Please help, Ill make sure to rate.

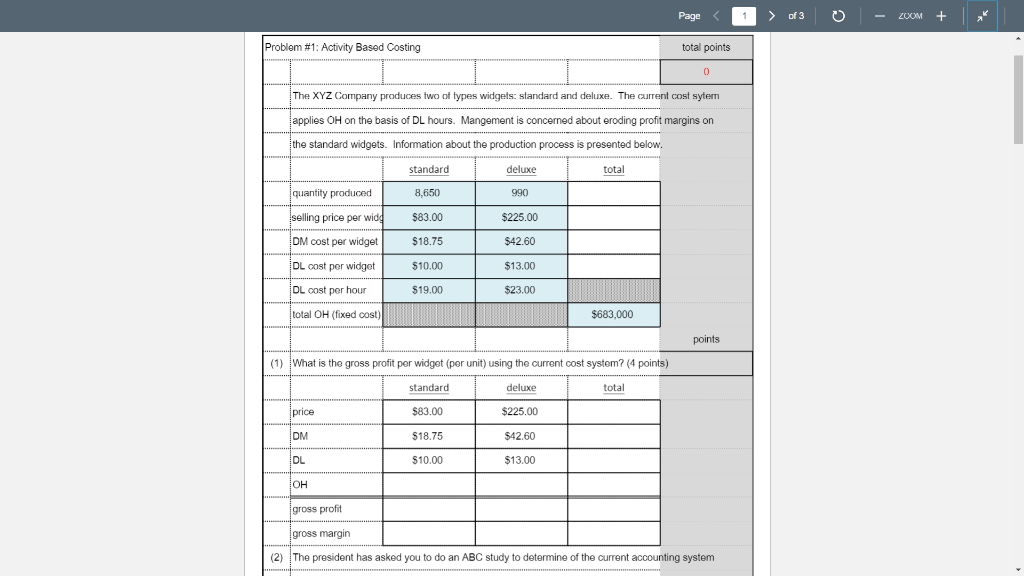

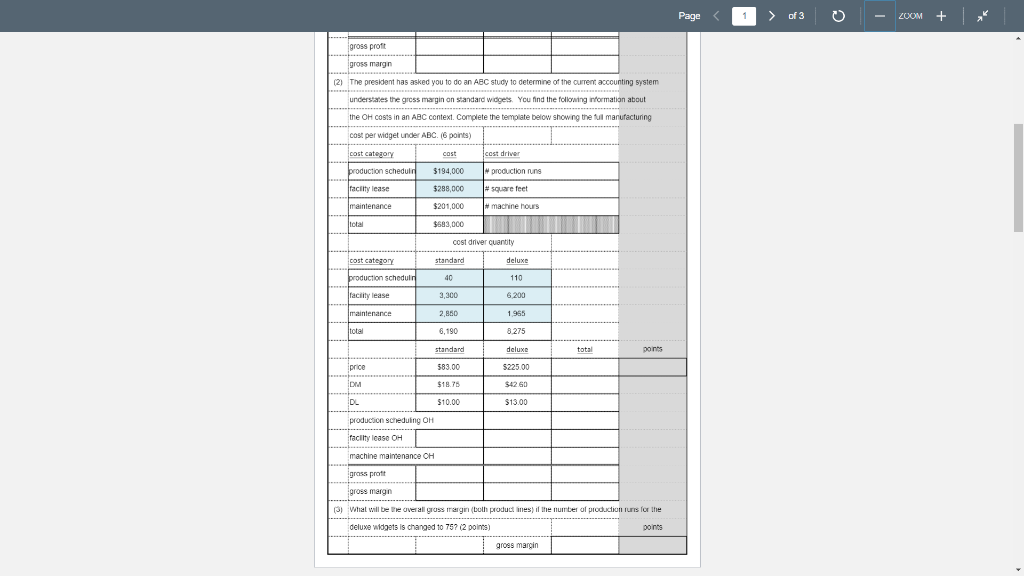

Pages ZOOM + Problem #1: Activity Based Costing total points 0 The XYZ Company produces two of types widgets: standard and deluxe. The current cost sytem applies OH on the basis of DL hours. Mangement is concerned about eroding profit margins on the standard widgets. Information about the production process is presented below. standard deluxe total 8,650 990 quantity produced selling price per wide $83.00 $225.00 DM cost per widget $18.75 $42.60 $10.00 $13.00 DL cost per widget DL cost per hour total OH (fixed cost) ) $19.00 $23.00 $683,000 points (1) What is the gross profit per widget (per unit) using the current cost system? (4 points) standard deluxe total price $83.00 $225.00 DM $18.75 $42.60 DL $10.00 $13.00 OH gross profit gross margin (2) The president has asked you to do an ABC study to determine of the current accounting system Page of 3 ZOOM + L gross proft gross margin (2) The president has asked you to do an ABC study to determine of the current accounting system understates the gross margin on standard widgets you find the following information about the OH costs in an ABC context. Complete the template below showing the ful manufacturing cost per widget under ABC. (6 points) cost category cost cost driver production scheduld production runs $194,000 $285,000 facility lease #square feet maintenance $200,000 #machine hours total $683,000 cost driver cuantity standard deluxe cost category production schedulr 40 110 facility lease 3,300 6.200 maintenance 2,850 1965 total 6,190 8.275 standard deluxe total points price 583.00 $225.00 DM $18.75 $ $4260 DL $10.00 $13.00 production scheduling OH facilty lease OH machine malmenance OH grass profit gross mergin 3) What will be the overall gross margin (both product lines) if the number of production runs for the deluxe widgets is changed to 75? (2 points) points gross margin Pages ZOOM + Problem #1: Activity Based Costing total points 0 The XYZ Company produces two of types widgets: standard and deluxe. The current cost sytem applies OH on the basis of DL hours. Mangement is concerned about eroding profit margins on the standard widgets. Information about the production process is presented below. standard deluxe total 8,650 990 quantity produced selling price per wide $83.00 $225.00 DM cost per widget $18.75 $42.60 $10.00 $13.00 DL cost per widget DL cost per hour total OH (fixed cost) ) $19.00 $23.00 $683,000 points (1) What is the gross profit per widget (per unit) using the current cost system? (4 points) standard deluxe total price $83.00 $225.00 DM $18.75 $42.60 DL $10.00 $13.00 OH gross profit gross margin (2) The president has asked you to do an ABC study to determine of the current accounting system Page of 3 ZOOM + L gross proft gross margin (2) The president has asked you to do an ABC study to determine of the current accounting system understates the gross margin on standard widgets you find the following information about the OH costs in an ABC context. Complete the template below showing the ful manufacturing cost per widget under ABC. (6 points) cost category cost cost driver production scheduld production runs $194,000 $285,000 facility lease #square feet maintenance $200,000 #machine hours total $683,000 cost driver cuantity standard deluxe cost category production schedulr 40 110 facility lease 3,300 6.200 maintenance 2,850 1965 total 6,190 8.275 standard deluxe total points price 583.00 $225.00 DM $18.75 $ $4260 DL $10.00 $13.00 production scheduling OH facilty lease OH machine malmenance OH grass profit gross mergin 3) What will be the overall gross margin (both product lines) if the number of production runs for the deluxe widgets is changed to 75? (2 points) points gross margin