please help just trying to work through

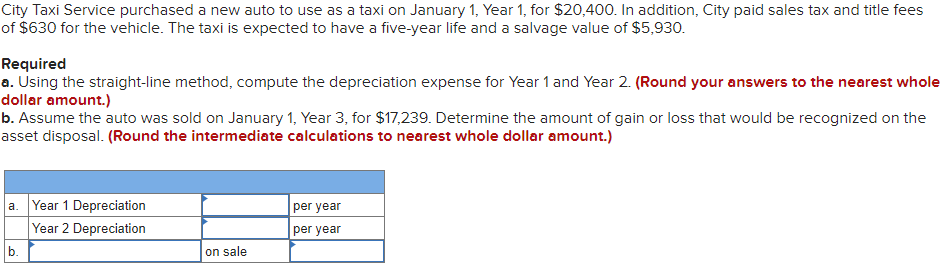

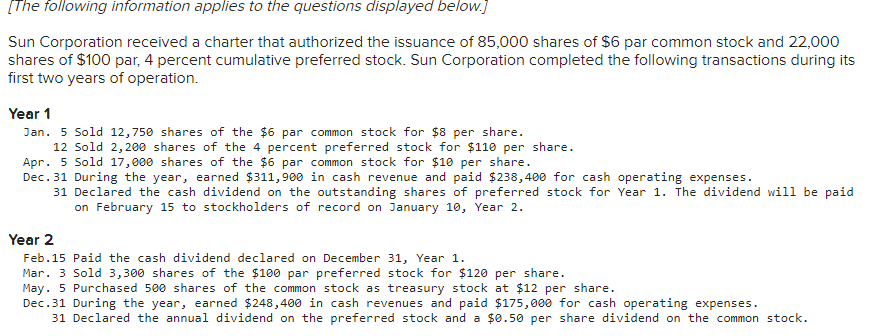

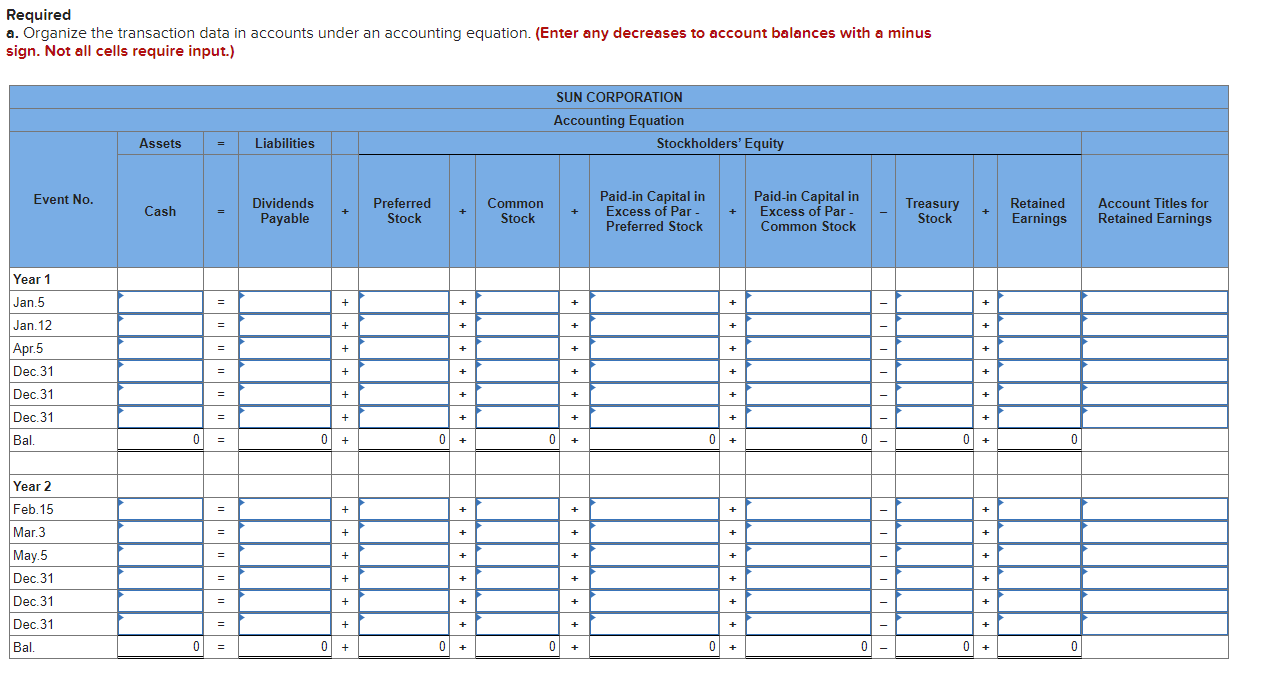

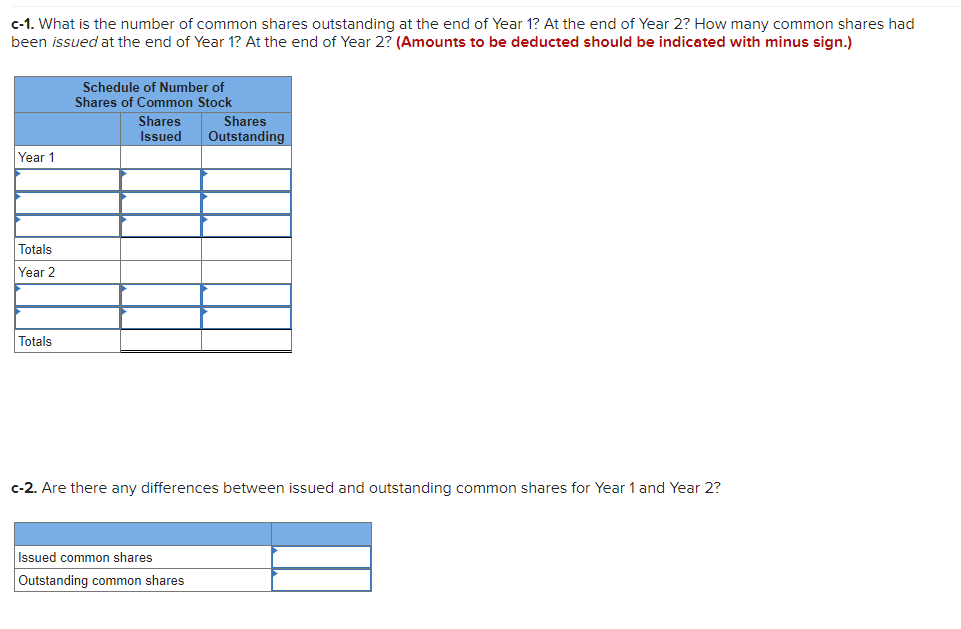

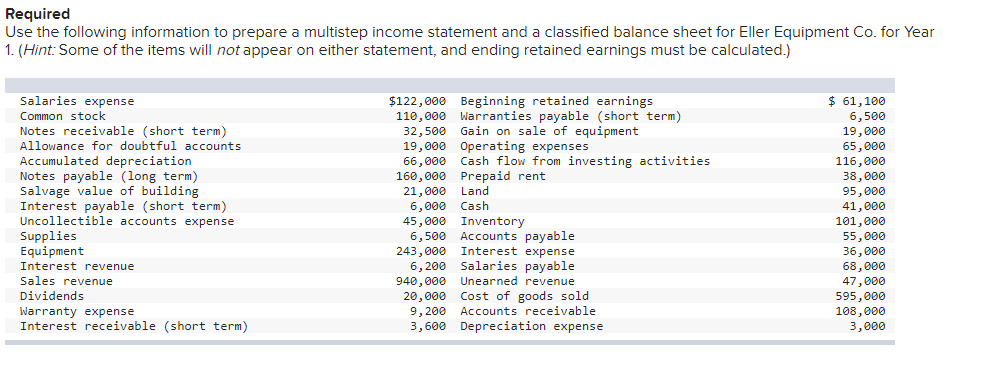

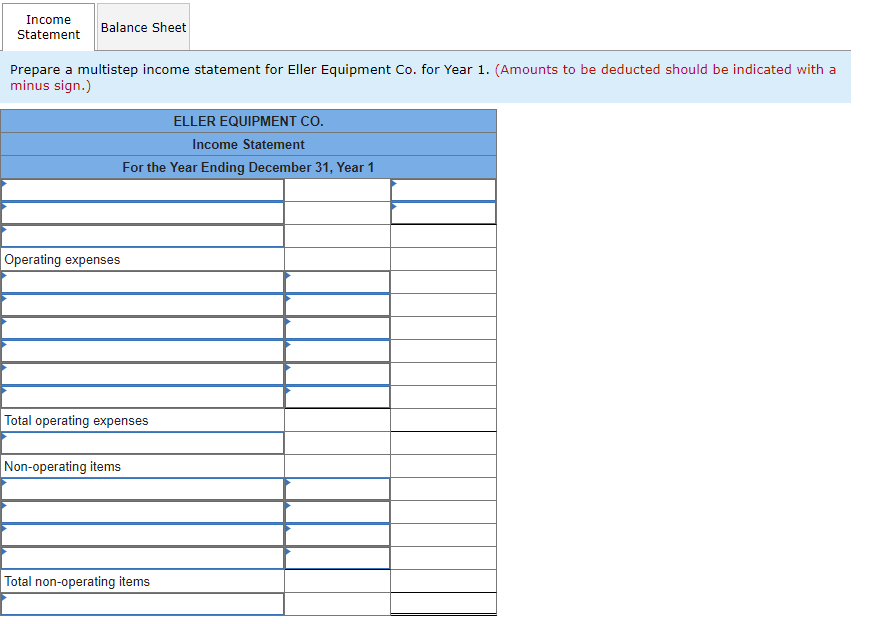

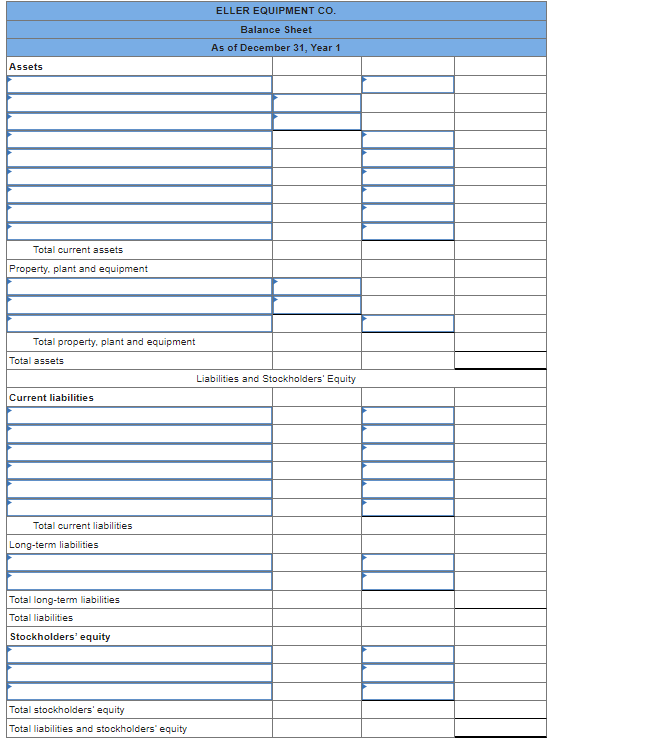

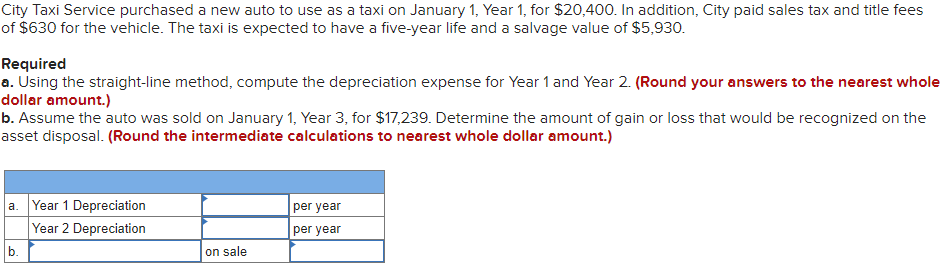

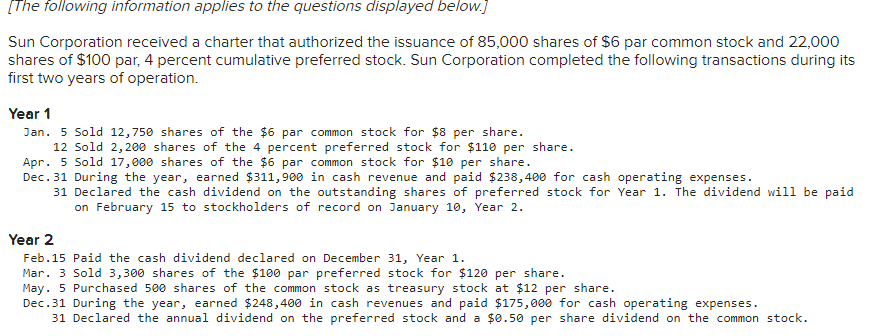

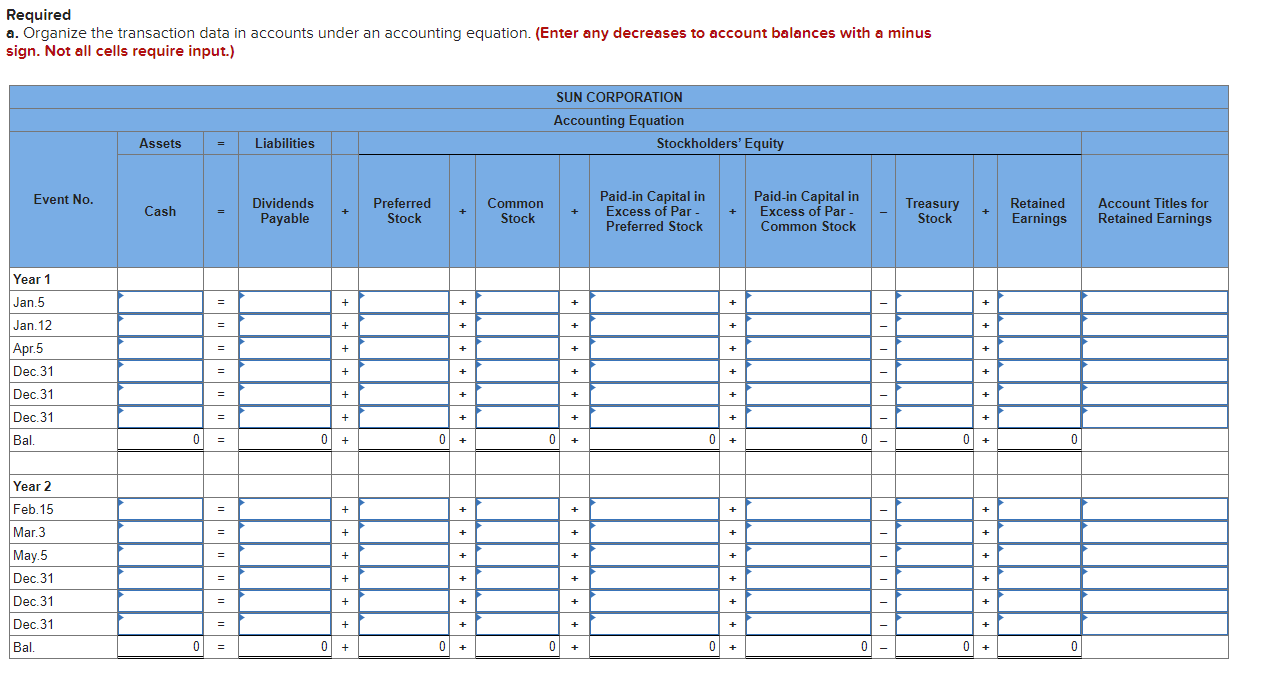

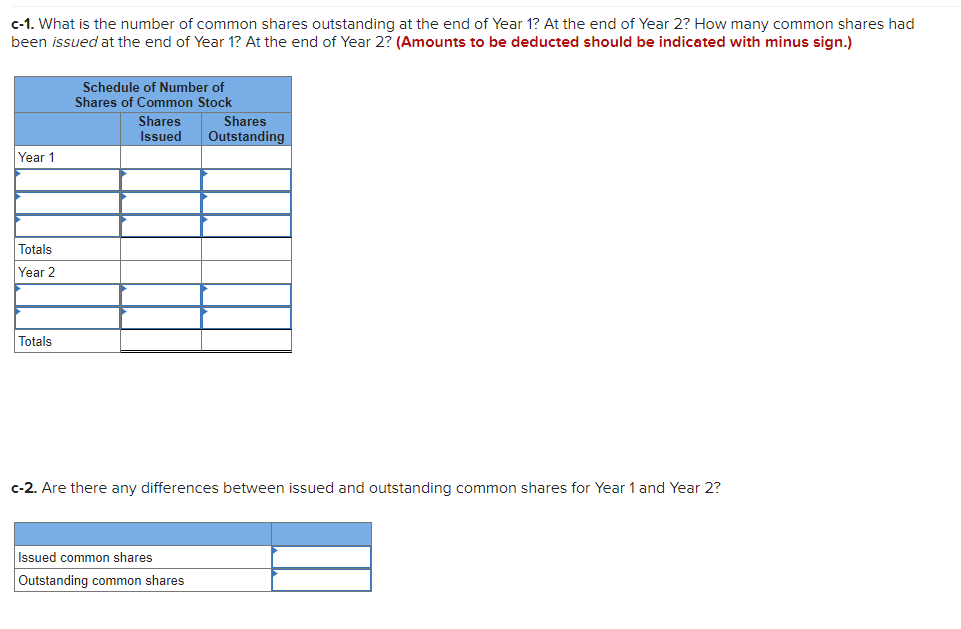

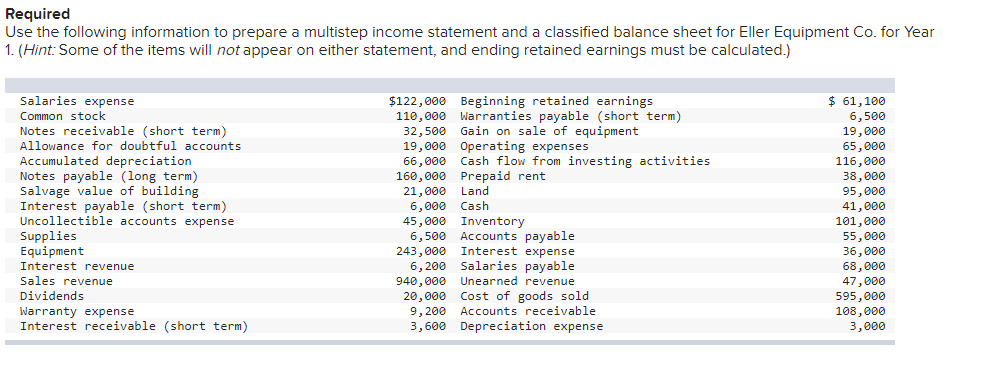

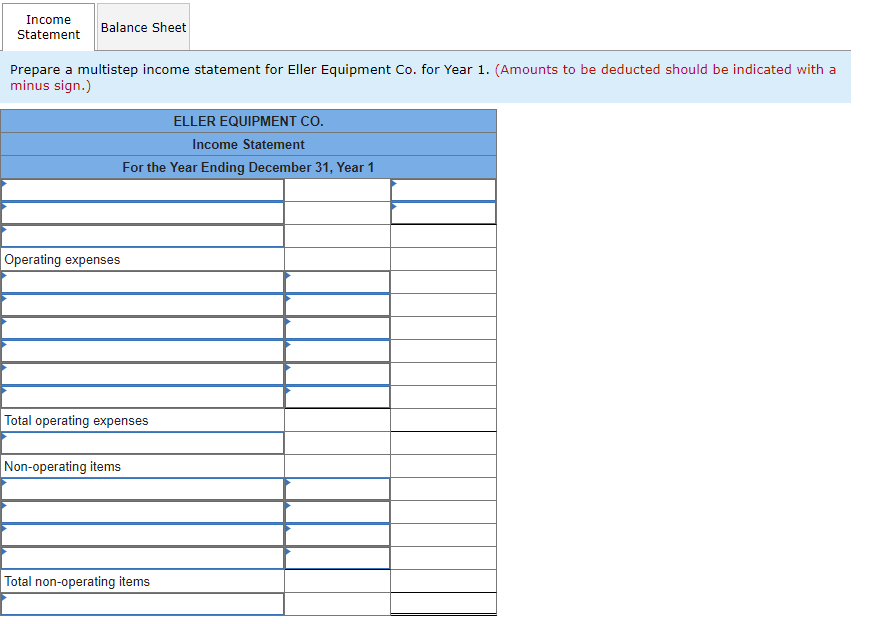

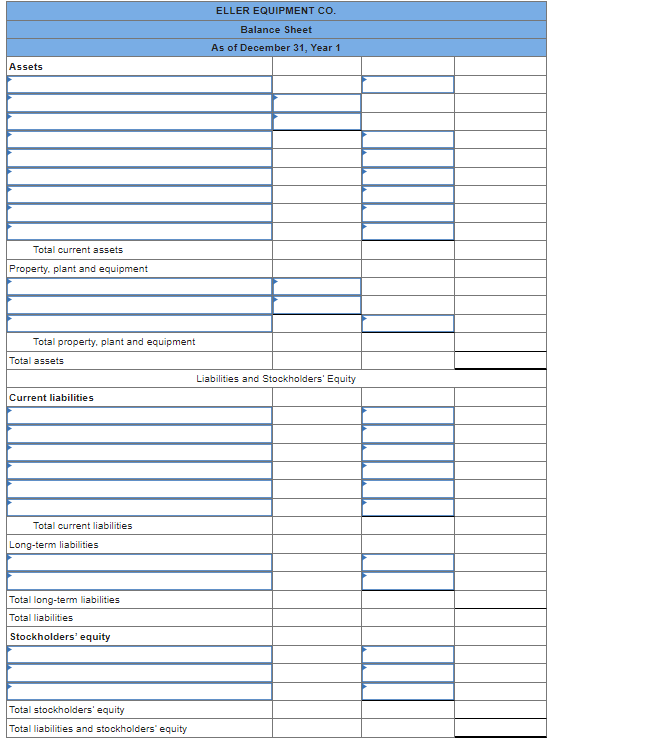

City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $20,400. In addition, City paid sales tax and title fees of $630 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $5,930. Required a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. (Round your answers to the nearest whole dollar amount.) b. Assume the auto was sold on January 1, Year 3, for $17,239. Determine the amount of gain or loss that would be recognized on the asset disposal. (Round the intermediate calculations to nearest whole dollar amount.) a. Year 1 Depreciation Year 2 Depreciation b. per year per year b. on sale (The following information applies to the questions displayed below.] Sun Corporation received a charter that authorized the issuance of 85,000 shares of $6 par common stock and 22,000 shares of $100 par, 4 percent cumulative preferred stock. Sun Corporation completed the following transactions during its first two years of operation. Year 1 Jan. 5 Sold 12,750 shares of the $6 par common stock for $8 per share. 12 Sold 2,200 shares of the 4 percent preferred stock for $110 per share. Apr. 5 sold 17,000 shares of the $6 par common stock for $10 per share. Dec. 31 During the year, earned $311,900 in cash revenue and paid $238,400 for cash operating expenses. 31 Declared the cash dividend on the outstanding shares of preferred stock for Year 1. The dividend will be paid on February 15 to stockholders of record on January 10, Year 2. Year 2 Feb. 15 Paid the cash dividend declared on December 31, Year 1. Mar. 3 Sold 3,300 shares of the $100 par preferred stock for $120 per share. May. 5 Purchased 500 shares of the common stock as treasury stock at $12 per share. Dec.31 During the year, earned $248,400 in cash revenues and paid $175,000 for cash operating expenses. 31 Declared the annual dividend on the preferred stock and a $0.50 per share dividend on the common stock. Required a. Organize the transaction data in accounts under an accounting equation. (Enter any decreases to account balances with a minus sign. Not all cells require input.) SUN CORPORATION Accounting Equation Stockholders' Equity Assets = Liabilities Event No. Cash = Dividends Payable Preferred Stock + Common Stock + + Paid-in Capital in Excess of Par- Preferred Stock + Paid-in Capital in Excess of Par- Common Stock Treasury Stock Retained Earnings Account Titles for Retained Earnings Year 1 Jan.5 Jan. 12 = + + + + + + + + + + + = + + + + + + + + + Apr.5 Dec. 31 Dec. 31 Dec. 31 Bal. + + + + + - + + + + + + 0 = 0 + 0 + 0 + 0 + 0 0 + + 0 = + + + + + = + + + + + Year 2 Feb. 15 Mar. 3 May 5 Dec. 31 Dec. 31 Dec. 31 + + + + + + + + + + + + + + + = + + + + + Bal. 0 = 01 + + 0 + 0 + 0 + 0 0 + + 0 C-1. What is the number of common shares outstanding at the end of Year 1? At the end of Year 2? How many common shares had been issued at the end of Year 1? At the end of Year 2? (Amounts to be deducted should be indicated with minus sign.) Schedule of Number of Shares of Common Stock Shares Shares Issued Outstanding Year 1 Totals Year 2 Totals c-2. Are there any differences between issued and outstanding common shares for Year 1 and Year 2? Issued common shares Outstanding common shares Required Use the following information to prepare a multistep income statement and a classified balance sheet for Eller Equipment Co. for Year 1. (Hint: Some of the items will not appear on either statement, and ending retained earnings must be calculated.) 66,000 Salaries expense Common stock Notes receivable (short term) Allowance for doubtful accounts Accumulated depreciation Notes payable (long term) Salvage value of building Interest payable (short term) Uncollectible accounts expense Supplies Equipment Interest revenue Sales revenue Dividends Warranty expense Interest receivable (short term) $122,000 Beginning retained earnings 110,000 Warranties payable (short term) 32,500 Gain on sale of equipment 19,000 Operating expenses Cash flow from investing activities 160,000 Prepaid rent 21,000 Land 6,000 Cash 45,000 Inventory 6,500 Accounts payable 243,000 Interest expense 6,200 Salaries payable 940,000 Unearned revenue 20,000 Cost of goods sold 9,200 Accounts receivable 3,600 Depreciation expense $ 61,100 6,500 19,000 65,000 116,000 38,000 95,000 41,000 101,000 55,000 36,000 68,000 47,000 595,000 108,000 3,000 Income Statement Balance Sheet Prepare a multistep income statement for Eller Equipment Co. for Year 1. (Amounts to be deducted should be indicated with a minus sign.) ELLER EQUIPMENT CO. Income Statement For the Year Ending December 31, Year 1 Operating expenses Total operating expenses Non-operating items Total non-operating items ELLER EQUIPMENT CO. Balance Sheet As of December 31, Year 1 Assets Total current assets Property, plant and equipment Total property, plant and equipment Total assets Liabilities and Stockholders' Equity Current liabilities Total current liabilities Long-term liabilities Total long-term liabilities Total liabilities Stockholders' equity Total stockholders' equity Total liabilities and stockholders' equity