Answered step by step

Verified Expert Solution

Question

1 Approved Answer

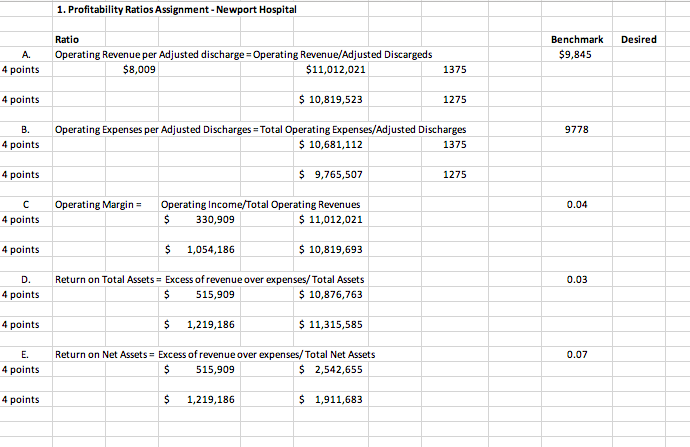

Please help. I will give you a thumb-up. Thank you! The question asks to calculate the five (5) Profitability ratios for Newport Hospital two fiscal

Please help. I will give you a thumb-up. Thank you!

The question asks to calculate the five (5) Profitability ratios for Newport Hospital two fiscal years. Please let me know if you have any more questions

A. 4 points 4 points B. 4 points 4 points 4 points 4 points D. 4 points 4 points E. 4 points 4 points 1. Profitability Ratios Assignment - Newport Hospital Ratio Operating Revenue per Adjusted discharge - Operating Revenue/Adjusted Discargeds $8,009 $11,012,021 $ 10,819,523 Operating Expenses per Adjusted Discharges = Total Operating Expenses/Adjusted Discharges $ 10,681,112 1375 $ 9,765,507 Operating Income/Total Operating Revenues $ $ 11,012,021 Operating Margin= $ $ 330,909 $ 1,054,186 Return on Total Assets= Excess of revenue over expenses/Total Assets 515,909 $ 10,876,763 $ $ 11,315,585 Return on Net Assets= Excess of revenue over expenses/Total Net Assets 515,909 $ $ 2,542,655 1,219,186 $ 10,819,693 1,219,186 $ 1,911,683 1375 1275 1275 Benchmark $9,845 9778 0.04 0.03 0.07 Desired A. 4 points 4 points B. 4 points 4 points 4 points 4 points D. 4 points 4 points E. 4 points 4 points 1. Profitability Ratios Assignment - Newport Hospital Ratio Operating Revenue per Adjusted discharge - Operating Revenue/Adjusted Discargeds $8,009 $11,012,021 $ 10,819,523 Operating Expenses per Adjusted Discharges = Total Operating Expenses/Adjusted Discharges $ 10,681,112 1375 $ 9,765,507 Operating Income/Total Operating Revenues $ $ 11,012,021 Operating Margin= $ $ 330,909 $ 1,054,186 Return on Total Assets= Excess of revenue over expenses/Total Assets 515,909 $ 10,876,763 $ $ 11,315,585 Return on Net Assets= Excess of revenue over expenses/Total Net Assets 515,909 $ $ 2,542,655 1,219,186 $ 10,819,693 1,219,186 $ 1,911,683 1375 1275 1275 Benchmark $9,845 9778 0.04 0.03 0.07 DesiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started