Question: Please help, I will rate. Thank you! Planning for Capital Investments Effects of straight-line versus accelerated depreciation on an investment decision LO 10-2, 10-4 Problem

Please help, I will rate. Thank you!

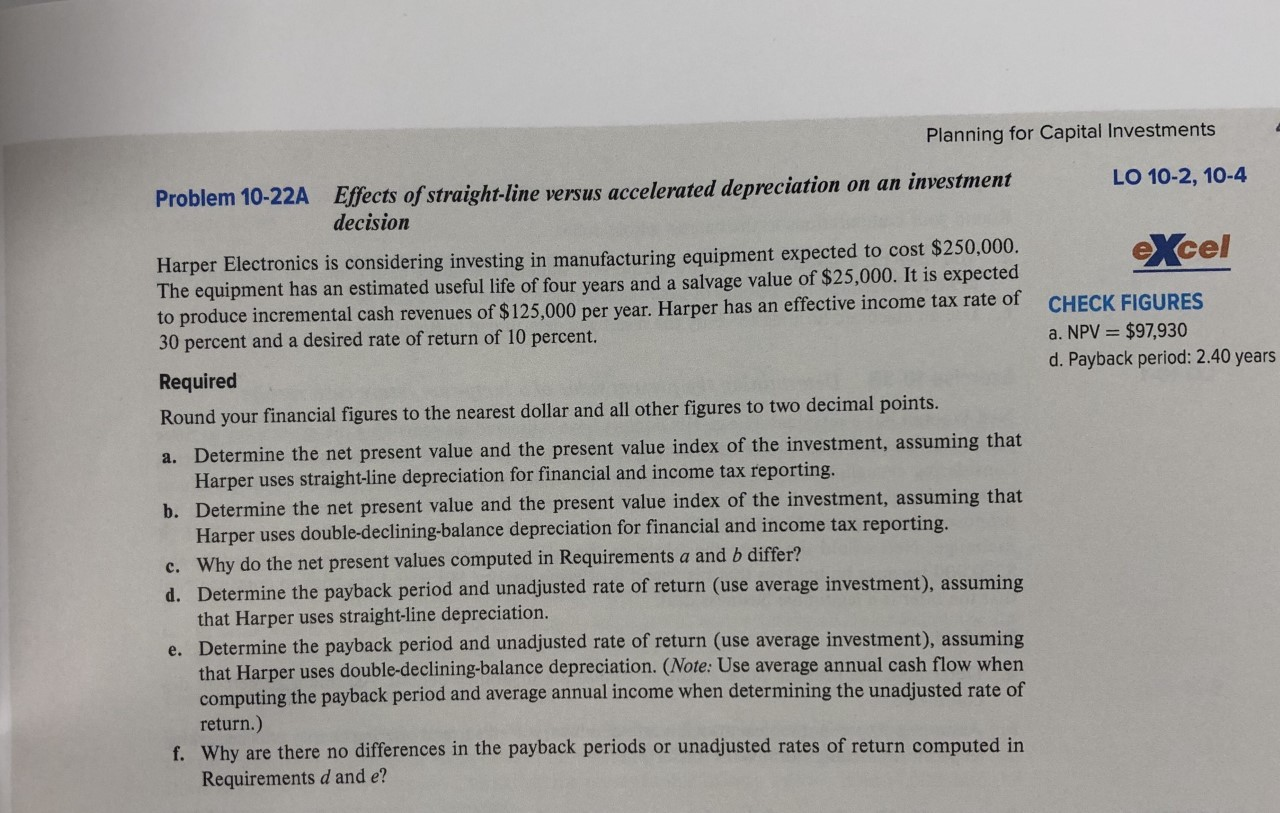

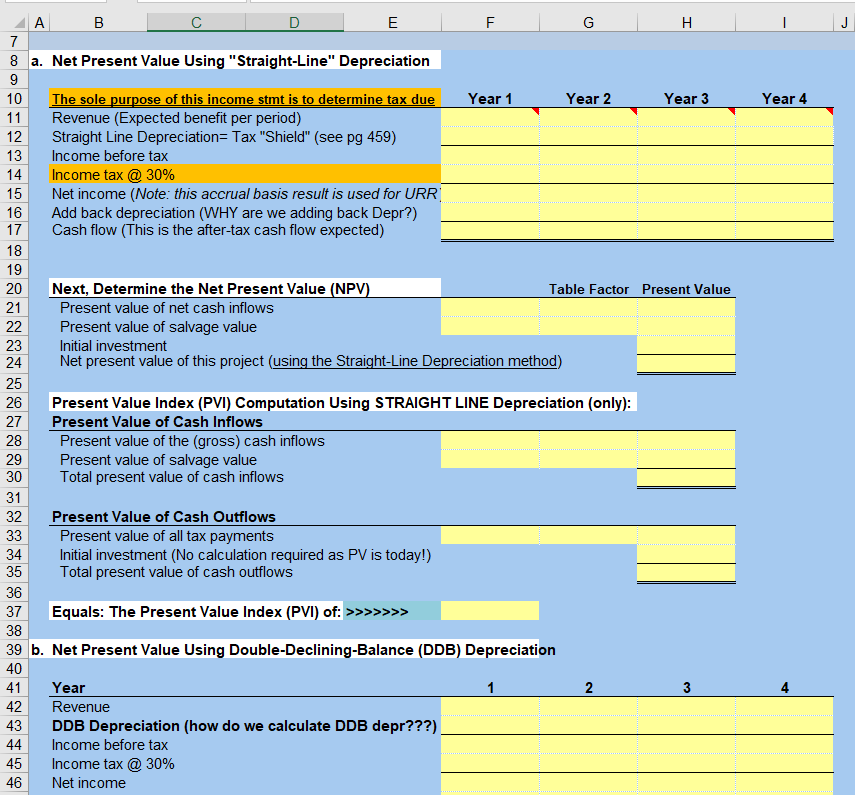

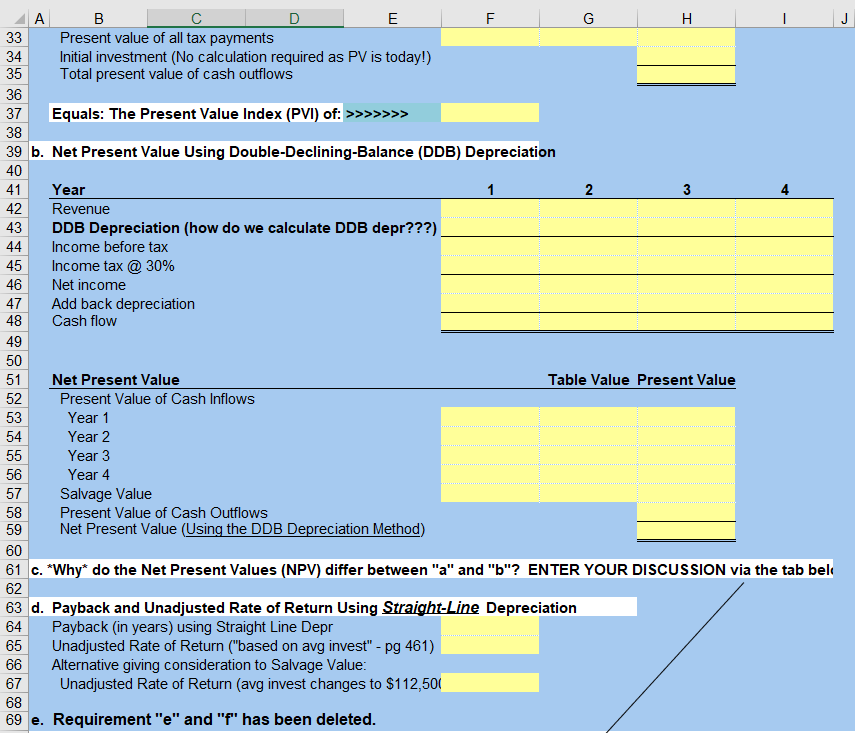

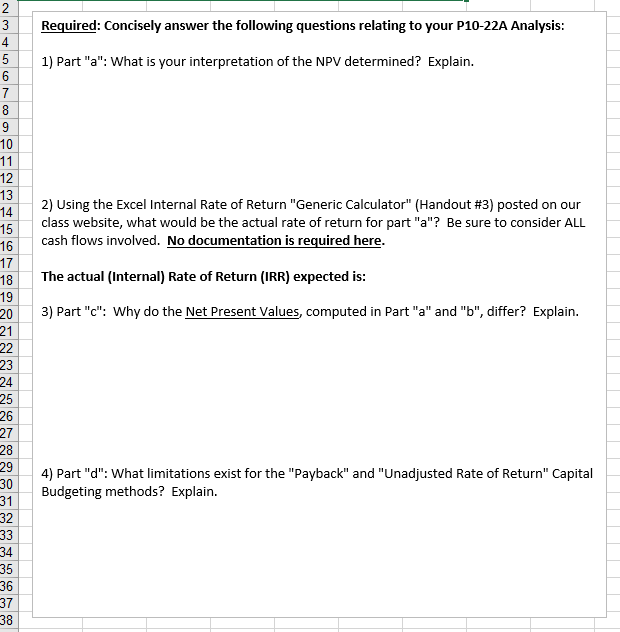

Planning for Capital Investments Effects of straight-line versus accelerated depreciation on an investment decision LO 10-2, 10-4 Problem 10-22A eXcel Harper Electronics is considering investing in manufacturing equipment expected to cost $250,000. The equipment has an estimated useful life of four years and a salvage value of $25,000. It is expected to produce incremental cash revenues of $125,000 per year. Harper has an effective income tax rate of 30 percent and a desired rate of return of 10 percent. CHECK FIGURES a. NPV $97,930 d. Payback period: 2.40 years Required Round your financial figures to the nearest dollar and all other figures to two decimal points. a. Determine the net present value and the present value index of the investment, assuming that Harper uses straight-line depreciation for financial and income tax reporting. b. Determine the net present value and the present value index of the investment, assuming that Harper uses double-declining-balance depreciation for financial and income tax reporting. c. Why do the net present values computed in Requirementsa and b differ? d. Determine the payback period and unadjusted rate of return (use average investment), assuming that Harper uses straight-line depreciation. e. Determine the payback period and unadjusted rate of return (use average investment), assuming that Harper uses double-declining-balance depreciation. (Note: Use average annual cash flow when computing the payback period and average annual income when determining the unadjusted rate of return.) f. Why are there no differences in the payback periods or unadjusted rates of return computed in Requirements d and e? A B E F H J 7 8 a. Net Present Value Using "Straight-Line" Depreciation The sole purpose of this income stmt is to determine tax due Revenue (Expected benefit per period) Straight Line Depreciation= Tax "Shield" (see pg 459) Year 4 10 Year 1 Year 2 Year 3 11 12 13 Income before tax Income tax@ 30% Net income (Note: this accrual basis result is used for URR Add back depreciation (WHY are we adding back Depr?) Cash flow (This is the after-tax cash flow expected) 14 15 16 17 18 19 Next, Determine the Net Present Value (NPV) 20 Table Factor Present Value 21 Present value of net cash inflows 22 Present value of salvage value Initial investment Net present value of this project (using the Straight-Line Depreciation method) 23 24 25 26 Present Value Index (PVI) Computation Using STRAIGHT LINE Depreciation (only): Present Value of Cash Inflows Present value of the (gross) cash inflows Present value of salvage value Total present value of cash inflows 27 29 30 31 Present Value of Cash Outflows Present value of all tax payments Initial investment (No calculation required as PV is today!) Total present value of cash outflows 33 34 37 Equals: The Present Value Index (PVI) of: >>>>>>> 39 b. Net Present Value Using Double-Declining-Balance (DDB) Depreciation 40 41 Year 1 2 42 Revenue 43 DDB Depreciation (how do we calculate DDB depr???) 44 Income before tax Income tax@ 30% 46 45 Net income A G J Present value of all tax payments Initial investment (No calculation required as PV is today!) Total present value of cash outflows 33 34 35 36 37 Equals: The Present Value Index (PVI) of: >>>>>>> 38 39 b. Net Present Value Using Double-Declining-Balance (DDB) Depreciation 40 41 Year 1 2 42 Revenue DDB Depreciation (how do we calculate DDB depr???)| 43 44 Income before tax Income tax@ 30% 45 46 Net income Add back depreciation Cash flow 47 48 49 50 51 Net Present Value Table Value Present Value 52 Present Value of Cash Inflows 53 Year 1 54 Year 2 55 Year 3 56 Year 4 Salvage Value 57 58 Present Value of Cash Outflows Net Present Value (Using the DDB Depreciation Method) 59 60 61 c. "Why* do the Net Present Values (NPV) differ between "a" and "b"? ENTER YOUR DISCUSSION via the tab bel 62 63 d. Payback and Unadjusted Rate of Return Using Straight-Line Depreciation 64 Payback (in years) using Straight Line Depr Unadjusted Rate of Return ("based on avg invest" - pg 461) Alternative giving consideration to Salvage Value: Unadjusted Rate of Return (avg invest changes to $112,50 65 66 67 68 69 e. Requirement "e" and "f" has been deleted. T LLU 2 3 Required: Concisely answer the following questions relating to your P10-22A Analysis: 1) Part "a": What is your interpretation of the NPV determined? Explain. 6 7 10 11 12 13 2) Using the Excel Internal Rate of Return "Generic Calculator" (Handout #3) posted on our class website, what would be the actual rate of return for part "a"? Be sure to consider ALL 14 15 cash flows involved. No documentation is required here. 16 17 The actual (Internal) Rate of Return (IRR) expected is 19 3) Part "c": Why do the Net Present Values, computed in Part "a" and "b", differ? Explain. 18 20 21 22 23 24 25 26 27 28 29 4) Part "d": What limitations exist for the "Payback" and "Unadjusted Rate of Return" Capital 30 Budgeting methods? Explain. 31 32 33 34 35 36 37 38 Planning for Capital Investments Effects of straight-line versus accelerated depreciation on an investment decision LO 10-2, 10-4 Problem 10-22A eXcel Harper Electronics is considering investing in manufacturing equipment expected to cost $250,000. The equipment has an estimated useful life of four years and a salvage value of $25,000. It is expected to produce incremental cash revenues of $125,000 per year. Harper has an effective income tax rate of 30 percent and a desired rate of return of 10 percent. CHECK FIGURES a. NPV $97,930 d. Payback period: 2.40 years Required Round your financial figures to the nearest dollar and all other figures to two decimal points. a. Determine the net present value and the present value index of the investment, assuming that Harper uses straight-line depreciation for financial and income tax reporting. b. Determine the net present value and the present value index of the investment, assuming that Harper uses double-declining-balance depreciation for financial and income tax reporting. c. Why do the net present values computed in Requirementsa and b differ? d. Determine the payback period and unadjusted rate of return (use average investment), assuming that Harper uses straight-line depreciation. e. Determine the payback period and unadjusted rate of return (use average investment), assuming that Harper uses double-declining-balance depreciation. (Note: Use average annual cash flow when computing the payback period and average annual income when determining the unadjusted rate of return.) f. Why are there no differences in the payback periods or unadjusted rates of return computed in Requirements d and e? A B E F H J 7 8 a. Net Present Value Using "Straight-Line" Depreciation The sole purpose of this income stmt is to determine tax due Revenue (Expected benefit per period) Straight Line Depreciation= Tax "Shield" (see pg 459) Year 4 10 Year 1 Year 2 Year 3 11 12 13 Income before tax Income tax@ 30% Net income (Note: this accrual basis result is used for URR Add back depreciation (WHY are we adding back Depr?) Cash flow (This is the after-tax cash flow expected) 14 15 16 17 18 19 Next, Determine the Net Present Value (NPV) 20 Table Factor Present Value 21 Present value of net cash inflows 22 Present value of salvage value Initial investment Net present value of this project (using the Straight-Line Depreciation method) 23 24 25 26 Present Value Index (PVI) Computation Using STRAIGHT LINE Depreciation (only): Present Value of Cash Inflows Present value of the (gross) cash inflows Present value of salvage value Total present value of cash inflows 27 29 30 31 Present Value of Cash Outflows Present value of all tax payments Initial investment (No calculation required as PV is today!) Total present value of cash outflows 33 34 37 Equals: The Present Value Index (PVI) of: >>>>>>> 39 b. Net Present Value Using Double-Declining-Balance (DDB) Depreciation 40 41 Year 1 2 42 Revenue 43 DDB Depreciation (how do we calculate DDB depr???) 44 Income before tax Income tax@ 30% 46 45 Net income A G J Present value of all tax payments Initial investment (No calculation required as PV is today!) Total present value of cash outflows 33 34 35 36 37 Equals: The Present Value Index (PVI) of: >>>>>>> 38 39 b. Net Present Value Using Double-Declining-Balance (DDB) Depreciation 40 41 Year 1 2 42 Revenue DDB Depreciation (how do we calculate DDB depr???)| 43 44 Income before tax Income tax@ 30% 45 46 Net income Add back depreciation Cash flow 47 48 49 50 51 Net Present Value Table Value Present Value 52 Present Value of Cash Inflows 53 Year 1 54 Year 2 55 Year 3 56 Year 4 Salvage Value 57 58 Present Value of Cash Outflows Net Present Value (Using the DDB Depreciation Method) 59 60 61 c. "Why* do the Net Present Values (NPV) differ between "a" and "b"? ENTER YOUR DISCUSSION via the tab bel 62 63 d. Payback and Unadjusted Rate of Return Using Straight-Line Depreciation 64 Payback (in years) using Straight Line Depr Unadjusted Rate of Return ("based on avg invest" - pg 461) Alternative giving consideration to Salvage Value: Unadjusted Rate of Return (avg invest changes to $112,50 65 66 67 68 69 e. Requirement "e" and "f" has been deleted. T LLU 2 3 Required: Concisely answer the following questions relating to your P10-22A Analysis: 1) Part "a": What is your interpretation of the NPV determined? Explain. 6 7 10 11 12 13 2) Using the Excel Internal Rate of Return "Generic Calculator" (Handout #3) posted on our class website, what would be the actual rate of return for part "a"? Be sure to consider ALL 14 15 cash flows involved. No documentation is required here. 16 17 The actual (Internal) Rate of Return (IRR) expected is 19 3) Part "c": Why do the Net Present Values, computed in Part "a" and "b", differ? Explain. 18 20 21 22 23 24 25 26 27 28 29 4) Part "d": What limitations exist for the "Payback" and "Unadjusted Rate of Return" Capital 30 Budgeting methods? Explain. 31 32 33 34 35 36 37 38

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts