Answered step by step

Verified Expert Solution

Question

1 Approved Answer

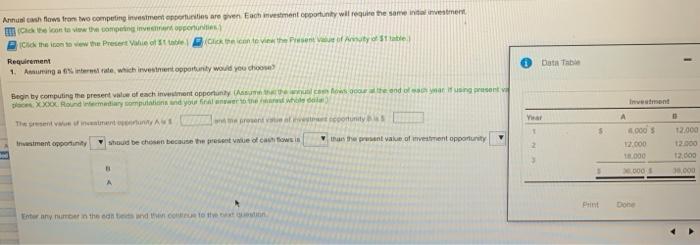

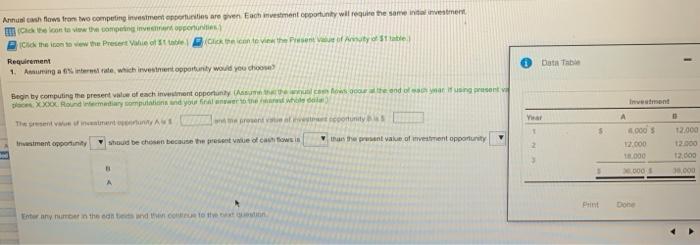

Please help if you can! Annushflows from two competing investment opportunities are given Each investment opportunity will require the same investment monta view the origine

Please help if you can!

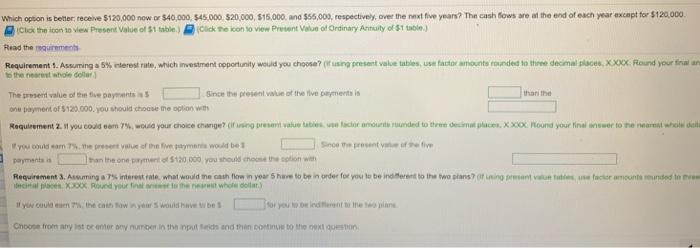

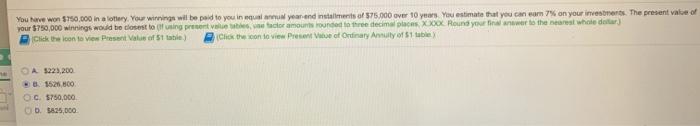

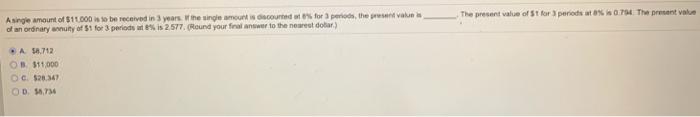

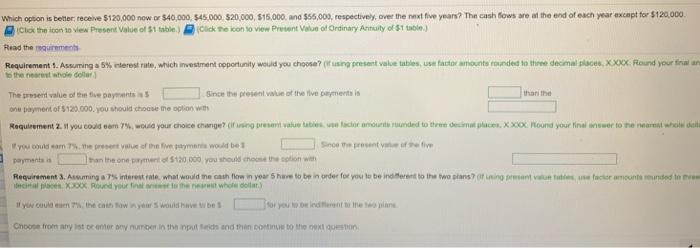

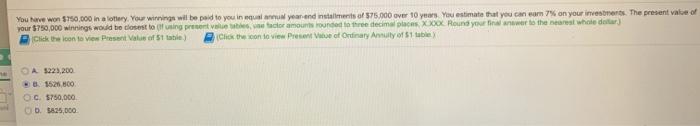

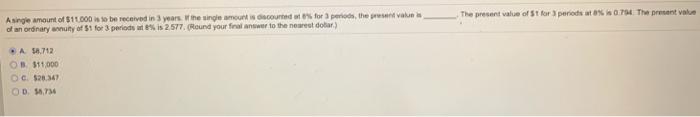

Annushflows from two competing investment opportunities are given Each investment opportunity will require the same investment monta view the origine Cid the tow the rest vahi al conte Vinthe Present of State Requirement 1 Arming are, which investment opportunity would you choose Data Table Begin by computing the present low of each investment opportunity was the odoring present Dom XX Round intermediary souland your finner to the del Investment Year A troenteront 000 12 000 Investment opportunity should be chosen because the rest of cows in than the present value of investment opportunity 12.000 1.000 12.000 000 38.000 Done Enter any number the end and I love Which option is better receive $120,000 now or $40,000, 545,000 $20,000, $15,000 and $56,000, respectively, over the next five years? The cash flows are at the end of each year except for $120.000 Click the icon to view Present Value of 51 faible) Click the icon to view Present Value of Ordinary Annuity of $1 table) Read the rements Requirements. Assuming a 5% interest rate, which investment opportunity would you choose? (it use present value toties, un factor amounts anders in thisee decimal places, XXXX Round your firman to the whole color The prosent value of the five payments Since the procent value of the five payments in than the on payment of $120.000. you should choose the option with Mequlrument 2. l you could eam ?, would your choice change? (it wing present at the contacte amount torded to three decimot phacea. XXXCC Hound your Wina wwwer to the nearest which dich you could come tale of the man would be payments than the one to 5120 000 you should the thesion with Requirement 3. Arouming a7s interest rate what would me cash flow in year 5 have to be in order for you to be indifferent to the two piars? wing pantalon tuttes facter amounts runded to 3006 Round your feet whole ollut for you would the one Choose to try to try number in the inputs and into the You have won $750,000 in a lottery. Your winning wil be paid to you in a year and installments of 375.000 over 10 years Your estimate that you can com 7% on your investments. The present value of your $750,000 winnings would be closest to using protector amous Founded in three decimal places Xxx Round your new to the nearest whole dar) Click the icon to view Present Value of State) Chick the con to view Present of Ordinary Annuity of 1 table A 3221,200 152,800 C. $750,000 b. 25,000 The present value of St for periods to 0.794 The present value A single amount of $10.000 is to be received in 3 years, the single amount counted for periods, the privalu of an ordinary nuty of 1 for 3 periods is 2.577. Round your final awer to the nearest dobar) SA 58.712 OB. 511,000 | 6 2 1 OD 5.73

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started