Answered step by step

Verified Expert Solution

Question

1 Approved Answer

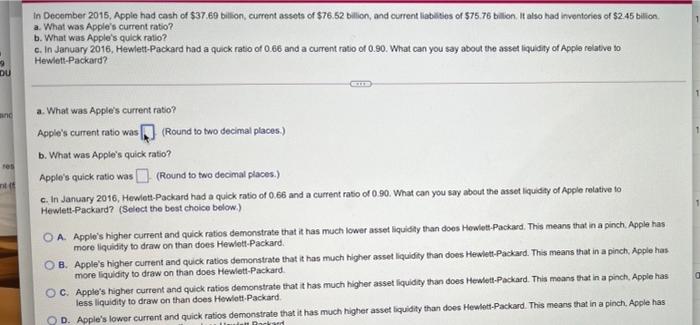

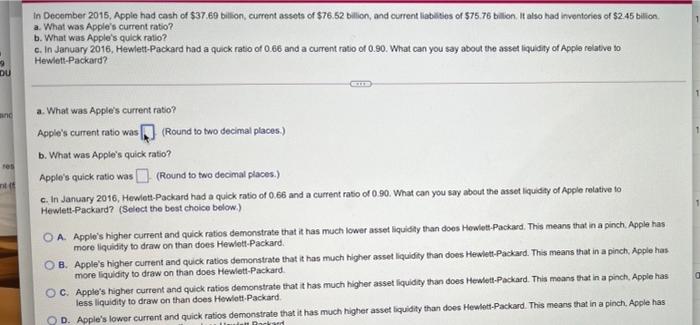

please help in December 2015, Apple had cash of $37.60 billion, current assets of $76.52 billion, and current liabilities of $75.76 billion. It also had

please help

in December 2015, Apple had cash of $37.60 billion, current assets of $76.52 billion, and current liabilities of $75.76 billion. It also had inventories of $2.45 billion c. In January 2016, Hewlett-Packard had a quick ratio of 0.66 and a current ratio of 0.90. What can you say about the asset liquidity of Apple relative to Hewlett-Packard? a. What was Apple's current ratio? b. What was Apple's quick ratio? DU and a. What was Apple's current ratio? Apple's current ratio was (Round to two decimal places) b. What was Apple's quick ratio? Apple's quick ratio was I (Round to two decimal places.) c. In January 2016, Hewlett-Packard had a quick ratio of 0.66 and a current ratio of 0 90. What can you say about the asset liquidity of Apple relative to Hewlett-Packard? (Select the best choice below) OA Apple's higher current and quick ratios demonstrate that it has much lower asset liquidity than does Hewlett-Packard. This means that in a pinch. Apple has more liquidity to draw on than does Hewlett-Packard O B. Apple's higher current and quick ratios demonstrate that it has much higher asset liquidity than does Hewlett-Packard. This means that in a pinch, Apple has more liquidity to draw on than does Hewlett-Packard OC. Apple's higher current and quick ratios demonstrate that it has much higher asset liquidity than does Hewlett-Packard. This means that in a pinch, Apple has less liquidity to draw on than does Howlett-Packard OD. Apple's lower current and quick ratios demonstrate that it has much higher asset liquidity than does Hewlett-Packard. This means that in a pinch Apple has Racire

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started