Answered step by step

Verified Expert Solution

Question

1 Approved Answer

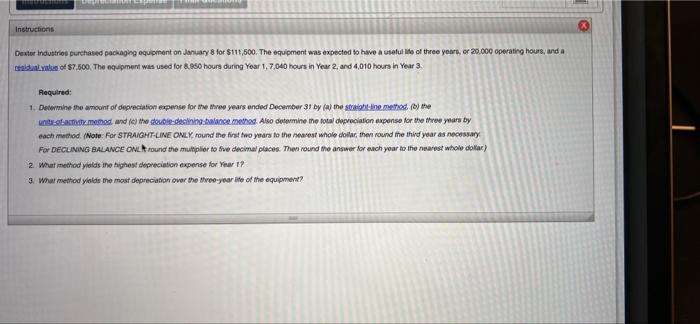

please help!! Instructions Dexter Industries purchased packaging equipment on January 8 for $111,500. The equipment was expected to have a sett lite of three years,

please help!!

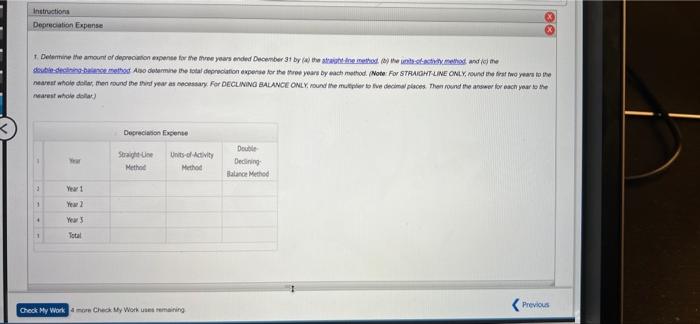

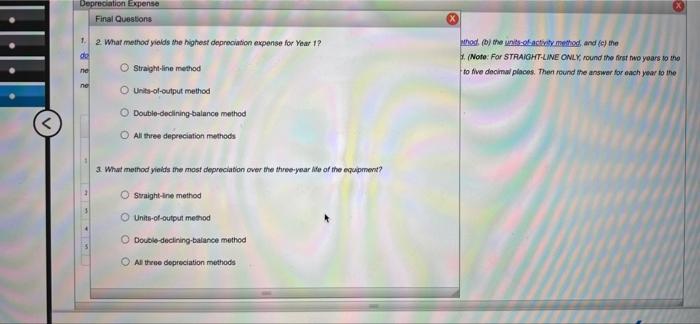

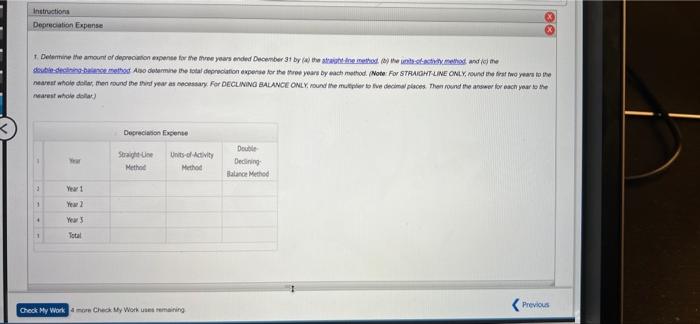

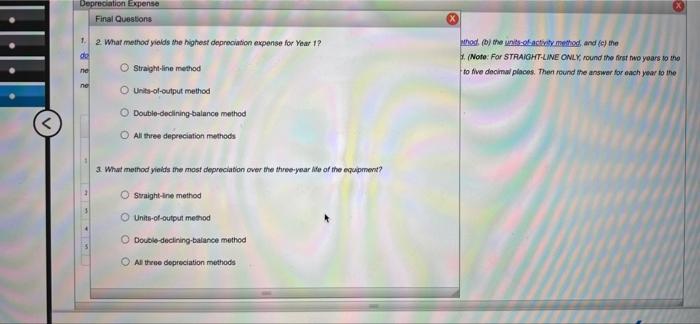

Instructions Dexter Industries purchased packaging equipment on January 8 for $111,500. The equipment was expected to have a sett lite of three years, or 20.000 operating hours, and a mida value of 87.500. The copment was used for 8.050 hours during Year 1,7,040 hours in Year 2, and 4,010 hours in Year 3 Required: 1. Determine the amount of depreciation expense for the three years anded December 31 by (a) the straight-line.hod () the manod and le) the decling-balance method Also determine the total appreciation expense for the three years by each method. (Note: Far STRAIGHT-LINE ONLY round the first two years to the nearest whole dollar, the round the third year as necessary For DECLINING BALANCE ON Found the multiplier to five decimal places. The round to answer for each year to the nearest whole doftar) 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the three-year life of the equipment? Instruction Depreciation Expense 1. Determine the amount of deprecation expense for the tree years anded December 31 by the state de methode method and the det de method Also determine the foldeprecation expense for the three years by each method. Note For STRAIGHT LINE ONLY, round fra two years to i nearest wholesar, men found the end you as a For DECLINING BALANCE ONLY.Pure the mother o vedemptons The poor the answer trench your ne marest whole dolar) Depreciation Expense Straight Method Units-of-Activity Method Dette Declining alon Method Yeart Year 2 Yews Previous Check My Work Check My Work uses remaining Depreciation Expense Final Questions 1. 2. What method yields the highest depreciation expense for Year 1? de Straight-line method Mhad the bacts method and (e) the (Note: For STRAIGHT-LINE ONLY round the first two years to the to five decimw places. The round the answer for each year to the ne ne O Units-of-output method Double-dedining-balance method O All three depreciation methods 3 What method yields the most depreciation over the three-year Me of the equipment? Straight-Ine method Units-ot-output method Double declining balance method O All these depreciation methods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started