Answered step by step

Verified Expert Solution

Question

1 Approved Answer

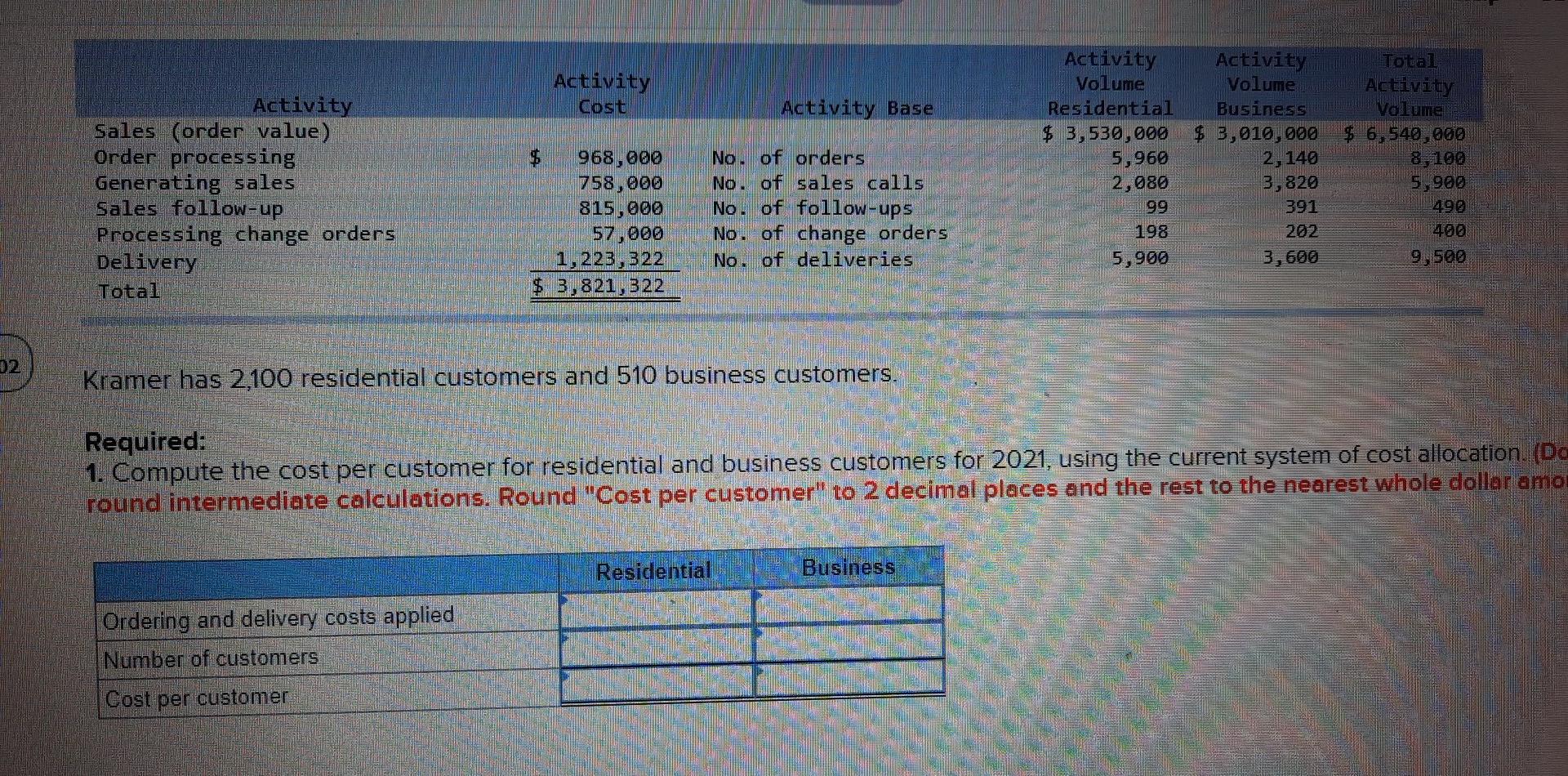

please help it's urgent Activity Cost Activity Base Activity Sales (order value) Order processing Generating sales Sales follow-up Processing change orders Delivery Total $ 968,000

please help it's urgent

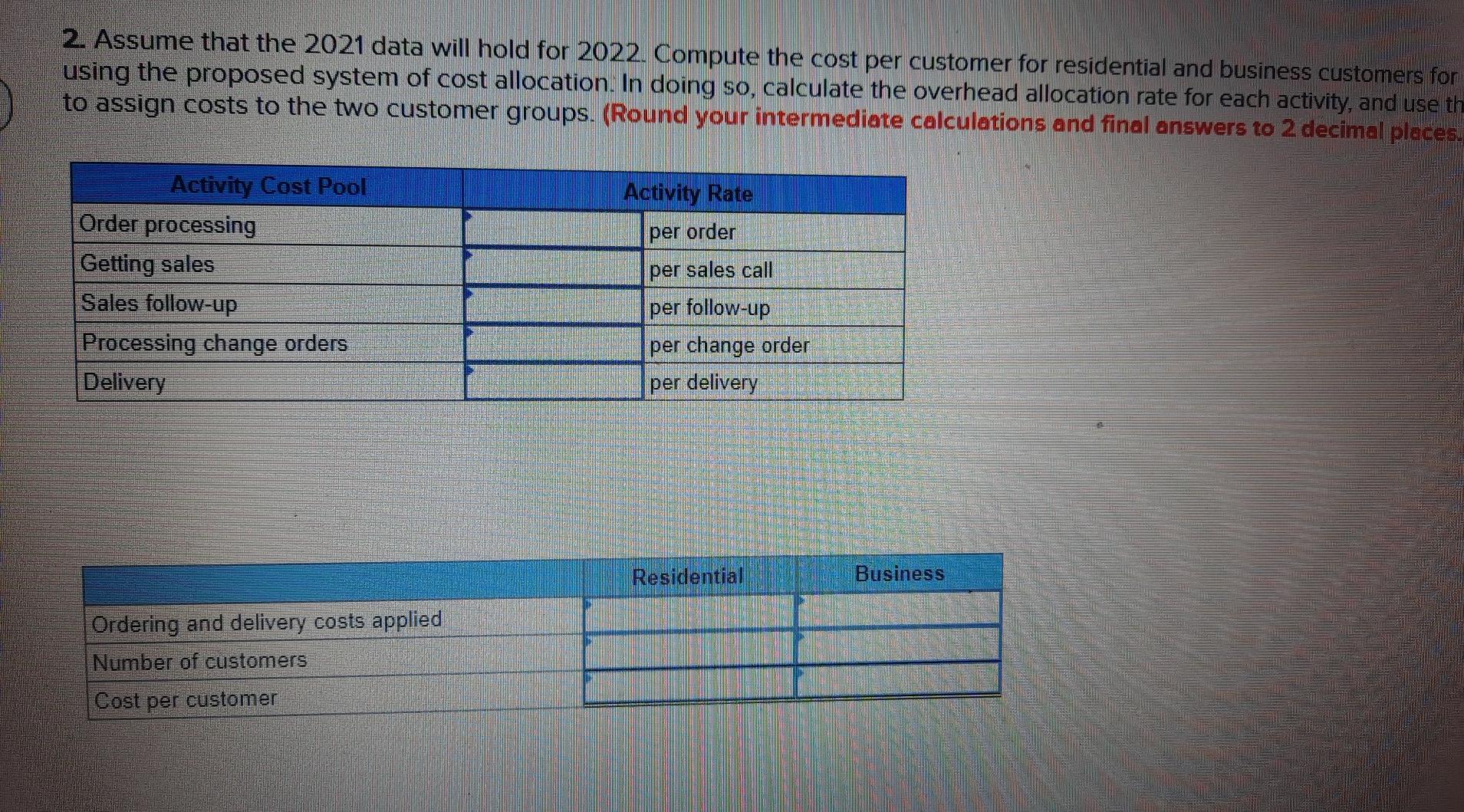

Activity Cost Activity Base Activity Sales (order value) Order processing Generating sales Sales follow-up Processing change orders Delivery Total $ 968,000 758,000 815,000 57,000 1,223,322 $ 3,821, 322 No. of orders No. of sales calls No. of follow-ups No. of change orders No. of deliveries Activity Activity Volume Volume Residential Business $ 3,530,000 $ 3,010,000 5,960 2,140 2,080 3,820 99 391 198 202 5,900 3,600 Total Activity Volume $ 6,540,000 8,100 5,900 490 400 9,500 02 Kramer has 2,100 residential customers and 510 business customers. Required: 1. Compute the cost per customer for residential and business customers for 2021, using the current system of cost allocation. (Da round intermediate calculations. Round "Cost per customer" to 2 decimal places and the rest to the nearest whole dollar amo Residential Business Ordering and delivery costs applied Number of customers Cost per customer 2. Assume that the 2021 data will hold for 2022. Compute the cost per customer for residential and business customers for using the proposed system of cost allocation. In doing so, calculate the overhead allocation rate for each activity, and use th to assign costs to the two customer groups. (Round your intermediate calculations and final answers to 2 decimal places. Activity Cost Pool Order processing Getting sales Sales follow-up Processing change orders Delivery Activity Rate per order per sales call per follow-up per change order per delivery Residential Business Ordering and delivery costs applied Number of customers Cost per customerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started