please help, i will give thumbs up!!

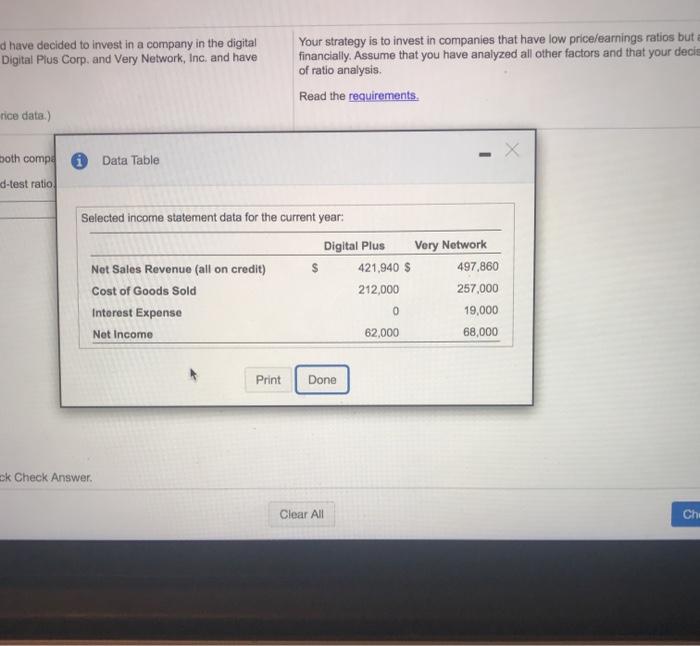

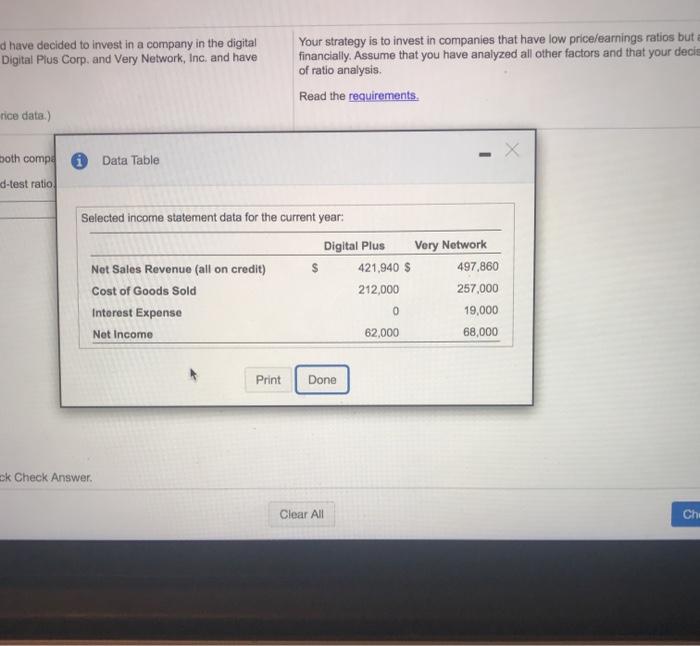

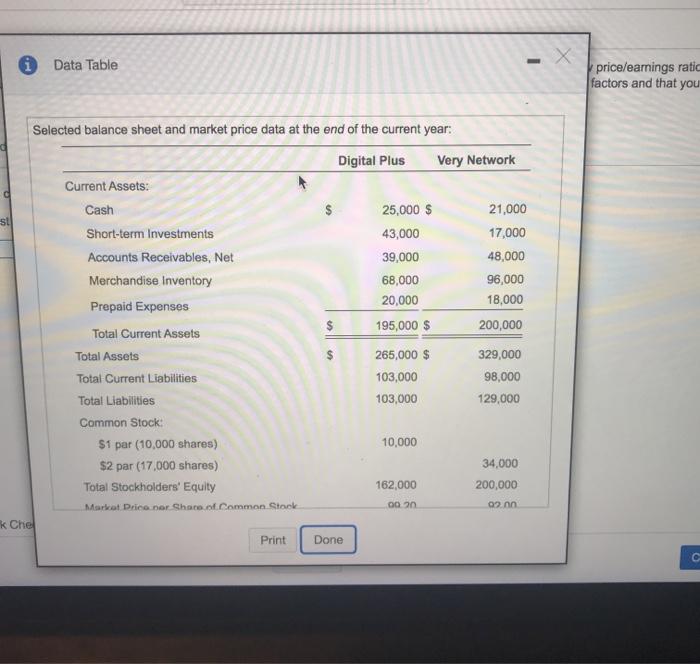

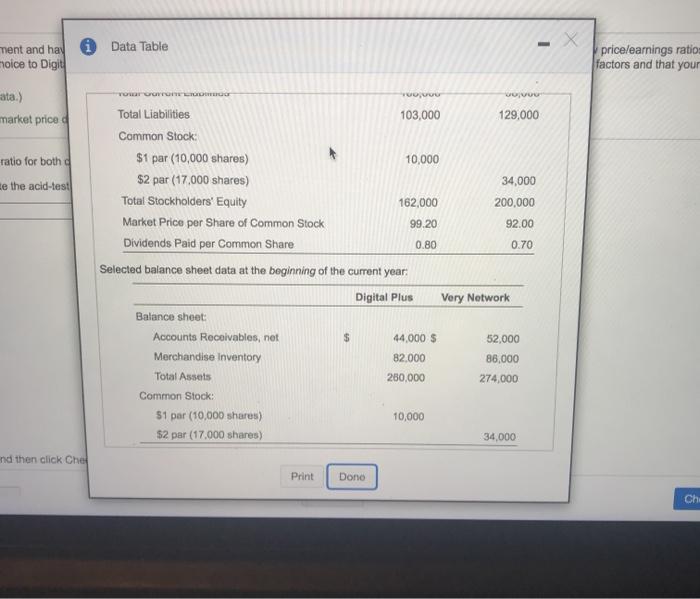

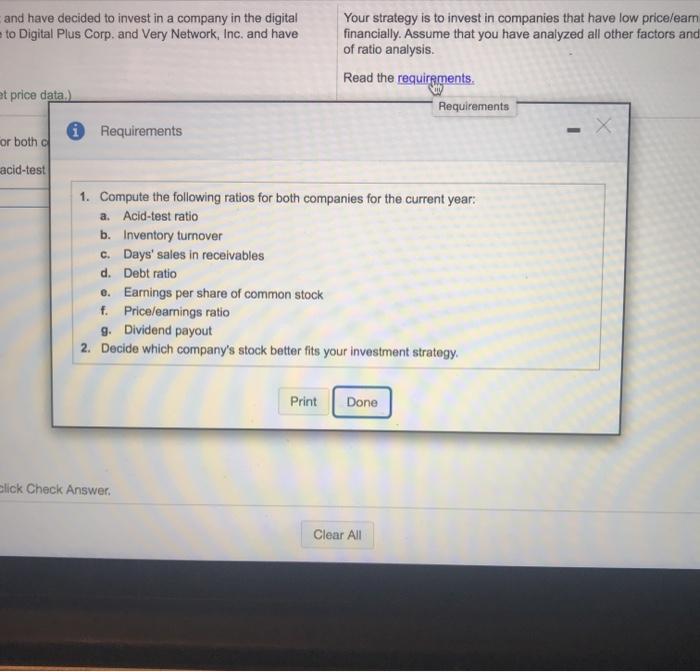

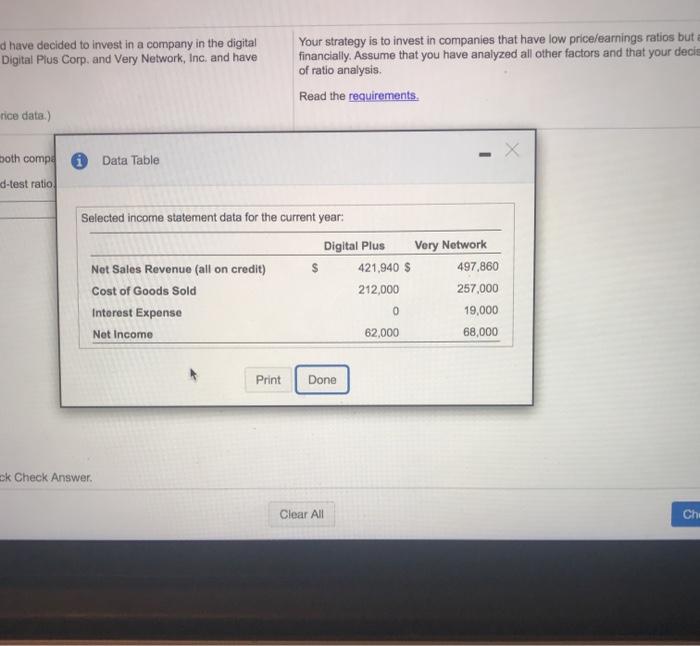

d have decided to invest in a company in the digital Digital Plus Corp. and Very Network, Inc. and have Your strategy is to invest in companies that have low price/earnings ratios but financially. Assume that you have analyzed all other factors and that your decis of ratio analysis. Read the requirements. rice data.) both comp i Data Table d-test ratio Selected income statement data for the current year: Digital Plus Very Network Net Sales Revenue (all on credit) $ 421,940 $ 497,860 Cost of Goods Sold 212,000 257,000 Interest Expense 19,000 Net Income 62,000 68,000 0 Print Done ck Check Answer Clear All Chi I Data Table price/earings ratic factors and that you d st Selected balance sheet and market price data at the end of the current year: Digital Plus Very Network Current Assets: Cash 25,000 $ 21,000 Short-term Investments 43,000 17,000 Accounts Receivables, Net 39,000 48,000 Merchandise Inventory 68,000 96,000 Prepaid Expenses 20,000 18,000 195,000 $ 200,000 Total Current Assets Total Assets 265,000 $ 329,000 Total Current Liabilities 103,000 98,000 Total Liabilities 103,000 129,000 Common Stock: $1 par (10,000 shares) 10,000 $2 par (17,000 shares) 34,000 Total Stockholders' Equity 162,000 200,000 Market Drico por Share of. Common Stock 00.20 02.0 k Chel Print Done X ment and has 0 Data Table hoice to Digit price/earnings ratio: factors and that your ata.) market price ratio for both de the acid-test Tour uurram oo Total Liabilities 103,000 129,000 Common Stock: $1 par (10,000 shares) 10,000 $2 par (17,000 shares) 34.000 Total Stockholders' Equity 162,000 200,000 Market Price per Share of Common Stock 99.20 92.00 Dividends Paid per Common Share 0.80 0.70 Selected balance sheet data at the beginning of the current year Digital Plus Very Network Balance sheet: Accounts Receivables, net 44,000 $ 52,000 Merchandise Inventory 82.000 86,000 Total Assets 260.000 274,000 Common Stock: 31 par (10,000 shares) 10,000 $2 par (17,000 shares) 34,000 and then click Chef Print Dono Ch and have decided to invest in a company in the digital to Digital Plus Corp. and Very Network, Inc. and have Your strategy is to invest in companies that have low price/eam financially. Assume that you have analyzed all other factors and of ratio analysis. at price data.) Read the requirements. Requirements * Requirements or both acid-test 1. Compute the following ratios for both companies for the current year: a. Acid-test ratio b. Inventory turnover c. Days' sales in receivables d. Debt ratio 6. Earnings per share of common stock f. Price/earnings ratio 9. Dividend payout 2. Decide which company's stock better fits your investment strategy Print Done blick Check Answer Clear All