please help

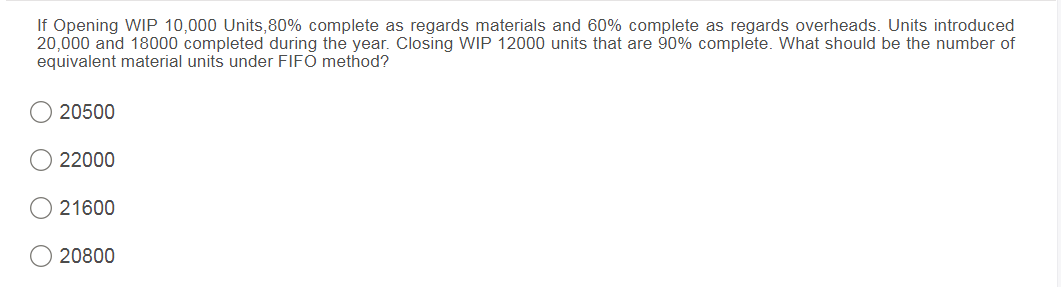

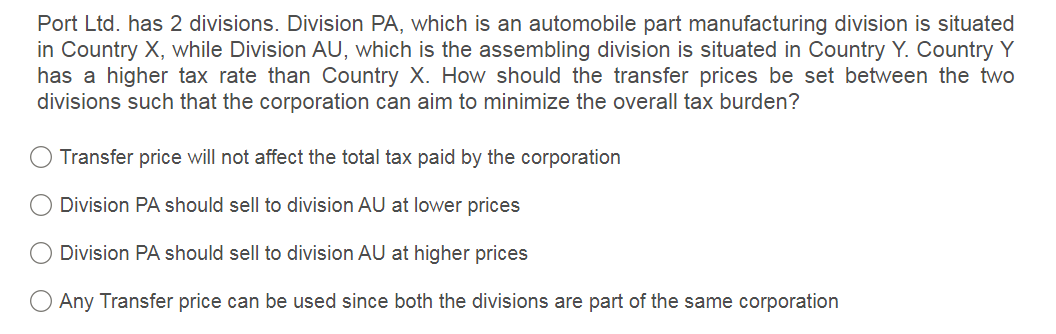

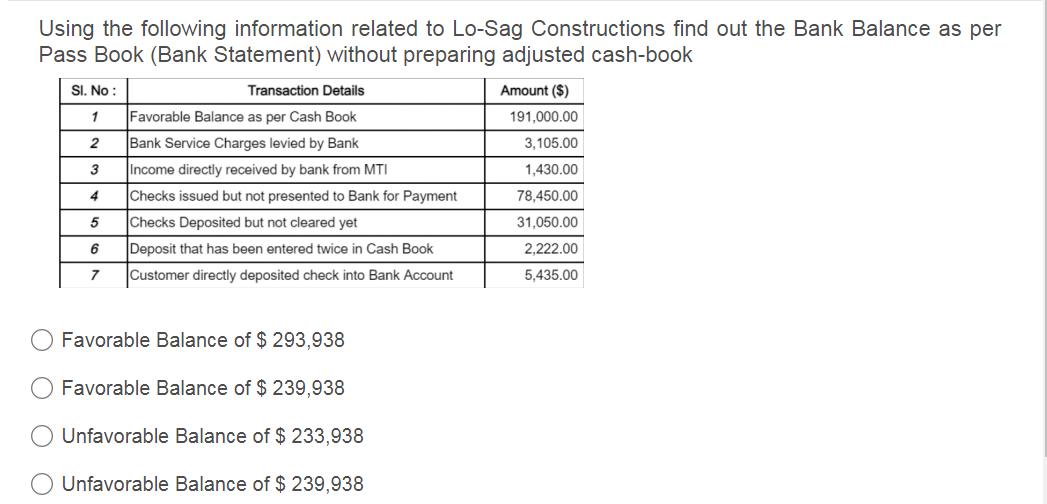

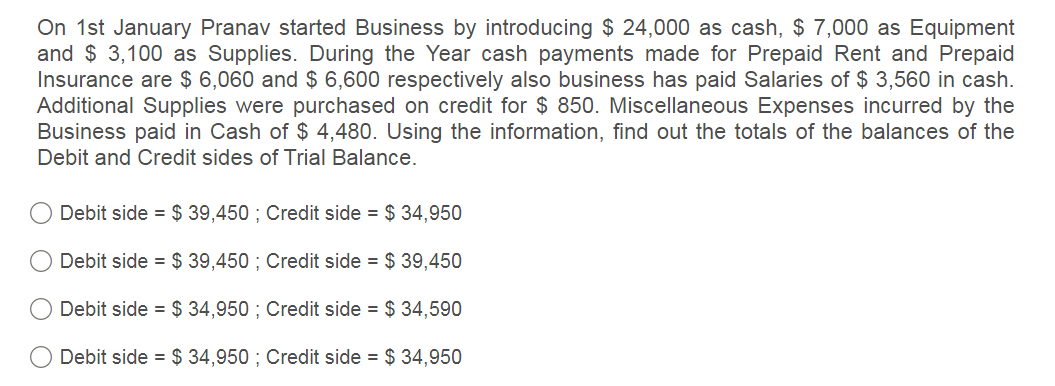

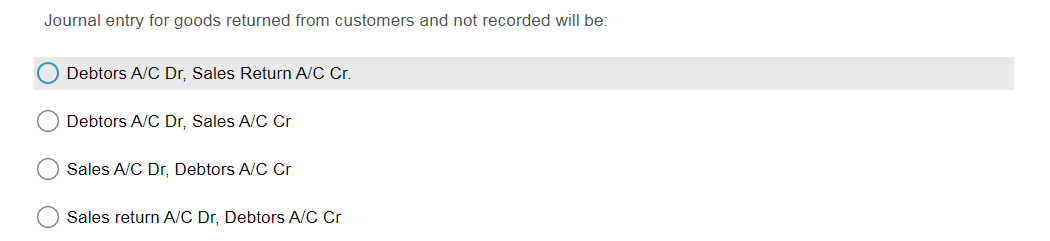

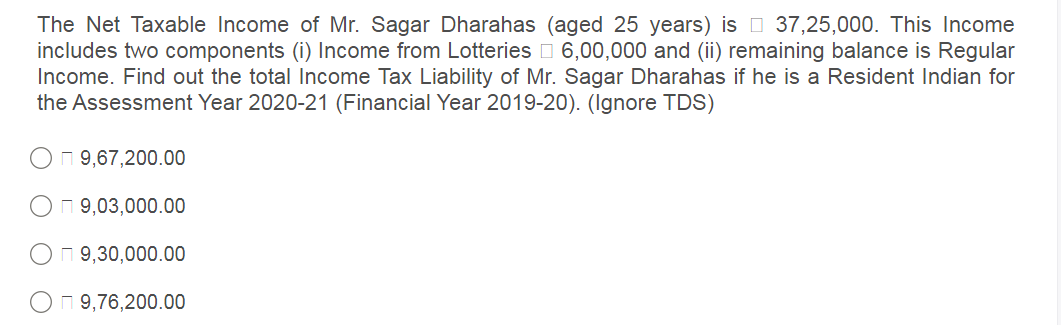

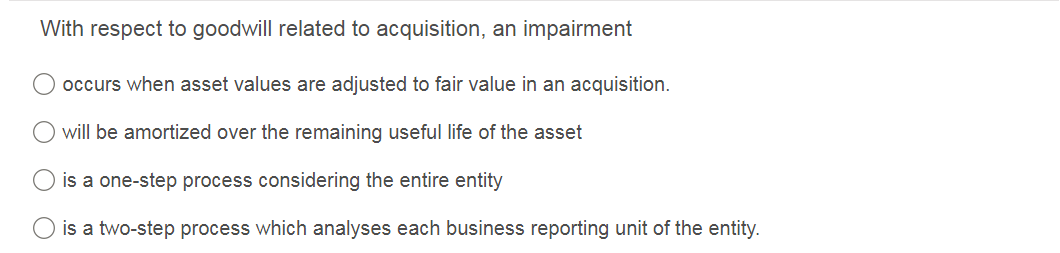

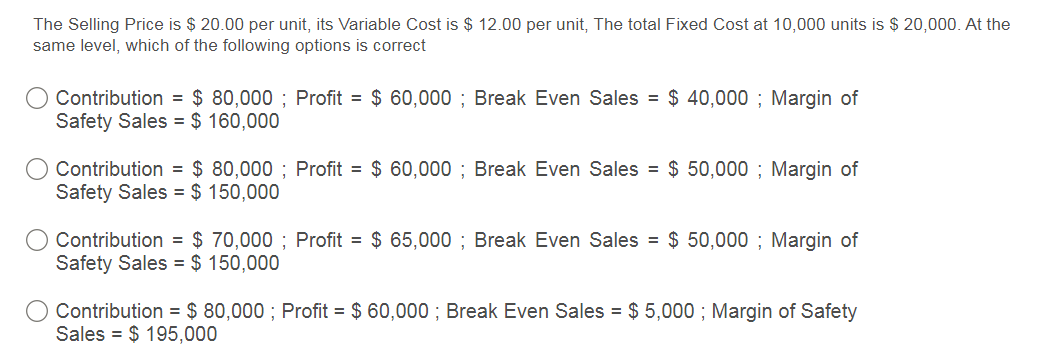

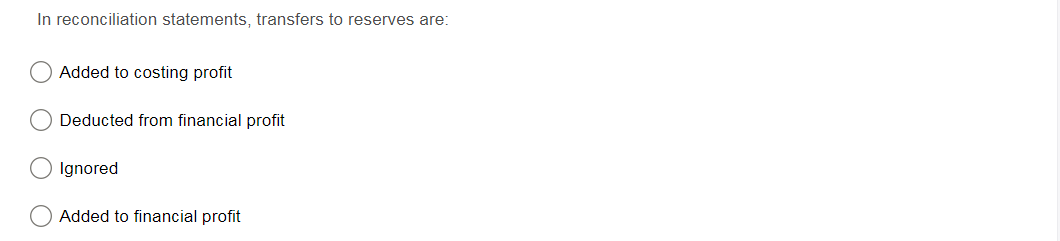

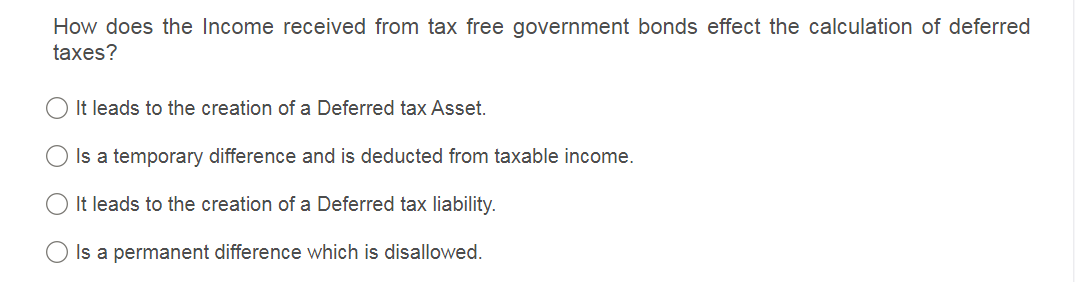

If Opening WIP 10,000 Units,80% complete as regards materials and 60% complete as regards overheads. Units introduced 20,000 and 18000 completed during the year. Closing WIP 12000 units that are 90% complete. What should be the number of equivalent material units under FIFO method? 0 20500 0 22000 0 21600 0 20800 Port Ltd. has 2 divisions. Division PA, which is an automobile part manufacturing division is situated in Country X, while Division AU, which is the assembling division is situated in Country Y. Country Y has a higher tax rate than Country X. How should the transfer prices be set between the two divisions such that the corporation can aim to minimize the overall tax burden? 0 Transfer price will not affect the total tax paid by the corporation 0 Division PA should sell to division AU at lower prices 0 Division PA should sell to division AU at higher prices C) Any Transfer price can be used since both the divisions are part of the same corporation Using the following information related to LoSag Constructions nd out the Bank Balance as per Pass Book (Bank Statement) without preparing adjusted cash-book Sl. No : Tm Dull mm {3) Favorable Balance as per Cash Book 191,000.00 Bank Senrioe Charges levied by Bank 3,105.00 Inoorm directly received by bank from MTI 1,430.00 Checks issued but mt presented to Bank for Payment T8,450.00 31 50.00 it that has been entered twice in Cash Book 2,222.00 .7 Customer directly deposited dteclr. into Bank Ado-mint 5,435.00 O Favorable Balance of $ 293,938 O Favorable Balance of $ 239,938 0 Unfavorable Balance of $ 233,938 0 Unfavorable Balance of $ 239,938 On 1st January Pranav started Business by introducing $ 24,000 as cash, $ 7,000 as Equipment and $ 3,100 as Supplies. During the Year cash payments made for Prepaid Rent and Prepaid Insurance are $ 6,060 and $ 6,600 respectively also business has paid Salaries of $ 3,560 in cash. Additional Supplies were purchased on credit for $ 850. Miscellaneous Expenses incurred by the Business paid in Cash of $ 4,480. Using the information, nd out the totals of the balances of the Debit and Credit sides of Trial Balance. 0 Debit side = $ 39,450 ; Credit side = $ 34,950 0 Debit side = $ 39,450 ; Credit side = $ 39,450 O Debit side = $ 34,950 ; Credit side = $ 34,590 0 Debit side = $ 34,950 ; Credit side = $ 34,950 \f\fWith respect to goodwill related to acquisition, an impairment 0 occurs when asset values are adjusted to fair value in an acquisition. 0 will be amortized over the remaining useful life of the asset O is a one-step process considering the entire entity 0 is a two-step process which analyses each business reporting unit of the entity. The Selling Price is $ 20.00 per unit, its Van'able Cost is $ 12.00 per unit, The total Fixed Cost at 10,000 units is $ 20,000. At the same level, which of the following options is correct 0 Contribution = $ 80,000 ; Prot = $ 60,000 ; Break Even Sales = $ 40,000 ; Margin of Safety Sales = $ 160,000 0 Contribution = $ 80,000 ; Prot = $ 60,000 ; Break Even Sales = $ 50,000 ; Margin of Safety Sales = $ 150.000 0 Contribution = $ 70,000 ; Prot = $ 65,000 ; Break Even Sales = $ 50,000 ; Margin of Safety Sales = $ 150,000 0 Contribution = $ 80,000 ; Prot = $ 60,000 ; Break Even Sales = $ 5,000 ; Margin of Safety Sales = $ 195,000 In reconciliation statements, transfers to reserves are: 0 Added to costing prot 0 Deducted from nancial prot 0 Ignored 0 Added to nancial prot How does the Income received from tax free government bonds effect the calculation of deferred taxes? 0 It leads to the creation of a Deferred tax Asset. Q Is a temporary difference and is deducted from taxable income. 0 It leads to the creation of a Deferred tax liability. Q Is a permanent difference which is disallowed