Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help. It. The IFRS measurement of revenue process includes all of the US GAAP Measurement of revenue categories except a. historical cost b. current

please help.

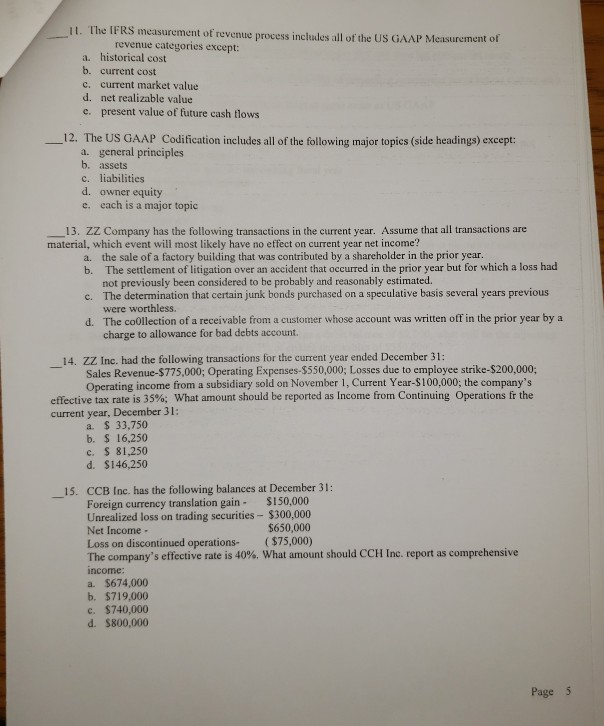

It. The IFRS measurement of revenue process includes all of the US GAAP Measurement of revenue categories except a. historical cost b. current cost c. current market value d. net realizable value c. present value of future cash tlows 12. The US GAAP Codification includes all of the following major topics (side headings) except: a. general principles b. assets c. liabilities d. owner equity e. each is a major topic 13. ZZ Company has the following transactions in the current year. Assume that all transactions are material, which event will most likely have no effect on current year net income? the sale of a factory building that was contributed by a shareholder in the prior year. b. a. The settlement of litigation over an accident that occurred in the prior year but for which a loss had not previously been considered to be probably and reasonably estimated. The determination that certain junk bonds purchased on a speculative basis several years previous c. were worthless. The coollection of a receivable from a customer whose account was written off in the prior year by a d charge to allowance for bad debts account. 14. ZZ Inc. had the following transactions for the current year ended December 31: Sales Revenue-$775,000; Operating Expenses-$550,000; Losses due to employee strike-$200,000; Operating income from a subsidiary sold on November 1, Current Year-$100,000; the company's effective tax rate is 35%; what amount should be reported as Income fron Continuing Operations fr the current year, December 31: a. 33,750 b. S 16,250 c. $ 81,250 d. $146,250 CCB Inc. has the following balances at December 31: Foreign currency translation gain $150,000 Unrealized loss on trading securities -$300,000 Net Income - Loss on discontinued operations- ($75,000) The company's effective rate is 40%. What amount should CCH Inc. report as comprehensive income: a. $674,000 b. $719,000 c. $740,000 d. $800,000 -15. $650,000 Page 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started