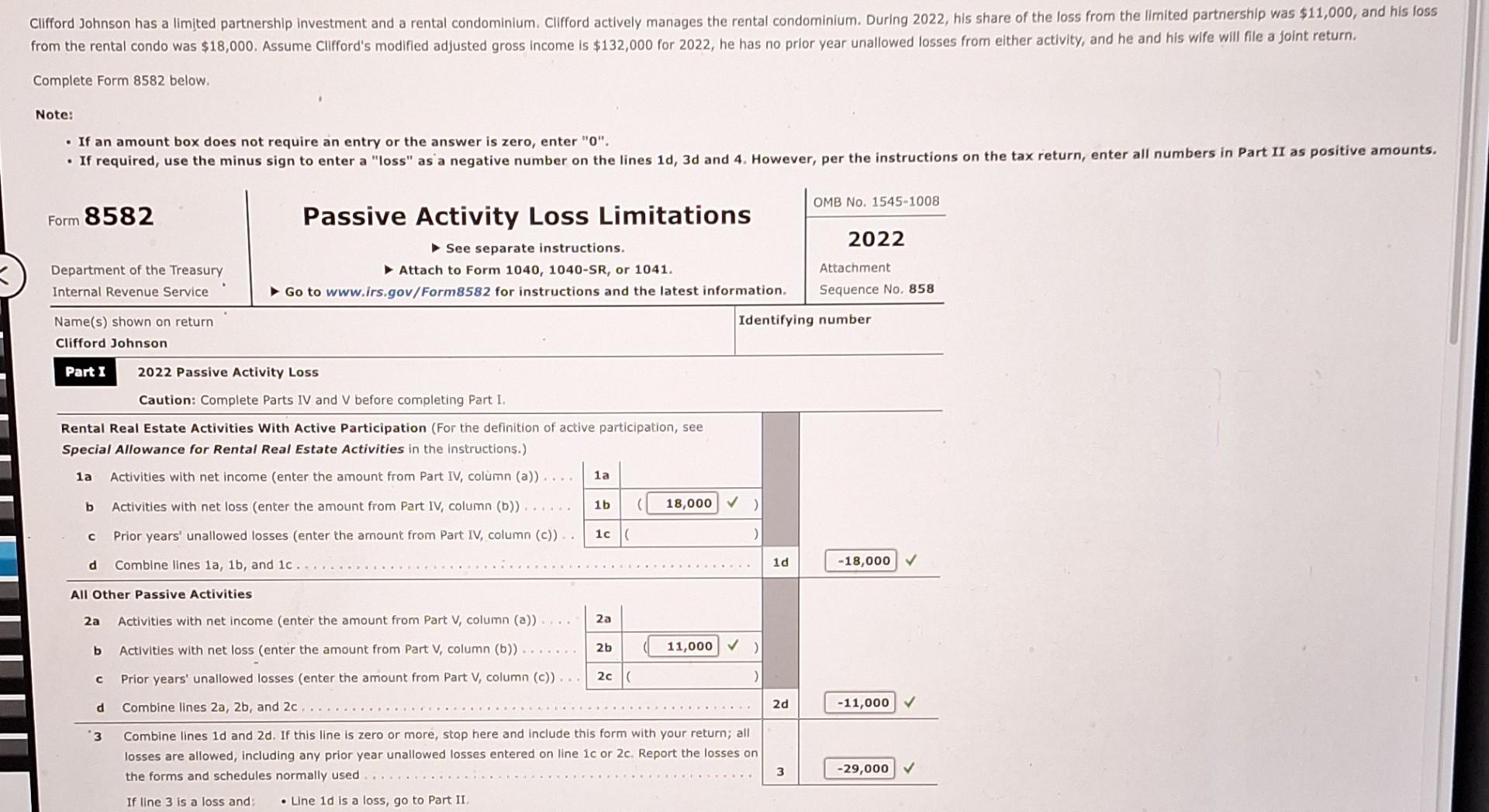

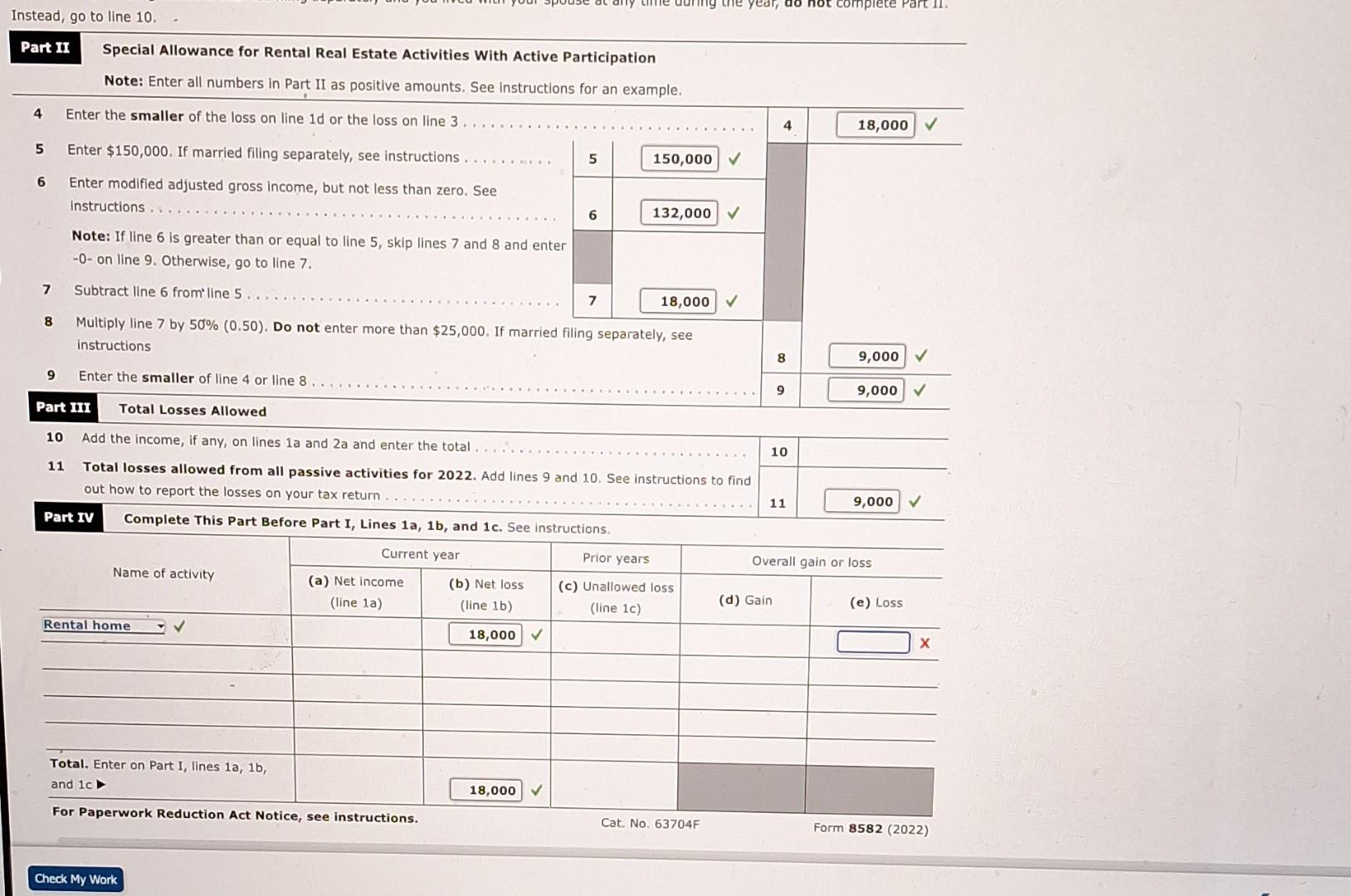

Complete Form 8582 below. Note: - If an amount box does not require an entry or the answer is zero, enter " 0 ". Instead, go to line 10. Part II Special Allowance for Rental Real Estate Activities With Active Participation Note: Enter all numbers in Part II as positive amounts. See instructions for an example. 4 Enter the smaller of the loss on line 1d or the loss on line 3 5 Enter $150,000. If married filing separately, see instructions 6 Enter modified adjusted gross income, but not less than zero. See instructions Note: If line 6 is greater than or equal to line 5, skip lines 7 and 8 and enter - 0 - on line 9. Otherwise, go to line 7. 7 Subtract line 6 from line 5 8 Multiply line 7 by 50%(0.50). Do not enter more than $25,000. If married filing separately, see instructions 9 Enter the smaller of line 4 or line 8 Part In Total Losses Allowed 10 Add the income, if any, on lines 1a and 2a and enter the total 11 Total losses allowed from all passive activities for 2022. Add lines 9 and 10. See instructions to find out how to report the losses on your tax return. \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Name of activity } & \multicolumn{2}{|c|}{ Current year } & \multirow{3}{*}{\begin{tabular}{c} Prior years \\ (c) Unallowed loss \\ (line 1c) \end{tabular}} & \multicolumn{2}{|c|}{ Overall gain or loss } \\ \hline & \multirow[t]{2}{*}{\begin{tabular}{l} (a) Net income \\ (line 1a) \end{tabular}} & \begin{tabular}{l} (b) Net loss \\ (line 1b) \end{tabular} & & (d) Gain & (e) Loss \\ \hline Rental home & & 18,000 & & & x \\ \hline - & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \begin{tabular}{l} Total. Enter on Part I, lines 1a,1b, \\ and 1c \end{tabular} & & 18,000 & & & \\ \hline For Paperwork Reduction Act Not & see instructions. & & Cat. No. 637 & & m 8582(2022) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started