please help

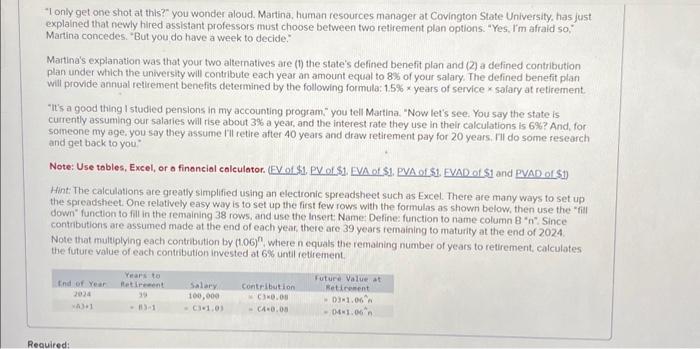

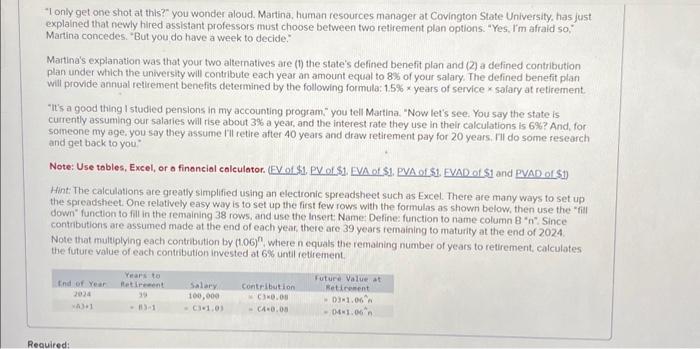

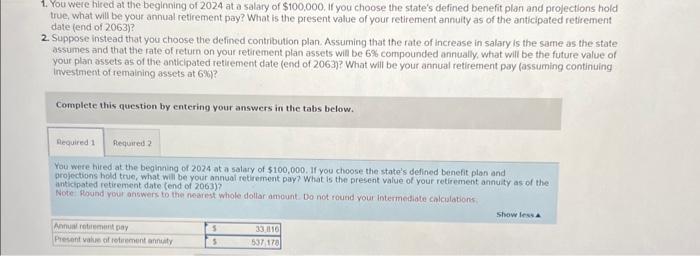

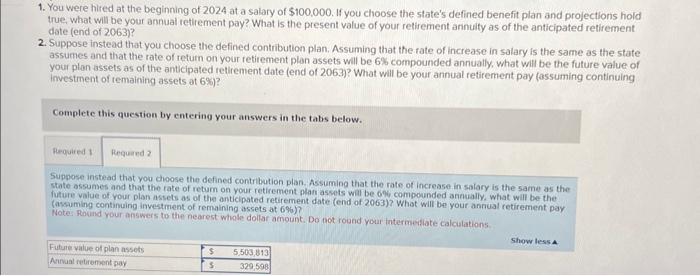

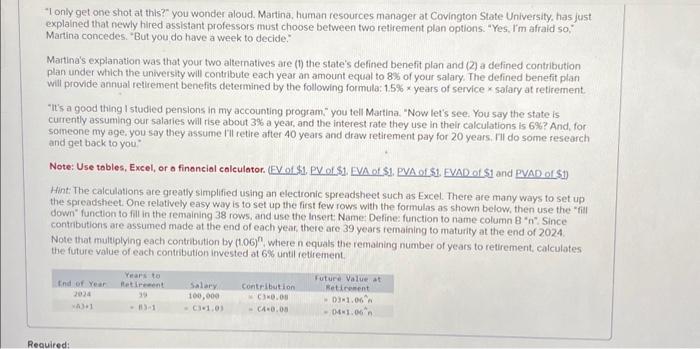

"I only get one shot at this?" you wonder aloud. Martina, human resources manager at Covington State University, has just explained that newly hired assistant professors must choose befween two retirement plan options. "Yes, l'm afraid so," Martina concedes. "But you do have a week to decide." Martina's explanation was that your two altematives are (1) the state's defined benefit plan and (2) a defined contribution plan under which the university will contribute each year an amount equal to 8% of your salary. The defined benefit plan will provide annual retirement benefits determined by the following formula: 1.5% years of service salary at retirement. "It's a good thing I studied pensions in my accounting program." you tell Martina. "Now let's see. You say the state is currently assuming our salaries will rise about 3% a year, and the interest rate they use in their calculations is 6% ? And, for someone my age. you say they assume I Ill retire after 40 years and draw retirement pay for 20 years. Fil do some research and get back to you" Note: Use tables, Excel, or a finenciol caleulator. (EV of \$1, PV of S1. EVA of \$1. PVA of S1. EVAD of S1 and PVAD of S1) Hint: The calculations are greatly simplified using an electronic spreadsheet such as Excel. There are many ways to set up the spreadsheet. One relatively easy way is to set up the first few rows with the formulas as shown below, then use the "fial down" function to fill in the remaining 38 rows, and use the Insert Name- Define: function to name column B " n ", Since contributions are assumed made at the end of each year, there are 39 years temaining to maturity at the end of 2024. Note that multiplying each contribution by (1.06)n, where n equals the remaining number of years to retirement, calculates the future value of each contribution invested at 6% until retirement. 1. You were hired at the beginning of 2024 at a salary of $100,000. If you choose the state's defined benefit plan and projections hold true, what will be your annual retirement pay? What is the present value of your retirement annuity as of the anticipated retirement date (end of 2063 )? 2. Suppose instead that you choose the defincd contribution plan. Assuming that the rate of increase in salary is the sarme as the state assumes and that the rate of return on your retirement plan assets will be 6% compounded annually, what will be the future value of your plan assets as of the anticlpated retirement date (end of 2063)? What will be your annual retirement pay (assuming continuing investment of remaining assets at 696) ? Complete this question by entering your answers in the tabs below. You were hired at the beginning of 2024 at a salary of 5100,000 . If you choose the state's defined benefit plan and projections hold true, what wili be your annual retirement pay? What is the present value of your retirement annuity as of the anticipated retirement date (end of 2003 )? Note Rownd vour answers to the nearest whole dollar anount. Do not round your intermediate calculabions 1. You were hired at the beginning of 2024 at a salary of $100,000. If you choose the state's defined benefit plan and projections hold true, what will be your annual retirement pay? What is the present value of your retirement annuity as of the anticipated retirement date (end of 2063 )? 2. Suppose instead that you choose the defined contribution plan. Assuming that the rate of increase in salary is the same as the state assumes and that the rate of return on your retirement plan assets will be 6% compounded annually, what will be the future value of your plan assets as of the anticipated retirement date (end of 2063)? What will be your annual retirement pay (assuming continuing investment of temaining assets at 696 ? Complete this question by entering your answers in the tabs below. Suppose instead that you dioose the defined contribution plan. Assuming that the rate of increase in salary is the same as the State ossumes and that the rate of retum on your retirement plan assets will be 6\%, compounded annually, what will be the future value of your plan assets as of the anticipated retirement date (end of 2063 )? What will be your annual retirement pay (assuming continuing investment of remaining assets at 6% )? Note. Ponind your answers to the nearest whicle dollar amount. Do not roond your intermesilate calculations. 3. Based on this numerical comparison, which plan would you choose? Defined contribution plan Defined benefit plan 4. What other factors must you also consider in making the choice? Note: You moy select more than one answer. Single click the box with the question mark to produce a check mark for a correct onswer and double click the box with the question mark to empty the box for a wrong onswer. Any boxes left with a question merk will be outomatically graded os incorrect. 7 Very often, detined contribution plans provide benetits only uriti you andior your spouse dies wath no benefis to other beneficiaries 3 Grebter uncentainy is assochated whth defined contribution plans, in generot 7 in a defined benafit plan the employer is responsible for making up the diference when investment performance is less than expected ? Defined benefis plans poy benefis from retiement to death ? Assets accumuinted under defined contribution phns are a fixed amount