Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP In year 1, Aldo sold investment land with a $61,000 tax basis for $95,000. Payment consisted of $15,000 cash down and the purchaser's

PLEASE HELP

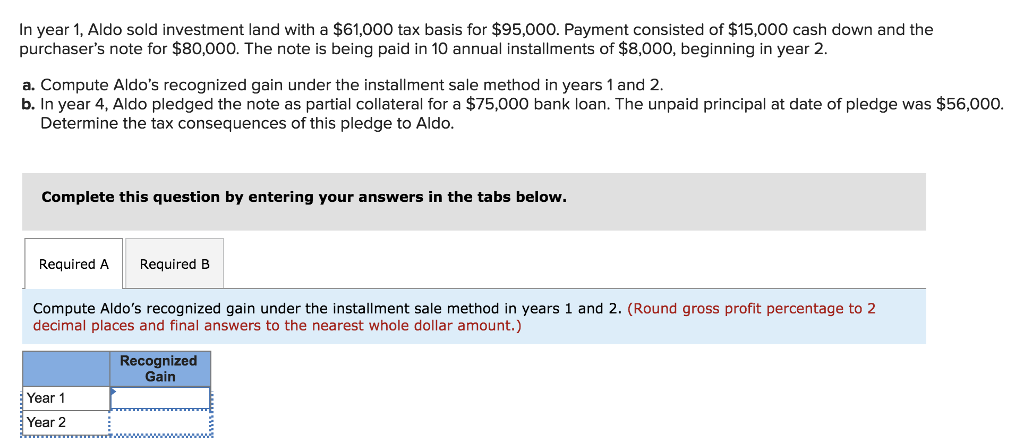

In year 1, Aldo sold investment land with a $61,000 tax basis for $95,000. Payment consisted of $15,000 cash down and the purchaser's note for $80,000. The note is being paid in 10 annual installments of $8,000, beginning in year 2. a. Compute Aldo's recognized gain under the installment sale method in years 1 and 2. b. In year 4, Aldo pledged the note as partial collateral for a $75,000 bank loan. The unpaid principal at date of pledge was $56,000 Determine the tax consequences of this pledge to Aldo. Complete this question by entering your answers in the tabs below. Required ARequired B profit percentage to 2 Compute Aldo's recognized gain under the installment sale method in years 1 and 2. (Round gross decimal places and final answers to the nearest whole dollar amount.) Recognized Gain Year 1 Year 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started